redtea

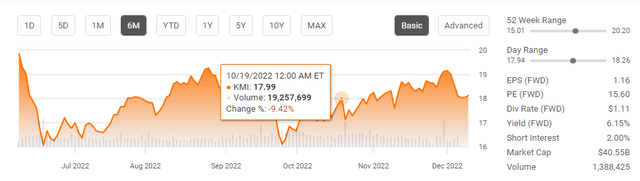

Shares of Kinder Morgan (NYSE:KMI) haven’t done much since reporting earnings on 10/19. KMI missed EPS estimates by $0.04 but beat the top line by $630 million. Shares initially declined to $17.12, then appreciated to $19.15 throughout November, and recently settled around the $18.10 level. On Wednesday, 12/7, KMI announced its 2023 financial expectations, which came in under the consensus estimates. It’s never positive when a company guides down, and KMI told the investment community that they expect distributable cash flow (or DCF) to decline from its 2022 forecast of $2.17 per share to $2.13 in 2023. In addition to lowering expectations for its DCF, KMI set the stage for flat YoY growth in net income per share as they expect to replicate their projected $1.12 per share of net income for 2022 in 2023. Kimberly Dang (KMI President) cited that the lower DCF projection is correlated to expected increases in interest expenses in 2023 from the 2022 forecasts.

The 2023 guidance shouldn’t be a concern for long-term investors and should highlight the importance of KMI’s fiscal responsibility initiative they previously implemented. Since Q1 of 2015, KMI has retired over $11 billion in debt, significantly deleveraging its balance sheet. KMI is projecting that it will end 2023 with a net debt to Adjusted EBITDA ratio of around 4x, which is below its long-term target of 4.5x. Things could have been much worse in the current environment of raising rates, but KMI’s management team made the hard decisions and navigated KMI to a position where rising rates won’t have as large of an impact as they could have. I am a long-term investor and plan on adding to my position in KMI. I think the impacts from larger interest expenses could be offset or nullified due to a stronger natural gas market in 2023. At the end of the day, KMI has established one of the most critical energy infrastructure networks in North America that will play an essential role in the future of natural gas. I believe KMI is a buy-and-hold on pullbacks for long-term income investors.

The importance of debt reduction and looking at KMI’s progress

The era of cheap money is gone, and it’s unlikely to return for quite some time as the FED is projected to continue increasing rates. KMI has $3.2 billion of debt maturing in 2023, with $1.8 billion maturing in Q1 and $1.4 billion maturing between the end of Q3 and Q4. KMI currently has $483 million in cash on hand, $42 million in trading asset securities, and $4 billion in liquidity through a revolver that is undrawn. The $3.2 billion may seem like a large number, but KMI is in a position where they can wait for market conditions to ease and assess the debt market throughout 2023 to refinance a portion of its maturities with new long-term debt.

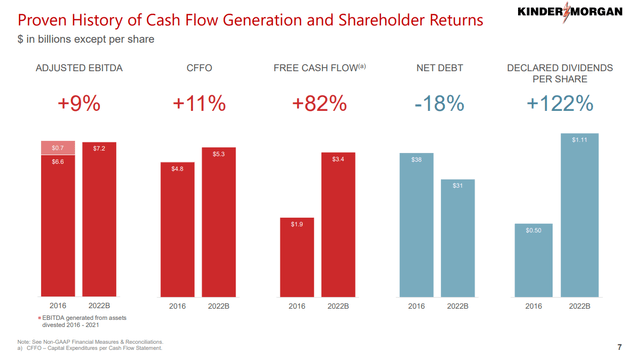

KMI measures net debt, which is a non-GAAP financial measure. Net debt is arrived at by subtracting cash and cash equivalents, preferred interest in the general partner, debt fair value adjustments, and foreign exchange impact on Euro-denominated bonds from KMI’s debt. Personally, I look at total debt because you never know what a management team will utilize cash for. At the close of 2015, KMI finished its fiscal year with $43.3 billion in total debt, which has been reduced by -$11.14 billion (-25.73%) at the close of Q3 2022. KMI currently has $32.16 billion of total debt on its balance sheet, of which $29.41 billion is long-term debt.

As KMI eliminated debt and refinanced at lower rates, its annual interest expenses declined by -28.96% from $2.05 billion to $1.46 billion. KMI has made considerable amounts of progress since the close of 2015 and has operated through several tough economic environments. If KMI didn’t make as much progress as they have over the previous 7 years, the rising rate environment would impact KMI much more severely than it currently is. While nobody wants to see a press release discussing that YoY DCF will decline due to impacts from increased interest expenses, I think it needs to be taken with a grain of salt. This is a company that tackled adversity head-on and implemented operational changes that put KMI in a position where a rising rate environment wouldn’t be detrimental to the company. Much credit needs to be given to management, especially since the decision came at a large expense to the dividend, which is a primary reason for owning shares of KMI. Management has established a positive track record, and I am not concerned about the headlines about 2023’s financial forecasts.

I am focused on how the natural gas market can positively impact Kinder Morgan and possibly overshadow the 2023 financial projections

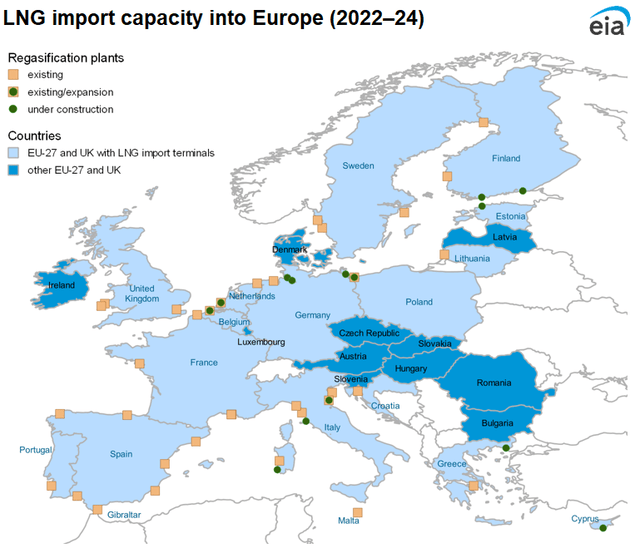

The energy situation overseas is extraordinary and presents an opportunity for natural gas companies domestically, both in the E&P and infrastructure sectors. The United States Energy Information Administration is projecting that liquified natural gas (or LNG) terminals across the European Union will expand their capacity by 5.3 billion cubic feet per day (Bcf/d) by the end of 2023. In 2024, this capacity will expand by another 1.5 Bcf/d for a total of 6.8 Bcf/d of new LNG regasification capacity added in the region (34% expansion) compared with 2021. Between January and November 2022, an estimated 1.7 Bcf/d of new and expanded LNG regasification capacity was added in Poland, Italy, the Netherlands, Finland, and Germany. By the end of 2023, LNG regasification terminals that are currently under construction in Germany, Poland, France, Finland, Estonia, Italy, and Greece will add 3.5 Bcf/d of new capacity.

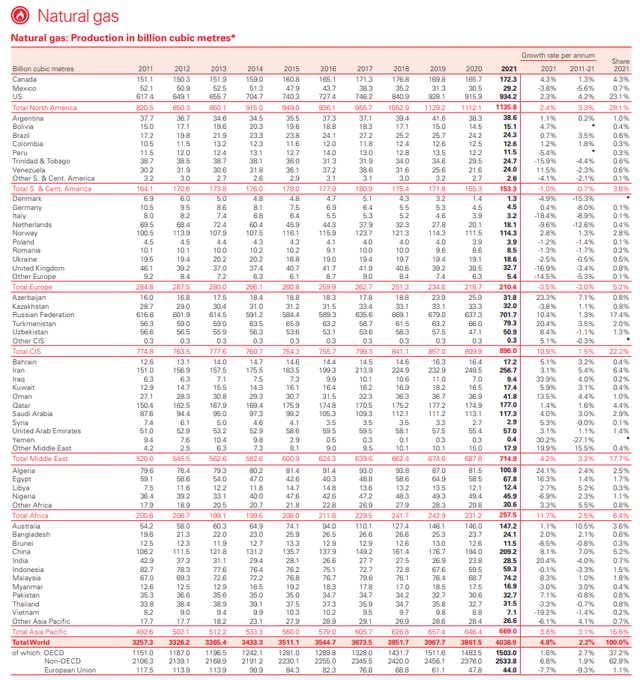

The BP p.l.c (BP) 2022 Statistical Review of World Energy was released, and it’s one of the most robust energy reports anyone interested in the sector can read. Within the report, BP provides a comprehensive breakdown of the global production of natural gas. The United States produced 934.2 billion cubic meters of natural gas throughout 2021, which was 23.14% of the global natural gas production level. When I add Canada to this figure the global production increases to 27.41% as Canada produced 172.3 billion cubic meters of natural gas in 2021. The European Union only generated 44 billion cubic meters of natural gas in 2021, and we can see by the extent they are increasing their import capacity through existing or new import terminals; natural gas will play a vital role in their energy mix for decades to come.

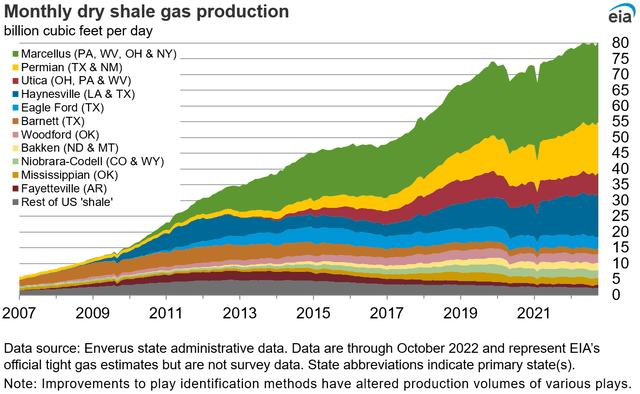

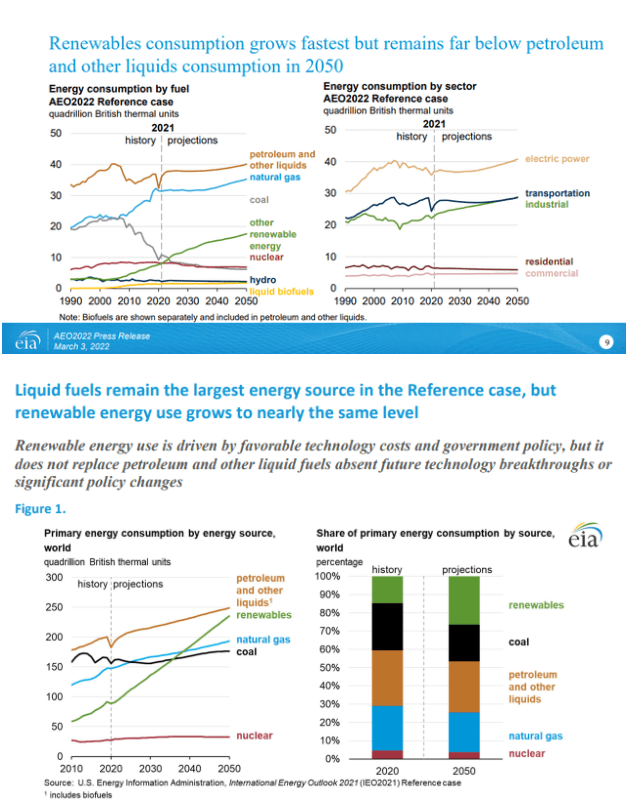

Natural gas production in the United States has increased by 51.31% over the past decade, as it increased by 316.8 billion cubic meters. According to the EIA, we have seen the most production increase come out of the Marcellus shale, and Permian Basin. On 3/3/22, the EIA released its 2022 Annual Energy Outlook and concluded that petroleum and natural gas remain the most consumed sources of energy in the United States through 2050 (1st slide below). The EIA publishes its international energy outlook every 2 years, and the last one was published prior to the war in Ukraine. In 2021, on a global scale, the natural gas consumption rate will increase by roughly 18% by 2050 per the EIA’s projections (2nd slide below). Their next report is slated for 2023, and it will be interesting to see how things have changed due to the growing demand for natural gas overseas.

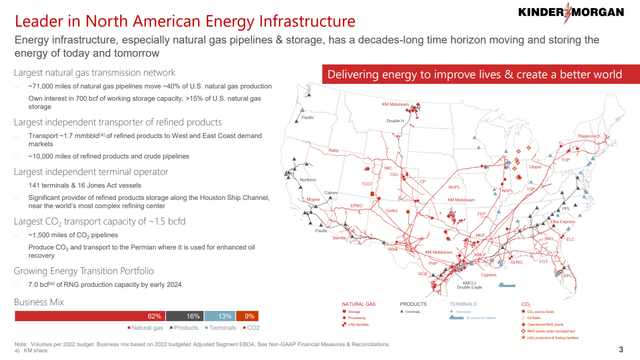

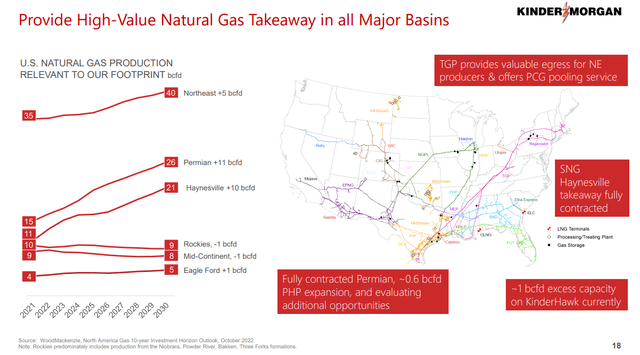

KMI is one of the best-positioned companies to capitalize on the future of natural gas. KMI has 71,000 miles of natural gas pipelines and transports roughly 40% of the natural gas produced domestically. KMI provides takeaway capacity in every major basin throughout the country, connecting production to major markets and export terminals. KMI currently moves 7 Bcf/d to LNG facilities and is a top transporter due to its network connectivity and 700 bcf of working gas storage. As production in the United States continues to increase, KMI will remain a top transporter, and capacity throughout its system will become more sought after.

The next several years could change the narrative for energy infrastructure companies

The narrative around energy infrastructure companies hasn’t been great, but I would like to think it’s changing. One of the most important aspects is the barrier to entry in the sector. A group of individuals can’t just go build 71,000 miles of pipelines and develop all the storage and processing facilities needed to go along with them. You need to map out what facilities the pipelines will need to connect, get permits, purchase land, do the environmental studies, build the infrastructure, and sell contracted services. This is the main reason why I am invested in several of the big players, including KMI. If it’s more cost-effective for Berkshire Hathaway (BRK.A)(BRK.B) to purchase 7,700 miles of pipelines from Dominion (D) rather than building them, then it’s hard to believe a company without BRK.A’s resources and political standing would be able to compete in the sector.

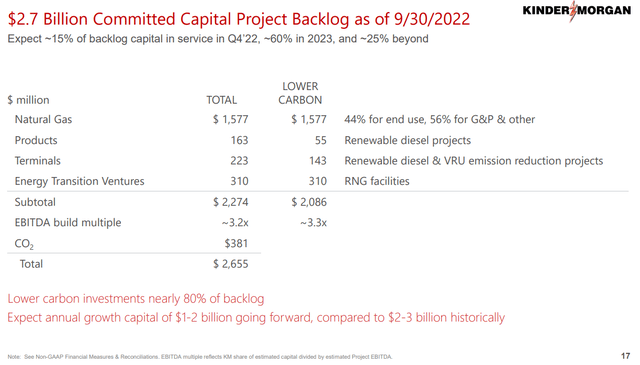

KMI has committed $2.7 billion of capital to its backlog of projects, of which $1.58 billion is allocated toward natural gas. In Q4, KMI will bring roughly 15% of its projects online, then another 60% in 2023. Once its backlog of projects is clear, KMI expects to allocate $1-$2 billion to capital projects going forward. This presents a golden opportunity, as KMI’s network capacity will grow with domestic production.

I look at KMI as an energy tollbooth as it makes money for fuels transported through its network or when its services are utilized. It’s a favorable business model for KMI as the bulk of its business is created from take-or-pay and fee-based services. These types of contracts help mitigate risk on the transporter side to offset the possibility of declining commodity prices and the correlating effects throughout the energy industry. 63% of KMI’s cash flow is backed by take-or-pay contracts, which ensure that KMI is paid the negotiated rate regardless of the number of fuels that pass through its system. Companies electing to enter into a take or pay contract with KMI are reserving future capacity based on their projections. Fee-based services represent 25% of KMI’s cash flow. This is where a fixed rate is negotiated upfront between KMI and its customers. The revenue which is generated from fee-based contracts is based on volume, which passes through the system as the fee has already been set. Fee-based contracts are also a mitigation method to an uncertain commodity market as fees are agreed upon upfront, so whether commodity prices increase or decrease, KMI is generating a revenue amount that is attractive to their overall business.

KMI’s 2023 guidance came in at $2.5 billion in net income, which is flat YoY, $7.7 billion in Adjusted EBITDA (3% increase YoY), and $4.8 billion in DCF (down -2% YoY). The rising rate environment is putting some pressure on the 2023 guidance, but I don’t believe this will be the case outside of 2023. KMI also could see increased revenues as additional capacity is brought online due to more contracted capacity being needed by producers. Depending on how KMI handles the 2023 debt maturities and the level of new contracts, there is a chance that KMI could surprise everyone at the end of 2023 with better-than-expected results. Even if their forecast comes true, KMI will be in a great position to capitalize on the global energy landscape in 2024 and beyond.

Conclusion

I am not looking at the EPS and DCF news as negative, because it doesn’t change much in the grand scheme of things for KMI. KMI has eliminated a large portion of its total debt, and is in a position where they can service their current debt obligations. KMI is one of the largest energy infrastructure companies and a premier transporter in the natural gas sector. The European Union is making large capital investments to add capacity to their LNG import facilities which will increase the amount of exports coming from countries such as the United States. The demand for natural gas is projected to increase, and with more natural gas being transported, companies will need to pay for additional capacity throughout KMI’s network. If KMI continues to slide, I will continue to add to my position, as this is not a short-term play. My opinion is that the world has changed and realized that 100% renewable isn’t realistic and that a global mix of energy that includes renewables is the viable option. I think KMI will continue to progress and generate increased DCF over the next several years. Investors can be rewarded along the way with a growing dividend and recognize capital appreciation in the future.

Be the first to comment