_ultraforma_/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) as an investment option at its current market price. This is a fund with an objective to “provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Regional Banks Select Industry Index.”

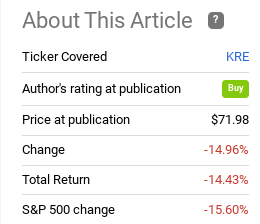

I wrote about KRE roughly six months ago. At that time, I suggested readers give it some consideration as I was fading international exposure due to war in Europe, and I also anticipated rising interest rates would help the underlying sector. Unfortunately, my thesis did not work out as hoped, as KRE’s return since then has been quite poor and only slightly beaten the S&P 500:

Fund Performance (Seeking Alpha)

With this in mind, I figured it was time to take another look at KRE to see if I should change my outlook. Despite the fund being noticeably cheaper than it was six months ago, my sentiment has soured a bit. Higher interest rates do not seem to be helping the sector as many market participants thought they would, concerns over economic growth are pressuring share multiples, and the idea that investors would want more domestic-plays has not been the tailwind I hope it would be. As a result, I am downgrading my rating to “hold” on this fund, and will explain why in detail below.

Rates Are Up, But Curve Inversion Signals Worries

To begin, let us reflect on the current state of the market here in 2022. This has clearly been a challenging year. While KRE has performed poorly, so have most other sectors (Energy and Utilities are notable exceptions). So I don’t want to be too hard on regional banks, as most of the market is suffering along with it.

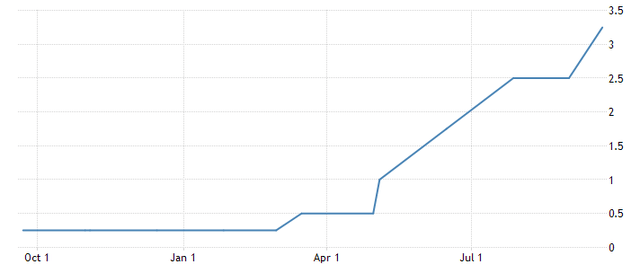

The problem is I would have expected more from this sector given that rising interest rates tend to favor banks and other lenders. The Fed has been steadily increasing its benchmark rate through this calendar year, including yesterday, when it was hiked by another .75 basis points:

Fed’s Target Rate (Federal Reserve)

This should be good for banks, and KRE by extension, right?

In fairness, it is if all other things are equal. But all other things are rarely equal. What I mean is that higher interest rates do trickle down to borrowers by financial institutions. This means that the amount of income the lender can earn on each loan theoretically should increase. That is good news for investors.

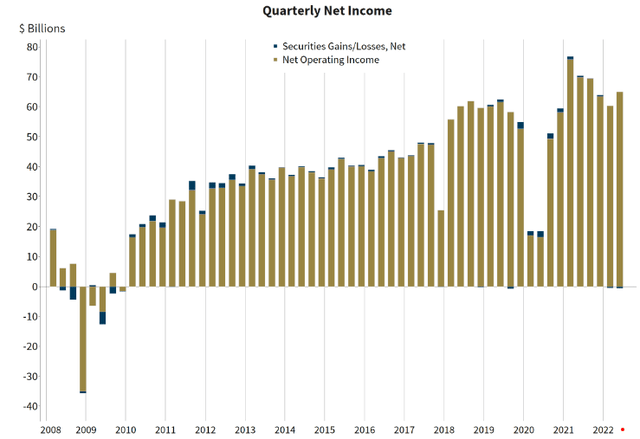

The bad news is that other factors come in to play. These include credit quality (the ability of the borrower to pay back the loan) and demand. As rates go up, demand from borrowers can dry up and/or they could have trouble paying back their obligations. This could mean that banks earn less in income despite a more favorable backdrop with higher interest rates. As 2022 has gone on, that seems to be a valid concern. Despite a rising interest rate environment, quarterly net income has gone down, on average, at America’s financial institutions:

Quarterly Net Income (FDIC-insured banks) (FDIC)

The good news is that the net interest margin widened, meaning that banks are able to pass-on more of the rate hike to borrowers than they are offering back to depositors. But quarterly net income is still being challenged anyway. Part of the reason for this is rising provision expenses being put on the books at large and medium-sized U.S. banks. These are line items that the bank expects may not be paid back in full (or at all) in the future, and have to be baked in to earnings estimates going forward.

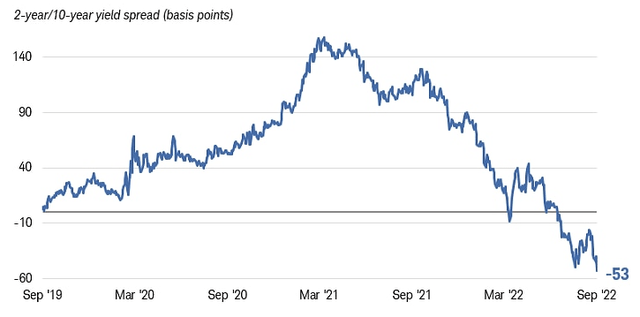

To understand why lenders are boosting provision expenses, we have to consider the worsening economic outlook. When lenders expect things to get worse in the future, they naturally have to expect a higher percentage of delinquencies and/or defaults. And banks are not alone in this thinking. The bond market, driven by institutional investors, are onboard with this outlook. For proof, consider the yield curve is inverting at a wider level. This indicates broad concerns about future growth and macro-conditions:

Yield Curve Inversion (Bloomberg)

My conclusion from this is the outlook heading in to the final stages of 2022 is much more than it was when 2022 began. What was supposed to be a year or growth and a tailwind of higher interest rates has turned over on its head. Now, despite rates being higher, markets are concerned with a declining growth environment in 2023. This has led to a yield curve inversion, pressures of bank shares, and the benefit higher borrowing costs going mostly unrealized at the nation’s banks. When I consider this backdrop in the near term, I am forced to downgrade my rating on KRE.

New Regulations On The Way?

Another concern I have at the moment is the potential for new regulations out of Washington. This is a downside risk, as one of the reasons I have considered regionals banks in the past is they are not subject to as strict regulations as the largest banks in the country are. This gives them more flexibility and lower thresholds for cash reserves – allowing the smaller and medium size banks to put more cash to work that would otherwise be in liquid, low-yielding assets as a safety buffer.

While these has not been any official announcement out of the Biden administration to date, a report from Bloomberg last week notes the following:

US banking regulators are considering asking large regional banks to add to financial cushions to make it easier to wind them down in a future crisis”

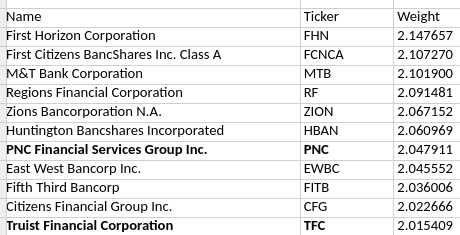

This could lead to new for regional banks similar to those large-cap banks have, such as raising long-term debt. While this is only speculation at this point, sources have pointed to targets being PNC Financial Services Group (PNC), Trust Financial Corp (TFC), and U.S. Bancorp (USB), among others.

This is relevant for KRE because two of those names happen to be top holdings within the fund:

KRE Top Holdings List (State Street)

The thought here is simply to keep this in mind for part of the analysis before buying KRE. If we start to see more regulations out of Washington for this space, the net impact probably won’t be positive. While I would surmise any new laws or regs are probably a ways off, understanding this as a potential headwind will likely limit returns going forward.

Global Risks Haven’t Been The Boon I Hoped For

My next thought is just to admit defeat on an area I thought would benefit KRE in 2022. Specifically, back in March when I recommended the fund, military conflict between Russia and Ukraine was just getting underway. We saw an immediate risk-off move in equity markets, and I suggested investors were probably wise to avoid Europe for the foreseeable future. That turned out to be the right call, but not quite in the way I hoped.

What I mean is, while Euro-zone stocks have done poorly, U.S. and other developed markets haven’t fared so well either. I had hoped that investors would turn to more domestic-oriented themes – such as regional banks. The idea was regional banks generate most of their revenues and profits domestically. This is in contrast to the mega U.S. banks, and also to other sectors. I believed a move to domestic focus would occur, the eventuality being out-performance by KRE.

The point is I was just flat-out wrong. KRE has trended generally in-line with equity markets and certainly hasn’t received a boon from global geo-political risks. This comes despite the Russia-Ukraine conflict being an escalating, drawn-out affair, as well as renewed concerns over military action in the East Asia sea (i.e., China and Taiwan).

The net result is I would have expected KRE to out-perform and it didn’t. Perhaps if we saw a quick resolution to the Russia-Ukraine conflict it would make sense that a broad rotation in to pure domestic ideas did not pan out. But that conflict is as relevant today as ever before, and other conflicts are at risk of sparking out across the globe! Yet, KRE has not been an “alpha” generator, and I have to accept that sometimes my logic does not always correlate to market gains.

Slowing Growth Is Not Good For Banks

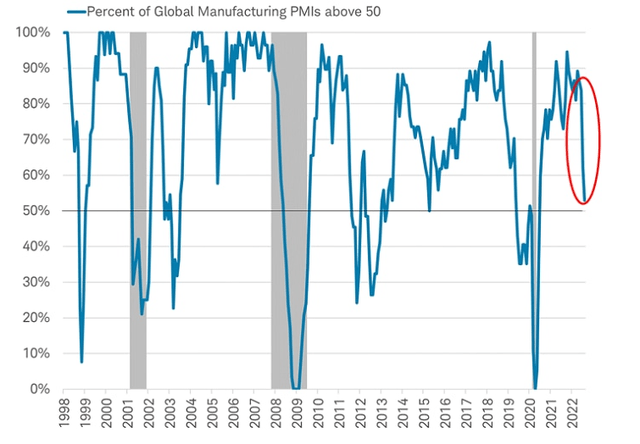

Another macro-concern I have is simply that it is not just U.S. growth that is expected to slow, it is global growth. Now, the impact on KRE could be minimal when nations outside the U.S. come under pressure given it is mainly exposed to U.S. conditions. But whether we like it or not global concerns tend to make their way in to U.S. equities, justified or otherwise. My worry is that as global growth slows, U.S. stocks (KRE included) are going to fall as a result. And this is not a far-fetched idea, as the number of countries with PMI’s above 50 (which is the level considered expansionary) is falling dramatically:

Percent of Economics with PMI’s Above 50 (Charles Schwab)

The takeaway here is straightforward. As economic growth slows, so will loan demand, on-time interest payments, and banking sector profits. While KRE is more isolated from global concerns than their mega-bank peers, the problem is the growth outlook is weakening domestically as well. This makes me much more cautious on new positions at the moment.

Of Course, The News Isn’t All Bad

Through this review I have not painted a very rosy picture. And it is true I see some challenging headwinds ahead for KRE and U.S. equities as a whole. But I want to reiterate I am not overly “bearish” on the fund at these levels. Certainly, I should have been six months ago, but with a double-digit drop having already occurred, I don’t see an overwhelming risk of more downside either. I think managing expectations about return potential is important here, but I don’t want to portray an alarmist attitude either.

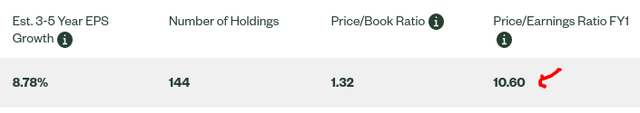

There are a few key reasons for this. One, KRE is pretty cheaply priced. While the market has seen some P/E compression in the near term, the S&P 500 still has a current P/E above 19. By contrast, KRE sits with a P/E of just 10.6:

In addition, the dividend story behind this fund is also attractive. While the yield is certainly not “high” at the current level, the dividend growth metric is one I find attractive. Through 2022, KRE has raised its distribution in each quarter on a year-over-year basis, as shown below:

KRE’s Distributions (State Street)

Again, this is not a metric to suggest buying in droves, but the distributions in 2022 translate to a dividend growth rate of roughly 6.5%. That is close to inflation level and, in this climate, I would view that favorably.

Bottom-line

My followers know I never shy away from admitting an error. And recommending KRE back in March was one such error. Rather than double-down on this call, I am taking a more cautious stance on the regional banking sector. Rising interest rates could be an important tailwind, but not if economic growth disappoints and/or loans and interest payments begin to go in arrears. The valuation and dividend growth are two metrics that will allow me to keep KRE ETF on my radar, but the weakening macro-climate tells me this fund should be a hold for now. Therefore, I would suggest readers approach this fund very selectively at this time.

Be the first to comment