Matt_Brown

The Update

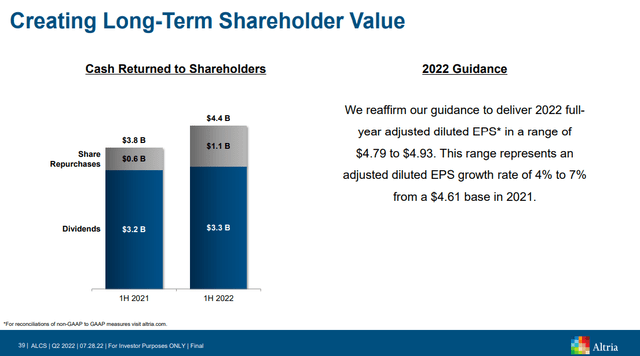

On August 25th we found out that Altria (NYSE:MO) increased the dividend by 4%. That’s $3.76 annualized, providing a yield of about 8.2% for investors.

That’s largely good news although I expected $3.88 which means that I missed by $0.12 per my forecast. Here’s why, in reference to earnings:

MO itself is looking at a range of $4.79 to $4.93, so we’re in the right ballpark. I think conservatively, we should go with $4.85, which is right next to the analysts and definitely within MO’s own projections.

And, just to be clear, here was my basic assumption before MO’s recent dividend announcement:

It’s simple math. If we take the $4.85 adjusted earnings estimate for 2022, and the 80% payout, we’re probably looking at $3.88 for the new dividend.

Roughly speaking what this all means to me is that MO is expecting $4.70 in earnings for 2022. The math is pretty easy. Just take the dividend and divide by 80%. Now, if you think I’m just kind of pulling this out of my hat, I’m not.

Altria Group’s target dividend payout ratio is approximately 80 percent of adjusted earnings per share.

What Is Altria Expecting?

I’m not complaining about MO’s dividend increase. I want to be really clear about that fact. I’m not sad or disappointed. Instead, I’m just a bit confused because my earnings estimates appear to be off more than I expected.

Let’s step back a minute. Take a look at this:

Altria Earnings Estimates (Seeking Alpha & Altria)

It’s very clear that EPS is estimates to range between $4.79 and $4.93, per the Q2 2022 earnings call presentation. However, per the math above using the 80% payout of earnings, we’re below the low end of MO’s estimate.

As a quick reminder, the guidance is based on adjusted diluted EPS. And, the 80% payout ratio is also based on adjusted earnings. So, that possible discrepancy doesn’t wash.

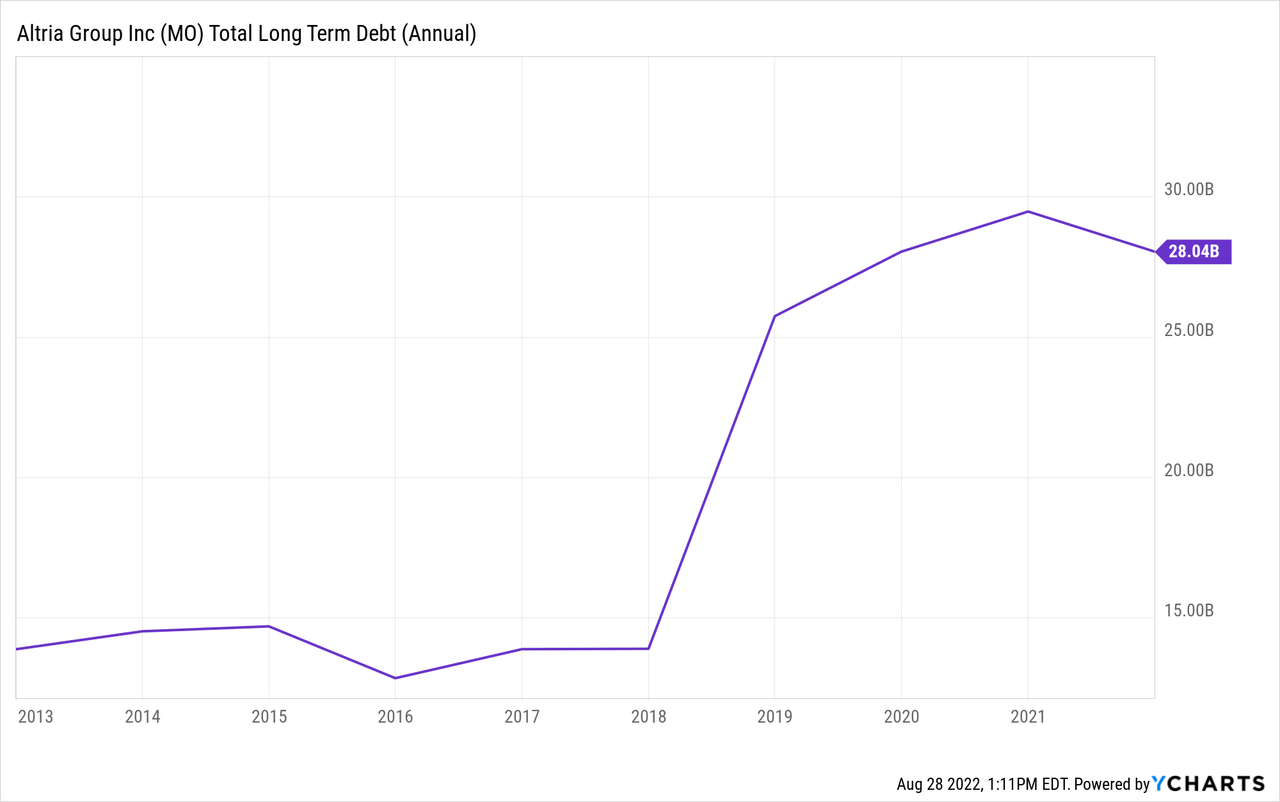

I was wondering if maybe a ton of debt was coming due soon in late 2022 or maybe 2023. My quick at-a-glance review didn’t reveal much at all. I’m seeing about $1.5 billion due in 2023, and if they roll it will likely be at higher rates. So, maybe there’s a desire to clear that out with earnings. But, again, that’s 2023. Debt did balloon in late 2018.

How did that happen? In short, the JUUL investment.

Altria financed the JUUL transaction through a $14.6 billion term loan facility arranged by JPMorgan Chase Bank, N.A.

I cannot find the exact terms of the “term loan” but obviously there’s still a large pile of long-term debt on the balance sheet. So, maybe there’s a plan to burn that down that MO hasn’t yet telegraphed to investors.

What is clear to me is that the JUUL deal went through in late 2018 and then in early 2019 that debt hit really started to land hard.

Why Are We Looking At Debt?

First, again, I’m not worried about MO’s debt. Still, in many ways this is an important little trip. We’re seeing the lasting impact to MO’s business, even if earnings and dividends are flowing like crazy. In other words, it’s frustrating – even sad! – that MO seems to have screwed up with JUUL. But, the shareholder rewards continue because the business is so damn good.

But, at the same time, it’s hard to tell if MO will retire this debt of let it ride. I’ve reviewed the quarterly reports and I haven’t seen much at all about MO’s debt, or if there are plans to burn it off. I’m seeing some pretty good interest rates (e.g., 1%, 1.7%, 3.125%) but I’m also seeing some “ugly” rates out through 2039, 2049 and 2059 (i.e., 5.8%, 5.95% and 6.2% respectively).

Please keep in mind I’m not identifying serious issues with debt repayment. but, perhaps this is worth considering:

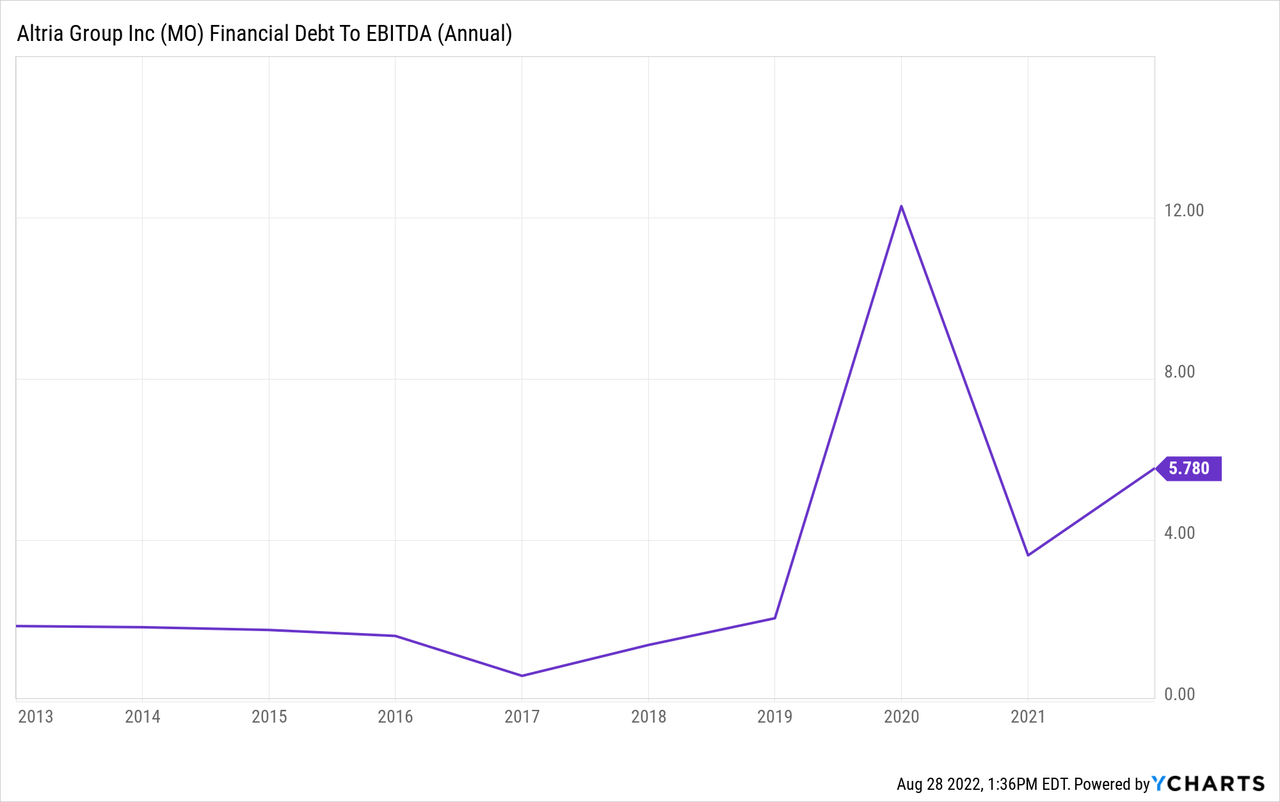

Debt as a percentage of EBITDA helps investors understand how well a company can pay off debt. For an interesting reference here’s what the Corporate Finance Institute has to say:

Higher net debt-to-EBITDA ratios indicate that the company may face difficulties in paying off their financial liabilities, based on their liquid assets and EBITDA. The ratio is often used by credit rating agencies, potential investors, as well as corporate buyers (i.e., for a merger or a takeover) to assess the financial status of the company.

Generally, net debt-to-EBITDA ratios of less than 3 are considered acceptable. The lower the ratio, the higher the probability of the firm successfully paying off its debt. Ratios higher than 3 or 4 serve as “red flags” and indicate that the company may be financially distressed in the future.

The most interesting idea here is that MO’s debt to EBITDA is about 5.8 and there are “red flags” when you go over ratios or 3 or 4. Before this deeper analysis, I didn’t realize the impact of the JUUL debt burden. Like many investors, I just figured it was water under the bridge and easily handled. What I’m seeing more clearly now is that the JUUL-related debt is actually an albatross around the neck of our dividends.

Wrap Up

Something still doesn’t quite add up with the JUUL investment. I already knew that JUUL is no jewel. I explained how it was contributing nothing to MO’s bottom line. At same time, I’m seeing more and more that it could be directly or indirectly dragging down MO’s dividends. If nothing else, the JUUL debt is ugly on the balance sheet, with little upside at this point in time. Frustrating.

Now, that said, I am not convinced that my $0.12 dividend miss was caused by JUUL. I mean, maybe a little, per the above analysis. But the most strange piece of this deeper dive is just the straight math. We know MO pays out 80% of earnings and the dumb and simple math tells us that adjusted EPS ought to be closer to my $4.85 estimate than $4.70 I’m seeing here today.

I thought maybe this is how it could work. We know that MO paid out $0.90 in Q1 and Q2, and it’s almost certain that MO will pay out $0.94 in both Q3 and Q4. That brings us to a total of $3.68 for the year. That takes us to $4.60 using the same math, backing into the 80% payout. But, here’s the problem I can’t quite square. That $4.60 of adjusted EPS, backed out, still doesn’t get us into the $4.79 and $4.93 range that MO has telegraphed in the Q2 2022 earnings call.

Adding it all up, I see the dividend increase as a “miss” by MO. I’m not upset or angry, and I certainly haven’t lost faith in MO. But, my faith is shaken a bit. I must be missing something but I don’t like that it’s not blatantly obvious. From a valuation point of view, MO is a “BUY” but my mathematical confusion has left me in a neutral position. I’m not adding and I’m not selling. Until this gets resolved, I’m going to put a HOLD on MO.

Be the first to comment