pichitstocker/iStock via Getty Images

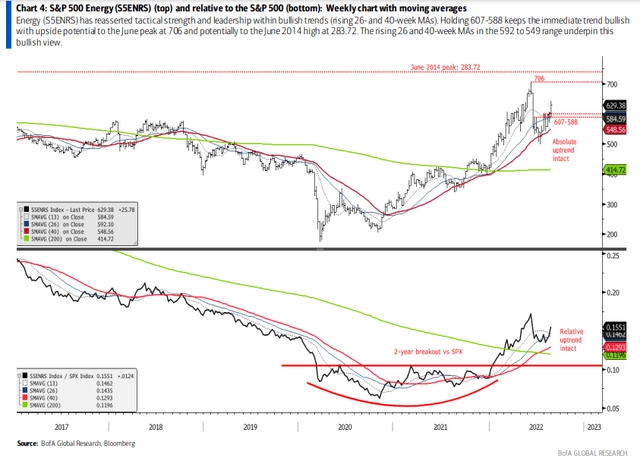

The Energy sector has come back with a vengeance. Many oil & gas names, particularly those with exposure to the in-demand LNG market, continue to benefit from a secular shift that appears well underway. Looking at the technical picture of the sector from Steve Suttmeier at Bank of America Global Research below, Energy held critical levels on its summer dip from both an absolute and relative perspective.

Energy Reasserts Itself As A Leading Sector

BofA Global Research

Just last week, one small cap was upgraded by the team at Berenberg. Kosmos Energy (NYSE:KOS) has structural upside to counter a possible downturn in the domestic economy. Moreover, the firm is deleveraging in the LNG space, positioning itself well for further EPS growth.

According to Bank of America Global Research, Kosmos is a conventional oil and gas E&P company with assets across the U.S. Gulf of Mexico, Ghana, Equatorial Guinea, Senegal, and Mauritania. This gives the company a diverse asset base and supports both infrastructure-led exploration as well as high-impact basin opening drilling. Recent corporate activity (GoM and EG assets) and exploration success (Senegal and Mauritania) support roughly.60- 70k barrels of energy per day of production, set to grow to 100kboe/d by 2024.

The Texas-based $3.3 billion market cap Oil, Gas & Consumable Fuels industry company within the Energy sector trades at a trailing 12-month price-to-earnings multiple of 18.3 and does not pay a dividend, according to The Wall Street Journal.

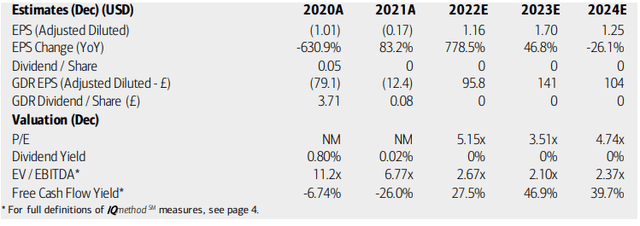

On valuation, analysts at BofA see earnings continuing to trend positive and higher. After reporting losses in its fiscal years 2020 and 2021, a sharp reversal appears to be sustainable through 2024, though EPS is seen as dropping from 2023 to 2024. BofA is bullish on the stock with a price target of $8.60. While the firm does not pay a dividend right now, I would not be surprised to see one reinstated should free cash flow continue to grow.

KOS: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

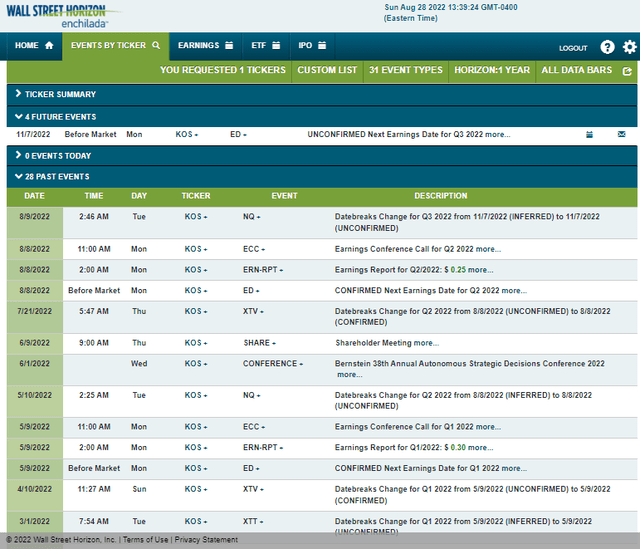

Looking ahead, KOS has an unconfirmed Q3 earnings date of Monday, Nov. 7 BMO, according to corporate event data provider Wall Street Horizon. The company reported better-than-expected Q2 results back on Aug. 8, but the stock did not react much to the report.

Kosmos Corporate Event Calendar

Wall Street Horizon

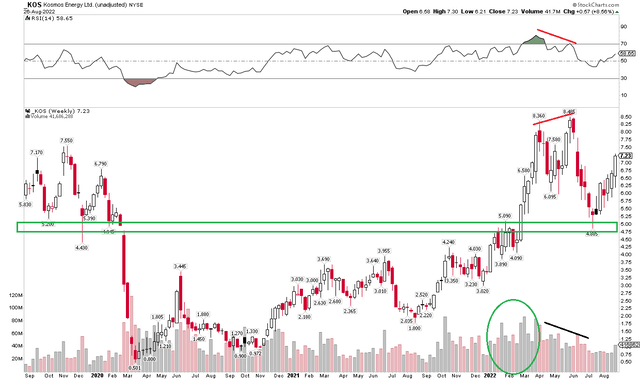

The Technical Take

KOS has more than tripled in the last year amid a secular tailwind within the sector. I see solid support around $5. Notice how the stock pulled back to that level off its early June peak near $8.50. The $5 mark was significant earlier this year and way back in late 2019 – the rug was pulled out from under Kosmos when it dropped under $5 back then.

On the upside, notice how the stock featured bearish negative divergence when it made a fresh peak above the March-April 2022 high. That momentum loss proved very bearish, as the stock was nearly halved to its July low. But the bulls can point to solid volume on the way up and a drop-off in volume when shares moved lower this summer.

I think the stock is headed right back toward that $8.50 level (which is also near BofA’s fundamental price objective). I would not be surprised to see the stock ultimately climb above that and rival its late 2018 high of $9.75.

KOS: Bearish Divergence Led To A Big Summer Pullback. Trending Back Up.

StockCharts

The Bottom Line

Those who seek exposure to the Energy sector should consider this small cap with positive technicals. I see about 17% of upside from here, and perhaps a lot more if it climbs above $8.50. The valuation and earnings growth outlooks look favorable, too.

Be the first to comment