JimVallee

Introduction

When last discussing Kinder Morgan (NYSE:KMI) in the lead-up to the release of their third quarter of 2022 results, my previous article discussed how this grandpa of the midstream industry is still worth visiting even though their high growth days were in the past. Merely days ago, their guidance for 2023 was released and disappointingly, it seems they are dropping the ball in 2023, proverbially speaking, as they are left unprepared for higher interest rates.

Coverage Summary & Ratings

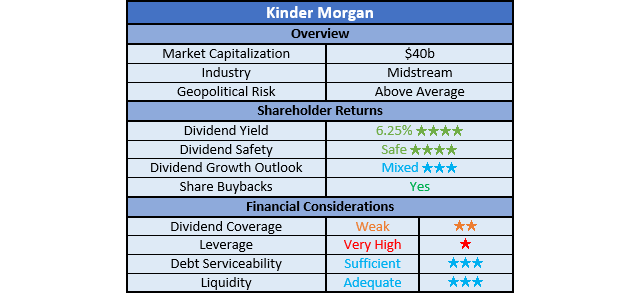

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

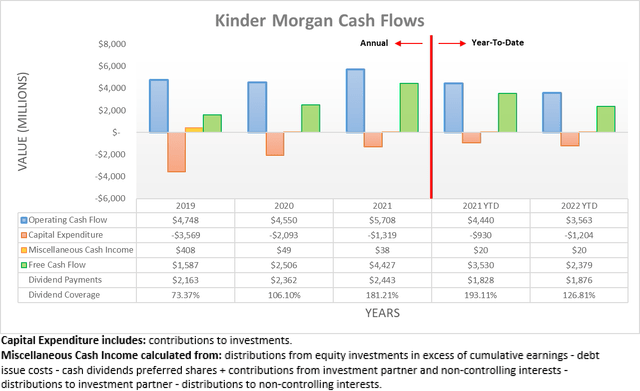

When heading into their third quarter of 2022 results, expectations were high after they lifted their adjusted EBITDA guidance for the full year, as discussed within my previous analysis. Alas, this seemingly did not translate into their operating cash flow with their result during the first nine months only reaching $3.563b and thus representing a decline of almost 20% year-on-year versus their previous result of $4.44b during the first nine months of 2021. Whilst yes, their previous results during 2021 were aided by the Texas Winter Storm dubbed Uri during the first quarter, this latest decline is actually larger than the near-17% year-on-year decline observed during the first half of 2022, as per my previously linked article.

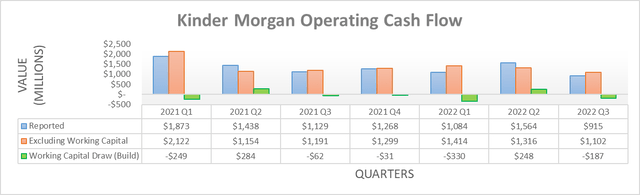

There are further interesting findings when zooming into their operating cash flow on a quarterly basis, which shows their reported result of $915m during the third quarter of 2022 was the lowest result since at least the beginning of 2021. Even if excluding their working capital build of $187m, it still sees their underlying result of $1.102b, which remains the lowest result across this same length of time. If not for this net working capital build across the first nine months of 2022, their operating cash flow would have otherwise been $3.832b. Either way, disappointingly their operating cash flow was soft across the first nine months and hopefully, the fourth quarter will see an improvement.

Whilst interesting, the bigger and most important story right now is their freshly released guidance for 2023. There are many moving parts to consider, the first of which being their adjusted EBITDA that is forecast to increase to $7.7b versus their forecast for $7.5b during 2022, which represents a circa 3% year-on-year increase. Despite not being particularly strong, especially in light of this high inflationary economy, the real disappointment is their distributable cash flow that unlike their adjusted EBITDA, does not exclude their interest expense, hence the “I” in EBITDA.

On this front, their guidance forecasts a year-on-year decline of circa 2%, landing at $2.13 per share during 2023 versus their forecast for $2.17 per share during 2022. They claim if not for higher interest expenses, their distributable cash flow forecast for 2023 would have been $0.15 per share higher and thus landing at $2.28 per share, which would have otherwise represented an increase of 5% year-on-year.

It would be one thing to see flat guidance but to see declines is particularly disappointing, especially because higher interest rates were not necessarily a sudden surprise that only came about this last week. In my eyes, management is dropping the ball in 2023 because despite interest rates climbing rapidly in recent months and exceeding most expectations from earlier in 2022, realistically as the year began, virtually no one expected they would be cut even before the Russia-Ukraine war, thereby skewing the risk-to-reward favorably towards hedging or refinancing away their exposure to variable interest rates. Furthermore, after this tragic event, the ensuring inflationary wave via higher energy prices effectively guaranteed higher interest rates would be forthcoming, which was already around ten months ago.

Circling back to their guidance for 2023, they also forecast $2.1b of growth capital expenditure, which marks a sizeable increase year-on-year versus 2022 given its forecast for growth capital expenditure of only $1.3b, as per my previously linked article. Once combined with their routine circa $900m of maintenance capital expenditure, it leaves the forecast total at $3b for 2023. Elsewhere, their guidance also forecasts dividends of $1.13 per share for the full year, which in turn should cost $2.54b given their latest outstanding share count of 2,247,742,071. Therefore, after being aggregated, this sees their estimated cash outflows for 2023 landing at $5.54b.

On the other side of the equation, their cash inflows naturally stem from their operating cash flow and because their distributable cash flow for 2023 is forecast to decline slightly, the best-case outlook for their operating cash flow would be broadly flat performance versus 2022. If looking back at their operating cash flow during the first nine months, their reported results of $3.563b annualize to circa $4.75b or if excluding working capital movements, their underlying result of $3.832b annualizes to circa $5.11b.

Unless they happen to see a sizeable working capital draw, their guidance at this point in time indicates they will face an approximate $400m to $800m gap between their cash inflows and outflows. As a result, this will have to be plugged via debt funding or divestitures, thereby leaving their dividend coverage weak at less than 100%. Although not necessarily ideal and partly a result of being unprepared for higher interest rates, thankfully this gap is not large enough to endanger their dividends. Plus, their higher growth capital expenditure is the primary reason and thus down the track, it raises prospects for stronger financial performance, which should boost their dividend prospects for 2024 and beyond, despite management dropping the ball in 2023.

Even though their lack of preparedness for higher interest rates is disappointing, thankfully the Federal Reserve will not be hiking interest rates forever with a pivot to a dovish stance forthcoming, quite likely by the end of 2023 as the economy slows. To also give credit where due, at least their financial performance is expected to increase during 2023 on an underlying level, hence their higher adjusted EBITDA. Once the burden of higher interest expenses subsides in future years, they should get a double-whammy of higher operating cash flow that not only receives a boost from their interest expense easing but also the benefit of their growth investments forecast for 2023.

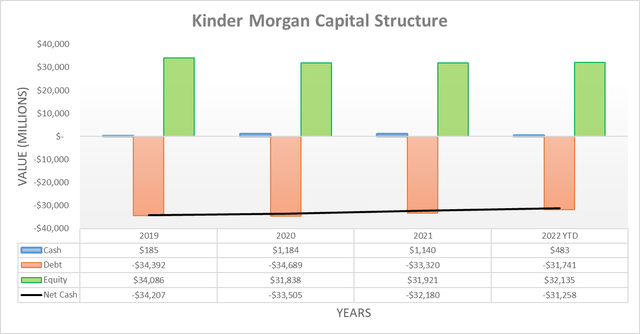

Despite their soft underlying operating cash flow and accompanying working capital build during the third quarter of 2022, their net debt still decreased ever-so-slightly to $31.258b versus where it ended the second quarter at $31.392b. This was made possible due to the proceeds from their Elba Liquefaction divestiture, which ultimately landed at $557m after associated expenses.

Obviously given the analysis so far, when looking ahead into 2023, their net debt will start edging higher given the gap between their estimated cash inflows and outflows. That said, the $400m to $800m, excluding any yet-to-be-known acquisitions or divestitures, does not represent a big change against their existing net debt, thereby further ensuring it does not endanger their dividends.

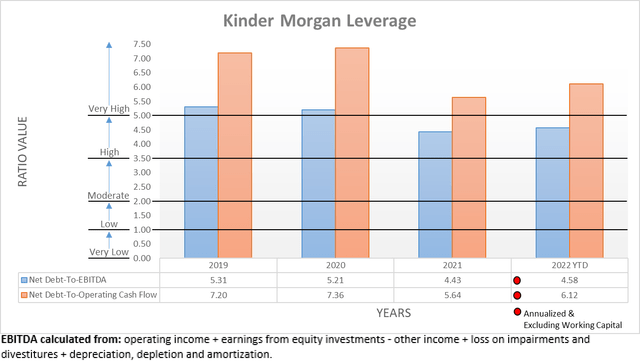

As it stands right now, their net debt is immaterially different since conducting the previous analysis following the second quarter of 2022, which means that it would be redundant to reassess their leverage in detail, especially as the bigger story is actually their debt serviceability. Nevertheless, the relevant graph was still included below to provide context for any new readers, which unsurprisingly sees their respective net debt-to-EBITDA and net debt-to-operating cash flow slightly higher at 4.58 and 6.12 with the latter above the threshold of 5.01 for the very high territory. If interested in further details regarding this topic, please refer to my previously linked article.

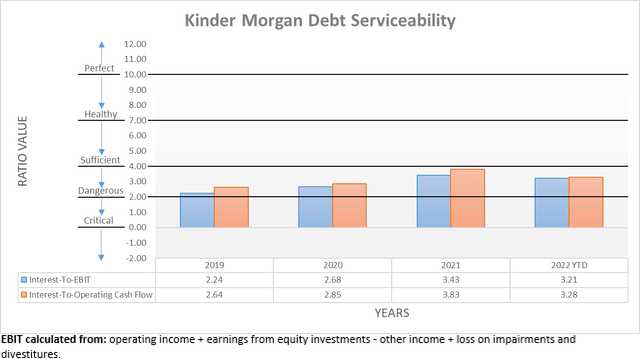

When viewing their debt serviceability, unsurprisingly, their very high leverage weighs it down even in the best of times. Such as the end of 2021 when they saw both strong financial performance on the back of the Texas Winter Storm and loose monetary policy, their interest coverage was still only 3.43 and 3.83 when compared against their EBIT and operating cash flow, respectively.

As a midstream company, this was not necessarily concerning given their steady financial performance and the fact that debt is simply par for the course in their capital-intensive industry. Nevertheless, as their financial performance softened during 2022, their interest coverage naturally slipped with a result of 3.21 following the third quarter when compared against their EBIT, which is down from its previous result of 3.45 following the second quarter. Concurrently, their latest interest coverage when utilizing their operating cash flow produces a result of 3.28, which is very similar.

At least in both accounts, their interest coverage is still sufficient and whilst this is effectively guaranteed to suffer during 2023 on the back of higher interest expenses, their latest results still have a margin of safety above the 2.00 threshold whereby their interest coverage becomes dangerous if dropping beneath. It does not dissolve the disappointment of seeing a setback during 2023 but if nothing else, it further confirms their dividends are not endangered.

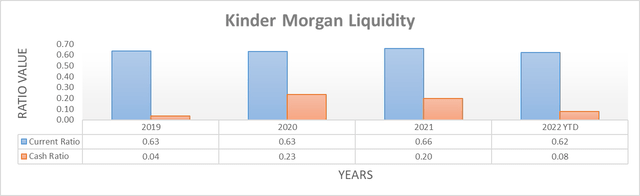

At least their liquidity saw modest improvements during the third quarter of 2022, despite the otherwise soft results elsewhere with their current ratio increasing to 0.62 from 0.52 following the second quarter. Whilst their cash ratio increased noticeably to 0.08 from 0.01 across these same two points in time, it nevertheless remains on the low side but their liquidity is still adequate given the $3.5b of availability on their largest credit facility that does not mature until August 2026. Plus, as one of the largest midstream companies, they enjoy superior access to capital markets over their smaller peers, regardless of where monetary policy heads.

Conclusion

I can understand there are many challenges running a company of their size but at the same time, it was abundantly clear early in 2022 that interest rates were very likely to increase or at minimum, not decrease given the inflationary shock as Russia attacked Ukraine. It remains disappointing that management did not better prepare the company for this outcome by hedging or refinancing away their exposure to variable interest rates. At the end of the day, thankfully the damage to their financial performance does not endanger their dividends and equally as important, this should only prove to be a short-term temporary issue as monetary policy will one day ease and thus I believe that maintaining my buy rating is appropriate for their high 6%+ dividend yield.

Notes: Unless specified otherwise, all figures in this article were taken from Kinder Morgan’s SEC filings, all calculated figures were performed by the author.

Be the first to comment