georgeclerk/iStock Unreleased via Getty Images

Investment Thesis

The year 2020 and 2021 had been extraordinary for Amazon.com, Inc. (NASDAQ:AMZN) in terms of sales. Lower interest rates, stimulus checks as well as social distancing requirements catalyzed the consumer demand for online shopping. However, things took a turn for worse in 2022 and as the Fed continues to hike interest rates to combat inflation and the economy reopens, the next couple of quarters could see soft demand for online shopping in addition to margin pressure due to overstaffing, inflation, and excess capacity-related headwinds. The investor concerns around these have caused a significant correction in the stock price.

I believe these headwinds are transitory in nature and should dissipate over the next couple of years. The company’s secular growth story looks attractive and its operating margins are expected to improve looking forward. Furthermore, the AWS business is expected to remain strong which bodes well for the future of the company.

Last Quarter Earnings

Amazon, Inc. reported Q1 22 revenue of ~$116.4 billion, slightly beating the consensus estimate of ~$116.3 billion and growing 7.3% year over year. As a result of a significant decline in operating margins and a $7.6 bn loss included in non-operating expenses from the company’s common stock investment in Rivian Automotive (RIVN), the diluted EPS was ~$7.56 (without adjustment for the recent stock split) lagging behind the consensus forecast of $8.36 (without adjustment for the recent stock split). Operating margin fell to ~3.15%, down 500 basis points Y/Y as a result of inflation, productivity issues, fixed cost deleveraging and other expenses. The net loss was $3.84 billion in Q1 2022 compared to a net income of $8.1 billion same quarter last year.

AMZN Stock Key Metrics

Revenue

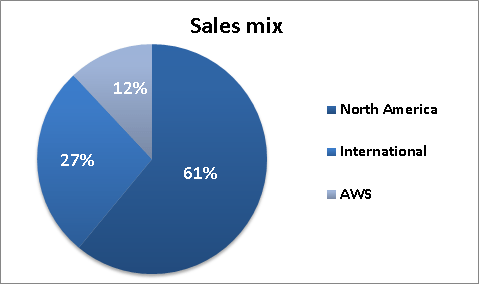

The company’s revenue has been growing at a healthy rate and Amazon Web Service (AWS) business should be an important contributor looking forward. AWS currently accounts for a low double-digit percentage of the total revenue (as of the 2021 year ending) and is still in the early stages.

Amazon Sales mix (as of the 2021 year end) (Company Data, GS Analytics Research)

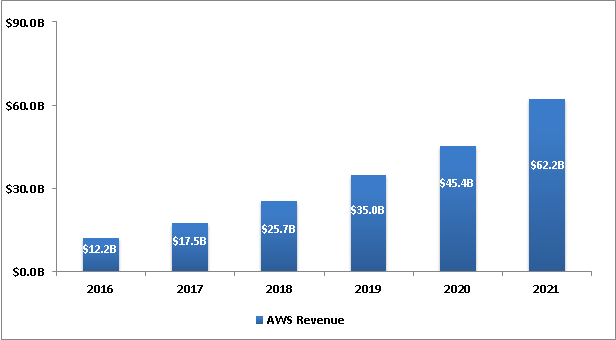

AWS (Amazon Web Service Revenue) (Company Data, GS Analytics Research)

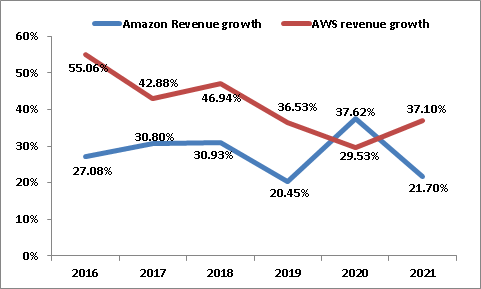

Amazon vs. AWS revenue growth (Company Data, GS Analytics Research)

AWS revenues have outperformed the total company’s growth rate every year except in 2020. Looking at the evolving conditions where the need and importance of digitization are rising, the AWS business growth should be greater than the overall revenue growth in the future as well and should play a major role in Amazon’s growth story.

Operating Margins

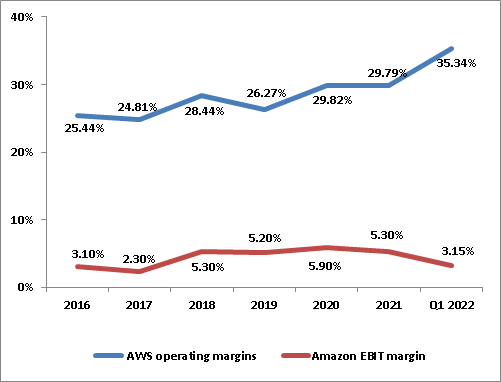

Amazon vs. AWS operating margin (Company Data, GS Analytics Research)

AMZN’s consistent efforts to improve efficiency and grow the business has paid off in terms of margins. The company’s EBIT margin has increased from 3.10% in 2016 to 5.30% last year. However, the current inflationary environment, labour productivity issues, and excess capacity impacted Q1 2022 margins.

The current macro-economic conditions along with operational inefficiencies do pose near-term headwinds. However, looking forward, in the medium to long term, I am optimistic about the margin growth trajectory thanks to the AWS business which could act as a tailwind for the company’s margin. The company is also taking steps to control costs and improve its eCommerce margin which also bodes well for the margin outlook.

What is the margin outlook for AMZN?

Amazon Web service (AWS) accounts for roughly ~13% of the company’s revenue. It is a highly profitable business with operating margins of 29.79% in 2021 and 35.34% in Q1 2022. In the recent quarter, AWS reported 37% revenue growth year-over-year, compared to 7.3% growth in net sales. This was primarily driven by the demand for upgradation in digital capabilities that started during the pandemic when most companies were pushed to reinforce the digital infrastructure to support day-to-day operations.

Companies like Telefonica (TEF), Verizon (VZ), Boeing (BA), MongoDB (MDB), Amdocs (DOX), Bundesliga, Maple Leaf Sports, Entertainment, the NHL, and Thread announced new agreements and service launches supported by AWS. The company recently completed the launch of the first 16 local zones in the United States with 32 more to come across 26 countries. Local Zones extend AWS Regions to place services near large populations, industry, and IT centres. Now that the companies are better aware of the benefits of digitization, this secular trend should sustain with these companies wanting to leverage it for better efficiency and operations. This bodes well for Amazon’s AWS business. Amazon is well placed to benefit from it and more than 50% of its 2022 CAPEX will go into feeding the AWS infrastructure to support this ongoing demand.

A higher contribution from AWS business towards the company’s net sales should improve the company’s overall margin profile.

On the eCommerce side, the company continues to face a variety of cost pressures, including inflation-related costs and costs that can be controlled internally, such as productivity and fixed cost deleverage. Despite seeing strong demand, the company has excess capacity in the fulfilment and transportation network. To address fixed cost issues, the company will reduce operational CAPEX for 2022 in order to improve fixed cost leverage. This should provide some relief from the margin pressure. As the company’s excess capacity gets utilized, operating margins should improve.

Due to overstaffing, the company experienced lower productivity in the last couple of quarters. With the emergence of the Omicron variant in late 2021, there was a significant increase in fulfilment network employees taking leave. The company began hiring new employees to compensate for these absences. As the variant subsided and employees returned from leave, the company went from being understaffed to being overstaffed. The overstaffing added approximately $2 billion of extra costs in Q1 2022 compared to the same quarter last year.

The combined impact of externally driven cost and the internally controllable cost was ~$6 bn in Q1 22. About, two-thirds or $4 bn of these costs are within the company’s control. If the company is able to remove this additional internally controllable cost, it can help improve its operating margins by 340 bps. In my opinion, most of the cost-related headwinds including inflation and higher freight costs are transitory in nature. They may impact the margins in the first half of 2022. But moving forward, the margins should improve.

In addition to benefiting from the increased mix of AWS business and better leverage in eCommerce business, the company will also benefit from the increased number of prime users. The company has the widest selection ever available for Prime’s fast delivery. The delivery options along with a huge catalogue of movies, TV shows, and music from different genres that cater to specific needs including other perks offer a great value to the members. Prime Video is also bidding to launch the highly anticipated The Lord of the Rings: The Rings of Power in the coming September. It also signed a historic 11-year agreement with the NFL (National Football League), a popular sport in the USA with a large fan base, which allows it to broadcast games on its platform.

Amazon closed its acquisition of MGM and now has over 4,000 film titles, 17,000 television episodes including 180 Academy Awards and 100 Emmy Awards winning titles. The catalogue includes classic movies such as Thelma & Louise, The Silence of the Lambs, The Magnificent Seven, and Raging Bull. The deal complements Prime Video and Amazon Studios’ efforts to provide a diverse slate of original films and television shows to a global audience.

The company added millions more new Prime members during the quarter. Despite a price hike last quarter, the company didn’t notice any substantial changes in the number of prime subscribers. Given the numerous benefits combined in a single subscription package, I believe it has the potential to attract additional customers, allowing better-fixed cost leverage.

The conducive market condition to AWS business along with the utilization of excess capacity in the eCommerce network and continuous growth of prime members, all together, bodes well for the margins. The margin growth outlook for the stock appears to be healthy which makes the stock a good choice for long-term investors.

What is AMZN’s Revenue Outlook?

Amazon witnessed revenue growth of 21.7% last year owing to healthy demand and government stimulus checks to support the economy battered by Covid. People were shopping online during the pandemic to avoid crowding and getting infected, but now that the economy is improving, people want to go out to have that in-store shopping experience. E-commerce companies, who rely largely on online-based businesses for the majority of their revenue, were adversely affected by this change and faced difficult comparisons. Additionally, the Fed’s continued rate increases to control inflation should have a negative impact on discretionary spending. As a result, Amazon’s revenue growth should slow down in the near term. However, I think that over the longer term, the company should benefit financially from the increased traction in the AWS business, headwind from difficult comparisons going away, and the growing number of prime users.

If we look at the numbers, the company’s revenue growth increased from 20.45% Y/Y in FY2019 to 37.62% Y/Y in FY2020 due to strong ecommerce demand. It remained strong in the first half of 2021 growing 43.60% Y/Y in Q1 2021 and 27.18% Y/Y in Q2 2021. However, as the economy began reopening it slowed to 15.26% Y/Y growth in Q3 2021, 9.44% Y/Y growth in Q4 2021, and the Y/Y growth was just 7.30% in the last quarter.

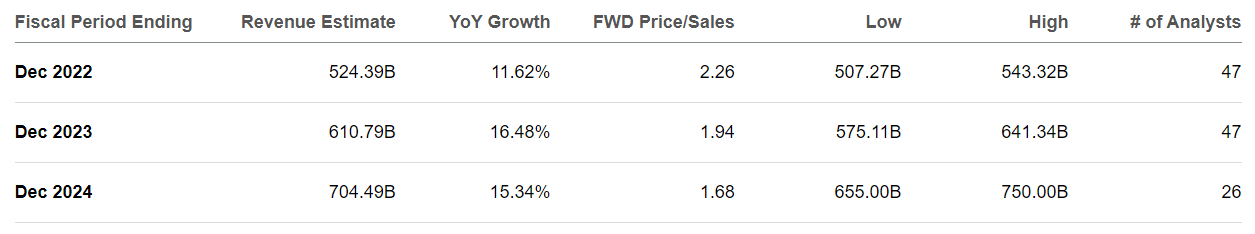

Looking forward, for the full year of 2022, the current consensus estimates is predicting 11.62% Y/Y revenue growth. However, for 2023 and 2024 as headwinds from difficult comparisons go and AWS and prime continue to gain traction, revenue growth is expected to reaccelerate to mid-teens. So, the company’s secular growth story and medium to long-term revenue growth outlook are still attractive.

Amazon Consensus Revenue Estimates (Seeking Alpha)

Is AMZN Stock Undervalued?

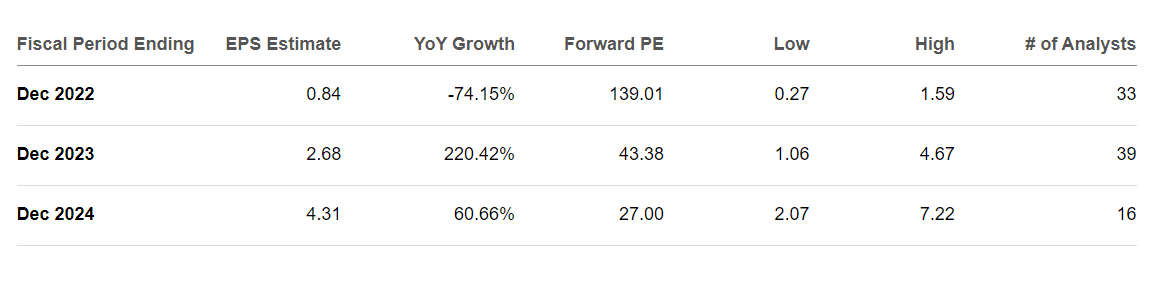

If we look at Amazon’s current year P/E, it looks very high at 139.01x FY2022 estimates. However, one needs to remember that for FY2022 EPS is going to be significantly depressed due to margin pressures and loss in Q1 22 due to losses related to the Rivian stake. The company has good visibility on margin improvement in the coming years as many factors related to this year’s margin decline are internally controllable and management is acting to fix them. This margin improvement will lead to a good EPS growth in FY 2023 and FY2024 and if we look at the company’s forward P/E it is trading at 43.38x FY 2023 consensus EPS estimates and 27x FY2024 EPS estimates. I believe the company’s stock is undervalued if we take into consideration its long-term growth prospects. So, long-term investors can consider buying the stock at the current levels.

Amazon Consensus EPS Estimates and Forward P/E (Seeking Alpha)

Bottom Line

Amazon’s margins are poised to increase over the next couple of years and one should see a significant improvement in EPS as a result. The inefficiency from excess capacity as well as labour productivity issues should improve as management takes steps to address them. In addition, increasing AWS contribution in mix should also be beneficial for the margins. While, in the near term, the revenue growth is expected to slow, I believe the company’s long-term secular growth story remains intact. The company’s valuation on FY23 and FY24 EPS looks attractive given its longer-term growth profile. Hence, I believe the stock is a good buy at the current levels.

Be the first to comment