JuSun/iStock via Getty Images

Not every stock has to be bought with the expectation of it being a home run. In reality, it pays to have a portion of one’s portfolio dedicated to the essential “blocking and tackling” that could in turn, serve as the bulk of the portfolio’s gains over the long run. This is especially true when it comes to solid dividend payers in the consumer staples sector.

This brings me to Kimberly-Clark (NYSE:KMB), which has traded rather weakly since the start of the year, and sits comfortably below its 52-week high of nearly $146, achieved just back in January. This article highlights the merits of investing in KMB at present, so let’s get started.

KMB: Staple Some Dividends To Your Portfolio

Kimberly Clark is a consumer staples company that owns a variety of well-known brands that people use on a daily basis, including Huggies, Kleenex, and Scott. Its top 5 brands generate over $1 billion in revenue per year, and it holds the number 1 or 2 position in its key categories in 80 countries. Notably, KMB is also about to become a Dividend King at the end of this year, after having raised its dividend for the 50th year in January.

The company’s competitive advantages are numerous. This includes strong, established relationships with retailers around the world, which gives it insight into consumer trends and allows it to efficiently get its products onto store shelves. This established scale also serves as a moat for the company, as it is difficult for new entrants to duplicate.

Meanwhile, KMB continues to grow its top line, with net sales increasing by 3% YoY during the fourth quarter. While this may appear to be rosy on the surface, KMB does face challenges from cost inflation and supply chain disruptions. This is reflected by organic sales declining by 1% during Q4, and by full-year 2021 adjusted EPS being down by 20% compared to the prior year.

Having said that, I believe these headwinds have been baked in through the share price decline since earlier this year. Moreover, management sees a turnaround this year, with organic sales growth guidance of 3-4, and expected cost savings in the range of $300-500 million through the FORCE program.

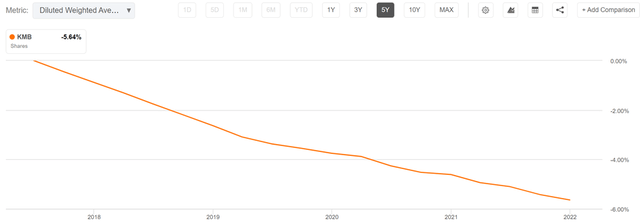

Additionally, management seeks to continue share repurchases with $100M of planned share buybacks this year. As shown below, KNB has reduced its share count by 5.6% over the past 5 years.

KMB Shares Outstanding (Seeking Alpha)

Looking forward, I see potential for KMB to move past its near-term input cost challenges through cost containment and price increases. This is reflected by management’s sentiment during the recent conference call and by Morningstar’s assessment in its recent analyst report:

We don’t surmise Kimberly is sitting on its hands. Rather, we continue to believe it is employing a judicious, multipronged course to numb the impact of these challenges. For one, Kimberly has been raising prices (a nearly 3% benefit to sales in fiscal 2021), and while early, we’re encouraged management cites minimal volume retraction since its initial price increases first hit store shelves at the end of the second quarter. Despite this, we anticipate additional price hikes are in the cards, as inflationary headwinds remain, which could ultimately weigh on volumes.

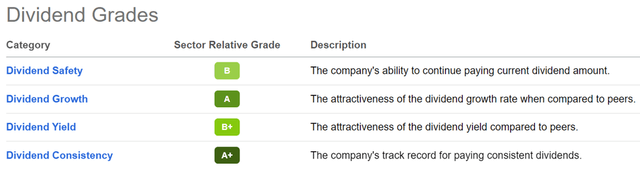

Meanwhile, KMB maintains a strong A rated balance sheet with a safe net debt to EBITDA ratio of 2.3x excluding restructuring charges. This supports its 3.7% dividend yield, which is nearly 3x that of the S&P 500 (SPY). The dividend also comes with a safe 74% payout ratio (for a consumer staples company). As shown below, KMB scores A and B grades for dividend safety, growth, yield, and consistency.

KMB Dividend Scores (Seeking Alpha)

I see KMB as being a worthy of a safe income portfolio at the current price of $126 with a forward PE of 21.5. While this doesn’t screen particularly cheap, patient investors may see this investment bear fruit down the line, as analysts expect double-digit EPS growth next year.

Investor Takeaway

KMB is a moat-worthy, diversified consumer staples company that has strong relationships with retailers and an efficient supply chain. The company is facing headwinds from cost inflation and supply chain disruptions, but I believe these have been baked into the share price decline.

Management sees a turnaround this year and the company maintains a strong balance sheet. While I wouldn’t expect a pop in KMB’s share price in the near term, patient investors may be rewarded over the long run, all while collecting a stable and growing dividend.

Be the first to comment