Torsten Asmus/iStock via Getty Images

By Somya Sharma

2022 has been a challenging year for the broad global economy, but less so for the insurance sector. Consumer demand has increased for many types of insurance. In addition, rising interest rates and new technologies have benefited the industry this year.

There are three U.S.-traded ETFs focused on the insurance sector. The SPDR S&P Insurance ETF (NYSEARCA:KIE) is the largest of that group. As of this writing, KIE has outperformed the S&P 500 by more than 15% in 2022.

We rate KIE as a hold as we believe this outperformance can continue in the year ahead. Note that a hold rating in our system is unlike many “buy side” Wall Street firms’ stock rating systems. When they say “hold,” it really means “sell,” except they don’t want to upset companies for fear of losing investment banking business. We have no such conflict of interest.

So, to us, “hold” means hold if you own it and are committed to being invested in the equity market, even if the broad stock market breaks down much further. It also signifies that in a market environment where very few equity sectors get a buy rating from us, KIE is part of a small group of “relatively attractive” market segments. These are unique times for equity investors, and the distinction is essential.

Strategy

KIE tracks the performance of the S&P Insurance Index, which tracks publicly traded companies in the insurance industry. What differentiates KIE from other insurance ETFs is that this fund employs a sampling strategy to select stocks. Sampling means the fund managers can choose the funds from the securities within the index and don’t need to include all the equities at all times. However, it’s required that the characteristics of the fund do not deviate much and should reflect the same features of the index, even though every component of the index is not included.

The S&P Insurance Select Industry Index comprises insurance companies, reinsurance companies, and insurance brokers. KIE charges a modest 0.35% in fees and has good liquidity, trading about 1 million shares per day on average.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Industries

- Sub-Segment: Insurance

- Correlation (vs. S&P 500): High

- Expected Volatility: Moderate

Proprietary Technical Ratings

- Short-Term Risk (next three months): Moderate

- Short-Term Reward (next three months): Moderate

- Long-Term Risk (next 12 months): Moderate

- Long-Term Reward (next 12 months): Moderate

Holding Analysis

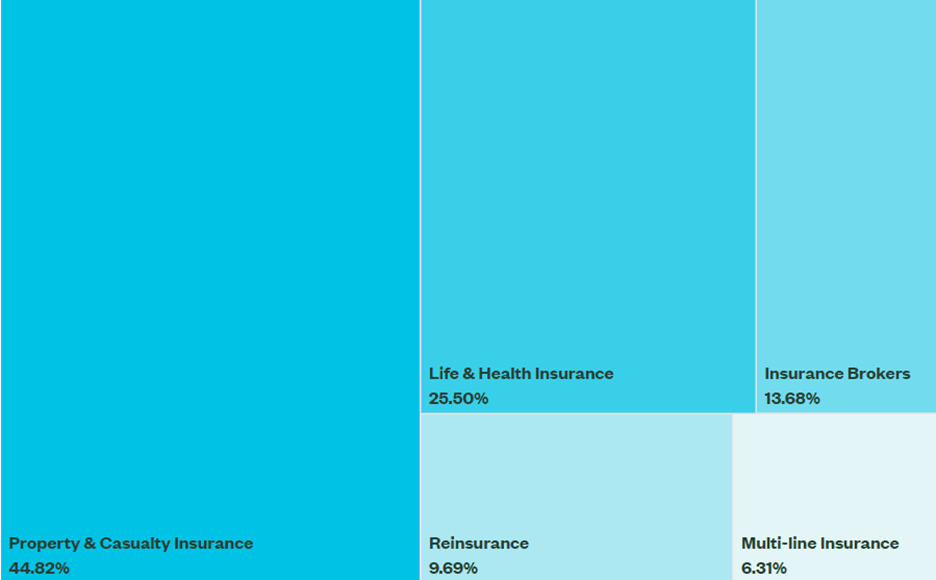

KIE equally weighs its stock holdings. While it stays true to the definition of an insurance company, its selection universe and equal-weighting scheme narrow its stock universe to create what is a very different portfolio from the other funds in the segment. The fund underweights property and casualty insurance, and gives more weightage to reinsurance compared to its counterparts. This diversification also reduces its concentration risk.

Additionally, the fund is widely diversified across various market spectrums, with 24% allocation to large caps, 45% to mid-caps, and 30% to small caps. Property and casualty insurance stocks are the highest subindustry weighting, accounting for 45% of the portfolio, while life and health insurance and insurance brokers each receive double-digit percentage exposure.

Fund Sub-industry allocation (ssga.com)

Strengths

While many people think of insurance companies as being in the business of managing risk, they are also major players in the world of investing. A large portion of most insurance companies’ assets is invested in bonds. When interest rates rise, as they have in recent months, it becomes easier for insurance companies to find investments that offer good yields and less risk. As a result, profits tend to increase.

Weaknesses

A significant weakness before investing in KIE is that insurance companies are heavily regulated. As such, any regulation change can significantly impact ETF performance. Also, events like natural calamities or pandemics can adversely affect the sector’s performance. That’s because in those situations the risks that insurance companies are paid to offset become a reality, leaving these businesses on the hook to pay out on their policies.

Opportunities

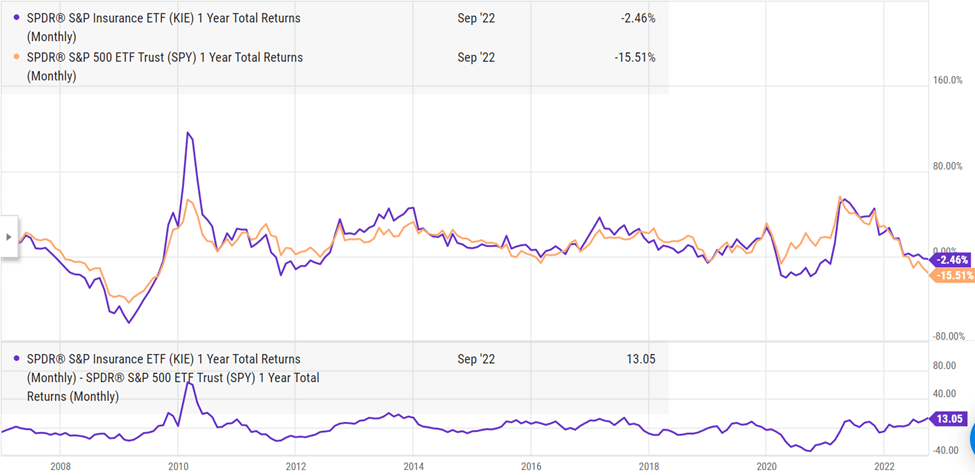

KIE and SPY relative performance in the last 12 months (YCharts)

As the chart above shows, during the past 12 months KIE has had some of its best relative performance to the S&P 500 in recent memory, outperforming by about 13% and nearly posting a profit during a rough stock market climate. Given a host of uphill issues for global equity markets, the odds of this outperformance continuing are good. The weighted average P/E ratio of the fund sits just below 10x, which adds to its relative attractiveness for long-term investors.

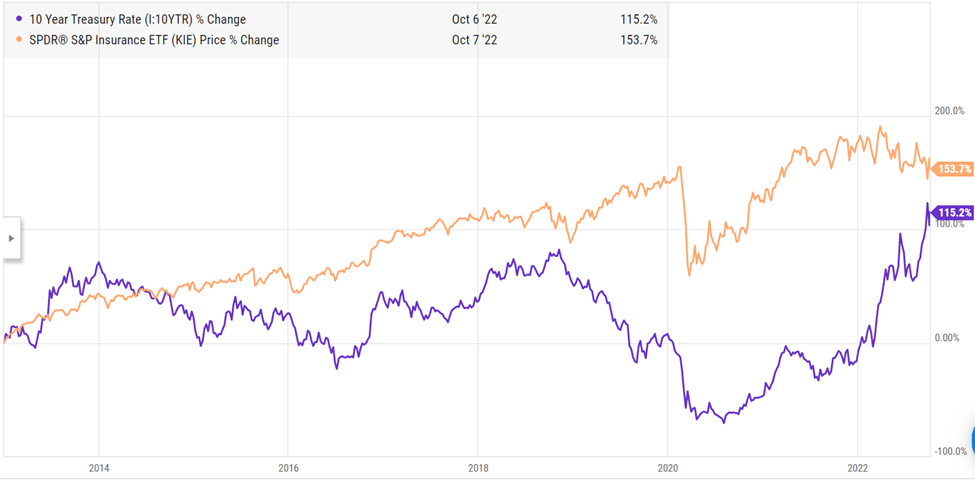

The rise in the Interest rate and KIE price change relationship (Ycharts)

The insurance sector is often a direct beneficiary of a rise in interest rates because it increases the spread between what the companies pay out to policyholders and what they can earn on their investments. This income can flow through earnings and revenue and provide market-beating returns during otherwise hazardous market conditions. For instance, in 2013 KIE surged 20%, outperforming the S&P 500 by 4% at a time when 10-year Treasury yields rose from 1.7% to 3.0% in seven months (May to December).

Threats

Insurance companies, and thus KIE, are still stocks. And in a market that is increasingly divorced from traditional fundamentals and is more emotional and technical, any stock segment is potentially at risk of being dragged down with its stock peers.

Conclusion

In a historically bad climate for stocks and bonds, our hold rating on KIE should be looked at differently than a hold rating during a bull market. Essentially, we’re saying that while the global equity market is, in general, a “hot mess,” pockets of the market are more likely to outperform the S&P 500 – and this is one of them. As the past year’s performance has shown, we think there’s a good chance that outperformance can continue in the short and intermediate term.

For long-term investors, who tend not to make a lot of tactical moves during bear markets, the benefit of holding a strong outperformer at times like this is straightforward: You are closer to breakeven when the next bull market eventually begins. So, the “math of investment loss” works in your favor.

Be the first to comment