simoncarter

Thesis

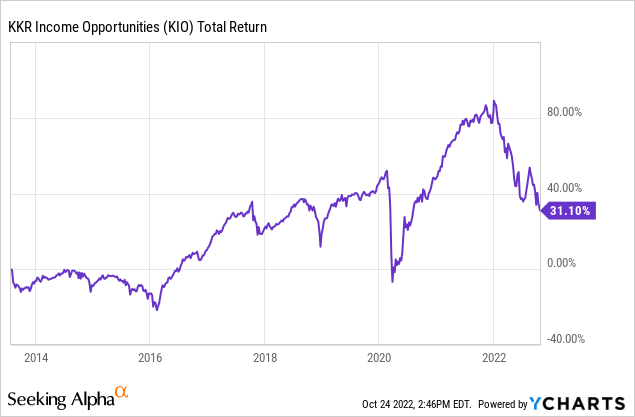

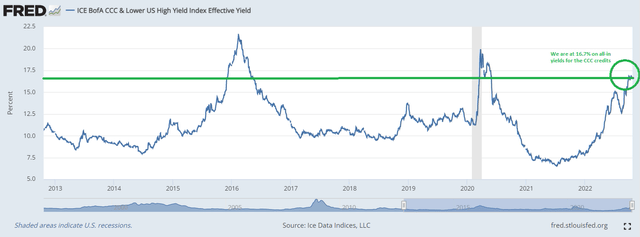

We wrote a couple of pieces on the KKR Income Opportunities (NYSE:KIO) CEF. The last one was entitled “KIO: Not Set Up For A Recession“, and the fund is indeed down -10% on a price basis since that article. A true CCC fund with significant leverage, KIO is not for the faint of heart. However, as more analysts are now of the opinion we are currently in the middle of a recession (even if NBER has not called one yet), we believe the markets are also pricing in one. While credit spreads are by no means at historic wides, CCC spreads have leaped, which coupled with high-risk free rates have resulted in CCC credits yielding almost 17%:

That is a pretty significant number. It translates into a large cushion for defaults. Let us assume 5% of theoretical CCC portfolio defaults with zero recoveries. If the portfolio yields 17%, then at the end of the year it still provided a 12% return to investors, even with large default rates. As per Moody’s:

The speculative-grade corporate default rate will climb to 4.3% next year under our baseline forecast, up from 2.3% in September. That rate, if realized, would exceed the historical average.

So as of now, the rating agency predicts an increase in defaults, but not an Armageddon. With issuance at a standstill in the high yield space, the market is telling us that these levels are not sustainable. For the U.S. credit spigot to keep cranking we need to see a reversion to 11% to 12% in all in yields.

KIO’s portfolio is overweight CCC credits, which comprise over 50% of the portfolio. Add a 44% leverage ratio on top of that and you get a very credit risky fund. However, we believe the market is already pricing in the collateral spreads a significant portion of the defaults to come. Down already -30% year to date on a total return basis, the fund might have another -10% to go until a true bottom is reached. However, it is beginning to look attractive here.

We like KIO’s portfolio management team since it has proven itself throughout the years. Unlike other funds who seem to post mediocre results by choosing bland credits, KIO runs very significant credit risk but with good metrics. Unless one believes we are going to see a much higher wave of defaults than what Moody is predicting, KIO is beginning to look attractive and is to be kept on the radar.

Holdings

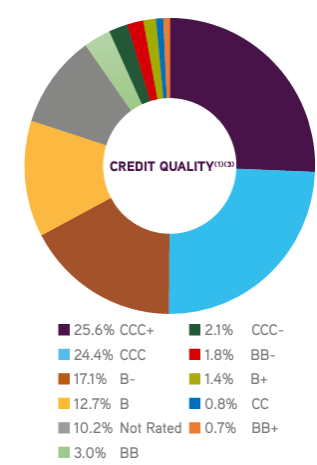

The fund is indeed very credit risky:

Holdings (Fund Fact Sheet)

We can see from the collateral composition that over 50% of the fund represents pure CCC credits, while another 29% is composed of “B” credits. The only saving grace here is the manager – KKR is an extremely versed distressed investor, and its team has seen several credit cycles develop and end.

Almost as important as the rating of a credit is its recovery rate. Why? Because if a name has a high recovery rate, an investor should more easily stomach a low credit rating. Please keep in mind that a rating only talks about the probability of default (i.e. the fulfilment of timely interest and principal payments), not about recovery. Let us take a theoretical example – if you own a plant and borrow against it, at a 50% loan to value, even if your credit rating is really poor the investor in the loan should feel safe because there is a 50% cushion to get back what is owed. The recovery ratings data is not available for the KIO portfolio, but we would surmise there are many credits with high recovery rates.

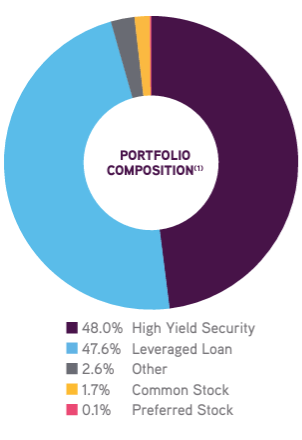

The portfolio is split evenly between high yield bonds and high yield loans:

Portfolio Composition (Fund Fact Sheet)

Leveraged loans are usually senior secured, meaning they have a first lien in a bankruptcy and thus higher recovery rates. Historically leveraged loans recovery rates have ranged from 60% to 70% versus 40% for unsecured high yield bonds.

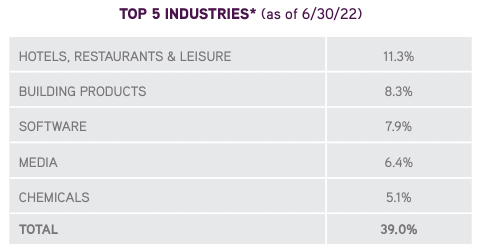

The fund does not have any sectoral concentrations:

Top Industries (Fund Fact Sheet)

We can see that no industry breaches the 15% threshold maximum we like to see. Certain CEFs like to take overweight positions in certain industries, but it is not the case with KIO.

Performance

The fund is down -30% year to date, in line with the ACP performance:

YTD Total Return (Seeking Alpha)

On a 5-year basis the fund is now flat:

5Y Total Return (Seeking Alpha)

And on a 10-year basis the fund is up:

We recently covered a CEF here, which has a conservative build and a low leverage ratio, but has provided investors an almost zero return on a 10-year basis. How is that possible, you ask. The answer lies in the management team. KIO takes significant credit risk, but its risk/reward metrics stack up in its favor due to its portfolio management team. Risk is good as long as you get paid for it. And the KIO management team has delivered. We like that.

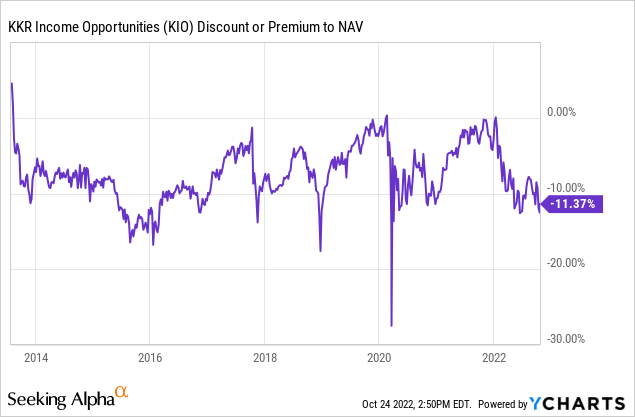

Premium / Discount to NAV

The fund is currently trading at a discount:

The current fund discount is towards the wider side from a historic perspective, but it is expected in today’s market. The discount might widen by a couple more points during the next down leg, that is almost a certainty, but we feel a year from now, at the end of 2023, this number will be much closer to 0%.

Conclusion

KIO is a CEF from the KKR platform. The fund runs significant credit risk via its portfolio, which is overweight CCC credits. The vehicle is down over -30% year to date, as credit spreads have widened and risk-free rates have risen. With average CCC names now yielding almost 17%, the market is already pricing in a recession, albeit not a significant one. We like KIO’s management team since it has proven itself in picking credits with good risk/reward profiles and generating long-term returns for the fund. An investor should not shy away from significant credit risk if it is priced correctly. At these levels and with a -11% discount to NAV, KIO is beginning to look attractive, although we are not of the opinion, we have hit a bottom here.

Be the first to comment