Md Saiful Islam Khan

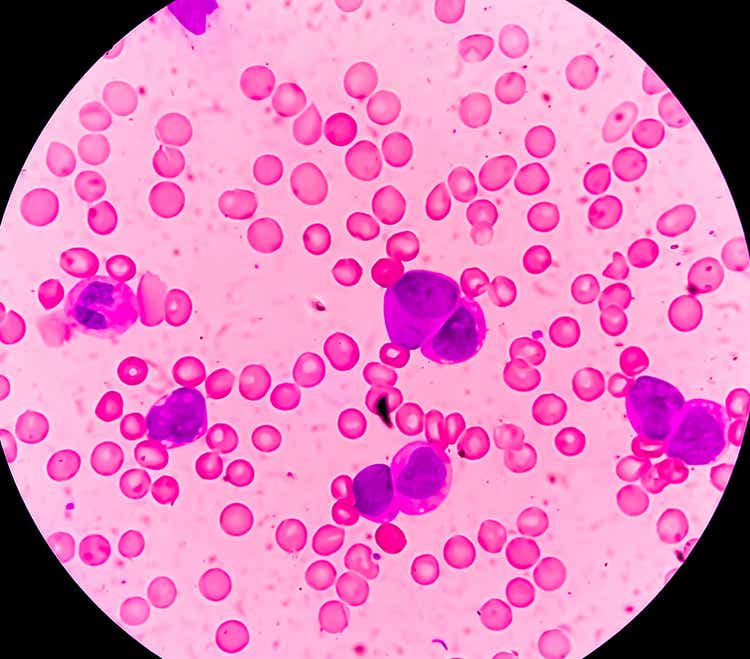

Kura Oncology, Inc. (NASDAQ:KURA) is based in San Diego, California, and is developing therapies in oncology. This note will focus on the company’s pipeline targeting acute myeloid leukemia, AML, in view of the upcoming data readout in this indication this quarter.

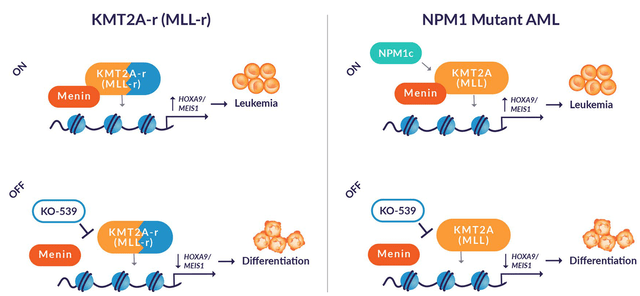

Ziftomenib is a selective, reversible, small molecule inhibitor that blocks the interaction of two proteins menin and the protein expressed by the KMT2A gene. Preclinical data showed the potent anti-tumor activity of this drug. In the preclinical study, 100% clinical remission, CR was seen with durable responses compared to FLT3 inhibitor on which the animals relapsed.

Ziftomenib: mechanism of action

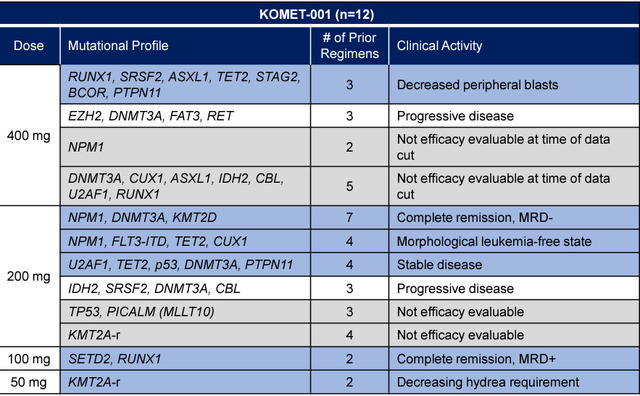

In Phase 1/ 2 clinical trial, (KOMET-001), the preliminary data were presented at the Annual Society of Hematology meeting 2020 from 12 patients with relapsed/ refractory AML. Efficacy data were available for 8 patients. Clinical or biological activity was reported in six of eight patients, including complete remission, CR in two patients., one patient achieving a morphological leukemia-free state, and one patient achieving a significant reduction in hydroxyurea requirements. All patients tolerated the treatment well without any serious adverse events.

Early clinical data in refractory AML

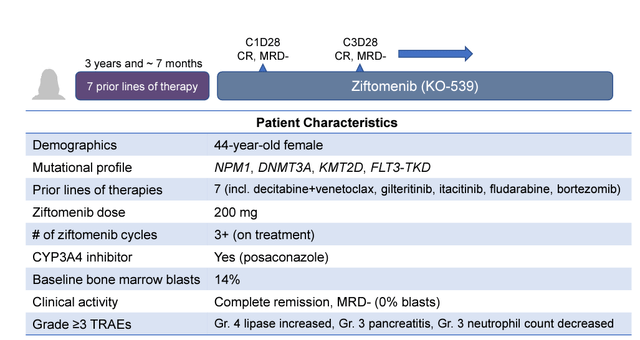

Notable was the achievement of CR in an NPM1 mutant AML patient who had failed 7 prior lines of therapy.

CR in an NPM1 mutant AML patient

In the Phase 1b portion of this trial, the company is focused on enrolling NPM1 mutant and KMT2A-rearranged AML patients. The Phase 1b data is expected this quarter, a significant price-moving event. In November 2021, FDA placed a partial hold on the KOMET-001 trial due to Grade 5 serious adverse event due to differentiation syndrome. In January this year, FDA lifted the partial clinical hold after the company’s mitigation strategy for differentiation syndrome.

The target market for the drug is 35% of all AML (30% of AML has NPM1 mutations and another 5% has KMT2A abnormalities). The drug has the potential for combination with other targeted AML therapies like Venectoclax + azacytidine and FLT3 inhibitors. According to the company’s estimate, there are 6000 annual cases of NPM1 mutant AML in the U.S. and another 1000-2000 annual cases of KMT2A rearranged AML. The relapse rate in these patients is high when treated with therapies like Venectoclax.

The company is well-funded, with $480 million in cash reserves, enough for the next 12 months. Prominent institutional holders include ECOR1 capital, Avoro Capital, Deerfield management and Suvretta Capital.

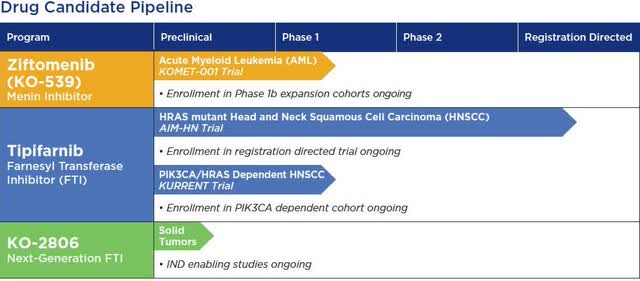

The complete pipeline of the company is shown in the figure below.

The mean Wall Street analyst price target is $35 or 84% upside. I bought the stock recently.

Risks in the investment include underwhelming data in future readouts or unexpected side effects. Investing in development-stage biotech/pharma companies is risky and it is possible to lose all invested capital. This note is my own opinion and doesn’t represent professional investment advice.

Be the first to comment