Marc Bruxelle

Thesis

Kayne Anderson NextGen Energy & Infrastructure, Inc. (NYSE:KMF) is another MLP closed-end fund (“CEF”) from our series of analyzed funds. In this article, we analyze the fundamental fund set-up, its performance versus its peers, and provide an outlook in terms of our view for the fund’s performance going forward. The vehicle focuses on MLP equity and has total return as its main objective:

Investment Objective & Strategy:

To provide a high level of total return with an emphasis on making cash distributions. The Fund intends to achieve this objective by investing at least 80% of its total assets in securities of Energy Companies and Infrastructure Companies.

An investor should think about MLPs in a normalized environment as a high yielding asset class with very little upside. MLPs are more of a “buy-the-dip” play, and recessionary fears with low oil / energy prices are the best entry points:

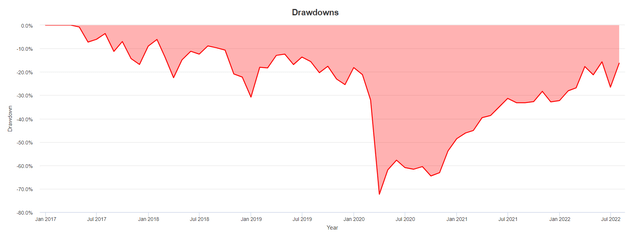

Drawdown (Portfolio Visualizer)

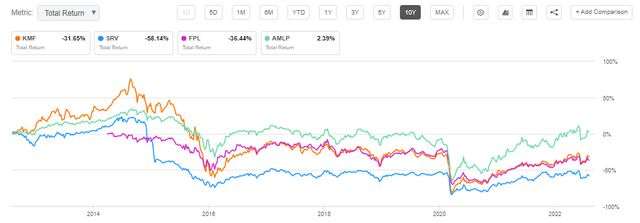

We can see in the above graph the depth of the Covid-19 drawdown for this fund and the fact that utilizing 2017 as the start of our analysis still puts us in a multi-year drawdown for KMF. The fund has a current dividend yield of 7.8% and a 26% leverage ratio. KMF is indeed trading at a -19% discount to NAV, but we expect this to persist. We talk more about our views on this topic in the “Premium/Discount to NAV” section below.

The fund is up +15% in 2022 and has been a decent Energy play. As balance sheets are mended and debt paid down in the MLP structures, the equity has reflected the recovery. We expect most of the positive move to be behind us, with the asset class mostly holding value and improving only in certain pockets going forward. That leaves KMF as a “clip-the-yield” type of fund.

In our view the best way to take advantage of this structure is to wait for a -5% to -10% drawdown during a risk-off bout (for example KMF was down more than -15% during the June risk off environment) to enter this vehicle. If you buy expecting a steady-Eddy 7.8% yield here, you are wrong. KFM is very volatile, reflecting the volatility of the MLP asset class with the added leverage on top. We expect robust overall performance for the CEF holdings in the next year, but the best way to exploit that is by buying the next risk off dip and being able to stomach volatility with this fund.

What are MLPs

KMF is a CEF that provides investors access to a lesser known asset class, namely Master Limited Partnerships, or MLPs, from the Oil & Gas sector. MLP is a fancy way of describing a form of incorporation for a company that generally runs pipeline and processing infrastructure for the Oil & Gas sector. In a nutshell, a classic MLP is a company which owns transportation (pipelines) and storage facilities for oil and gas. Since this business has traditionally been very stable (irrespective of oil prices, the actual liquid has to be transported from the extraction site to a port or storage facility) many large corporates chose to spin off their transportation and storage arms into free standing companies with long-term standing transportation contracts. The MLP format provided tax advantages for both the respective companies as well as investors.

Holdings

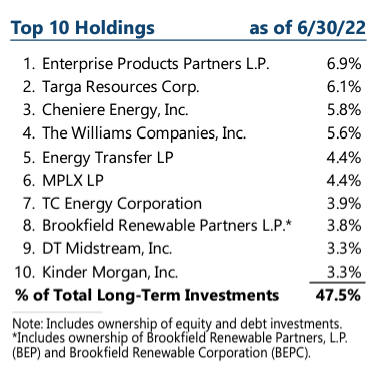

The top holdings are well known MLPs and C-corps:

Top Holdings (Fact Sheet)

Enterprise Products Partners (EPD), for example, just announced an earnings beat, and is an industry leader. EPD is organized as an MLP while the likes of Targa Resources (TRGP) are now C-Corps. One of the major reasons MLPs have considered moving to other tax structures such as C-Corp, is the sharp reduction in U.S. corporate tax rates. When corporate tax rates were similar to, or higher than, the rates paid by individual tax-payers, as was the case before the tax changes, the MLP structure was potentially useful. Now, most U.S. corporations pay U.S. taxes at a lower rate of approximately 21% (down from as high as 35%), so the benefit of an MLP structure is now less pronounced under the current tax regime.

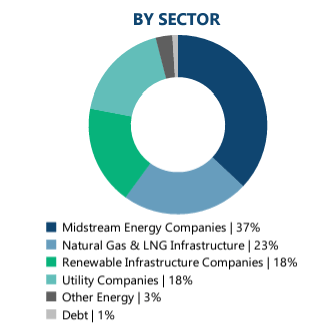

The sectoral breakdown for the underlying companies is as follows:

Sectors (Fund Fact Sheet)

We can see that the sectoral breakdown is fairly similar to other MLP CEFs we have analyzed recently and we feel trading in and out of certain names and reducing leverage are better levers for this fund to generate long term alpha.

Performance

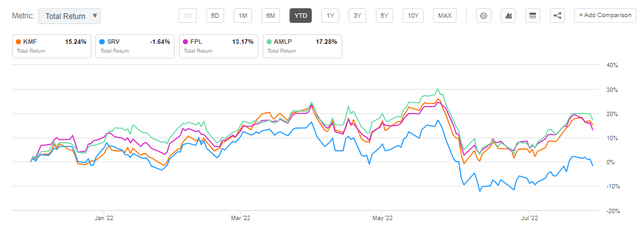

The fund is up over +15% year to date:

YTD Performance (Seeking Alpha)

KMF is in the same cohort with the “better” MLP CEFs and exchange-traded funds (“ETFs”) in terms of 2022 performance.

On a 5-year basis, the CEF’s performance careens towards the bottom of the cohort:

5-Year Total Return (Seeking Alpha)

The fund is deeply negative on a ten year basis:

10-Year Total Return (Seeking Alpha)

We can see from the above graph that the fund lost more than -31% on a total return basis in the past decade. That does not denote an asset class which is suitable for a buy and hold investor.

Premium / Discount to NAV

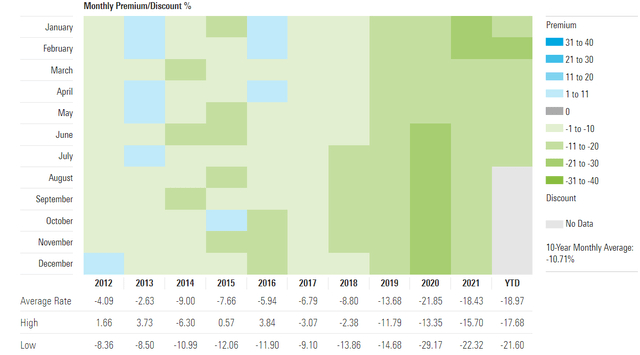

The fund is currently trading at a -17% discount to NAV, and has tended to trade at discounts to net asset value in the past decade:

Premium / Discount to NAV (Morningstar)

We can see from the above graph that, similarly to other MLP CEFs, KMF has traded at discounts to NAV in the past decade. During the Covid crisis the discount got as wide as -29.17% to net asset value. Due to its historic poor performance the MLP asset class, especially when leveraged up, attracts a discount requirement from the investor community. It really boils down to performance – if an asset class historically underperforms and the CEF structure does not liquidate, then as an investor you are stuck in a leveraged fashion in an asset class which will not move you forward. That is why one generally tends to see CEFs from “hot” asset classes trading at premiums to NAV where the laggards trade at discounts.

Conclusion

KMF is an MLP CEF. The fund has a 26% leverage ratio and has managed a total return exceeding 15% in 2022. The vehicle has a 7.8% dividend yield but exposes very high volatility being down more than -15% during the June market sell-off. Do not expect a “steady-Eddy” 7.8% dividend yield here, but look at this fund as a “buy the dip” opportunity. The underlying companies will have a robust fundamental performance in the next year, thus the opportunity with KMF lies with underwriting the fund during the next market sell-off.

Be the first to comment