loveguli/E+ via Getty Images

The Chart of the Day belongs to the industrial inorganic chemical company Kronos Worldwide (KRO). I found the stock by sorting Barchart’s Top Stocks to Buy list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 5/17 the stock gained 17.77%.

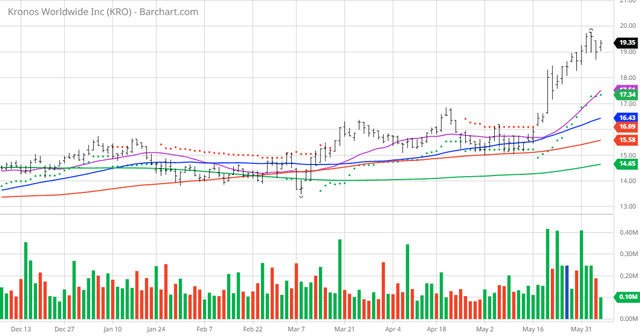

KRO Price vs Daily Moving Averages ( )

Kronos Worldwide, Inc. produces and markets titanium dioxide pigments (TiO2) in Europe, North America, the Asia Pacific, and internationally. The company produces TiO2 in two crystalline forms, rutile and anatase to impart whiteness, brightness, opacity, and durability for various products, including paints, coatings, plastics, paper, fibers, and ceramics, as well as for various specialty products, such as inks, foods, and cosmetics.

It also produces ilmenite, a raw material used directly as a feedstock by sulfate-process TiO2 plants; iron-based chemicals, which are used as treatment and conditioning agents for industrial effluents and municipal wastewater, as well as in the manufacture of iron pigments, cement, and agricultural products; specialty chemicals for use in the formulation of pearlescent pigments, and production of electroceramic capacitors for cell phones and other electronic devices, as well as for use in pearlescent pigments, natural gas pipe, and other specialty applications.

In addition, the company provides technical services for its products. It sells its products under the KRONOS brand through agents and distributors to paint, plastics, decorative laminate, and paper manufacturers. The company was founded in 1916 and is headquartered in Dallas, Texas. Kronos Worldwide, Inc. operates as a subsidiary of Valhi, Inc.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals but increasing

- 41.52+ Weighted Alpha

- 18.18% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 26.98% in the last month

- Relative Strength Index 70.70%

- Technical support level at 18.66

- Recently traded at 19.40 with 50 day moving average of 16.44

Fundamental factors:

- Market Cap $2.19 billion

- P/E 14.97

- Dividend yield 3.88%

- Revenue expected to grow 16.30% this year and another 3.40% next year

- Earnings estimated to increase 102.00% this year, an additional 3.50% next year and continue to compound at an annual rate of 33.23% for the next 5 years

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts give 1 strong buy and 1 under perform opinions on the stock

- The individual investors following the stock on Seeking Alpha voted 128 to 16 for the stock to beat the market with the more experienced investors voting 20 to 5 for the same result

- 4,890 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Ranked Overall

Ranked in Sector

Ranked in Industry

Quant ratings beat the market »

Dividend Grades

Be the first to comment