Melena-Nsk

Published on the Value Lab 12/5/22

West Fraser Timber (NYSE:WFG) has now started to see the declines in EBITDA that come with lumber prices coming off the highs of this last cycle. They are unlikely to go too much lower, despite higher rates putting pressure on the housing market. Secular tailwinds support volumes, and the prices in lumber and OSB are beginning to get close to long-term averages. The US economy isn’t in terrible shape at all, and complete collapse is rather unlikely. Even at current run rate income figures, the multiple is low and the margin of safety is there with margins still running high. Moreover, capacity increases should give a thrust to EBITDA in 2024. With more of the demand coming from renovation and remodeling markets, we think cyclicality, while still very much there, is less than it used to be. Overall, it’s still an attractive proposition.

Q3 Breakdown

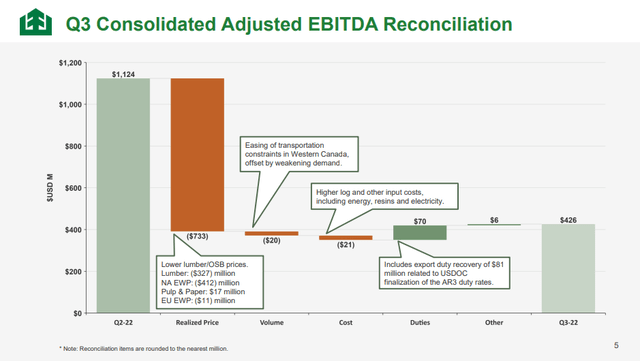

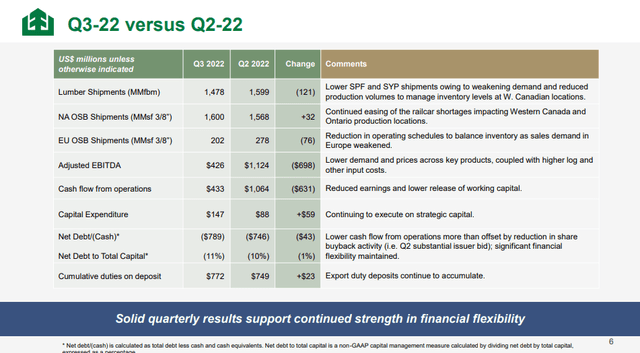

The financial data looks discouraging. While volumes were relatively solid, massive declines in prices for lumber and OSB have shrunk run-rate EBITDAs very meaningfully from the higher levels we were getting used to.

Volumes also declined, now not due to supply chain issues, or previously the lack of flatbeds to actually offtake lumber, but due to reduced demand primarily from housing. Still, volume declines were limited compared to the more than 50% decline in EBITDAs which have come from operating leverage and pricing.

OSB and lumber prices are generally pretty similar in direction, and with lumber prices, the precipitous declines are pretty clear, with lumber prices now coming down to historically average levels, before all the dislocations from COVID-19.

Lumber Price (tradingeconomics.com)

Declines in price were more than 50% from mid-year, average 2022 levels. We are entering into a normalized range for lumber prices now.

The run-rate PE is about 7x, and there are capacity expansions coming in some of the pretty major OSB facilities which should add about 10-15% to the EBITDA line when they come online in 2024. Margins are still at 20% and we have reasons to believe this may be the bottom for WFG.

Bottom Line

There are a couple of reasons we think things won’t get that much worse from here. The most important is the state of the US economy. We are pretty convinced of a soft landing. Geopolitically, the US is gaining huge mercantilistic influence because of the war in Ukraine, and they have timed interest rate hikes with market strife in order to strengthen the dollar and substantially improve public finances. This is coming at the expense of Europe, which is becoming increasingly irrelevant. Europe is in recession, but the US still isn’t. Jobs are even rising. The housing market is suffering, and there’s no doubt about this from looking at housing start statistics and many other variables, all of which point very clearly to a quite sharp downturn in the housing industry. But the relative strength of the US, and the repeated failure of other analysts to properly appraise the importance and even the content of geopolitical factors, means that the expectations around housing are likely worse than they should be.

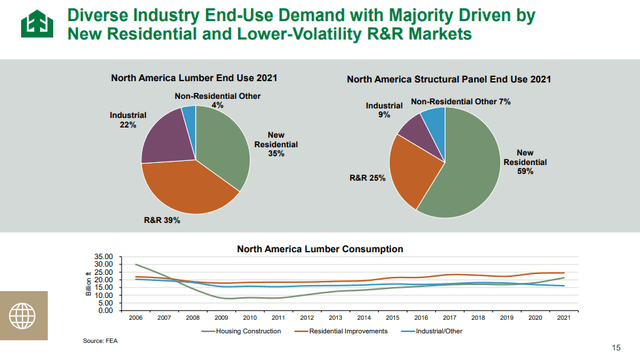

The other thing which is specific to WFG is how its products are more exposed to less commodified markets. Remodeling and renovation is a larger share than before, and OSB has even higher shares in more specialized markets like industrial. R&R markets respectively for OSB and lumber are around 30% and 40%, which gives more exposure to less income-sensitive markets. New residential matters much less, and that’s good considering the housing situation.

Lumber and OSB Market (Q3 Pres)

Overall, a 7x multiple in PE, and this is on a run-rate basis, gives a margin of safety in our view. Of course, the volatility just now demonstrated may have investors considering other plays. While we like WFG, we haven’t ever placed a chip on them. We prefer Nordic Waterproofing, which has a 10x PE and is in our opinion going to have very stable revenues and profits even through a housing and general construction downcycle in Europe.

Be the first to comment