jetcityimage

Introduction

The Kroger Co. (NYSE:KR) plans to acquire Albertsons Companies, Inc. (ACI). The merger is an interesting opportunity to allow Kroger to grow its business. The combined company should benefit greatly from synergy and geographic sales diversification. However, parts of the deal are being held up by lawsuits, such as Albertsons’ pre-merger special dividend distribution. The attractively valued share price makes it an interesting stock to investigate.

Furthermore, Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) bought Kroger until the second quarter of 2021, owning some 28M shares. Since then, Berkshire has been gradually reducing the position. Currently, as of the last report, it still owns about 50M shares, representing a total value of about $2.2B. This puts Kroger in position 17 in Berkshire’s stock portfolio. Still a fairly high stock allocation.

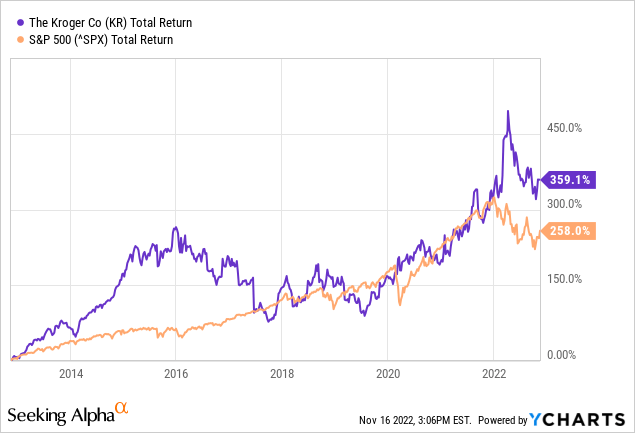

Kroger is a stock that has shown high total returns over the past 10 years. Its 10-year total return averages 13.6% per year, compared to the S&P500’s total return of 10.0%.

The recent decline provides an opportunity to take a closer look at the stock. After all, Kroger’s valuation has become favorable and its prospects remain excellent. The company is shareholder-friendly, making the stock a buy.

Kroger Raised Full Year Outlook

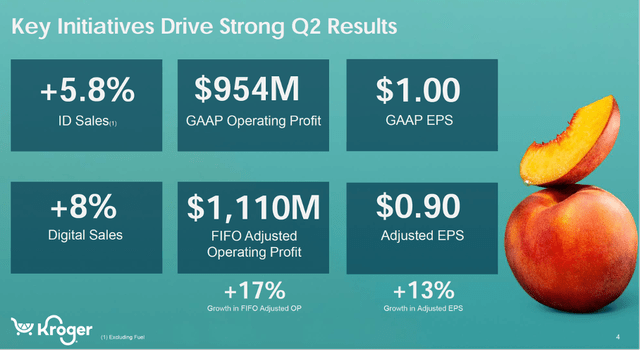

First, let’s take a look at the second quarter results. The second quarter investor presentation showed strong growth of 5.8% in identical store sales. Identical sales of Kroger brands were up 10.2% and digital sales were up 8%. Excluding fuel, sales increased 5.2% compared to the same period last year.

Non-GAAP EPS came in at $0.90, up 12.5% year over year. Free cash flow of $640 million during the quarter enabled Kroger to repurchase $309 million of shares and distribute $153M in dividends. On Sept. 9, the Board authorized a new $1B share repurchase program. Now share repurchases are paused ahead of the planned acquisition to reduce debt.

Key Initiatives Drive Strong Q2 Results (2QFY23 Investor Presentation)

Kroger raised its full-year outlook, expecting identical sales excluding fuel to grow 4% to 4.5% YoY. Adjusted net earnings per diluted share are expected at $3.95 to $4.05, representing growth of about 9% YoY.

Merger with Albertsons Is A Strong Catalyst For Kroger

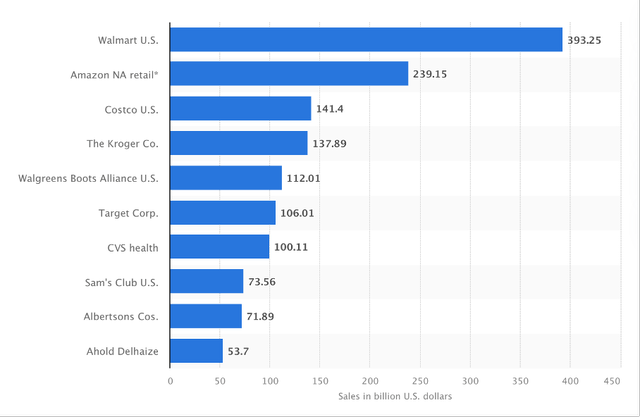

On Oct. 14, 2022, Kroger announced its intention to merge with Albertsons. Albertsons is a well-known food and drug store in the United States and posted sales of $72B in 2021. The acquisition will create strong synergies, reducing costs and giving both companies a strong competitive advantage over competitors. Albertsons’ food and drug stores are not located in areas where Kroger operates, so this will ensure better geographic sales distribution. Consolidated sales of both companies will be about $210 billion.

Sales of the leading food and grocery retailers in the United States in 2021 (in billion U.S. dollars)* (Statista)

For shareholders, this means the following:

- Kroger and Albertsons merge. Albertsons will be acquired for a total enterprise value of $24.6 billion.

- Kroger will pay Albertsons shareholders $34.10 per share.

- Before the acquisition:

- Albertsons shareholders will receive $6.85 special dividend, payable on Nov. 7, 2022 to shareholders of record as of the close of business on Oct. 24, 2022.

- 100-375 Albertsons stores will be spun off and incorporated into a spinoff company. Albertsons shareholders will receive shares in this company.

Kroger will receive Albertsons minus 100 to 375 Albertsons stores minus the special dividend.

When the merger was announced on Oct. 14, Albertsons shares rose to $30, plus the special dividend of $4 per share constitutes the acquisition price of $34.10 per share.

Albertsons’ stock price plunged shortly after news of the acquisition because investors are skeptical about its prospects; they believe the merger will not be approved under these conditions.

Several attorneys disagree on the special dividend distribution. They believe the dividend should be invested in the company, even though the Board of Directors has agreed to distribute a special dividend. Albertsons has $3.4 billion in cash on hand, and this will not be enough to pay the special dividend of $4B. Albertsons must take on debt to pay the special dividend to their shareholders.

The terms favor Albertsons shareholders as well as Kroger shareholders. Kroger is acquiring Albertsons for an enterprise value of $24.6 billion. Assume Albertsons divests 375 of its 2276 stores (worst-case scenario), EBIT is about 16% lower (rough estimate). Fiscal 2021 EBIT is $2.5B, so the EBIT from Albertsons after merger is expected at $2B. Albertsons’ EV/EBIT ratio is then only 12.

Kroger’s EV/EBIT ratio is currently 11.9. The acquisition of Albertsons is favorable for Kroger’s shareholders and there is certainly no premium paid when looking at the consolidated company.

The Albertsons merger is very favorable for Kroger shareholders because of its price, synergy benefits and geographic sales diversification.

Rodney McMullen, Chairman and Chief Executive Officer of Kroger, wrote the following:

Albertsons Cos. brings a complementary footprint and operates in several parts of the country with very few or no Kroger stores. This merger advances our commitment to build a more equitable and sustainable food system by expanding our footprint into new geographies to serve more of America with fresh and affordable food and accelerates our position as a more compelling alternative to larger and non-union competitors. … We believe this transaction will lead to faster and more profitable growth and generate greater returns for our shareholders.

Even if the merger fails, Kroger remains an attractive stock that I like to see in my portfolio.

Growing Dividends, Growing Income

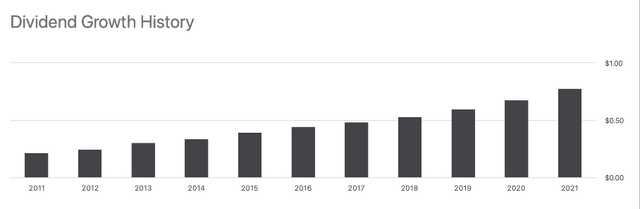

Kroger posted strong profits, raised its outlook and it has the opportunity to grow further by merging with Albertsons. Next, I want to know if Kroger is shareholder-friendly by looking at their past dividends and share buybacks. If Kroger’s dividend per share has risen steadily in recent years, I can assume that the level of the dividend per share was chosen wisely by management.

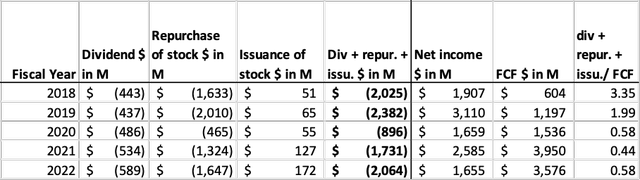

Over the past 10 years, dividends per share have grown at an average annual rate of 13.5%. Free cash flow increased from $697 million in fiscal 2012 to $3,579 million in fiscal 2022, representing strong growth averaging 17% per year. Although dividends per share have risen sharply in recent years, Kroger has also repurchased many shares during this period. As a result of the share repurchases, Kroger reduced the number of shares outstanding from 1,186 in fiscal 2012 to only 754 in fiscal 2022, representing an average annual buyback yield of 4.4%.

Repurchasing shares in the open market creates additional demand and less supply. Consequently, there is a chance for the stock price to rise sharply. Also, share repurchases are a tax-efficient way to return cash to shareholders.

Dividend Growth History (KR Seeking Alpha Ticker Page)

During fiscal year 2022, Kroger repurchased more than $1.6 billion worth of shares, representing a high buyback yield of 7.4%. Including dividend payments, Kroger returned $2 billion to shareholders, about 58% of free cash flow.

Krogers’ Free Cash Flow Highlights (SEC and Author’s Own Calculation)

Share repurchases are paused ahead of the merger with Albertsons to reduce debt. Current net debt to adjusted EBITDA is only 1.63. I expect share repurchases to be continued post-merger when debt levels are more favorable.

Analysts Are Upgrading Kroger

Inflation is up 7.7% year-over-year and food inflation will greatly benefit Kroger. Several analysts are upgrading Kroger. Evercore ISI sees a favorable risk-reward with food inflation as a catalyst. They expect a CY23 EPS of $4.20 and assign a base case value of $56. At 11.5x CY23 EPS, Kroger trades at a 35% discount to the S&P500. If the merger with Albertsons is approved, Evercore ISI sees even greater upside potential ahead. The bull case would lead to a share price above $70.

Several analysts talk about very rosy prospects for Kroger. I take a more conservative view by looking at the stock’s valuation ratios.

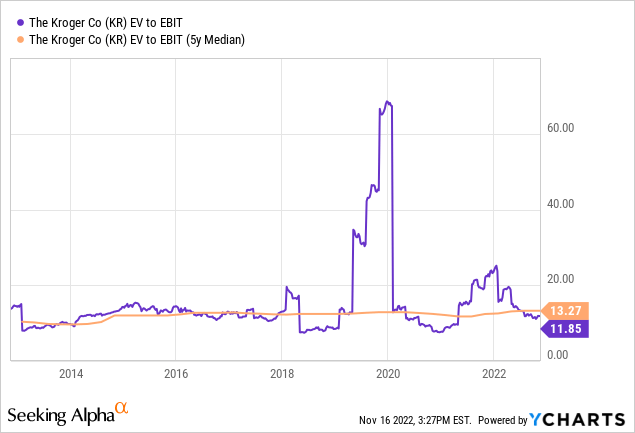

Since Kroger has a lot of debt on its balance sheet, the EV/EBIT ratio is an appropriate candidate for comparing the current valuation to the past.

Looking at the chart, the EV/EBIT ratio of 11.9 is lower than the average ratio of 13.3. Kroger is favorably valued here based on the EV/EBIT ratio. After the merger, the graph should look the same because Kroger will merge with Albertsons at an EV/EBIT both valued at 12. Overall, an EV/EBIT of 12 is low compared to the overall market.

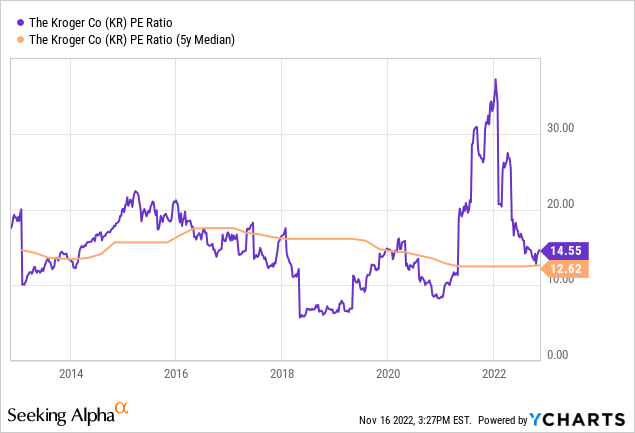

When we look a little deeper, we also see a favorable value on the PE ratio chart. The PE ratio of the S&P500 is 20.7, so Kroger is trading at a high discount of 30%. However, the current PE ratio of 14.6 is slightly higher than the 5-year median of 12.6.

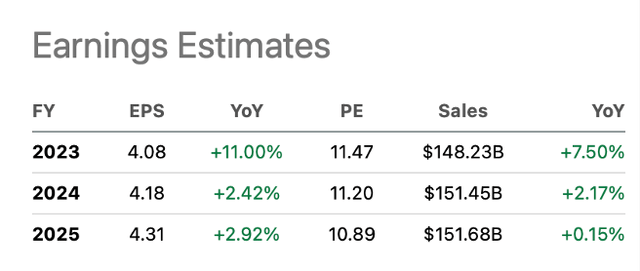

Earnings estimates for the next few years look good. Earnings per share are expected to increase 11% for fiscal 2023. Low-digit growth of about 3% is expected for subsequent years.

Earnings estimates should represent a lower range as 19 analysts revise earnings per share upward and Evercore ISI expects CY23 earnings per share of $4.20.

Earnings Estimates (KR Seeking Alpha Ticker Page)

Conclusion

The proposed merger with Albertsons is a strong catalyst for Kroger because of the favorable acquisition price, synergy benefits and geographic sales diversification. Several attorneys disagree with the special dividend payment. Even if the merger fails, Kroger is a strong growth stock that sees rising earnings and profits during this inflationary period.

Strong growth is also characterized by share price growth. Kroger is a stock that has risen significantly over the past 20 years. Its total return averages 13.6% per year, compared with that of the S&P500 of 10.0%.

Results for the second quarter of fiscal 2023 were strong with 5.8% growth in identical store sales. Excluding fuel, sales increased 5.2% compared to the same period last year. Non-GAAP EPS increased also strongly by 12.5%. Kroger increased guidance and expects identical sales excluding fuel to increase 4% to 4.5% and non-GAAP EPS to increase about 9% year over year.

Kroger’s management has been shareholder-friendly by increasing its dividend by 13.5% annually for the past 10 years. In addition to the dividend distribution, the company is repurchasing shares and returned a total of $2B to shareholders in fiscal year 2022.

Strong earnings, improving prospects, a favorable risk/reward due to the merger with Albertsons, favorable stock valuation and shareholder-friendly management are strong catalysts for the stock price and should give investors good prospects from an investment in Kroger.

What are your thoughts on the merger or the possible continuation of the share buyback program after the merger? Let me know in the comments section!

Be the first to comment