Scott Olson

About ten months ago – in September 2021 – I published my last article about Kroger (NYSE:KR). And while the fundamental business improved during that time, the stock is trading for almost the same price as back then. I was already bullish about Kroger in my last article, and I am bullish about Kroger once again.

Quarterly Results

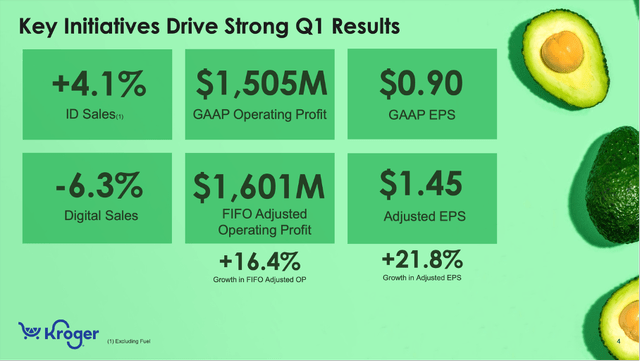

Kroger reported impressive growth rates in the first quarter of fiscal 2022. Sales increased from $41,298 million in the same quarter last year to $44,600 million in this quarter – resulting in 8.0% year-over-year growth. Identical sales without fuel increased 4.1%. Operating profit also increased from $805 million in Q1/21 to $1,505 million in Q1/22 – resulting in 87.0% year-over-year growth. Diluted earnings per share increased even 400% from $0.18 in the same quarter last year to $0.90 in this quarter. And adjusted earnings per share increased from $1.19 in the same quarter last year to $1.45 this quarter – resulting in 21.8% year-over-year growth.

And while digitally engaged households grew by more than half a million, digital sales decreased 6.3% during the first quarter of fiscal 2022. But management seems confident about digital sales to accelerate during the year. During the earnings call, CFO Gary Millerchip made the following comment:

Digital sales declined 6% in the first quarter, broadly in line with our expectations. We continue to ramp the digital growth initiatives shared at our Investor Day, including enhanced personalization capabilities, Boost membership, customer fulfillment centers, and Kroger Delivery Now. As a result of these initiatives, we grew digitally engaged households during the quarter, and we would expect digital sales to accelerate as the year progresses.

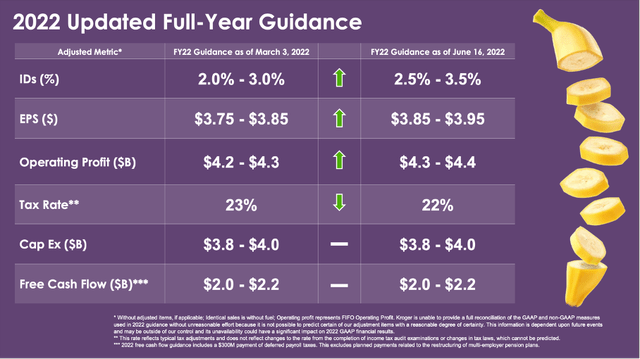

Kroger also raised the guidance for fiscal 2022. Earnings per share (adjusted numbers) are now expected to be in a range between $3.85 and $3.95 while free cash flow is expected to be between $2.0 billion and $2.2 billion. And identical sales are now expected to grow between 2.5% and 3.5% in fiscal 2022.

Growth

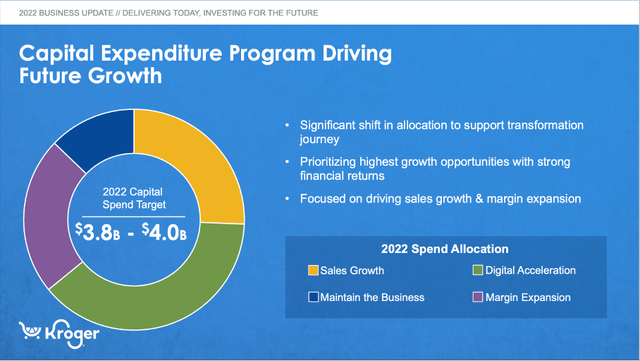

Kroger is also projecting capital expenditures to be about $4 billion, and we can look how that amount is spent to get a feeling how management is trying to grow the business. The biggest part of capital expenditures will be used for initiatives to grow sales. These include optimizing the stores and opening new stores (during the last business update in March 2022 the company announced 22 new stores) as well as focusing on providing fresh and always available products (Kroger’s full, fresh, friendly strategy). However, the biggest part of capital expenditures will be spent on digital acceleration. A third aspect Kroger is focusing on is margin expansion, which will be achieved by investing in the supply chains and focusing on waste reduction. And only a small part is spent on maintaining the business.

Kroger 2022 Business Update Presentation

A big part of Kroger’s strategy is focusing on its own brands, which generated about $28 billion in sales already and are making Kroger the ninth largest CPG in the United States with four $1 billion brands. These brands include over 10,000 items, which can only be found at Kroger’s own stores.

Kroger 2022 Business Update Presentation

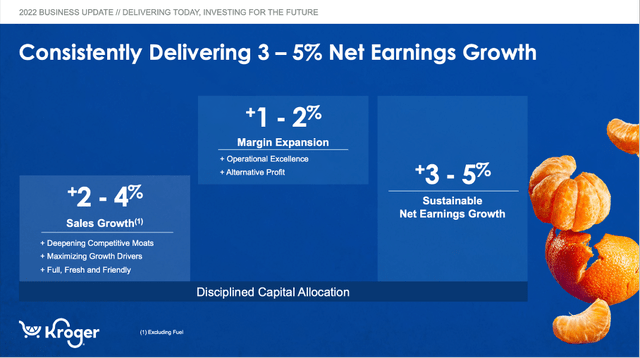

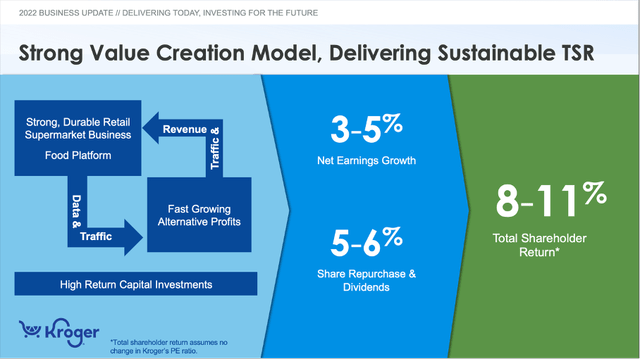

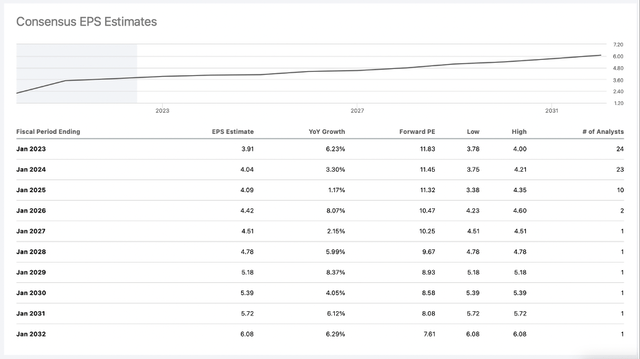

When combining the different growth initiatives, Kroger is expecting net earnings to grow between 3% and 5% in the years to come – driven by sales growth of 2% to 4% and margin expansion should contribute about 1% to 2% to the bottom line. When looking at analysts’ estimates for the next ten years, we get similar growth rates as Kroger’s management is expecting in the years to come. Between 2022 and 2032, analysts are expecting a CAGR for earnings per share of 5.15%.

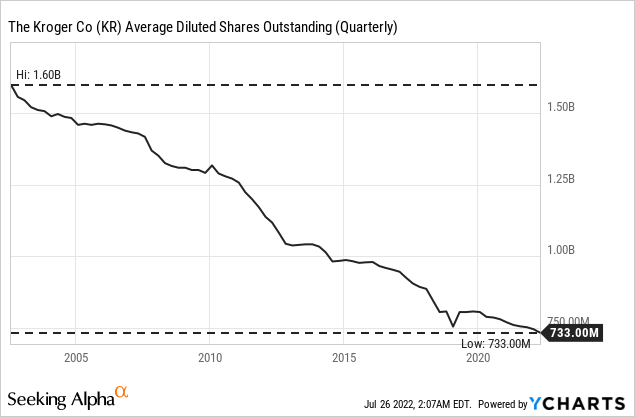

In total, net earnings growth rates of 5% seem realistic, but analysts seem to underestimate (or forget) the important role share buybacks have been playing in the past and will most likely continue to play. Over the last few decades, Kroger constantly decreased the number of outstanding shares.

Since 2002, the number of outstanding shares declined with a CAGR of 3.83% and in the last twelve months Kroger once again decreased the number of outstanding shares by 3.6%. For the years to come, we can assume that share buybacks will add at least 2% to 3% to bottom line growth.

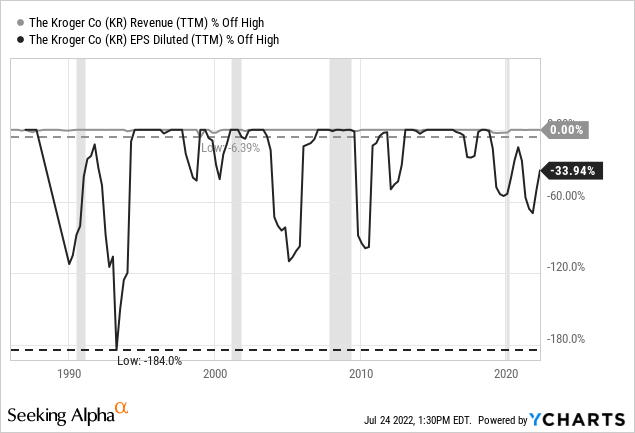

Recession

Like in almost every other article published in the last few months, we should also look at the performance of Kroger during past recessions and try to answer the question if the stock is a good investment before a potential recession. And when looking at Kroger during the last few decades we can see that revenue hardly ever declined during a recession – which is a good sign. Earnings per share on the other hand were fluctuating and declined steep on several different occasions. Kroger seems to be missing stability and consistency regarding earnings per share and while earnings per share clearly declined during recessions, EPS also declined in other years.

And although earnings per share are missing stability, Kroger still must be described as a recession-proof business. The company is operating about 2,750 grocery stores and these stores are mostly selling everyday essential items that must be bought during every economic condition – during a recession as well as during economic boom times.

Dividend

Kroger has not an extremely high dividend yield (2.25% right now), but management recently increased the dividend by 24%. The quarterly dividend was increased from $0.21 last year to $0.26 right now. And when looking at the last five years, the dividend grew with a CAGR of 11.84% and Kroger also increased the dividend every single year since 2007 when the company started paying a dividend again.

And despite the dividend increase, the annual dividend of $1.04 is more than covered by earnings. When comparing the current dividend to the trailing twelve months earnings per share ($2.89), we get a payout ratio of 36% and when using the mid-point of the guidance for fiscal 2022 (which is $3.90), we get a payout ratio of only 27%.

Intrinsic Value Calculation

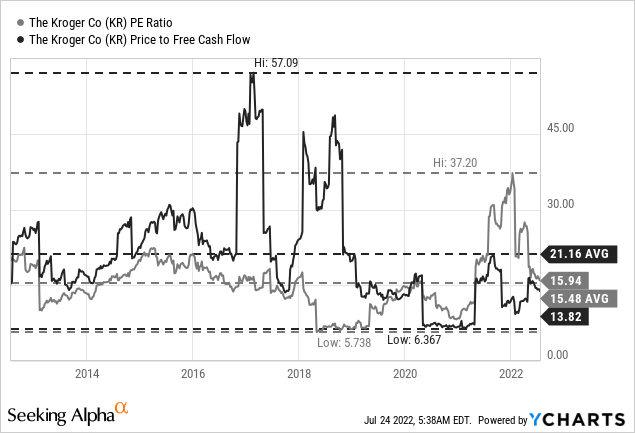

When looking at simple valuation metrics, Kroger seems to be trading more or less in line with past numbers. Especially, the price-earnings ratio of 16 is close to the 10-year average of 15.48 and would indicate that Kroger is fairly valued right now. Usually, I rather focus on the price-free-cash-flow ratio as it is the better metric and right now, Kroger is trading only for 13.82 times free cash flow. This is not only a rather low P/FCF ratio, but also below the average of 21.16 of the last ten years. We can certainly argue that Kroger is fairly valued at this point or even undervalued.

To back that claim up, we can also use a discount cash flow calculation to determine an intrinsic value for the stock. As basis for our calculation, we can use the mid-point of the company’s own guidance for fiscal 2022 (which is $2.1 billion in FCF). For the years to come, let’s be realistic (and maybe a bit cautious) and assume 5% growth from now till perpetuity. Calculating with 733 million outstanding shares and 10% discount rate, we get an intrinsic value of $57.30 for Kroger making the stock already undervalued.

Kroger 2022 Business Update Presentation

But when looking at Kroger’s own growth assumptions for the years to come, we can even be a little more optimistic. When assuming 3-5% net earnings growth and about 3% growth from share buybacks, we can also assume 6% growth from now till perpetuity. All other assumptions being identical, we get an intrinsic value of $71.62 for Kroger and the stock could be called a bargain at this point.

Cheaper than its peers

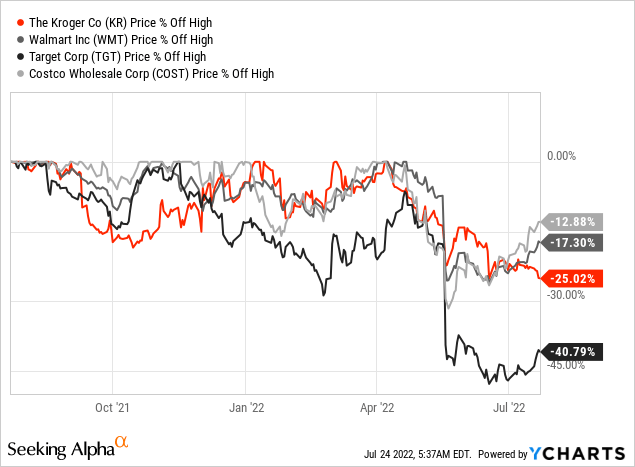

And in the last few months, Kroger clearly outperformed Target Corporation (TGT) – when looking at the stock price) but is lagging other companies like Walmart (WMT) or Costco (COST). Right now, Costco is trading about 25% below its all-time high.

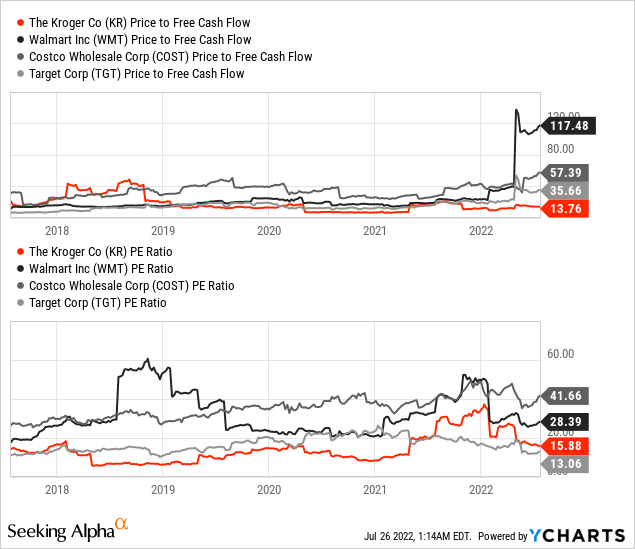

But among these four retailers, Kroger seems to be valued most attractive (maybe it is a head-to-head race with Target). When looking at the price-earnings ratio, Target is trading for a lower P/E ratio (Target is trading for 13 times earnings compared to 16 times earnings for Kroger) but Kroger seems cheap compared to Costco Wholesale Corporation as well as Walmart.

And especially when looking at the price-free-cash-flow ratio, Kroger is the cheapest of the four companies. And of course, a comparison between Kroger and Costco for example is lagging a bit as Costco will probably be able to grow with a higher pace. Nevertheless, Kroger seems to be a bargain.

Conclusion

Although Kroger saw its earnings per share decline during past recessions, we still must see the company as recession-proof (and revenue most likely won’t decline during the next upcoming recession). And as Kroger is trading for a reasonable valuation multiple and below its intrinsic value, it seems like a good pick right now.

Be the first to comment