DNY59

Introduction

I’ve covered autonomous security robot (ASR) company Knightscope (NASDAQ:KSCP) several times on SA, the latest of which was in September when I said that it could run out of cash by early 2023 as the order backlog represented an aggregate annual subscription value of just $1.6 million.

In October, Knightscope bought blue light emergency phone company CASE Emergency Systems and said that the latter had over $5.4 million of profitable revenue in 2021. However, I don’t think this acquisition improves the fundamentals as CASE had an order backlog of just 240 units representing $1.4 million of revenue as of November 2 (see page here). The order backlog for Knightscope products, in turn, represented an aggregate annual subscription value of $2.5 million on the same date. In my view, it’s too late for the company to turn its business around and I think investors should avoid this stock. Let’s review.

Overview of the latest developments

In case you haven’t read any of my previous articles about Knightscope, here’s a quick description of the business. The company is involved in the design and sale of ASRs for indoor and outdoor surveillance under a machine-as-a-service (MaaS) business model. Clients can get a security robot at an effective price of about $3 to $9 per hour through an all-inclusive service that covers deployment, maintenance, support as well as software and hardware updates among others.

Knightscope

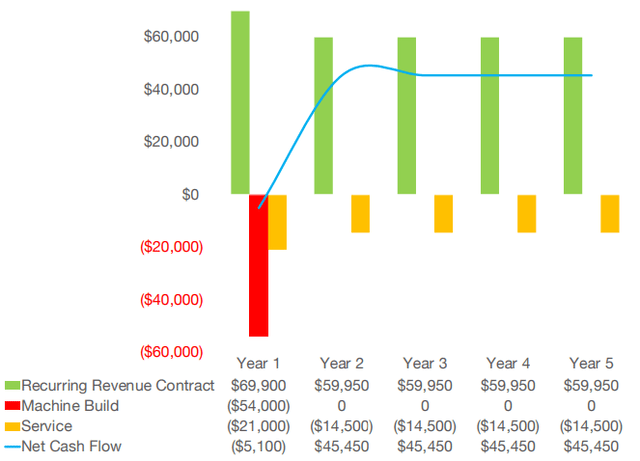

The standard subscription term is a year and a single ASR can generate about $309,700 of revenue over a 5-year period according to management estimates.

Start-ups that were looking for innovative ways to replace human labor gained traction during the COVID-19 lockdowns and Knightscope was among them, raising $22.36 million in an IPO on Nasdaq in January 2022. However, this isn’t a new company – Knightscope was founded in 2013 and has over a million hours of field experience. Yet, it hasn’t always been a smooth ride and the first time I heard of this firm was in 2017 when it gained global media attention when one of its K5 robots accidentally drowned itself in a fountain.

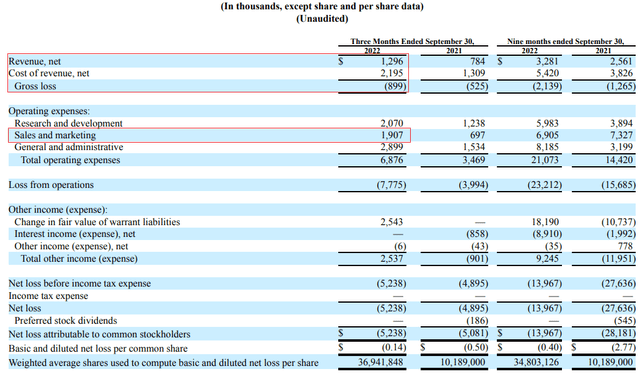

Turning our attention to the financial performance of Knightscope, the situation looks grim as net revenues stood at just $1.3 million in Q3 2022. Compared to Q2, they increased by just $0.25 million despite the company boosting its sales and marketing spending by $0.4 million. In addition, there don’t seem to be meaningful economies of scale as the gross profit margin deteriorated to -69.4% from -66.2% three months earlier.

Looking at the future, I don’t expect the fortunes of Knightscope to change much as the higher marketing spending hasn’t had a major impact on the order backlog either. As of November 2, the backlog of orders included just 49 ASRs which represented an aggregate annual subscription value of $2.5 million. For comparison, the backlog of orders included 35 ASRs which represented an aggregate annual subscription value of some $1.9 million as of August 10.

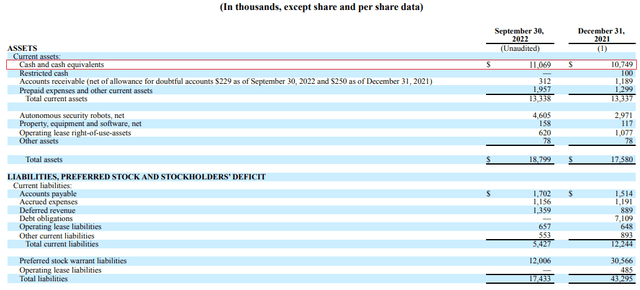

Net cash used in operating activities stood at $4.75 million in Q3 2022 alone which puts the company in a tough spot from a liquidity standpoint as cash and cash equivalents came down to $11.1 million at the end of September.

In October, Knightscope raised $5 million through a private placement of senior secured convertible notes with an original issue discount of 17.65% (see page 24 here) but these funds have already been used up as the payment for CASE included $6.16 million in cash and a $0.56 million promissory note that matures in April 2023 (see page 23). Knightscope says CASE is profitable, but I’m concerned that the order backlog seems inconsequential. As of November 2, its total backlog of orders included 240 units representing just $1.4 million in revenue (page 29).

Overall, I think that Knightscope had another poor quarter and that the purchase of CASE won’t help it avoid a significant capital increase in the coming months. Cash used in operating activities stood at $18.4 million for the first nine months of 2022 alone which means that almost all of the funds raised in the IPO are now depleted.

So, how do you play this? Well, short selling seems like a viable idea as data from Fintel shows the short borrow fee rate is 12.39% as of the time of writing. However, there are still no options available.

Looking at the risks for the bear case, I think that there are two major ones. First, Knightscope could become a takeover target if a major tech company decides to enter this industry. While the financial performance is underwhelming, Knightscope has over a million hours of field experience, and this could prove valuable for any company that wants to rapidly gain a foothold in this sector. Second, the share prices of microcap companies can sometimes increase for spurious and unknown reasons.

Investor takeaway

I view Knighscope as one of the leading players in the ASR space but unfortunately for investors the margins are far off management estimates and the company hasn’t managed to secure a meaningful number of orders despite being created almost a decade ago. Cash is starting to run out despite the company completing an IPO less than a year ago and I think that significant stock dilution is likely to take place in the next few months.

The short borrow fee rate seems low enough to make opening a small short position viable. However, considering there are no call options available, I think it’s best for risk-averse investors to continue avoiding this stock.

Be the first to comment