Eugene Gologursky

While hopes existed that the retail sector would maintain most of the sales from covid boosts, a lot of retailers outside of food and gas aren’t faring very well. Kohl’s (NYSE:KSS) is a prime example of a retailer failing to match elevated profits from 2021 leading to the stock actually trading lower now despite improvements in the actual business during the period. My investment thesis is ultra Bullish on the stock trading in the low $30s, as investors just have to throw away the results for the rest of the year.

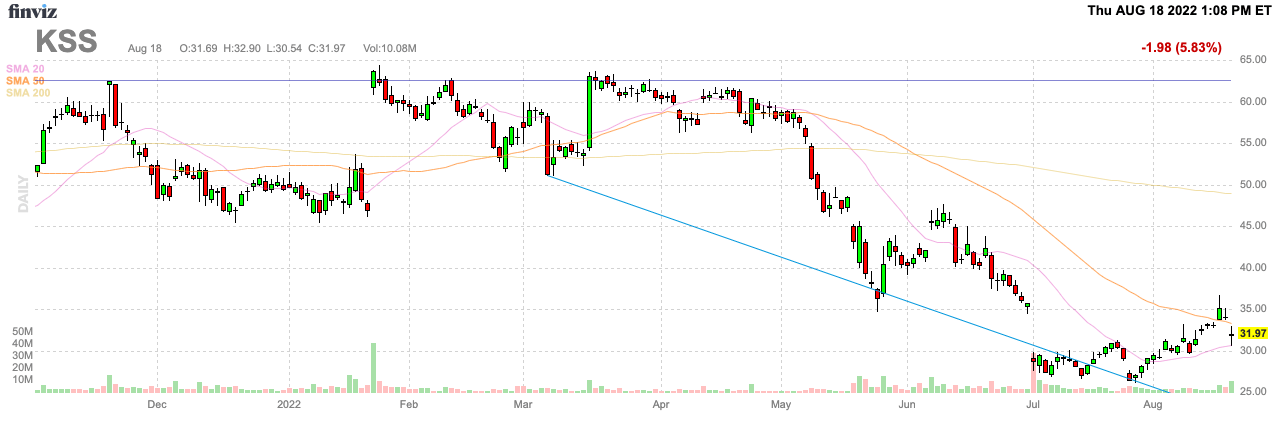

Source: FinViz

Volatile Results

Kohl’s just ended a year where the retailer generated an EPS of $7.33. The market didn’t necessarily expect the company to match those profits going forward, but the company didn’t report revenues above FY19 levels prior to covid providing hope for some stability in profits.

The company just reported FQ2’22 revenues that beat targets by $180 million, but the sales fell by 8.1% from last year. EPS slightly missed targets at $1.11, but the numbers were far below the $2.48 earned last year. Kohl’s spent the last couple of years streamlining operations and improving margins, but all of that work disappeared in a flash.

The macro issues are definitely impacting consumers purchasing apparel and home goods. In addition, one has to assume the failed sales process took management away from managing the business efficiently when the company shouldn’t have ever entertained bids far below the intrinsic value of the retailer.

With all of the crosscurrents, one can’t really isolate whether a problem exists with management or the business is just temporarily impacted by middle-income customers squeezed by inflation and focused elsewhere. Target (TGT) reported July quarter profits plunged 90% from last year in a sign maybe Kohl’s isn’t far off base in this environment.

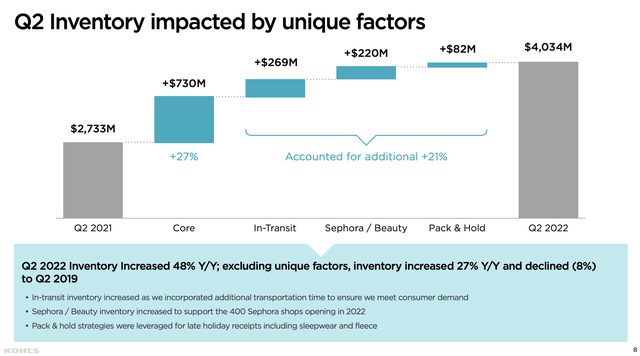

The retailer saw inventories surge during FQ2’22 to end at $4,034 million. Kohl’s actually had ~8% less inventory available for the store than back in FQ2’19 with the in-transit inventory and higher numbers for Sephora.

Source: Kohl’s FQ2’22 presentation

The inventory picture isn’t as impressive when considering the inventory now in-transit or packed away and the less store space for non-beauty products. The retailer plans has been more promotional to clear inventory and attract customers to the stores.

Throw Away Dismal Year

Kohl’s is now forecasting sales to fall 5% to 6% for the year cutting the profit picture for the year dramatically. The department store now forecasts an EPS of $2.80 to $3.20 for the year.

Due to the difficult period where discretionary consumer purchases are more focused on travel and food and gas inflation are eating into the available discretionary spending, investors just have to throw away the results for the year and normalize expectations for FY23.

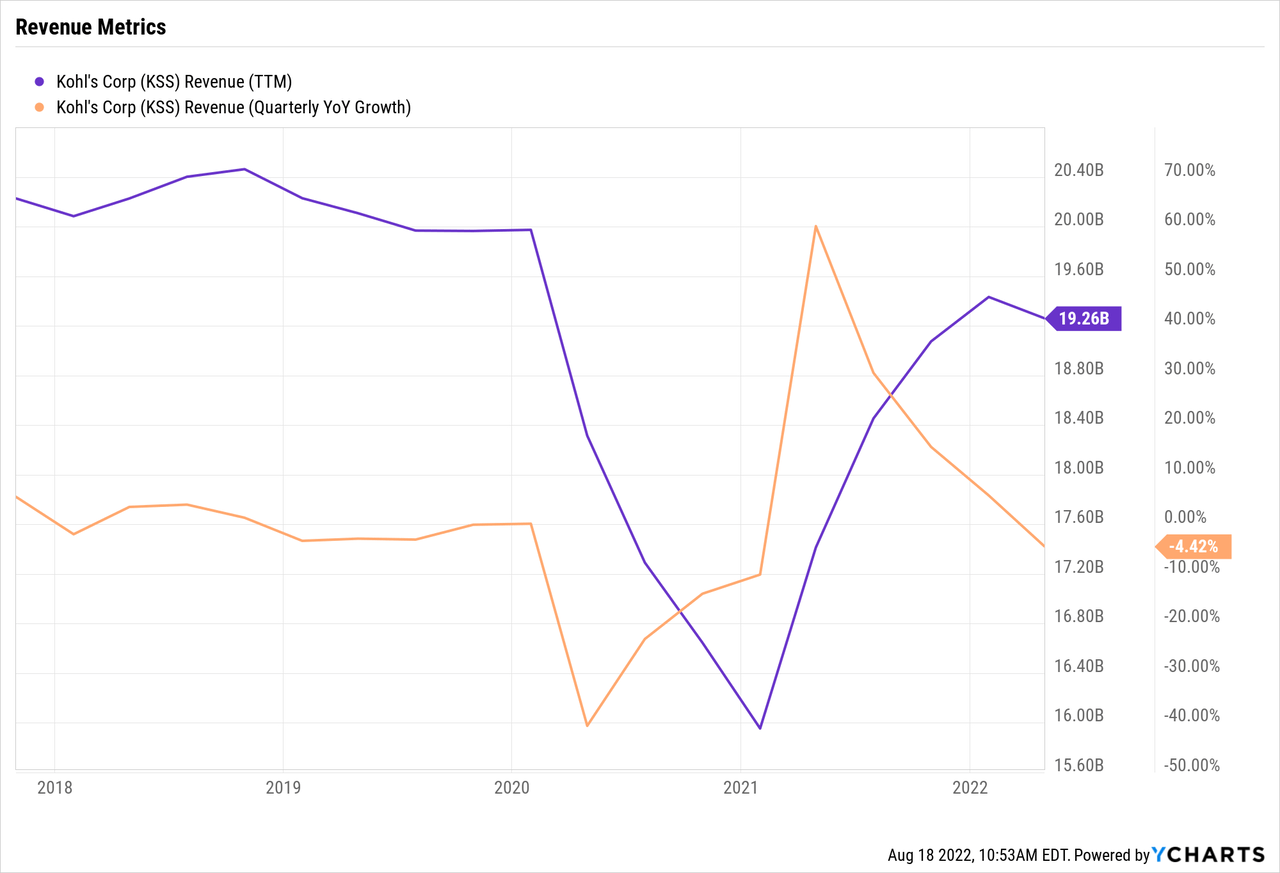

The following chart highlights the volatile quarterly results. Kohl’s saw revenues collapse with covid only to rebound in FY21. The company still hasn’t recaptured all of the sales lost during covid, yet the current downturn has occurred due to macro issues.

During this period, Kohl’s has innovated with new shipping options for online purchases and has introduced the Sephora concept into the department store. The retailer appears far better positioned for normalized business in the future, but the macro and inflation issues are clouding the financial picture. In addition, the sales process no doubt impacted current results.

According to the company and backed by Sephora expanding the partnership, Kohl’s now plans to implement the concept in all of the 1,150 stores, up from the original plan of 850 stores. The company provided the following details on the Sephora partnership leading to the expansion to all Kohl’s stores:

- The 200 Kohl’s stores with Sephora that opened in 2021 have maintained a high-single digit percent sales lift, relative to the balance of the chain.

- The nearly 400 stores opened this year, we are seeing a mid-single digit percent sales lift, which is consistent with the initial performance in the first 200 stores.

- Sephora at Kohl’s shows strength across all categories, including skincare, makeup and fragrance. Customers are shopping across the store. Roughly half of all customers buying Sephora are attaching at least one other category in their purchase.

- Kohl’s projects that Sephora at Kohl’s will grow to achieve $2 billion in annual sales by 2025.

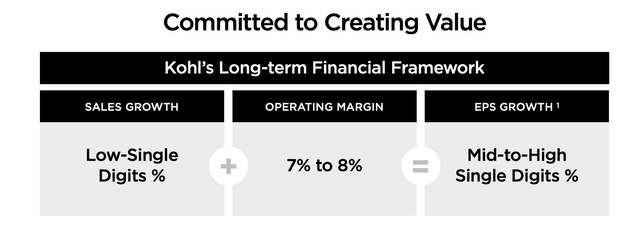

Kohl’s remains committed to the long-term financial framework where slow growth leads to solid EPS growth from share buybacks. The retailer has guided to FY22 operating margins of only 4.2% to 4.5% versus the goal of up to 8.0% margins.

Source: Kohl’s FQ2’22 presentation

Just normalized for the future expectations, Kohl’s only called for a 7.0% to 7.2% operating margin in FY22 to generate a $6.45 to $6.85 EPS. These lowered expectations following the FQ1’22 results would appear to set up a more normalized view of the business with some actual upside to the profit picture at the high end of margins nearly 10% above the previous guidance.

The big question is whether FY23 will return to a more normal year and how much the Sephora stores can possibly boost results. A lot of consumers don’t even know the local Kohl’s location has a Sephora store yet considering a lot of people have been busy traveling and not shopping.

Takeaway

The key investor takeaway is that Kohl’s is insanely cheap trading here near $30. The stock only trades at 10x the forecasts for a horrible year. Investors need to throw out the numbers for FY22 and realize Kohl’s trades below 5x more normalized profits.

Be the first to comment