Gonzalo Marroquin/Getty Images Entertainment

Following online-only apparel retailer ASOS’ (OTCPK:ASOMF) weaker-than-expected trading update for the June-August period, FY22 revenue growth is now set to reach +2% on an FX-neutral basis – well below even the lower end of the prior +4% FX-neutral guidance. Given the deceleration in August (vs. in-line growth numbers in June and July), expect more downward revisions in the coming quarters as well. For now, the profitability guidance remains at the bottom of the prior guidance at ~ GBP20m, as improvements in returns and cost discipline partially outweighed the revenue headwinds. Still, the August weakness warrants caution on FY22/FY23 numbers, particularly as we head into a weaker consumer environment and a potential recession in the coming months.

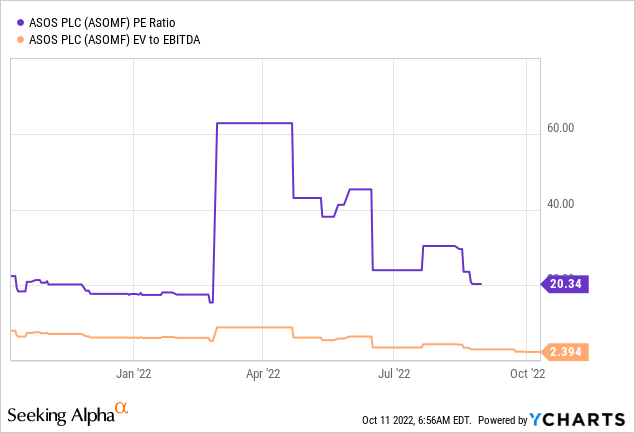

All in all, the stock’s discounted valuation seems warranted at this juncture, given the uncertainty on the macro front and with new CEO José Antonio Ramos Calamonte taking the helm. Fiscal results due next week should provide better visibility on the near and mid-term, with an updated strategic plan potentially on the cards as well.

Weak August Numbers Trigger a Profit Warning

In contrast to ASOS’ June and July results, which were largely tracking in line with expectations, August turned out to be a below-par month, likely even moving into negative territory. This will come as no surprise to followers of UK/European retail developments – recall that Primark operator Associated British Foods (OTCPK:ASBFF) had called out similarly weak sales numbers in its European business for the corresponding period. Similarly, the British Retail Consortium has also noted a slowdown in clothing demand in the UK. ASOS acknowledged the deteriorating consumer backdrop played a key part in the soft August print, exacerbated by extremely warm weather to start the autumn-winter shopping season. Management offered little color on any underlying changes in consumer behavior, though, so the extent to which inflationary pressures have affected consumer behavior remains unclear.

A Cautious Outlook

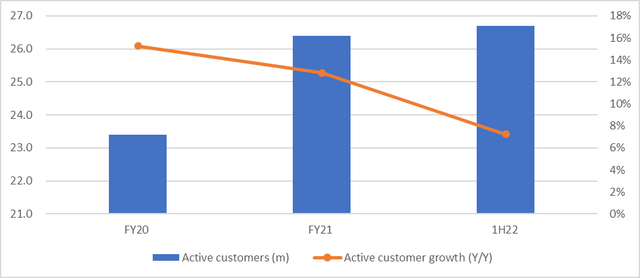

Following the below par trading update, ASOS is now guiding to FY22 sales growth of +2% YoY on an FX-neutral basis (vs. prior guidance of +4% to +7%), with pre-tax profit expected at the lower end of the prior GBP20-60m guidance range. While no official guidance has been provided for FY23, ASOS’ warning that it “remains cautious about the outlook for consumer spending” signals more downside ahead, in my view. ASOS did not allude to any recovery in trading into September as well, so expect Street estimates for FY23 to be revised lower post-FY results next week. The silver lining, though, is ASOS’ track record of consistent profitability through the cycles – despite subpar execution. Yet, the company is now in a more mature stage in its lifecycle, with an ~27m active customer base and a significantly larger revenue stream, so there will likely be fewer low-hanging fruits to capitalize on going forward.

Beyond the P&L, the year-end net debt guidance of GBP150m is also a concern – not only is this higher than the previous guidance range of GBP75-125m, but it also represents a significant YoY deterioration from the GBP200m net cash position last year. Like most other UK/EU retailers, the delta has been largely due to excess inventory, as over-ordering earlier in the year (to offset supply chain disruptions) and poor trading numbers weighed on the working capital flows. Assuming inventory commitments have peaked though, ASOS is well-capitalized following its convertible offering, with another ~GBP350m revolving credit facility (through 2024) available if necessary.

Potential Strategic Updates Ahead

A key source of uncertainty in the ASOS investment case is the potential changes to the mid-term strategic path now that it has a new CEO and Chairman. In particular, the disappointing performance of the US business despite elevated investment will likely come under the microscope. To be fair, there have been positives in the region – of note, the Nordstrom (JWN) partnership could unlock more growth in the coming years while US sales have already grown well above pre-COVID levels. That said, this growth has come at a high cost to margins, and with rising rates limiting access to low-cost capital, a full US exit or downsizing could be on the cards. Plus, import duties will also weigh on the growth prospects in the US, particularly on the distribution front.

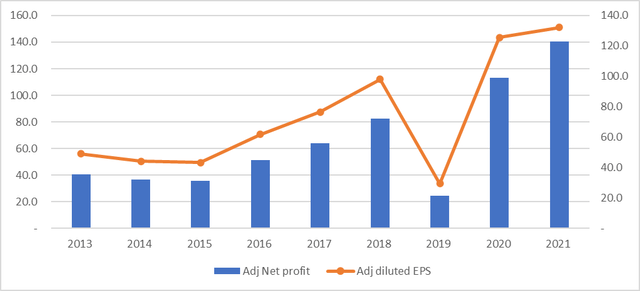

Elsewhere, expect updates from the new CEO on ways to unlock strategic value from the ASOS brand, which has built a significant customer base (~27m active customers) and social media presence (~14m Instagram followers). Finally, updates on the execution front will also be key if the company is to maintain its decade-plus track record of profitability through an upcoming recession.

Turbulence Ahead

The latest ASOS trading update highlighted the highly uncertain outlook for FY22/23, with a turnaround unlikely to materialize anytime soon. For now, the focus will likely be on managing inventory and markdowns to reverse gross margin pressures while implementing cost cuts to protect operating margins through a macro downturn. The mid-term visibility is also far from clear, with new CEO Calamonte taking the reins, although we could see a new strategic update as soon as next week’s fiscal results (potentially a positive catalyst if ASOS exits unprofitable regions like the US). Still, the weak August update likely means more weakness ahead, so even with the current valuation discount and strategic optionality, I would exercise caution.

Be the first to comment