Man working in aluminium can processing plant- Not that tin cans are made from tin these days of course….. JohnnyGreig/E+ via Getty Images

Cornish Metals (CA:CUSN) (OTCPK:SBWFF)

Looking at Cornish Metals (another of these Canadian Exchange quoted miners that have been added to the Seeking Alpha set) there seems to be nothing wrong and a lot right with the company. It’s well funded now, has a keystone investor, is exploiting a long known tin deposit in a jurisdiction fully behind the project. We should be able to just go Yep, that’s going to work.

And yet I’m still not quite sure. And it’s for that reason I keep going on about over the mining of metals. What really matters, after we look at all of those things, is how many other people are trying to do the same thing. For the global price of the metal being mined can be so undermined that a project can become unviable. It’s this last hurdle, the future price of tin, that worries me.

The basics at Cornish

Cornwall has been a tin province for at least 3,000 years. Folk have actually found ingots of Cornish tin in Carthaginian, Phoenecian, ships that sank in the Mediterranean back in 800 BC and the like. We’ve long, long, known there’s tin there.

The last operating mine was South Crofty. There’s no doubt there’s still substantial tin there in that same mine. That’s the mine that Cornish is building to exploit.

There are other interests – there’s the copper at United Downs, a few miles away. But that’s at an earlier stage. Cornish Metals has a cross agreement with Cornish Lithium. That second is looking for geothermal lithium and the two companies have a cross agreement. Hard rock things found by C Lithium get offered to C Metals, geothermal found by C Metals to C Lithium. A sensible arrangement.

The British Government is wholly in favour of the domestic production of these metals for the EV revolution – tin, lithium, nickel (not that there is much of that in the UK) and so on.

But the essence and value of Cornish Metals is the South Crofty tin deposit.

Finances

Cornish Metals has been able to raise significant finance for the project. The announcement is here. “…. is pleased to announce that it has closed the previously announced £40,500,000″ and that finances them all the way through to the actual construction decision itself ” to complete a dewatering programme and feasibility study at South Crofty, evaluation of downstream beneficiation opportunities, and potential on-site early works in advance of a potential construction decision. ” They’re funded right through the other side of the feasibility study.

Just as an aside for those who don’t grok mine finance, the feasibility study is the biggie among documentation. This proves that – proves note – that there is the mineral stated, in the quantities stated, that it can be mined using the named technique, at current prices, and make a profit. This is also exactly when bank and debt finance really becomes available. At this point there’s still a need for some risk capital, of course, but debt will carry much of the load from here on in. Equity dilution at the very least hugely slows down at this point.

That keystone investor is mining veteran Mick Davis through his Vision Blue Resources, which took £25 million of that £40 million issue.

The next date is in about 18 months when the feasibility study should be ready and the final decision to construct taken – or not of course.

Given that there’s currently no primary mining for tin in any volume in either Europe or North America at present we can imagine that the political push is going to be to mine, of course. Given the resources here, we can imagine the financial on will be too.

Everything looks great.

I don’t claim that there’s anything odd nor strange here at all. Everything looks just fine. Yet I still worry. This is because of history.

South Crofty

South Crofty used to produce. It was pretty much the last of the Cornish mines to keep going in fact. As we can see from the attention being paid now there always was still ore there. So, why did it close?

The proximate reason is that the International Tin Council went bust. This was one of those UN sort of ideas that the global tin business should be “organised”. Major producers, major consumers and governments would get together to plan the industry. As such things normally work out the producers ended up in control. After all, if you mine tin then you’re really, really, interested in the tin price. If you consume it then it’s just something among many that you do – you’re pretty interested in the tin price but not monomaniacally.

So, such commodity boards tend to settle on prices higher than would operate in a free market. That means that production will be higher than demand as well – that’s just how prices and supply interact. That in turn means the commodity board must buy up stock and keep it off the market – that’s what the ITC did. Then the ITC ran out of money and went bust. The tin price collapsed.

Well, OK. But the effect of this was that all hard rock mining in the rich world went bust. The ultimate cause here being that alluvial mining is cheaper than hard rock.

South Crofty details

The actual mining area is very much larger than the old South Crofty mine itself, it’s rather more the surrounding area of near 1500 hectares and includes 26 former producing mines. Most of those are very old workings and so small of course.

Environmental permits already exist, there’s already permission to dewater South Crofty itself, there’s permission to build a new processing plant and so on. The particular and specific value is therefore not damaged or reduced by some of the permitting problems that can league rich world mining. It’s the resources and the price of production that matters.

The full mineral resource report can be found here. The important thing to grasp is that there are no reserves here at all. Not because there aren’t what might become reserves, but because the work to prove that they are economic and viable simply has not been done as yet. That’s this next stage of operation that is to be done.

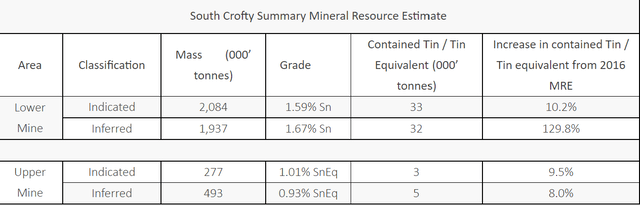

South Crofty mineral resources (Cornish Metals)

To repeat, these are mineral resources. That’s what we know, to a useful level of proof, is there. But we have not proven, to legal and stock market standards, that they can be extracted, using current tech, at current prices, and a profit made – that proof is what would turn them into mineral reserves. That’s also the proof that, largely enough, forms the basis of the feasibility study and thus the possible start of bank, rather than equity, financing.

And this is the work that they’re now funded to do. This next stage of proof.

As a not true in any legal sense but broadly true in reality we know that these is this tin here, that it can be mined. What matters is the price of the extracted tin at the end. That’s what will really determine profitability.

Issues like annual production, mine life (the two being the inverse of each other of course) and so on are simply not defined as yet. We’re not far enough along that process from resource to reserve. The same is true of mining cost and margins. Those are all issues explored in this next section of work, not things defined as yet. Even the cost of opening the mine to production – not known as yet, that’s all part of this next stage of work.

As a non-legal point, there really is tin there and considerable amounts of it too. At current tin prices of $35,000 and up then South Crofty would be nicely profitable. The whole issue of the value of the project depends upon that global tin price rather than anything else. But given that the work hasn’t been done to the required legal standards we can’t be any more accurate than that.

Tin and tin deposits

We really only mine the one tin ore, cassiterite. It’s found in volcanic rocks like granite. Can be in veins, or spread through the rock. Crush the rock to liberate the cassiterite and it’s easy enough from there.

But crushing granite to liberate is expensive.

It’s also true that erosion will have done this for us in places. Whole and entire volcanic ranges have been worn down over the tens of millions of years for example. Such deposits are called “alluvial” as we find them in river beds.

These are much cheaper to mine. The ones at Bangka and Belitung in Indonesia, people have – and I am not joking at all – successfully mined on an artisanal scale using a Mr. Henry vacuum cleaner. The long gone river action sorted the cassiterite into nice darker bands in the sand of the floor of the shallow lagoons.

Which is exactly what that tin problem was when the ITC went bust in the 1980s. Those alluvial deposits were vastly cheaper to mine than the hard rock in Europe. So, all the hard rock mines went bust and most of the alluvial did not. We’re really only just climbing back up out of that now. The EV revolution has many thinking that tin usage is about to explode, prices are going to rise up to make hard rock mining profitable all over again.

Which is where I’m hesitant

The tin price is significantly volatile. There are those saying we’re at the start of a new supercycle. Well, maybe we are. Demand is going to rise so much that these rich world hard rock deposits all become economically viable again (there are several people looking at the very similar deposits in the Ore Mountains for example. First Tin, European Metals and so on). And, you know, maybe they’re not all going to become viable again. Or even, if they all do then they fall over each other.

My read – OK, worry – is that that there’s enough alluvial out there to mean that hard rock never really will become fully viable again. That’s not something I’d want to have to prove and I’d not even assert it very strongly. But it is the thing to be worrying about here.

Rich world tin mining all went bust in the 1980s. To revive rich world tin mining we’ve got to be very sure that this isn’t going to happen again. That the alluvial deposits simply aren’t going to be large enough to supply at prices that make hard rock unviable.

Yes, I know all the projections say they won’t, that the new mines are needed. I’m just not sure

My view

So, Cornish Metals has a clearly decent tin deposit at South Crofty. It is financed at least to that next and final decision making stage. There’s nothing wrong here and much that is right. Except this one issue over the tin price.

The usual projections are that hard rock tin mining is going to be necessary, that prices will rise to support it. Which is the bit I’m having significant difficulty convincing myself of. It could happen, I agree, but that is the one single factor that Cornish Metals depends upon. That tin price staying high.

Why I’m wrong

Given that the only point of contention here is that long term tin price that’s the one factor that I could be wrong about. The world will use as much tin as it is said it will, alluvial and lower cost production will not expand to meet that and so hard rock supply will both be needed and profitable. If someone could show to me that this was going to be true then I’d be much more positive about Cornish Metals. For my worries aren’t about this mine – nor the management, political risk, the deposit or anything like that. It’s purely what is the global tin price going to be?

The investor view

That’s really what the discussion needs to be here. This also applies to other of those rich world hard rock tin projects (as I’ve said, European Metals and First Tin among them). Cornish Metals has, so long as pricing holds up, a great project at South Crofty. But, will that price hold up? For decades?

That’s the investment decision here

I just still can’t get away from the fact that near the entire global hard rock tin industry (certainly that based in rich countries) went bust only 40 years ago. Outcompeted by alluvial deposits. The revival of it depends upon that not happening again.

Well, OK. That’s what the decision is.

Be the first to comment