viper-zero

Delta Air Lines (NYSE:DAL) recently released its second quarter earnings and reported mixed fundamentals that are scaring some investors. The company outperformed revenue expectations and has nearly recovered to pre-pandemic sales due to the rising domestic market and recovering international market. However, massively higher gas prices caused it to miss on profit expectations and led to a huge sell-off of the stock. Despite this profit miss, management raised guidance above consensus estimates for the third quarter and is on track to achieve its 2024 price targets. In the shorter term, the likelihood of an upcoming recession and continued pilot shortage may cause fundamental and reputational issues for the company. Therefore, investors may want to wait to jump in even though the stock appears to be undervalued.

DAL’s Q2 Earnings Report Came In Mixed And Is Spooking Investors

Delta reported its second quarter earnings before the market opened on July 13 and released mixed data. The brightest aspect of the report was the company’s outstanding revenue. Revenue rose 94% Y/Y to $12.31 billion and has recovered to its pre-pandemic levels by 99%. This is largely due to domestic flights recovering and growing quickly. Revenue generated through domestic passenger flights rose 3%, while international passenger flights have only recovered by 81% when compared to 2Q19. Domestic corporate sales also have recovered 80% of their pre-pandemic sales while international corporate sales have only recovered by 65%. Furthermore, the company’s premium products are outperforming its main cabin offerings. In the second quarter, Delta’s Premium, Loyalty, Cargo, and MRO revenue streams generated 54% of the total sales.

Despite this great revenue growth, Delta missed on profit expectations due to massively higher costs. When compared to 2Q19, the company’s adjusted figures for operating income and net income were down 39% and 40%, respectively. Drastically higher fuel prices caused the company’s margins to contract as its fuel expenses were up 45% when compared to the second quarter of 2019. Furthermore, Delta paid an average of $3.82 per gallon of gas, up from $2.07 per gallon in 2Q19. Non-fuel unit costs are also up about 22% when compared to 2019’s second quarter.

Although Delta missed on earnings expectations, management still set guidance for the third quarter above consensus analyst estimates. Management expects to generate between $12.6-$13.1 billion in revenue in the third quarter, above estimates of $12.5 billion. Operating margins are also expected to be between 11%-13%, which is in-line with the second quarter’s margin of 11.7%. Due to these estimates and prior performance, Delta is on track to reach the 2024 targets of over $7 EPS and $4 billion in free cash flows.

During the pandemic, Delta issued lots of debt to stay afloat. In 2Q19, Delta had about $9.35 billion in net debt. In the second quarter, the company repaid about $1 billion in net debt and now has $19.58 billion in total net debt. However, the company may be able to slowly pay this off if it does achieve the $4 billion in free cash flows in the upcoming years.

Supply and Demand Issues Are Causing Higher Air Fares

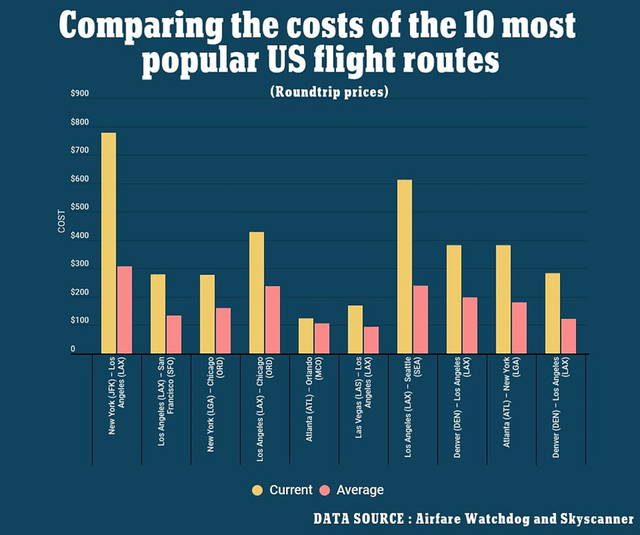

When compared to last year, air fares in the United States rose 34.1%. This is even after the average air fare dropped by 1.8% in June on a monthly basis. On the other hand, May saw an average price increase of 12.6% and April prices increased by 18.6%. The main reasoning for this massive price growth is due to the combination of rising demand and restricted supply, as well as compensating for the previously mentioned gas prices.

Due to many travel restrictions no longer being in place and consumers not being locked down, many individuals want to travel again. However, Delta is having trouble fulfilling this demand due to a long-lasting pilot shortage. During the pandemic, Delta and other airlines began cutting costs by offering buyout packages to its older pilots. This led to many of the company’s pilots retiring and outpacing new hires. For the airline system to operate efficiently, about 10,000 new pilots need to be hired per year. Currently, only about 5,000 pilots are being hired per year. This pilot shortage is expected to last years and is being accompanied by a shortage for other employees including gate agents, flight attendants, and air traffic controllers.

This pilot and worker shortage is causing Delta to cancel lots of flights, missing out on revenue and damaging the airline’s reputation. Currently, the airline industry’s total cancellations is up by 700 basis points Y/Y to 2.8%. Not only does this hurt Delta’s revenue by refunding the tickets, but it also harms the company’s reputation and reliability. Since companies in the airline industry have little differentiation besides price, Delta’s reputation among consumers is vital. The company has recognized these issues and is beginning to address them. Recently, CEO Ed Bastian said the airline industry “pushed too hard” after the pandemic and is now “scaled back a bit” and put “restrictions in place.” If Delta can properly fix these cancellation issues, its reputation may be improved among consumers and make it a top choice.

A Recession Could Cause Trouble For Delta

With the likelihood that a recession is already here, it’s important to determine how Delta could perform. Consumers typically cut back on large-scale spending during recessions, including vacations. This directly hurts Delta as less vacations means less consumers purchasing flights. This can already be seen as flight bookings are already down 2.3% when compared to last year. The main reason for this is due to the rising cost of airline tickets becoming out of a consumer’s price range, especially when money is becoming tight. However, it’s important to note that the airline’s premium products are outperforming its main cabin. This could mean that a recession may not be as harmful as it could be since wealthier consumers are still purchasing air fares.

Flight Ticket Prices (DailyMail.com)

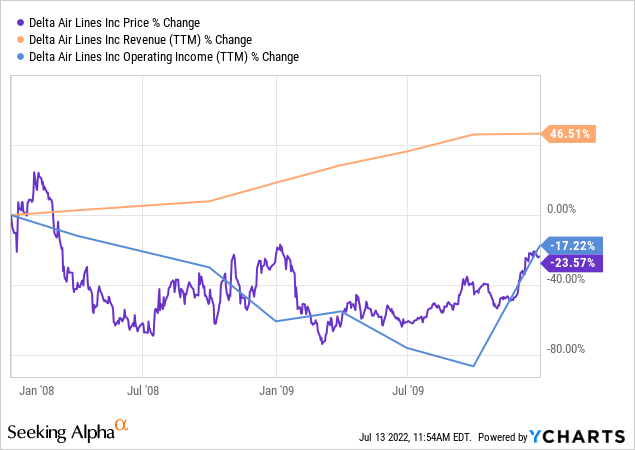

To further see how Delta may perform during a recession, we can look back at how the company did during the Great Recession. In 2008-2009, Delta increased its revenue by 46.51%. However, this is in part due to the company’s merger with Northwest Airlines which caused revenue to see a huge jump. Despite this growth in revenue, the company experienced a major drop in operating income of 17.22%. Similar to today, this was due to rising fuel costs in 2008. This all caused the stock to drop 23.57% in 2008-2009. Although the stock is already down over 25% YTD, a prolonged recession could cause an even further decline.

Valuation

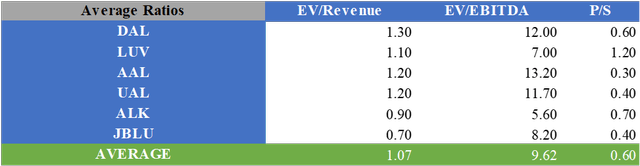

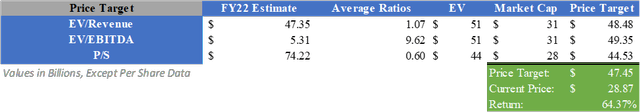

When finding a price target for Delta stock, I created a relative valuation. When multiplying consensus analyst estimates for FY22 by the average valuation multiples for EV/Revenue, EV/EBITDA, and P/S of Delta and its competitors, a price target of $47.45 can be calculated after adjusting for net debt. This implies an upside of 64.37%. This also is in-line with the consensus analyst price target of $52.67, implying an upside of 82.44%.

Valuation Multiples of Airline Stocks (Created by Author) Relative Valuation of DAL Stock (Created by Author)

What Does This Mean For Investors?

Delta Air Lines recently released its 2Q22 earnings report and experienced mixed financials. The company outperformed revenue expectations and has nearly fully recovered to its pre-pandemic levels. This is largely due to domestic flights seeing great recovery and growth, as well as international flights beginning to gain steam again. Despite this revenue recovery, operating income came in below expectations due to drastically higher fuel costs. When compared to 2Q19, Delta’s average price per gallon of fuel was 85% higher and caused the company’s operating margin to come in at 11.7%. On the bright side, management raised guidance above analyst expectations for the third quarter and is on track to achieve its 2024 targets. The continued pilot shortage and possible upcoming recession may hurt the company’s fundamentals and reputation among consumers, possibly leading to a further decline in share price. Despite the higher guidance and valuation, the uncertainty caused by a possible recession, rising costs, and pilot shortage are causing me to apply a Hold rating to DAL stock at this time.

Be the first to comment