@canada_by_alexis/iStock via Getty Images

Introduction

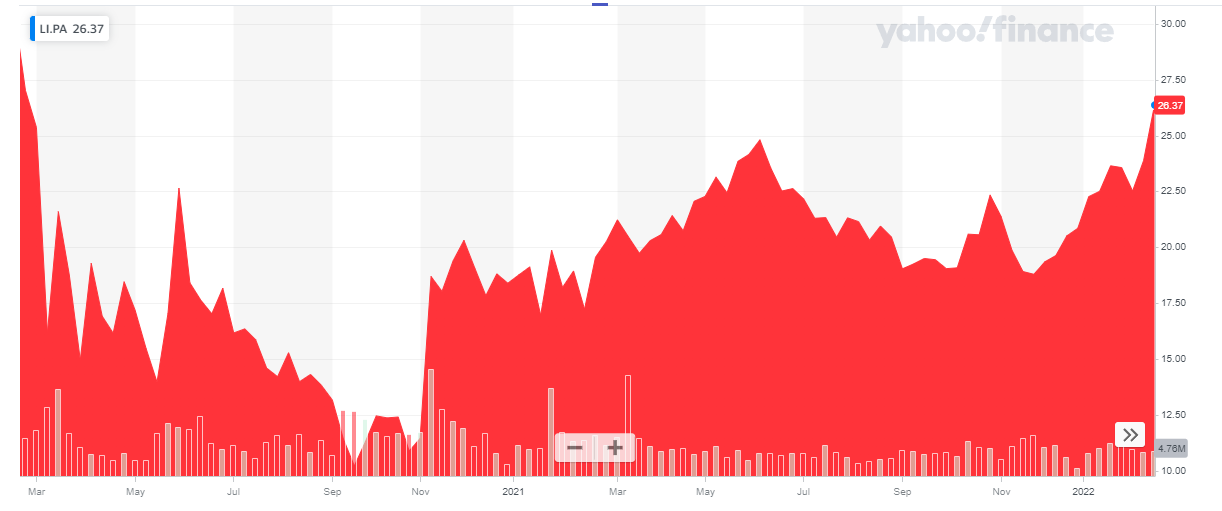

Klepierre (OTCPK:KLPEF) is one of the REITs I have been discussing quite regularly at European Small-Cap Ideas. This commercial REIT has obviously seen a negative impact of the COVID pandemic but was able to keep the damage limited in 2020 and recently released good to excellent results for FY 2021 with more growth to come in 2022 as the situation normalizes. The 2021 results and dividend are exceeding my expectations, and the share price is now trading approximately 40% higher than when my previous article was posted.

Yahoo Finance

Klepierre has its primary listing on Euronext Paris where it’s trading with LI as its ticker symbol. The average daily volume exceeds 1 million shares and as there are options available in Paris, it’s a very easy choice to trade in Klepierre’s stock on that exchange. I will use the EUR as base currency throughout this article.

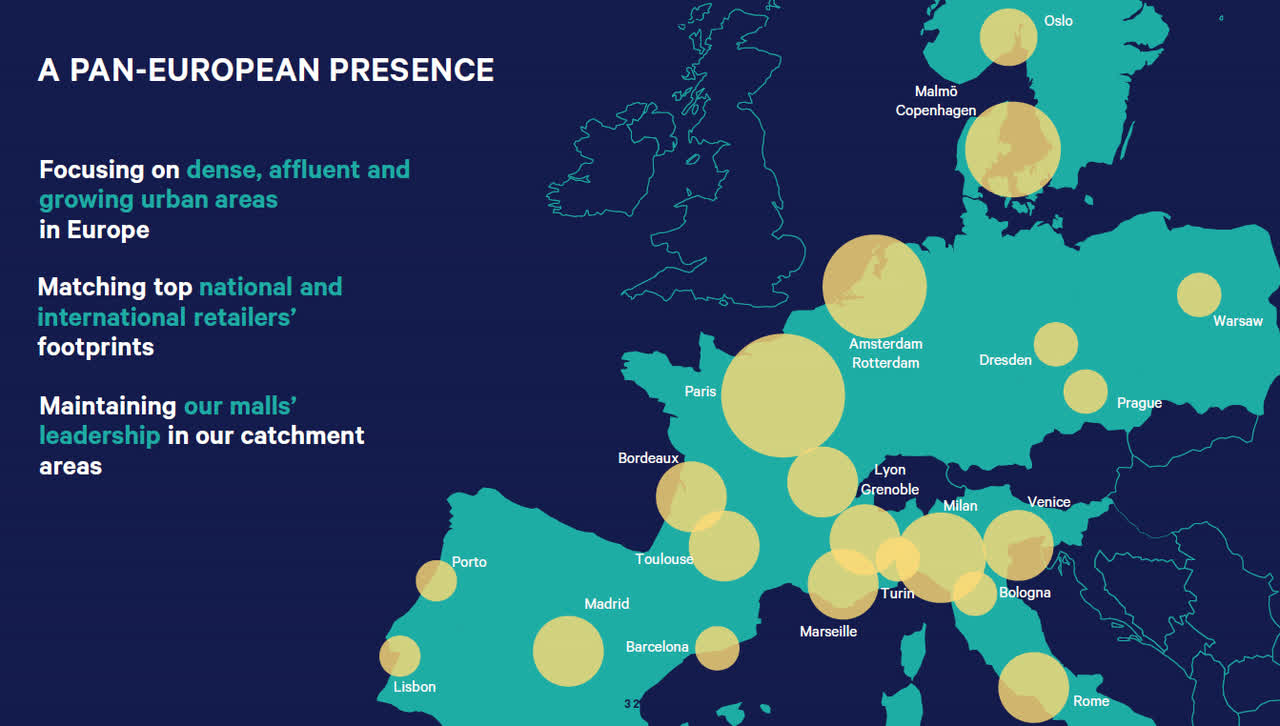

Klepierre Investor Relations

A relatively strong direct result

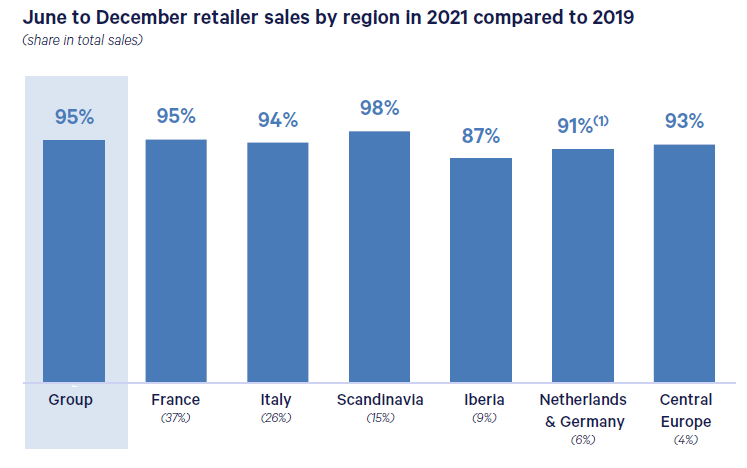

As most COVID-related restrictions were lifted in Klepierre’s jurisdictions in the second half of 2021, the REIT’s results bounced back right away and the direct result (comparable with the FFO/AFFO in North America) came in twice as high as in the first half of the year. The total sales results from the tenants in 2021 increased by about 10% compared to 2020 and in the second half of 2021, the retailer sales reached 95% of the pre-COVID levels. That’s likely the best evidence the business of the tenants is bouncing back. And perhaps even better than expected as the footfall improved at a slower pace to just 80% of the pre-COVID levels.

Klepierre Investor Relations

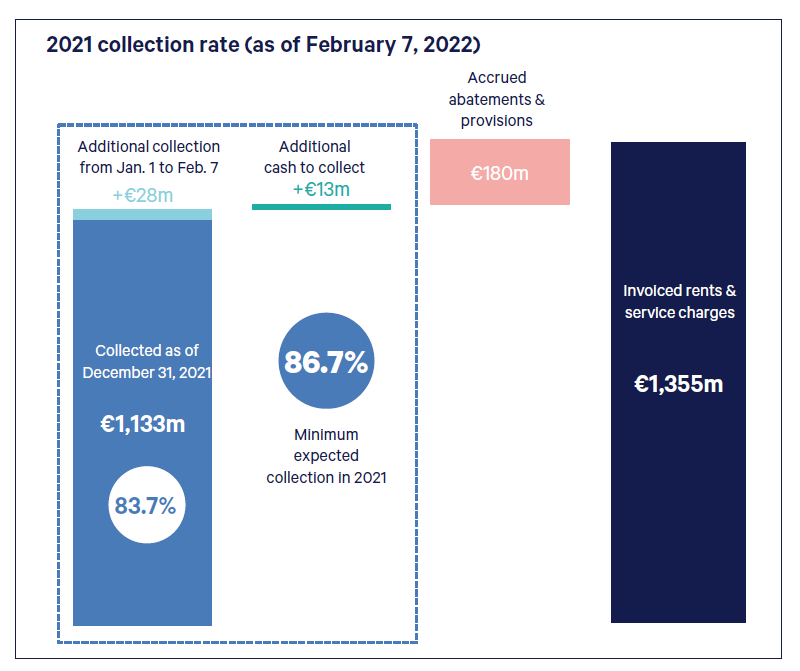

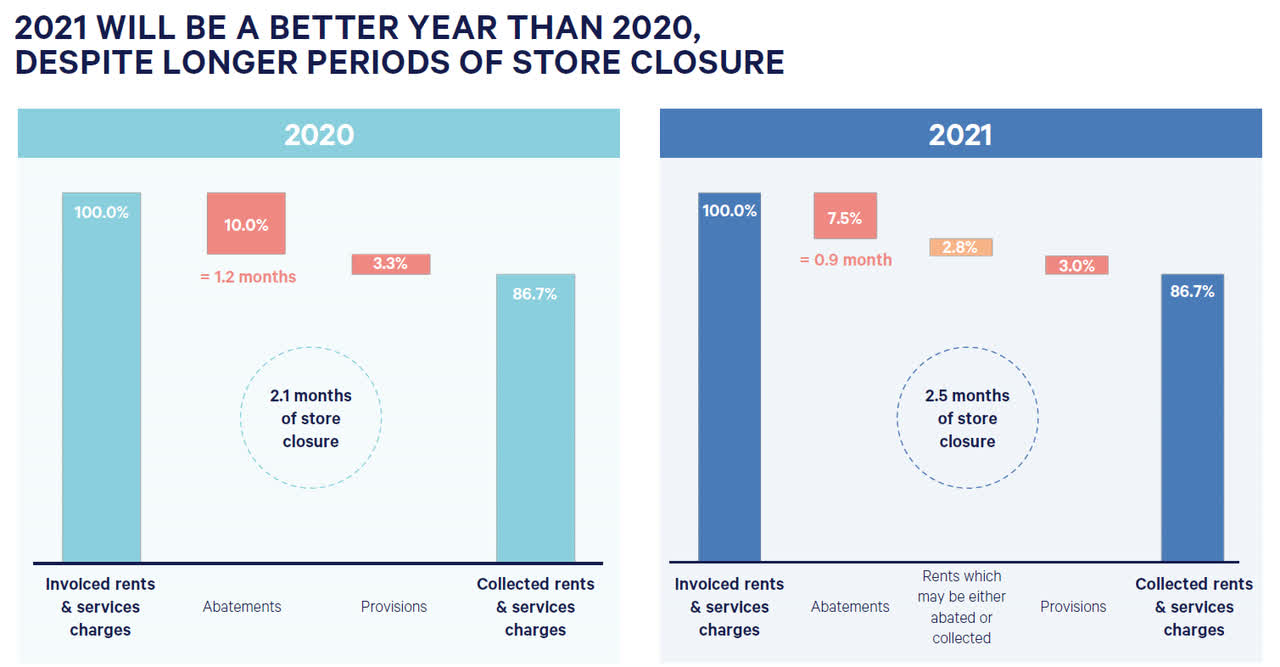

The key element for commercial REITs is the rent collection ate. Klepierre did well, especially after a strong second half of the year. It collected about 83.7% of the rent by Dec. 31, an additional 28M EUR came in after the end of the calendar year and Klepierre expects to receive an additional 13M EUR in the next few weeks, but attributable to the 2021 rent. This should result in a full-year collection rate of just under 87%.

Klepierre Investor Relations

That may still sound disappointing but keep in mind the rent collection rate in the first semester was just 74% so this basically means Klepierre received all the rent it was owed during the second half of the year. That doesn’t mean we can expect a 100% rent collection rate in 2022 but I am for sure expecting the rent collection rate to normalize further towards the mid-90s level.

Klepierre Investor Relations

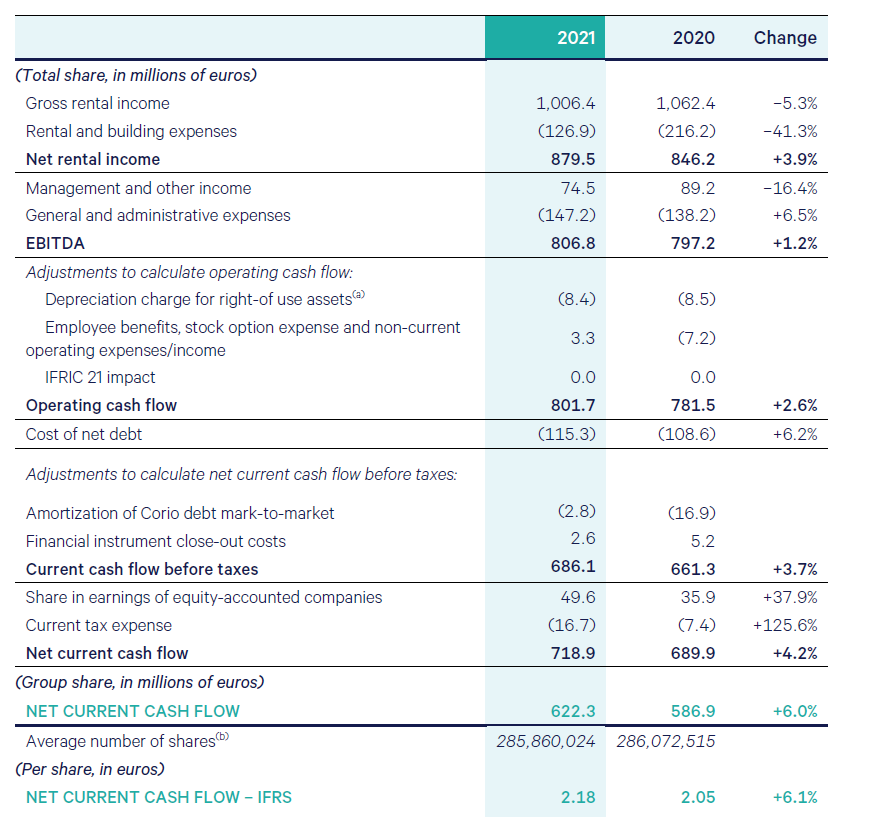

Thanks to the very strong occupancy ratio and rent collection levels, Klepierre was able to report a very high direct result of 622.3M EUR, as you can see below. Divided over 285.9M shares outstanding, the direct result was approximately 2.18 EUR per share. That’s an increase of in excess of 6% compared to FY 2020 although the stores were hit by longer mandatory closure periods during 2021.

Klepierre Investor Relations

The strong result allowed Klepierre to hike the dividend again and the REIT is proposing a distribution of 1.70 EUR per share. That’s an increase of 70% compared to the distribution of 1 EUR per share paid in 2020, and I think we can expect more distribution hikes as the payout ratio based on the 2.18 EUR cash flow per share is just around 78%. An additional bonus is that the distribution will likely be paid as an equity repayment which should be tax free.

There’s more to come in 2022, as the situation normalizes

Generating a direct result of 2.18 EUR is already much better than I had hoped for (I expected a direct result of 1.85 EUR per share), while the FY 2022 guidance of 2.30-2.35 EUR per share is slightly lower than my expectations of 2.40-2.50 EUR per share. That being said, Klepierre sold some assets in the past two years (completing almost 1B EUR of sales in 2021 alone) and those disposals obviously have a negative impact on the rental income and direct result. As interest rates are increasing again as well, balance sheet management will remain important for Klepierre. Fortunately the REIT has gradually reduced its net debt and as of the end of December last year, the LTV ratio was just 38.7%, a decrease from the almost 41.5% as of the end of 2020. And as most of the disposals happened in line with the official book values of the assets, there’s currently no reason to think the book value of the assets is materially overvalued.

If we would apply a dividend payout ratio of 80%, we can reasonably expect the FY2022 dividend to come in at around 1.85 EUR per share. At the current share price that would represent a yield of approximately 7% while Klepierre would retain in excess of 140M EUR to fund its development pipeline.

Investment thesis

Klepierre has performed very well in 2021 and the direct result came in higher than I anticipated while the LTV ratio is lower than I had expected. That being said the 1.7 EUR per share distribution will have a negative impact of approximately 2.5% on the LTV ratio but as Klepierre should obviously continue to receive rental income between now and the distribution payment date I expect the balance sheet after the first semester to still show a LTV ratio of just below 40%.

Klepierre is now the second largest position in the European REIT portfolio and the move toward increasing the exposure to commercial REITs is paying off.

Be the first to comment