Thinkhubstudio/iStock via Getty Images

The last decade or so has seen a significant change in the U.S. economy.

We are starting to learn some of the changes we have not identified up to this point.

Today, I want to bring to your attention the role that foreign investment in U.S. research and development seeming has helped to create the strong dollar we have recently seen advancing.

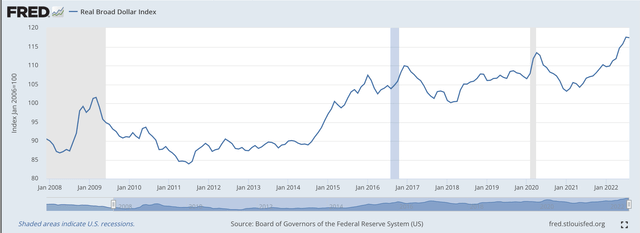

We see that the value of the U.S. dollar has been advancing since shortly after the conclusion of the Great Recession.

Real Broad Dollar Index (Federal Reserve)

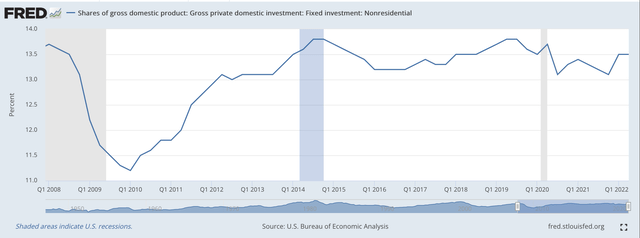

Now, notice how private non-residential fixed-investment as a share of GDP has remained high at near-historical peak levels during the same time.

Private Non-residential Fixed Investment Share of GDP (Federal Reserve)

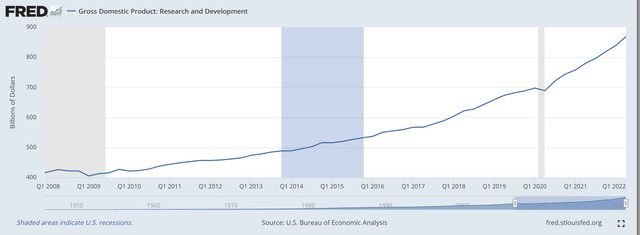

Finally, note here the sustained growth of R&D spending in the U.S. over this same time period.

Research and Development Spending: GDP (Federal Reserve)

These data were suggested by James Mackintosh in the Wall Street Journal, as he examined the “once in a generation surge” in the value of the U.S. dollar.

Mr. Mackintosh suggests that “Something else has been going on” and he wants to examine what possibilities might exist to explain the rise.

Of course, as I have written about many times, there is the fact that the Federal Reserve has moved out ahead of other central banks in its fight against inflation.

This Federal Reserve effort is a relative effect because the dollar strength only results from the “relative” movement of the different central banks as they move to combat the inflation in their own geographic regions, as well as the inflation that is now present in the world.

But, Mr. Mackintosh goes further.

He points to the research of Marvin Barth of Thematic Markets in claiming that a lot of the strength of the U.S. dollar is coming from the innovation that has gone on in the United States in recent years and decades.

Mr. Barth highlights the major relationship between academic research and “the close links of universities and business” which has given the U.S. “a head start in computerization in the 1970s and early 1980s, on the internet in the 1990s and in newer internet applications and artificial intelligence in more recently.”

The waves of innovation sparked investment, from domestic sources but also from foreign sources pushing up the dollar.

Note, that the leadership in each phase was short-term leadership, as others around the world copied each new advance.

But, these organizations practiced “time pacing” practices that fostered short-term leadership followed by a new wave of innovation to carry on the leadership in the next round of innovation.

The “cycles” of innovation became so closely weaved together that the overall picture of advancement taking place looked almost seamless, constantly moving upwards.

This, as pointed out, is something new. U.S. private non-residential fixed investment has stabilized at a fairly high share of GDP.

The 10-year average is the highest since the late 1980s.

Research and development spending is also at all-time highs as a share of GDP.

Things have definitely changed over the past.

“This cycle is very much about U.S. economic supremacy,” says Kit Juckes, Head of FX Strategy at Societe Generale.

The Future

Well, we’ll see.

Things are certainly different now, and the changing technology is going to continue to add to the “new future.”

Furthermore, the European competition seems to be falling even further behind. The events, including those in Ukraine, certainly are not helping the overall situation.

But, the thing to watch is where the research and development efforts are going. Innovation is taking place, but it is not producing advancements in labor productivity like it did in the past.

That, of course, helps to account for the slower economic growth during the economic recovery in the past ten years.

But, the advancements in R&D are going somewhere, and if Mr. Barth is correct, the changes are taking place in intellectual capital and not physical capital.

We have seen this in other areas of the supply side of the equation. Money for R&D is going into an area, but labor productivity is not rising. The reason is that the R&D spending is going into intellectual capital, and this is going to be the case, more and more.

Apparently, more sophisticated investors around the world have discovered this, and so their monies are finding their way into the U.S. world of innovation. This is also contributing to the rise in the value of the dollar.

Actually, this will probably be the case in more and more areas associated with innovation in computer advancement.

That is, investment in intellectual capital is going to be the future.

The United States leads in this area and will continue to lead.

And, sophisticated investment funds from around the world will continue to flow into these areas.

We are just starting to understand this. However, in the future, we should look for more and more opportunities like this one.

That is the future.

Be the first to comment