maroke/iStock via Getty Images

Investment thesis

The opportunity to invest in Kobe Bussan (OTCPK:KOBNF) is a play on the accelerating penetration of discount supermarkets in Japanese retail, driven by a weakening yen affecting food import prices. We believe that despite paying a premium for the shares, the company offers stable compounding returns for well-capitalized and free cash flow generative business.

Quick primer

Established in 1985, Kobe Bussan operates discount supermarkets in Japan called ‘Gyomu Super’, operating over 900 stores centered around its private label products. Like Costco (COST), it offers warehouse pricing to businesses and retail customers alike. It also runs a chain of restaurants (World Buffet and Premium Karubi) and conducts a renewable energy business with solar farms and a new biomass power plant. The company’s cost advantage stems from its direct import capabilities which cuts out any margin paid to middlemen for overseas food procurement, as well as its extensive private label product portfolio.

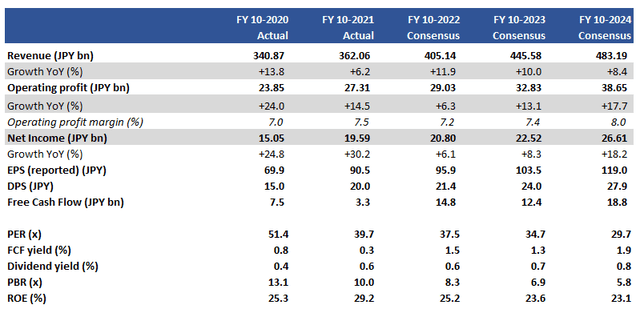

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

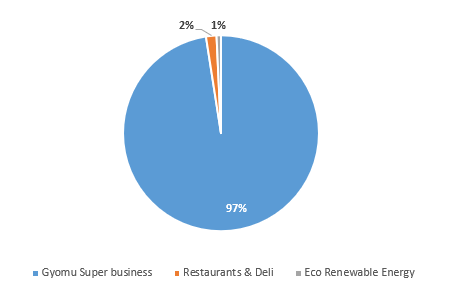

Q3 FY10/2022 revenue split by division

Q3 FY10/2022 revenue split by division (Company)

Our objectives

Tesco (OTCQX:TSCDF) Chief Executive Ken Murphy commented at interim 2022/23 results that “We know our customers are facing a tough time and watching every penny to make ends meet”. The outlook for the UK economy is challenging at best with discount supermarket chain Aldi becoming Britain’s fourth largest supermarket for the first time while Lidl’s market share also rose.

With global consumer spending under pressure from increasing prices, we looked at the Japanese market for a similar theme of a specialist discount retailer winning market share. We want to assess Kobe Bussan’s growth strategy and its outlook for growth.

Increasing market share with store openings

Kobe Bussan’s current medium-term plan for FY10/2022 to FY10/2024 is to have ‘over 1,000’ Gyomu Super shops. The current pace of store openings appears well ahead of schedule, with the business reaching 979 sites in Q3 FY10/2022 (page 4). Although we can expect some store closures in the future, it would appear that company targets look conservative here.

One of the key competitive traits of Gyomu Super stores are the low-price high-quality private label products (around 340 items, around 35% of all goods), ranging from salad dressing to puddings. The company also specializes in importing overseas foods that are Halal for a growing population of migrant workers in Japan. Increasing private label products is seen as an effective way to attract more customers, with an increasing variety of goods with cheap pricing.

Geographically, the company is aiming for new store openings in the Kanto (including the Greater Tokyo Area) and Kyushu areas where its presence is relatively low compared to its home markets in Kansai. Its aim is to become more of a national retail chain as opposed to a regional operator. Gyomu Super primarily operates under a franchise agreement (with a 1% royalty fee on all products purchased). Increasing awareness of the brand and effective marketing is resulting in sustained site number growth, and seasonally we expect to see a pickup in new openings from October 2022.

In terms of market presence, the larger supermarket operators like Aeon (OTCPK:AONNY) have around 2,000 shops nationwide, and the convenience store operators are boosting their private label offerings such as Seven & i Holdings (OTCPK:SVNDY) with over 21,000 stores. However, the differentiating factors of a high proportion of private label goods with cheaper pricing continue to make a positive impact on total store sales which grew over 10% YoY nationwide in Q3 FY10/2022 (page 7) (Aeon’s supermarket total sales were -2.2% YoY for the equivalent period, with a similar showing at Seven Eleven Japan). Despite the smaller scale, Gyomu Super is outperforming its peers.

Long term prospects look convincing

Kobe Bussan has 25 food production plants, allowing its private label business to compete against its larger peers. Despite such investment costs as well as its high-paced store opening program, the company has managed to generate positive free cash flow for the last 6 years. This is despite record-high capex of JPY18.4 billion/USD131 million in FY10/2021. With a solid balance sheet with a debt-to-equity ratio of 0.4x in FY10/2021, the company continues to de-lever and is able to fund expansion without any external financing.

The prospects of negative demographics impacting Japanese retail is a long-term concern. The company is aiming to hedge this through a combination of 1) growing its delicatessen business to boost exposure to ready-to-eat meal market, as the population ages resulting in less need for fresh groceries, as well as an increase in female participation in the workplace, and 2) an attempt at business diversification as well as gaining ESG credentials by running a renewable energy business. Whilst we believe both these attempts are unlikely to be major earnings drivers, the overall approach of increasing its Gyomu Super network remains positive – many of the new shops also have a delicatessen operation in place.

An interesting aspect of Kobe Bussan is the young CEO Hirokazu Numata, a youthful 39-year-old who has been in office for the last 10 years. The son of the former chairperson, has undoubtedly instilled a positive sense of strategic direction as well as demonstrating solid execution. What is also interesting is that despite Kobe Bussan’s relatively small and low sell-side research coverage, institutional overseas investors already make up over 30% of shareholding.

Valuation

Kobe Bussan appears attractive as a business. Although discount supermarkets have been a niche space in Japan, it is gaining more recognition and is set to become mainstream in our view. If we see how Western markets have developed, investing in Kobe Bussan should represent a stable compounding business with significant runway for growth.

Consensus forecasts (see Key financials table above) appear to be pricing in this expectation, with the shares trading on PER FY10/23 34.7x with a relatively low free cash flow yield of 1.3%. These valuations do not look particularly cheap.

Risks

Upside risk comes from sustained earnings growth for the medium term, as Kobe Bussan’s discount supermarket format continues to gain market share ahead of market expectations. Earnings could also see an upturn as the restaurant business begins to generate profits as customer volumes recover.

Downside risk come from higher-than-expected investment costs and capex related to store expansion and in-house food production facilities. Management spending time on sub-scale renewable energy may be viewed as negative capital allocation, although the total return on equity remains high at above 20%.

Conclusion

The shares are not cheaply valued, but we believe the opportunity to invest in Kobe Bussan is a play on the accelerating penetration of discount supermarkets in Japanese retail. We believe it would have been unthinkable a decade ago that Lidl would be the number 4 player in the UK grocery market – a similar process appears to be happening in Japan where arguably consumers are extremely price sensitive as inflation is beginning to kick in after decades of deflation. Despite paying a premium, we are buyers of Kobe Bussan.

Be the first to comment