GoodLifeStudio/E+ via Getty Images

Introduction

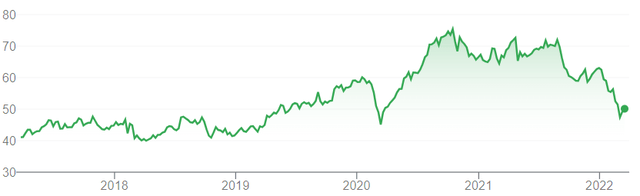

We review our KONE Oyj (OTCPK:KNYJY) investment case after shares fell below €50 this month for the first time since March 2020. At €50.10, shares are now 32% below their 52-week high, and just 11% above their COVID-19 trough:

|

Kone Share Price (Last 5 Years)  Source: Google Finance (20-Mar-22). |

We initiated our Buy rating on Kone in June 2020. Initially gaining 25% by October 2020, Kone stock is currently down 18% since our initiation, though dividends reduce the loss to 11%.

Input cost increases and a slowdown in Chinese construction are the main headwinds. However, even on reduced forecasts, we expect a total return of 61% (14.1% annualized) by 2025 year-end. Buy.

Kone Buy Case Recap

Our investment case is based on the following:

- Elevators and escalators represent a structurally-growing sector, driven by increased urbanization, taller buildings and new value-add services

- The installed base has a long-term unit CAGR of about 5%, and the long-term value CAGR is higher as value per unit grows

- Industry profits are mostly generated by recurring Maintenance and Modernization services on the installed base, due to their higher margin

- China represents a large exception, where profits are mostly in New Equipment sales. We expect construction activity there to be broadly stable, and Maintenance penetration to rise significantly over time

- The industry is consolidated, with a few players competing rationally; global leaders like Kone and Otis (OTIS) continue to gain market share

- Both companies operate a capital-light model, utilizing external suppliers and subcontractors, which enable a high Return on Invested Capital

- Earnings to grow faster than revenues, as operating margins expand, helped by economies of scale and cost savings

Kone is #1 in China and a top-3 player in every region except North America (where it is #4). Globally, it has a 19% market share in New Equipment but only a 10% share in Services (where it shares the #2 spot in Maintenance).

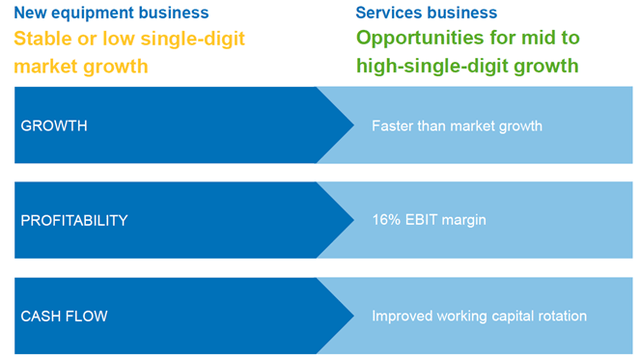

Kone targets faster-than-market revenue growth (including mid-to-high single-digits growth in Services) and a long-term EBIT margin of 16%:

|

Kone Medium-Term Financial Targets  Source: Kone investor day presentation (Sep-20). |

At our last update in July 2021, we expected Kone’s EPS to grow 7.5% in 2021 and 9.5% annually thereafter, and for the exit P/E to be 35x.

Kone’s EPS actually grew 7.9% in 2021, but will likely decline in 2022, and the P/E has de-rated to 26.2x.

2021 Improved Significantly from 2020

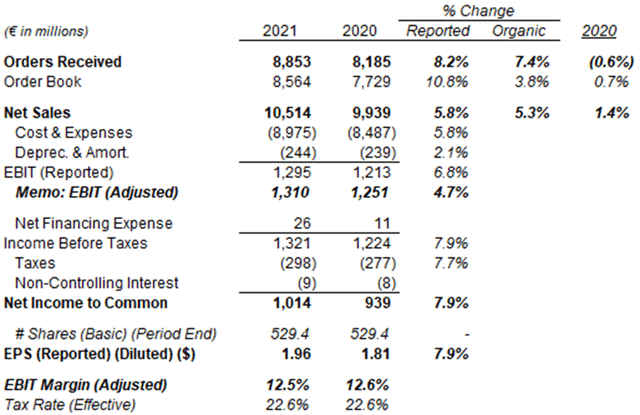

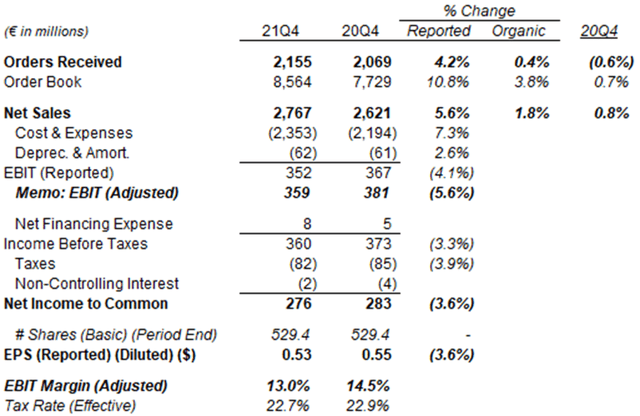

EPS grew 7.9% year-on-year in 2021; EBIT grew 6.8%, though Adjusted EBIT, which excludes restructuring costs, grew only 4.7%:

|

Kone Orders and P&L (2021 vs. Prior Year)  Source: Kone results release (Q4 2021). |

Adjusted EBIT Margin was 12.5% in 2021, down 10 bps year-on-year, deteriorating in H2 after commodity prices rose. Kone estimated higher component and logistics costs to be a €200m headwind in 2021 (with €150m in H2), equivalent to 190 bps of EBIT margin. Labor costs are not a major headwind, as they simply “go up a little bit more, not dramatically more”.

Net Sales grew 5.3% organically, after a relatively resilient 2020. Orders received rebounded 7.4%, and the order book was up 3.8% organically.

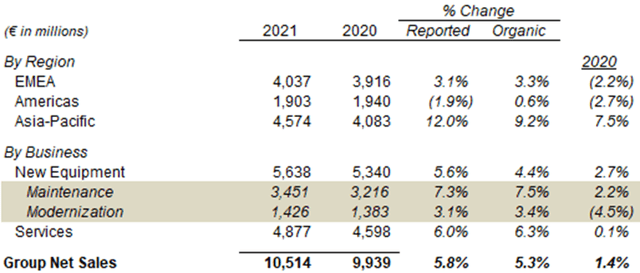

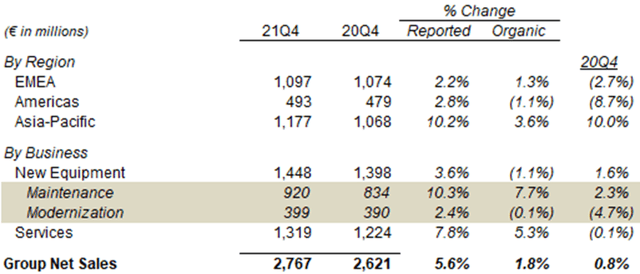

Net Sales growth improvement was broad-based, with EMEA and Americas both recovering from prior-year declines, and Asia-Pacific even stronger:

|

Kone Net Sales By Region & Business (2021 vs. Prior Year)  Source: Kone results release (Q4 2021). |

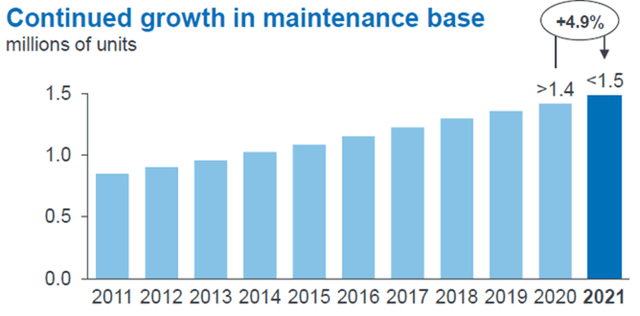

Maintenance revenues grew 7.5% organically in 2021, after growing 2.2% in 2020, helped by a 4.9% growth in the number of units (4.0% in 2020). The more discretionary Modernization revenues rebounding 3.4%. New Equipment grew in both 2021 and 2020, driven by strong Chinese sales.

|

Kone Maintenance Base Size (2011-21)  Source: Kone results presentation (Q4 2021). |

However, Q4 results were much weaker in both growth and margin terms.

Sales Slowed & Margin Declined in Q4 2021

EPS declined 3.6% year-on-year in Q4, primarily due to the Adjusted EBIT margin shrinking 150 bps, after a €75m impact (270 bps in EBIT margin) from higher component and logistics costs:

|

Kone Orders and P&L (Q4 2021 vs. Prior Year)  Source: Kone results release (Q4 2021). |

Reported Net Sales growth was 5.6%, similar to the full year, but organic growth was much lower at 1.8%. Organic growth turned negative in both New Equipment and Modernization in Q4, but was positive in Maintenance. It decelerated in every region, most significantly in Asia-Pacific:

|

Kone Net Sales By Region & Business (Q4 2021 vs. Prior Year)  Source: Kone results release (Q4 2021). |

The same pressures in Q4 resulted in a weak 2022 outlook.

2022 Outlook Includes 2-13% EBIT Decline

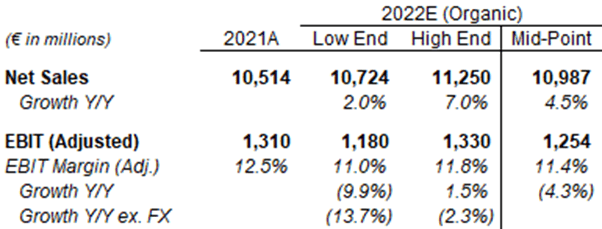

At Q4 2021 results, Kone expects the following for 2022:

- Sales growth to be 2-7% excluding currency

- Adjusted EBIT to be €1,180-1,330m

|

Kone 2022 Outlook  Source: Librarian Capital estimates. |

Excluding a €50m benefit from currency, this implies an expected EBIT decline of 2.3-12.7%, with the bulk of this (€100-150m, or 7.6-11.5%) due to higher component and logistics costs.

The outlook assumes the New Equipment market will be down year-on-year in China (by mid-to-high single-digits, in essence back to 2019 levels), but continue to recovery elsewhere; it also assumes growth in Modernization and Maintenance markets globally:

|

Kone 2022 Outlook Assumptions  Source: Kone results presentation (Q4 2021). |

Headwinds for Kone, in both its EBIT margin and New Equipment sales growth, are mostly attributable to China.

Margin Pressures Much Worse in China

China is the biggest market for elevators and escalators in the world, with approx. 66% of global New Equipment units and 41% of the install base. It was 35% of Kone’s sales in 2021 (from 30% in 2020), and margin there is higher than the rest of the group.

China has also been a competitive market, and margins have been falling over the years. Kone’s pricing in China were merely “stable” in 2021, which with rising costs meant that a decline in its EBIT margin:

“Costs have increased, so that means that it is something where we’ve not been able to pass through that cost increase to our customers in China so far … Clearly, our goal is to be able to counter the headwinds with pricing productivity and product cost factors. But clearly, in China, that’s not the case here … pricing competition has continued to be quite tough throughout the recent history in China”

Ilkka Hara, Kone CFO (Q4 2021 earnings call)

Kone has been much more successful in raising prices in other regions, as Hara also stated on the call:

“If you look at the pricing overall … pricing continues to develop positively. I would call out, particularly, our business in North America, as well as in Europe, where we’re seeing good continued progress in improving pricing, as well as Asia Pacific, where we start to now see improvement on the pricing front as well.”

We believe markets outside China are helped by their higher mix of Maintenance services, which use less components/logistics are more sticky for existing providers, and by their more consolidated competitive landscapes.

Chinese New Equipment Market Slowdown

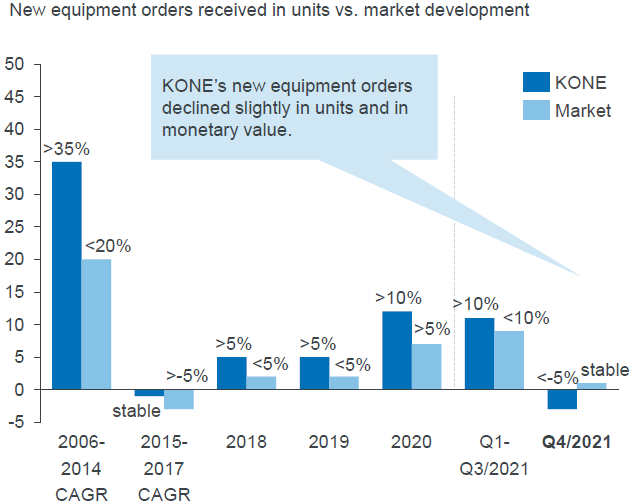

The Chinese New Equipment market also slowed down significantly in Q4, from a high-single-digit unit growth in Q1-3 to being “stable” year-on-year:

|

China New Equipment Unit Growth – Kone vs. Market  Source: Kone results presentation (Q4 2021). |

Kone uncharacteristically lost market share in Q4, with a <5% decline, possibly due to more disciplined pricing and payment terms. Across 2021, Kone grew “more or less in line” with the market, worse than prior years, while rival Otis claims to have grown at twice the market rate.

The slowdown is significant, as 80% of Kone’s sales in China are in New Equipment (with 15% in Maintenance and 5% in Modernization).

The elevator/escalator market in China is 65-70% in Residential buildings and 10% in Infrastructure. New construction has slowed significantly in China as a result of government policy changes since summer 2020 intended to reduce indebtedness among property developers. More recently, new COVID lockdowns and geopolitical tensions – with fears of Western sanctions against Russia being extended to China – have increased macro uncertainties.

Our base case is for a relatively stable Chinese construction market, in line with Kone’s views, but macro and geopolitical events are hard to predict.

Russia/Ukraine Exposure is Minimal

Kone has minimal exposure to Russia and Ukraine.

Russia accounts for less than 1% of its sales, and Ukraine is even smaller. Kone has “temporarily” suspended deliveries to Russia and stopped accepting new orders there in early March, but continues to provide Maintenance.

We Expect Growth & EBIT Margin to Recover

Our base case is that Kone’s revenue growth will reaccelerate and its EBIT margin will recover over time.

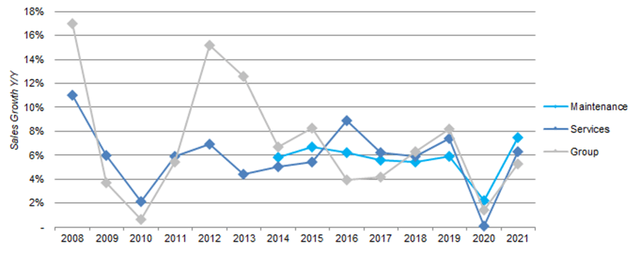

Kone has a good financial track record. Maintenance revenue growth (disclosed since 2014) was consistently around 6% in 2014-19, decelerated to 2.2% in 2020 due to COVID, but rebounded to 7.5% in 2021. Services revenue growth, which also include Modernization, has averaged 5.8% since 2008:

|

Kone Sales Growth by Type (ex. Currency) (Since 2008)  Source: Kone company filings. |

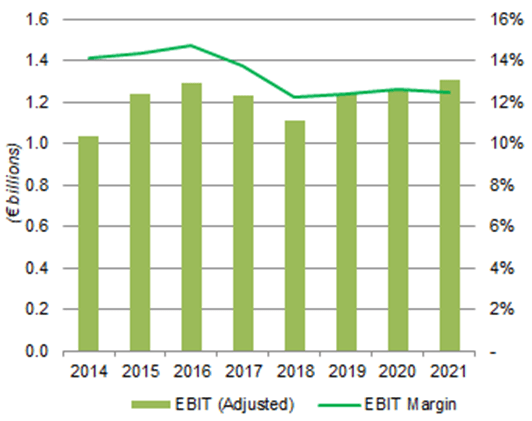

Adjusted EBIT Margin tends to rise each year, except in 2017-18, when it was impacted by higher steel prices (after U.S. and E.U. tariffs), currency (both USD and Chinese RMB falling against EUR) and price pressures in China:

|

Kone Adjusted EBIT & Margin (2014-21)  Source: Kone company filings. |

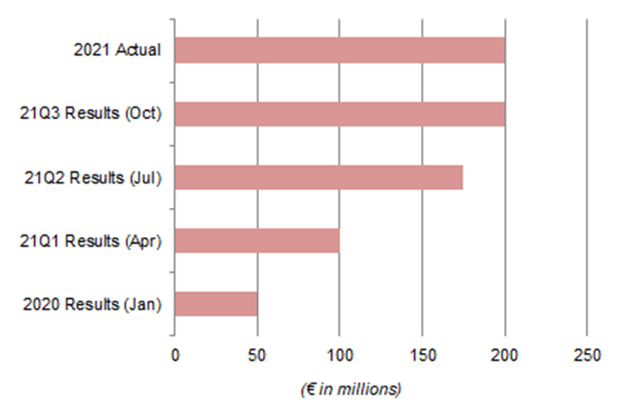

We believe the margin decline in 2021 was partly due to the sudden nature of cost increases. The expected 2021 headwind from component and logistics costs escalated from an €50m in January to €200m by October:

|

Kone 2021 Component & Logistics Costs Headwind – Expected vs. Actual  Source: Kone earnings calls. |

Rapid cost increases are more difficult to offset. Margin on orders received improved sequentially in Q4, after the headwind stabilized at €200m.

In China, margin decline has been a persistent feature due to competition, and Kone was not able to raise prices to offset cost inflation during 2021. However, the market is becoming more consolidated, and Maintenance revenues are growing quickly (up double-digits in 2021). Kone’s pricing power should improve over time.

We expect a high-single-digit EBIT CAGR for Kone from 2023, mainly from:

- Maintenance revenues outside China growing at 6%

- New Equipment revenues in China growing at 5%

- Service revenues in China growing at 10%+ (from a low base)

- Margin to be stable in China and to improve in other markets

Valuation: Is Kone Stock Overvalued?

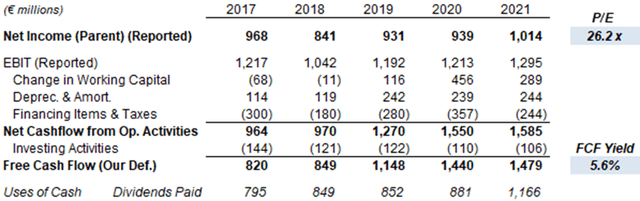

At €50.10, relative to 2021 financials, Kone stock is trading at a 26.1x P/E and a 5.6% Free Cash Flow (“FCF”) Yield:

|

Kone Earnings, Cashflows & Valuation (2017-21)  Source: Kone company filings. |

Assuming a 7.5% decline in earnings in 2022, this would imply a P/E of 28.3x and a FCF Yield of 5.2% relative to 2022 financials.

FCF exceeded Net Income significantly since 2019, as Investing Activities cashflows have been below Depreciation & Amortization.

Kone paid a regular dividend of €1.75 per share and a special dividend of €0.35 per share for Class B shares in March 2022 (compared to €1.75 and €0.50 respectively the year before). This represents a 3.5% Dividend Yield.

Dividends exceeded EPS in both 2021 and 2020. Kone had net cash of €2.16bn at 2021 year-end (up from €1.95bn in 2020), or €1.24bn after dividends paid, equivalent to 4.7% of its market capitalization. We expect dividends to at least equal EPS in the next few years.

Kone Stock Forecasts

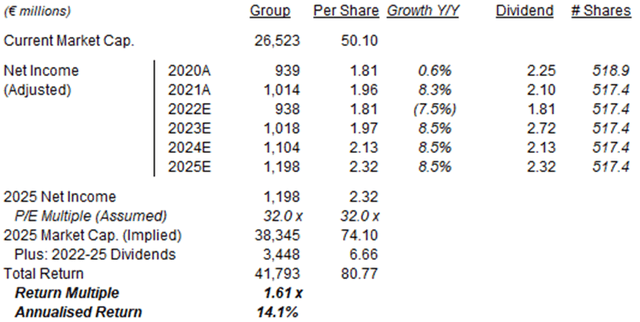

We significantly reduced our growth and P/E assumptions:

- 2022 Net Income decline of 7.5% (was growth of 9.5%)

- 2022-25 Net Income growth of 8.5% each year (was 9.5%)

- Share count to be flat (unchanged)

- Dividends to be on a Payout Ratio of 100% (was 90%)

- 2025 year-end P/E of 32.0x (was 35.0x)

Our new 2024 EPS forecast is 15% lower than before (€2.55):

|

Kone Illustrative Return Forecasts  Source: Librarian Capital estimates. |

With Kone stock at €50.10, we expect a total return of 61% (14.1% annualized) by 2025 year-end.

Is Kone Stock a Buy? Conclusion

We reiterate our Buy rating on Kone stock.

Be the first to comment