shih-wei/E+ via Getty Images

Investment thesis: As the market has shifted to a more defensive tone, stocks like Kimberly-Clark (NYSE:KMB) will benefit.

Kimberly-Clark is in the household products sector:

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products worldwide. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The Personal Care segment offers disposable diapers, swimpants, training and youth pants, baby wipes, feminine and incontinence care products, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Depend, Plenitud, Softex, Poise, and other brand names. The Consumer Tissue segment provides facial and bathroom tissues, paper towels, napkins, and related products under the Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve, and other brand names. The K-C Professional segment offers wipers, tissues, towels, apparel, soaps, and sanitizers under the Kleenex, Scott, WypAll, Kimtech, and KleenGuard brands.

The company is the fifth-largest company in this sector.

My standard method of analyzing a company is to first look at the economic backdrop, followed by a look at the company’s financials (with an eye towards safety), and then its stock chart.

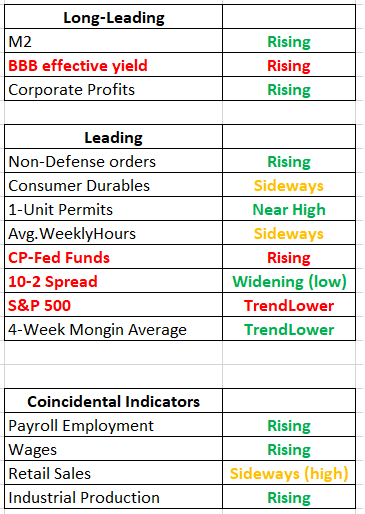

Turning to the economy, this is a table of the long-leading, leading, and coincidental indicators that I’ve compiled and just updated:

Long-leading, leading, and coincidental indicators (FRED; author’s calculations)

The number of financial indicators that are red are rising: commercial paper spreads have increased; the S&P 500 is trending lower; BBB yields are rising. While some of the data is yellow for caution, most are due to sideways movement. The data is generally printing at high levels.

Remember that financial market stresses usually start to occur 12-18 months before a recession.

Finally, the Fed is in a tightening mood. A number of Fed presidents have directly or strongly implied that they back a 50 basis points hike at an upcoming meeting. Regardless of the actual pace, rates are heading higher, which is generally negative for stocks.

While the economy is expanding, there are reasons to be concerned about potential softness.

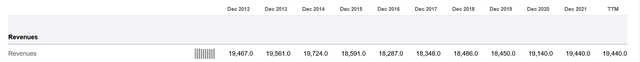

Turning to KMB, let’s start with gross revenue:

Kimberly-Clark gross revenue (Seeking Alpha)

Kimberly-Clark is a mature company. As a result, its gross revenue growth appears to have peaked. But it has not decreased.

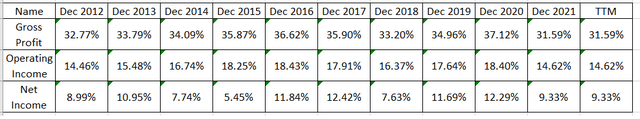

Kimberly-Clark income statement percentages (Seeking Alpha)

Kimberly-Clark’s gross and operating margins have been pretty consistent. The company’s net income has been a bit more volatile, but it’s been positive during the last 11 accounting periods.

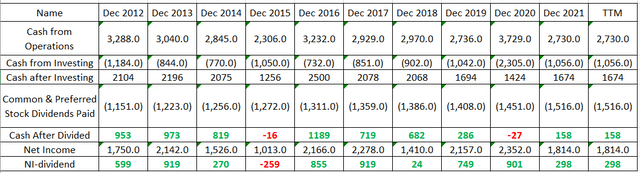

Kimberly-Clark dividend safety check (Seeking Alpha)

Kimberly-Clark is a dividend aristocrat; it has raised its dividend for 49 consecutive years. It is currently yielding 3.67%. Investors will be attracted to that feature but will also want to make sure that the dividend is safe. The above data – which utilizes income and cash flow data – shows that it is. The third row from the bottom shows that, after paying for investments and dividends, the company has had remaining cash in all but two of the last accounting periods. The bottom row shows the amount of cash remaining after subtracting dividend payments from net income. That number has been positive in all but one of the last 11 accounting periods.

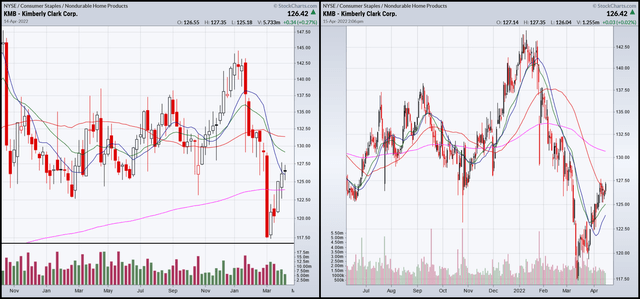

Finally, let’s take a look at the charts:

Weekly and daily KMB charts (StockCharts)

The weekly chart (left) shows that the stock had been stable for most of the last two years. But it dropped sharply at the beginning of the year, which is better shown on the daily chart. The reason is cost pressures:

Kimberly-Clark Corporation KMB has been grappling with escalated input costs for a while now. Cost inflation is exerting pressure on the company’s profits. The consumer products company has been witnessing softness in the Consumer Tissue segment for the past few quarters. Thanks to such downsides, shares of the Zacks Rank #4 (Sell) company have lost 12.9% in the past three months compared with the industry’s 9.1% decline.

Cost pressures shouldn’t be surprising; we’ve been reading about rising prices for the last 12 months.

The question is now, “Is the worst over?” Probably. But even if the stock moves lower, that will increase its dividend yield, which, in turn, will attract income investors who will buy the stock. And don’t forget that the market is taking a more defensive tone, which plays into KMB’s defensive nature.

This is a buy.

Be the first to comment