Tim Boyle

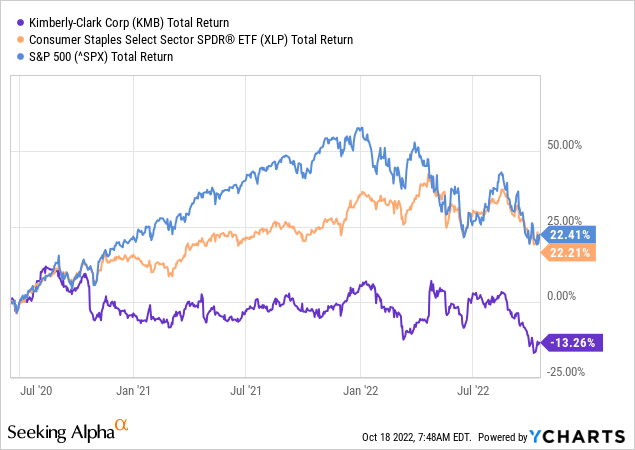

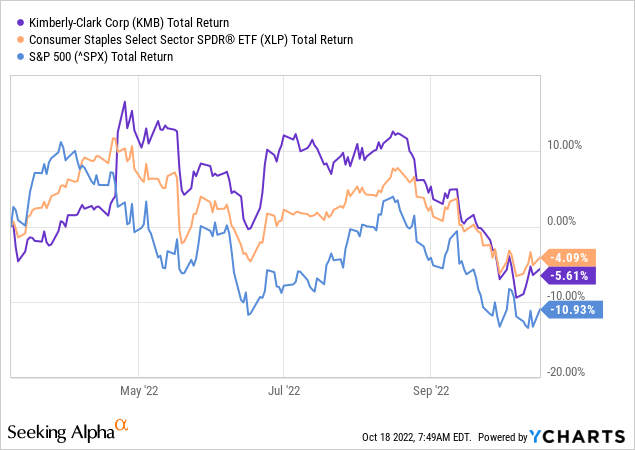

The past two years have been more than disappointing for Kimberly-Clark (NYSE:KMB) shareholders. Since the summer of 2020, when I first laid out my bearish thesis on the company, KMB returned a negative 13% while at the same time both the S&P 500 and the Consumer Staples sector had a total return of more than 22%.

While the outperformance of the broader equity market was to be expected, given the tailwinds for the technology sector, the performance gap between KMB and XLP is staggering.

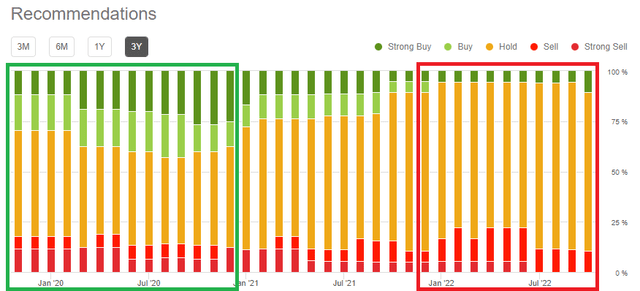

Throughout this period, Wall Street analysts with either ‘Strong Buy’ or ‘Buy’ ratings have also almost disappeared and the overall sentiment around the company is mostly within the negative territory.

Seeking Alpha

The main problem, however, is that buying Kimberly-Clark shares in the summer of 2020 involved far more risks than it does now. Although the company remains challenged as a result of poor capital allocation decisions in the past, Kimberly-Clark’s expected returns are higher at this point in time.

Where Are We Now?

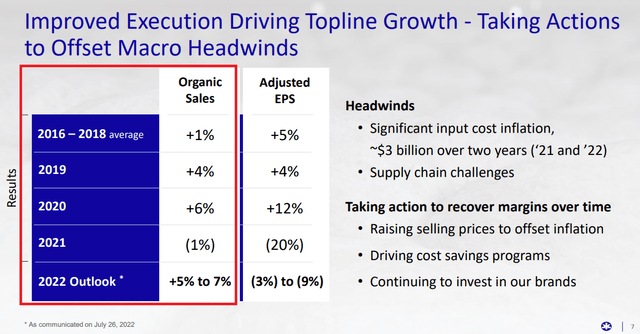

As of the last reported quarter, the company achieved a 9% organic revenue growth.

I’m proud of our team’s execution as we closed our first half with 9% organic sales growth in the second quarter.

Source: KMB Q2 2022 Earnings Transcript

This is something that KMB has not even come close to in most recent years and even during 2020 when pandemic tailwinds were strong.

Kimberly-Clark Investor Presentation

What is more encouraging, is that Kimberly’s brands have so far been able to support significant price increases, without sacrificing volume growth.

But overall, I think the organic outlook and the increase in the outlook reflects both volume and price. Overall, we feel like our pricing execution is going very well. We are driving the realization. You can see it in the numbers.

But the second part of it is also the volume is holding up a little bit better than we originally planned.

Source: KMB Q2 2022 Earnings Transcript

On itself, this is a major achievement in product segments where brand loyalty is relatively low.

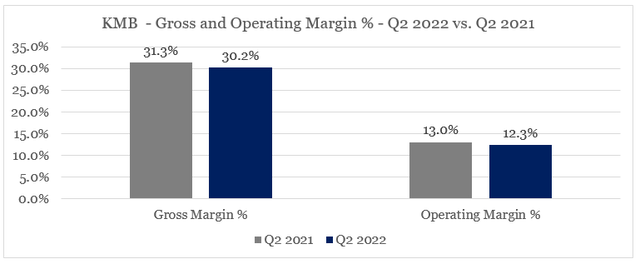

Even with price increases in place, both gross and operating margins fell as inflationary pressures persist. Nevertheless, the year-on-year decrease in profitability has so far been muted.

prepared by the author, using data from SEC Filings

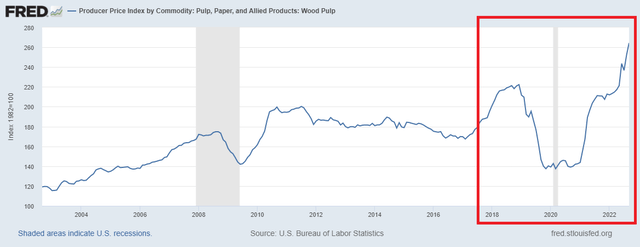

At the same time, raw material prices continue to skyrocket which might necessitate continued price increases into the coming months.

FRED

As a result of all that, KMB’s price performance since March of this year (when I outlined why a slow and steady decline is the most likely scenario ahead) has been at par with the broader consumer staples sector.

As analysts and market commentators grow ever more pessimistic on Kimberly’s business, the falling share price also reduces many of the risks associated with the company’s valuation.

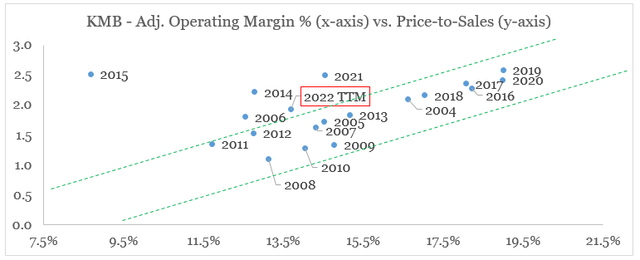

Based on the data for KMB’s margins and revenue for the past 12-months and the current share price, the company appears to be priced almost in-line with its margin profile (a significant improvement since 2021).

prepared by the author, using data from SEC Filings and Seeking Alpha

Challenges Remain

While there are small pockets of optimism around Kimberly-Clark’s business fundamentals, by far the biggest challenge in front of the current management is capital allocation.

Although prudent capital allocation is to be expected, KMB’s management also needs to slowly move the business into more heavily branded areas where higher customer loyalty and price premium could be achieved. More importantly, as I highlighted before, the company’s profitability is far more sensitive to commodity price changes than many of its peers.

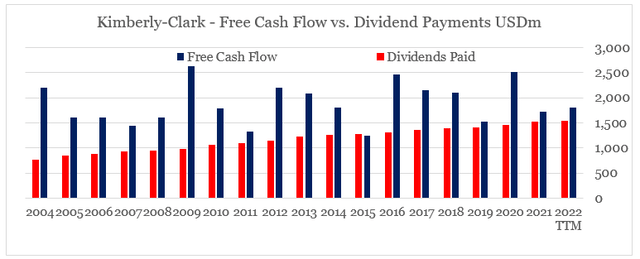

The reason why this is so necessary is that Kimberly-Clark’s free cash flow has literally gone nowhere since 2004 (see the graph below).

prepared by the author, using data from SEC Filings

While free cash flow did not experience any sustained increase throughout the period, small annual dividend increases have been slowly squeezing the company’s available free cash flow for business reinvestment and inorganic growth opportunities.

The management has recently indicated that dividend payouts and share buybacks for the full fiscal year 2022 are expected to be at least $1.5bn.

We continue to allocate capital in disciplined, shareholder-friendly ways. Capital spending in the second quarter was $217 million in 2022 compared to $201 million in 2021. Second quarter dividends and share purchases totaled approximately $415 million and we continue to expect the full year amount will be at least $1.5 billion.

Source: Q2 2022 Prepared Remarks

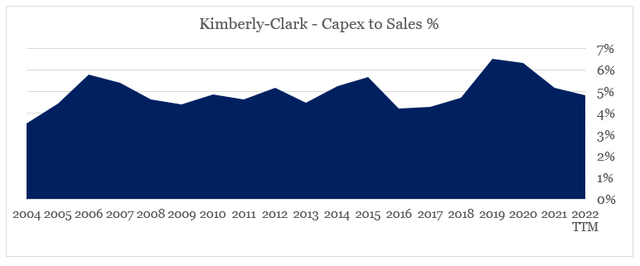

This significantly limits the company’s free cash available for both internal and inorganic expansion. At the same time, KMB’s capital expenditure has been declining as a share of total sales.

prepared by the author, using data from SEC Filings

As we saw above, KMB’s sales volumes have been rising and given the current inflationary environment, the company will most likely need to increase its level of capital expenditure in the coming years.

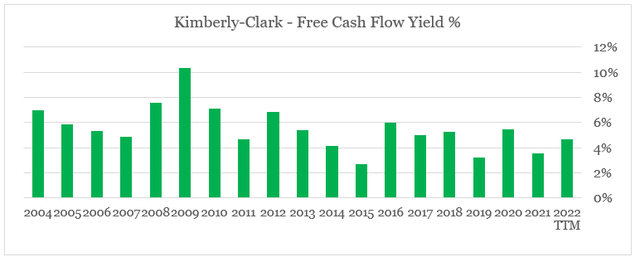

Lastly, KMB still trades at much lower than its historical average free cash flow yield and provided all the difficulties discussed above, a free cash flow of below 5% does not seem attractive.

prepared by the author, using data from SEC Filings

Conclusion

After a disastrous 2-year period, Kimberly-Clark’s share price is now more attractive than it was back in the summer of 2020. At the same time, many analysts and market commentators are influenced by its recent performance and with that are turning bearish on the stock at a time when its future expected returns are improving.

Having said that, most of the challenges faced by KMB’s management have not gone away. The company is still in a very tough spot as far as its competitive positioning and capital availability are concerned. The company is also more vulnerable to commodity price increases than most of its peers are. Valuation has improved somewhat, however, it is not yet low enough to justify all the risks associated with investing in the company.

Be the first to comment