ideabug/iStock Editorial via Getty Images

Earlier on I wrote an article on Eastman Kodak Company (NYSE:KODK), a renowned film business, that is not flourishing nowadays. Earlier on it reported better-than-expected earnings results. But in my view, there is nothing extraordinary here although the stock’s valuations are better than they used to be. The company is not particularly strong financially, whilst the production costs are rising substantially. But let me explain this in some more detail.

Earnings results

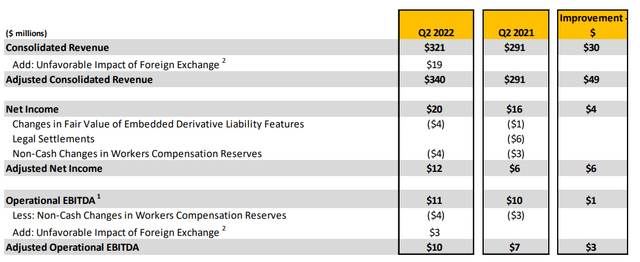

In my previous article from ages ago, I covered the company’s 2020 full-year earnings that were negative. For 2Q2022 this was not the case. Kodak even managed to break even but I would not personally get too excited about this. Instead, let us just see and compare the quarterly results to the previously reported ones.

Source: Eastman Kodak Company’s presentation, slide 7

On the surface, everything looks good. After all, the net income rose by 25% – in Q2 2021 it was $16 million, whilst in Q2 2022 it totaled $20 million. But this result is not very good if we calculate the net profit margin relative to Kodak’s revenue. So, $20 million/$321 million x 100 is equal to 6.23%. This is a relatively low net profit margin. A good net profit margin should be around 20%, whilst a medium one is about 10%. Moreover, a quarterly net profit of just $20 million is not particularly good for a company with a market capitalization of $354 million as of the time of writing. One might argue that this result is only for one quarter. But, unfortunately, this was not a one-off.

Quite regularly Kodak publishes new earnings reports. I would not even touch the larger quarterly losses reported in 2020. I will just touch on several previous quarters. For example, for 1Q2022 Kodak reported $(3) mln in earnings. Exactly the same number was reported for 4Q2021. Most of the quarters of 2020 were also loss-making.

But let me also have a look at the annual earnings and revenues history.

Earnings and revenues history

|

Year |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Revenue |

$1,543 mln |

$1,386 mln |

$1,325 mln |

$1,242 mln |

$1,029 mln |

$1,150 mln |

|

Net profit |

$16 mln |

$94 mln |

$(16) mln |

$116 mln |

($541) mln |

$24 mln |

Source: prepared by the author based on the company’s earnings presentations

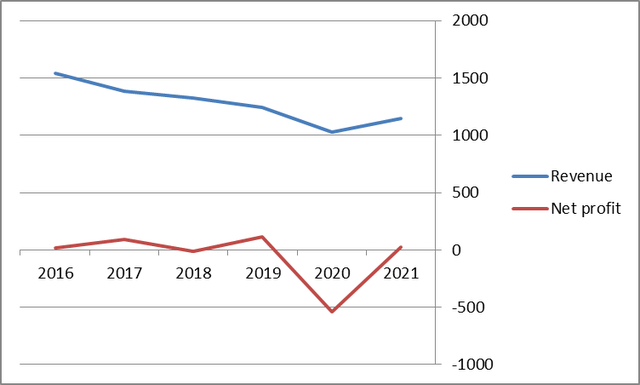

I also prepared a diagram below to illustrate how Kodak’s revenues and profits changed from the years 2016 to 2021.

Source: prepared by the author based on the company’s earnings presentations

As you can see, the picture is not inspiring at all. What is more, the sales revenues seem to be falling slowly but steadily, a worrying sign too.

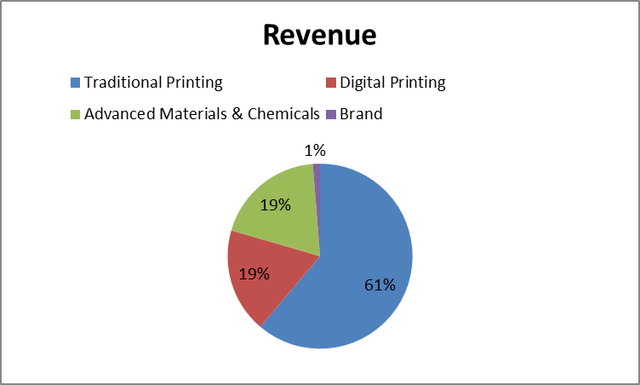

In my previous article, I touched on the topic of revenue distribution for Kodak. I will briefly revisit it for a good reason and show you the main sources of sales for 2Q2022.

Source: prepared by the author based on Kodak’s presentations

As you can see, traditional printing is the most important segment for Kodak, whilst digital printing and advanced materials & chemicals also matter. This distribution is important since it helps us to predict some further risks.

Key risks

First and foremost, the company is suffering from a high debt load. What is more, Kodak’s credit rating is CCC+, as confirmed by S&P Global Ratings. That means the company has to pay the bank much higher interest than a business with a better credit rating. If we lived in a low-interest rate environment, the situation would have been quite stable for Kodak. However, many central banks but most importantly the Fed are increasing the interest rates since inflationary pressures are breaking multi-decade record highs. So, the servicing of the debt is only getting more expensive, which is bad news for Eastman Kodak.

But the problems do not end here. Unfortunately, Kodak’s businesses are suffering greatly because of substantial cost increases and also supply chain failures. The areas Kodak operates in require substantial spending on materials. These include both digital and traditional printing as well as advanced materials and chemicals. Although the company increased its material stocks, these might not be enough. But the cost pressures do not end there. Kodak’s employees require pay rises, which is expensive, given the company’s financial condition.

Not to mention that the current economic situation is quite complicated. The Fed’s hawkish stance makes it likely the next recession will happen very soon. The fact a recession may be near is highly bearish for risky assets. Kodak’s stock is, unfortunately, one of them.

But what I do not like the most is the fact the company’s financials are not showing any signs of improvement over the period of several years. This can be said about Kodak’s revenues and net profits.

Valuations

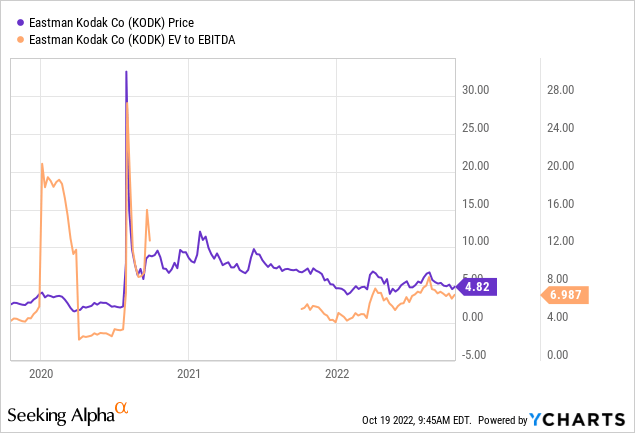

Since Eastman Kodak is a loss-making company, we cannot use the price-to-earnings (P/E) ratio to evaluate it. At least we won’t get a very accurate picture. So, we have to use the other valuation methods. A sound alternative, in my view, is the enterprise value/ earnings before interest, taxes, depreciation and amortization (EV/EBITDA) ratio.

Y-Charts generated the following graph for me.

Generally speaking, an EV/EBITDA of 10 or below is considered to be good. According to Y-Charts, right now as of the time of writing Kodak’s indicator is even below 7. This is relatively good. But if we see the whole history, we will get disappointed. That is because in 2020-2021 the company was not just loss-making. It recorded negative EBITDA. This means the company even reported negative cash flow, which is not a very good sign. But the EV/EBITDA criterion at least suggests Kodak is not overvalued.

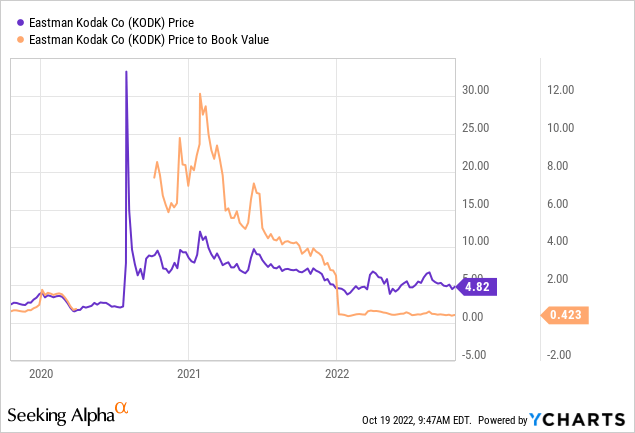

I also decided to use the P/B ratio, one of the methods to value a loss-making company. Again, here is what Y-Charts generated for me.

The price-to-book (P/B) ratio also seems to be quite depressed as far as Kodak’s valuations are concerned. A good P/B is between 1 and 3, whilst an indicator below 1 is very low.

So, I would say Kodak’s shares are undervalued or better said, fairly valued, given the company’s debt and earnings.

Conclusion

Kodak’s stock price reflects investors’ pessimism. The economy is not doing great. The interest rates are rising, which is worrying, given the company’s debt load. The revenues and earnings are not rising, unfortunately. I do not personally see much growth potential. But some investors might find this company to be of value, given the fact it is so cheap. It used to be a very powerful brand that, unfortunately, failed to adapt to the new reality. I would give the company a “Hold” rating, given its cheapness but plenty of risks.

Be the first to comment