skynesher/E+ via Getty Images

Thesis

2022 has been a challenging year for Korn Ferry (NYSE:KFY) investors, who have seen their investment lose 25.83% of its value year to date. These losses can be attributed to rising interest rates, higher inflation, and concerns about a looming recession. In addition, businesses may stop hiring new employees, which hurts demand for KFY’s services. Despite these concerns, KFY is led by an experienced leadership team, and favorable industry trends can be strong tailwinds for the company moving forward. That, combined with an attractive stock price, makes KFY an excellent investment opportunity.

Company Background

KFY operates in the professional services industry. The company helps its clients hire board members, chief executive officers, senior level executives, and general managers through its executive search services. As well as strategic planning, assessment, and succession planning, it provides leadership and professional development and total rewards. In addition, KFY offers a range of technology solutions to identify companies’ structures, roles, capabilities, and behaviors which helps its clients improve profitability. Over the last year, KFY has partnered with over 15,000 organizations. KFY’s clients include public and private companies and government and non-profit organizations.

KFY was founded by Lester B. Korn and Richard M. Ferry in 1969 in Los Angeles, CA. The company has humble beginnings, starting in a small office with one assistant and one phone, but KFY did have a coveted Rolodex of contacts to build on. Even then, KFY had aspirations of being a global company. The company grew steadily through the following decades, eventually going public in 1999. Today, KFY has over 10,000 dedicated employees who work to create value for its clients and stakeholders. KFY operates in 53 countries, with 49% of revenue coming from outside the United States.

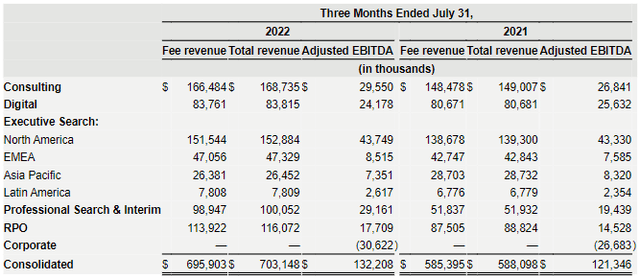

The company organizes its business through five business lines: Consulting, Digital, Executive Search, Professional Search & Interim, and RPO. The Consulting business line drives growth by optimizing organization structure, culture, performance, and people. The Digital segment builds technology solutions that help identify your business’s best structures, roles, and capabilities. The largest segment is Executive Search which helps organizations find top talent for boards, CEOs, and other senior-level executive positions. The Professional Search & Interim segment focuses on single-hire to multi-hire positions and interim contractors. It helps clients source high-quality candidates fast and at scale worldwide. RPO’s final segment uses customized technology to offer recruitment outsourcing solutions.

The table below shows how each segment performed during the last quarter.

What to Like

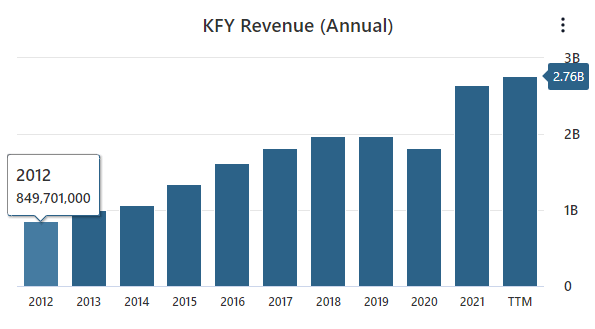

KFY has an experienced leadership team led by CEO Gary Burnison, who has held the position since 2007. Burnison is influential in the professional services industry and has written seven leadership and career development books. Under Burnison’s leadership, KFY has grown its revenues in all but one year over the last decade. That one year of negative revenue growth happened to be 2020, the year the COVID-19 pandemic hit. The company rebounded nicely in 2021, growing revenues by 45%. Overall, KFY has grown revenues by 224% over the last decade, which is astonishing revenue growth.

KFY data by Stock Analysis

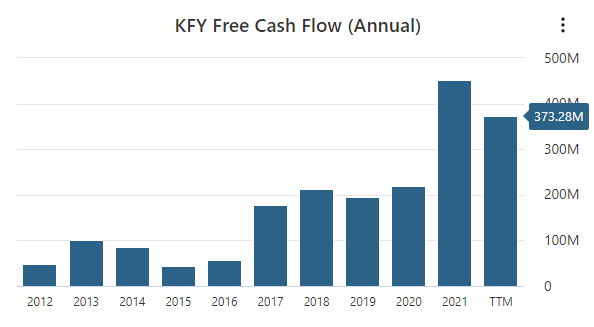

Beyond revenue, KFY has done an excellent job growing its free cash flow. Famed businessman Richard Branson once said,

Never take your eyes off the cash flow because it’s the life blood of business.

This is a great quote from Sir Richard, without free cash flow, KFY would not be able to invest in future growth, pay down debt, or return capital to shareholders. Over the past decade, KFY grew its free cash flow by 668%.

KFY data by Stock Analysis

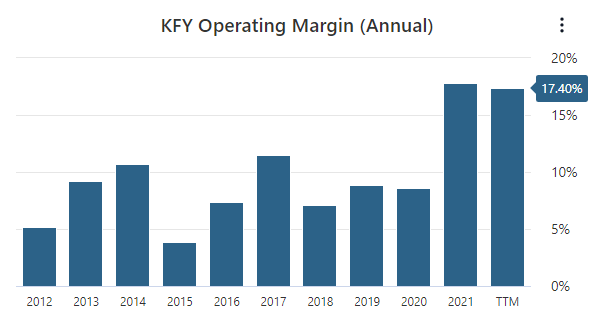

In addition to spectacular revenue and free cash flow growth, management has done an excellent job of cutting costs as they have grown operating margins significantly over the past decade.

KFY data by Stock Analysis

This level of revenue, free cash flow, and operating margin growth are encouraging to see from the experienced leadership team. Their strong performance over the past decade proves that KFY is led by competent management who can continue to drive growth over the next decade. If KFY can continue to execute and drive earnings growth, the share price will also grow.

Another trend right now that favors KFY is that people are changing jobs more frequently than before. After the COVID-19 pandemic rocked the world, many people were forced to begin working remotely, allowing them to reevaluate their careers and work-life balance. For the first time, remote work has given many people a chance to work for companies they do not have to live close to. Millions of people have seized this opportunity, and the movement has been called the “Great Resignation.” As more people switch jobs, this creates demand for KFY’s services and could be a key growth driver for the company moving forward.

Risks and Challenges

KFY faces several risks and challenges related to macroeconomic conditions, technology disrupting labor markets, and even risks related to future and past acquisitions. First of all, KFY is a cyclical company. The local and global economy influences their performance. When macroeconomic conditions deteriorate, many companies elect to higher fewer employees, and some companies even lay off employees to increase cost savings. When companies freeze hiring, demand for KFY’s services drops. As part of another cost-saving measure, some companies rely on their Human Resources departments to find talent rather than the services of search firms. These negative demand trends put a lot of pricing pressure on KFY. The current macroeconomic environment, which has seen rising interest rates, high inflation, and mounting recession worries, does not bode well for KFY.

Technological advancements that disrupt labor markets are also a risk to KFY’s business. The need for the talent of KFY’s customers drives its success. As technology evolves, human workers are increasingly being replaced by automation, machines, and A.I. Like uncertain macroeconomic environments, technological advancements also reduce the need for KFY’s services.

Another risk to consider is related to KFY’s recent acquisitions. Over the past couple of years, KFY has completed several acquisitions. These acquisitions include Miller Heiman Group, AchieveForum, Strategy Execution in 2020, and The Lucas Group and Patina Solutions Group, Inc. in 2022. Acquisitions have been a powerful part of their growth strategy and will continue moving forward. However, there is no guarantee that KFY will continue to find acquisition targets that fit their strategy at attractive terms. Another concern with the recent acquisitions is the substantial amounts of goodwill and other intangible assets added to KFY’s balance sheet. These intangible assets could be impaired by changes in business conditions which would require write-downs that negatively affect operating results.

Valuation

To place a value on KFY, we will run a comparative and discounted cash flow analysis. We will start with the comparative analysis and look at the highest, lowest, and average price-to-earnings ratios the market has paid for KFY over the past five years, which are 9.37, 30.97, and 145. Since the company had a P/E of 145 in 2020 and hasn’t had a P/E ratio close to this in recent years, I’m going to call the 2020 P/E ratio an outlier and use the next highest P/E ratio which was 29.73 in 2018. The 2020 P/E also skews the average P/E ratio over the past five years, so instead, we will use the median P/E ratio, which was 15.46 in 2021. So now we have our new high, low, and median P/E ratios, which are 9.37, 15.46, and 29.73. We will use these data points to estimate the bull, bear, and median scenarios.

As a bonus, we will also look at the company’s sector median P/E, which is 19.74. Finally, we will multiply these ratios by the average analyst estimate of 2023 earnings which is $5.54.

| Scenario | P/E | 2023 Earnings Estimate | Intrinsic Value Estimate | % Change from Current price |

| Bear Case | 9.37 – Current P/E | $5.54 | $51.90 | -8.57% |

| Median | 15.46 – 5-year average | $5.54 | $85.64 | 50.85% |

| Bull Case | 29.73 – 2018 P/E | $5.54 | $164.70 | 190.11% |

| Sector Median Valuation | 19.74 | $5.54 | $109.35 | 92.61% |

On a comparative analysis, KFY appears to have a more significant upside than downside. Investors would realize a very nice return if the market were to get bullish and apply the 29.73 multiple, we saw in 2018 to next year’s earnings estimate. Of course, KFY is currently sitting at the lowest P/E level we have seen over the last few years, so the market is very bearish on the outlook of KFY, which shows us that KFY has minimal downside risk from here.

Turning to the discounted cash flow analysis, we will begin by taking the average of the last five years of free cash flows, which is $290 million. I am confident in KFY’s future. Despite big tech layoffs making headlines, hirings are still outpacing layoffs which bode well for KFY. No matter what lies ahead for the job market, KFY is still led by a strong management team capable of weathering the storm. The growth rate we will use is 9% for the next ten years and then a 2.5% growth rate into perpetuity to figure out the terminal value. We will then use a discount rate of 10.00%. The DCF analysis gives us an intrinsic value of $122.86, representing an upside of 116.42% from KFY’s share price. KFY is undervalued at its current price based on the comparative and discounted cashflow analysis results.

Takeaway

Despite rising interest rates, high inflation, and fears of a recession on the horizon, the future is bright for KFY. The company’s excellent management team has led the business through multiple economic downturns. We are also seeing people change jobs more frequently, which drives demand for KFY’s services. With KFY’s stock price down -25.83% year to date, the company’s P/E ratio is the lowest it has been in the last five years. Backed by a comparative and discounted cash flow analysis, KFY is undervalued at its current price. The company is a buy at these levels, but if you disagree, please let me know in the comments below.

Be the first to comment