RobsonPL

Article Thesis

The global semiconductor industry has performed weakly in recent months on worries about an economic slowdown. Intel (NASDAQ:INTC) has also performed badly, although that was partially caused by company-specific issues such as declining market share and weak cash generation. More bad news keeps emerging — the value of its Mobileye (MBLY) business, which was supposed to lead to a big cash infusion for Intel, continues to slide, and it now looks like Intel has actually lost money with its Mobileye venture over the last couple of years on a net basis.

Intel: Underperformance Driven By Company-Specific Issues

Intel has seen its shares decline by 53% over the last year, and by 52% year-to-date. That’s a pretty hefty loss, relative to how the broad market performed. While some of its semiconductor peers, such as NVIDIA (NVDA) have seen their shares drop even more in that time frame, the driving force behind NVIDIA’s share price slump was a too-high valuation. NVIDIA’s underlying performance was not at all bad over the last year, although the company showed some weakness more recently. Nevertheless, NVIDIA managed to grow its revenue by around 50% in Q1, and by 3% in the most recent quarter. Intel, meanwhile, saw its revenue drop by 1% in Q1 and by a hefty 17% in the most recent quarter. So while NVIDIA and also AMD (AMD) have seen their share prices pull back over the last year, their underlying business performance remained positive. That can’t be said about Intel, which is battling several company-specific issues.

First, the company continues to lose market share in important growth markets such as data centers. While NVIDIA and AMD grew their data center revenue by 61% and 83%, respectively, in their most recent quarters, Intel saw its data center revenue drop by 16%. There is thus a big disconnect between the growth rates of Intel’s closest peers in this highly important market, versus the growth that Intel is able to generate. Intel’s widely sub-par performance can likely be attributed to the fact that the company has had problems with rolling out next-generation products, and that its chips are generally not great when it comes to energy efficiency. In a world of energy shortages and high electricity prices, that’s a major disadvantage for Intel versus peers such as AMD that have more efficient chips on the market.

A New Issue Is Emerging

More recently, a new problem has been emerging. Intel acquired Mobileye for a little more than $15 billion a couple of years ago. The business was not profitable yet, thus Intel had to put some of its core business’s cash flow into Mobileye in order to grow it.

More recently, Intel decided to IPO Mobileye, seeking to generate some funds that could be used for its foundry push that requires hefty cash outlays on Intel’s side. Not too long ago, Intel and parts of the market believed that Mobileye could fetch a $50 billion valuation when IPO’d. That would be a very large 45% boost versus Intel’s current market capitalization, meaning the valuation of Intel without the value of Mobileye would be pretty low. But since then, the presumed value of Mobileye has fallen down considerably — first, it was rumored that it would be IPO’d at a valuation of $30 billion, then $20 billion, while most recently that became $15 billion or so.

To me, this suggests that Intel’s management has had pretty bad timing with the IPO process of Mobileye. Had they brought Mobileye to the market one or two years ago, they probably would have received the $50 billion they originally wanted, or at least something close to that. After all, valuations for speculative, non-profitable tech companies were very high during the “bubbly” times when there were trillions of dollars in cheap money floating around. Especially companies that were a combination of “techy” and vehicle-related, such as Rivian (RIVN), IPO’d at very high valuations. Now, with the Fed focused on tightening financial conditions in order to bring down inflation, the market is much less appreciative of (not yet profitable), highly expensive tech stocks. If Intel had timed the IPO of its Mobileye unit well, it could have taken in a hefty amount of cash. Now, that’s not the case any longer. This, in turn, causes other problems. With the cash windfall from the Mobileye IPO, Intel wanted to fund its hefty capital investments for its emerging foundry business. That will now likely not be doable, which is why Intel will have to use cash that was originally planned for other purposes.

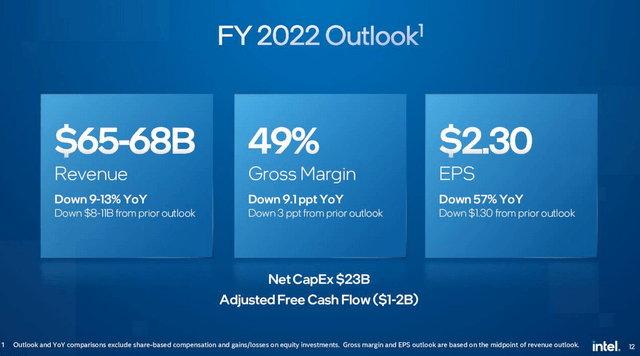

The company has announced that its free cash flow will likely be negative this year:

With net capital expenditures forecasted in the low $20 billion range, FCF will be negative at $1 billion to $2 billion. Those are Intel’s guidance numbers from July — since the macro environment has deteriorated to some degree since then, it is possible that Intel will revise its guidance downwards when it reports its Q3 results, as they did when they announced Q2 numbers.

No matter what, pressures for Intel’s balance sheet are growing. FCF will be negative even before dividends, and since Intel is paying out around $6 billion in dividends this year, net debt should rise by around $7 billion to $8 billion this year. Intel’s net debt position at the end of the second quarter was $9 billion, which isn’t especially high for a company the size of Intel. But it looks like that number will grow meaningfully this year, and possibly also next year.

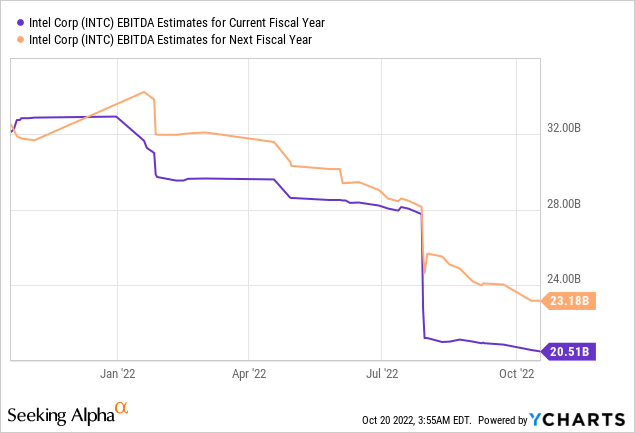

EBITDA is forecasted to grow a little less than $3 billion next year, which makes it likely that operating cash flows will improve slightly in 2023 versus 2022. Free cash flows could, if capital expenditures remain flat versus 2022, come in close to zero next year. That would be an improvement versus this year, but Intel’s net debt would still grow in that scenario, as it still would have to pay out billions of dollars in dividends — unless the company cuts its dividend. A dividend cut is, for now, not necessary, but it can’t be ruled out, either. With the Mobileye IPO not leading to a large cash inflow, Intel might be interested in freeing up financial resources in a different manner. Cutting the dividend would serve that purpose, thus investors should not see Intel’s dividend as ultra-safe — that held true when the dividend was well-covered by free cash flows in the past, but at least in the foreseeable future, that will no longer be the case, which increases the likelihood of a dividend cut.

Intel Is Not That Cheap

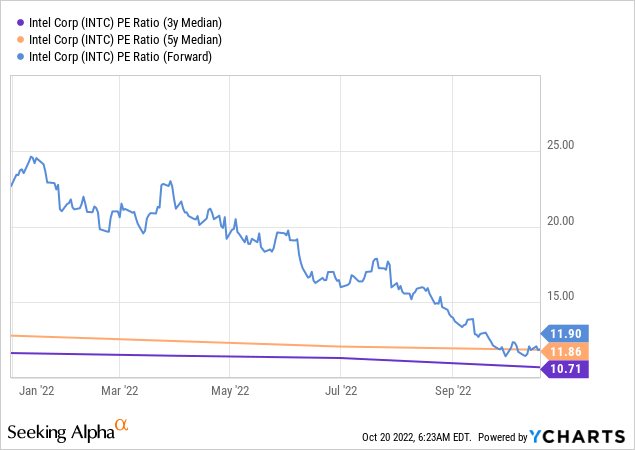

Intel has seen its shares drop by half so far this year, but its valuation is not actually that cheap, as earnings per share estimates have dropped a lot as well. And that makes sense, as the company has performed rather badly in recent quarters, losing market share, reporting declining revenues, and seeing its margins compress.

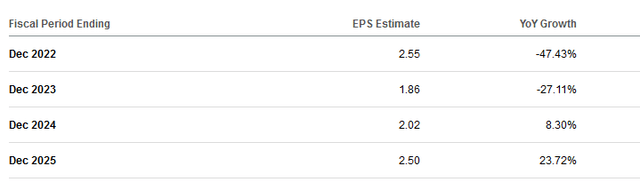

Based on current forecasts for this year’s earnings per share, Intel is trading at 12x net profits. That’s in line with the 5-year median earnings multiple, and slightly ahead of the 3-year median earnings multiple. In other words, Intel looks fairly valued to slightly overvalued relative to how its shares were valued in the past. When we consider that Intel is not forecasted to grow its earnings per share meaningfully over the next couple of years, that does not make for an overly attractive investment proposal.

According to current Wall Street estimates, Intel will earn roughly the same amount of money in 2025 as they will earn this year. If one were to put the median earnings multiple on those profits in 2025, Intel would thus not generate any share price gains. Of course, it is possible that Intel manages to reverse its course and that its actual profits will be higher than they are currently forecasted to be. But as a base case scenario, the analyst consensus estimates seem relatively suitable, and they do not suggest meaningful share price gain potential in the next couple of years. The dividend will provide a very meaningful 6% income yield as long as it is not cut, but I do not believe that this justifies a buy rating on Intel.

Takeaway

The macro environment has gotten harsher for semiconductor companies, but Intel’s biggest issues are self-made. The company’s product portfolio is not on par with what AMD, NVIDIA, etc. are offering, which results in ongoing market share declines in important areas such as data centers.

The Mobileye IPO seems botched as well, as Intel’s management has shown very poor timing. While the IPO could have resulted in a hefty cash inflow when done at the right time, the market is now relatively unappreciative of non-profitable tech stocks, which will result in a meager cash inflow only.

With Intel being free cash flow negative this year, that’s an issue. I thus do not believe that Intel is attractive at current prices.

Be the first to comment