JHVEPhoto

Thesis

Leading US natural gas pipeline company Kinder Morgan, Inc. (NYSE:KMI) stock has performed well for investors in 2022, even though its performance is less spectacular than some of its downstream peers.

However, given its primarily fee-based multi-year volume contracts, predicated mainly on take-or-pay (63% of cash flows), it provides robust security for the coverage of its dividend payouts. Therefore, investors who invest in KMI are not perturbed by the underlying volatility in the commodity markets, as its exposure (6%) is insignificant.

Notwithstanding, Kinder Morgan’s FY22 revised guidance suggests that its adjusted EBITDA is projected to decline from last year’s performance. Hence, we expect KMI to continue trading within a tight consolidation range.

Despite that, we believe its reasonable valuations and robust cash flows should help mitigate significant downside volatility through the looming economic recession.

We discuss several critical levels that investors should watch to assess potential entry zones that could improve their reward-to-risk profile moving ahead.

We rate KMI as a Buy, with a medium-term price target (PT) of $18.5.

KMI’s Valuation Has Been De-rated

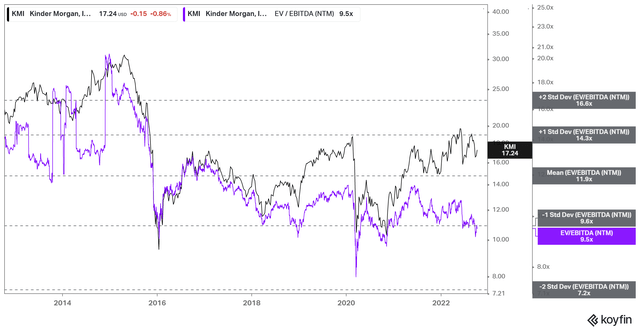

KMI NTM EBITDA multiples valuation trend (koyfin)

As seen above, we gleaned that the market has not re-rated KMI despite its highly profitable business model and cash flow visibility.

Despite recovering remarkably from its 2020 COVID lows, KMI has struggled to come close to re-test its 10Y NTM EBITDA multiples mean. Therefore, we believe the market remains tentative over downstream cyclicality, which could impact the operating performance of leading midstream players like Kinder Morgan. The company also highlighted such risks in its filings:

Sustained unfavorable commodity prices, volatility in commodity prices or changes in markets for a given commodity might also have a negative impact on many of our customers, which could impair their ability to meet their obligations to us. If economic and market conditions (including volatility in commodity markets) globally, in the U.S. or in other key markets become more volatile or deteriorate, we may experience material impacts on our business, financial condition, and results of operations. (Kinder Morgan 10-Q)

Investors Need To Monitor Kinder Morgan’s Adjusted EBITDA Growth

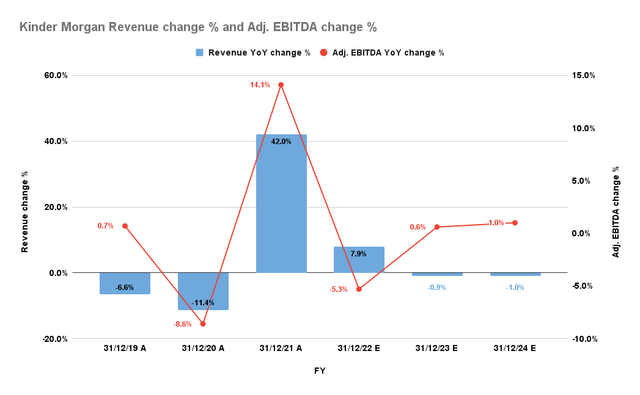

Kinder Morgan Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Management revised its FY22 adjusted EBITDA projections to $7.2B, while the consensus estimates (neutral) suggest a -5.3% YoY decline to $7.53B, above management’s guidance.

Therefore, we believe the market would unlikely re-rate KMI significantly in the near term, as it laps challenging comps from FY21. However, given its robust profitability and potential recovery from FY23, medium-term downside risks also appear to be limited at the current levels.

Is KMI Stock A Buy, Sell, Or Hold?

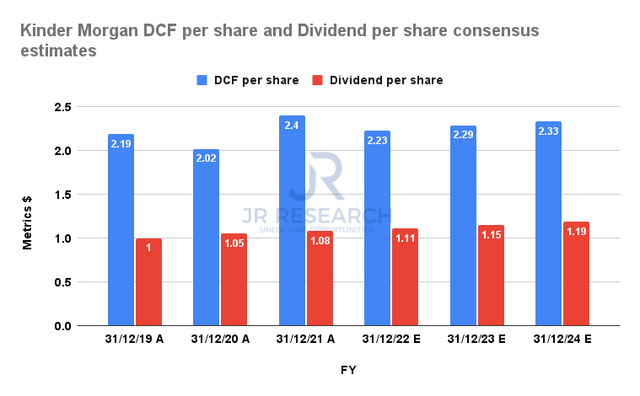

Kinder Morgan DCF per share and Dividend per share consensus estimates (S&P Cap IQ)

Despite the volatility in its adjusted EBITDA estimates, we think what matters most to investors in KMI is whether its dividend is well covered by its distributable cash flows (DCF).

As seen above, Kinder Morgan’s dividend strategy is reasonable, with its DCF providing a significant buffer for its dividend per share (DPS) through FY24. Hence, given the cash flow visibility from its fee-based contractual agreements, we believe its dividend strategy remains sound.

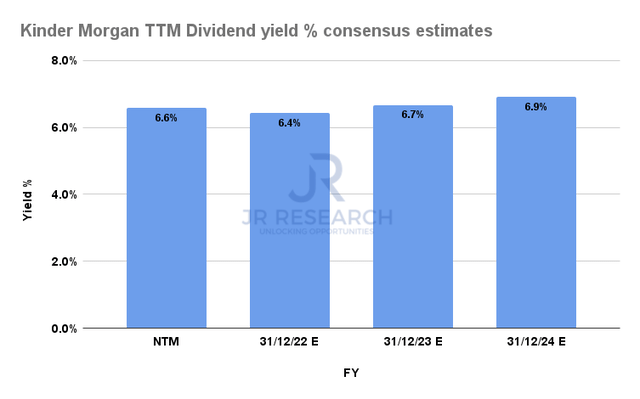

KMI TTM Dividend yields % consensus estimates (S&P Cap IQ)

With an NTM dividend yield of 6.6%, we assess that the opportunity in KMI is reasonable at the current levels. Hence, it should continue to provide robust valuation support at the current levels, which is also supported by its price action.

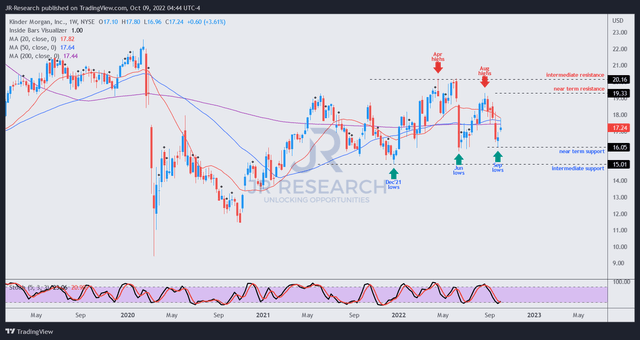

KMI price chart (weekly) (TradingView)

Investors should note that KMI has been trading within a consolidation zone since its high in May 2021. Therefore, the recovery momentum in KMI has weakened considerably over the past year, despite the massive upside seen in some of its downstream peers.

However, as discussed earlier, we believe the price action is justified, given the challenging comps that Kinder Morgan needs to overcome in FY22.

Therefore, it remains to be seen whether KMI could recover its medium-term bullish bias moving ahead. As such, we assess investors should demand a more significant margin of safety by adding at levels closer to its near-term or intermediate resistance, as indicated above.

We rate KMI as a Buy, with a medium-term PT of $18.5.

Be the first to comment