krblokhin

Shares of KeyCorp (NYSE:KEY) have tracked many other regional bank stocks this year, losing nearly one-third of their value. While shares fell 1% on their Q3 results, I was encouraged by the company’s credit performance, and its deposit outlook was encouraging. With shares trading just 8x earnings and 1.1x adjusted tangible book value, I see upside to $20.

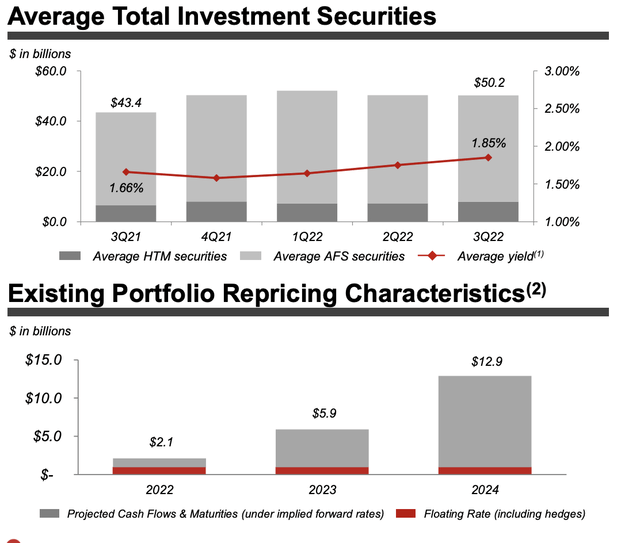

In the company’s third quarter, KEY earned EPS of $0.55 down from $0.65 last year when it benefitted from a reserves release. It generated a 21.2% return on tangible common equity. This EPS result was $0.04 below consensus. A major reason for this is that the bank is not showing as much gearing too higher interest rates as peers. Its net interest margin (NIM) expanded by 27bp over the past year and 13bp from last quarter to 2.74%. For comparison, Citizens Financial (CFG) saw a 52bp NIM expansion over the past year. KEY maintains a relatively large securities portfolio with its excess liquidity, which is largely fixed rate. This reduces earnings volatility, but it means there is less interest income to be gained when rates rise.

KEY is still benefiting, just not as much as peers. After all, net interest income of $1.2 billion was up 17% from last year and 9% from last quarter. The gain is coming from strong performance on its loan book. Loans rose 5% from last quarter to $114 billion. Management saw strength in commercial loans and also grew its consumer mortgage business with $1.9 billion in originations, a respectable pace given the slowing in the housing market.

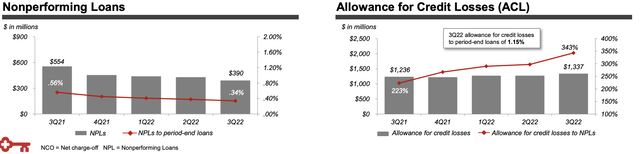

KeyBank is a generally cautious underwriter with new consumer loans having a 772 FICO score at origination. While just about every bank is seeing some credit deterioration, the absolute level of credit quality remains good at Key. Provisions for credit losses were $109 million from $45 million last quarter due to a weaker economic outlook, and charge-offs were 0.15%. Interestingly, nonperforming loans fell to 0.34% of total loans from 0.38% last quarter, meanwhile allowance for credit losses are 1.15% of loans, up from 1.13% last quarter.

Key’s conservative credit policy is quite apparent with NPLs falling even as it builds more allowances. It is now carrying over 3x as much in allowances as NPLs. This means the bank could see a meaningful rise in NPLs and not be faced with the need to build reserves much. Further economic deterioration is already being factored in. As a consequence, I do not expect quarterly reserves to continue rising at the pace they have been, which will eliminate a headwind KEY’s earnings have faced.

This earnings season, we have seen a wide divergence in bank deposit performance. Most banks have reported some deposit flight. Given consumers are spending savings and the Fed is doing QT, this is not surprising. Deposits are a stable, low-cost source of funding for a bank, so large declines can be a concern. Key’s performance was middle of the pack with deposits down 2% from last quarter to $144 billion. Its cost of deposits remains quite low at just 0.16%, and it has raised deposits rates at just a 0.09x ratio to higher interest rates, an extremely low level. I expect this beta to increase as rates keep rising. Deposits declining can be a warning sign, but I was extremely encouraged that management expects deposits to rise in Q4 by 1-3% from Q3.

Noninterest income was down 1% sequentially as investment services income declined due to lower equity market values. There was 15% decline from last year as investment banking activity fell a third given weak capital markets activity, something we have seen pretty widely reported.

As noted earlier, KEY maintains a large security portfolio of about $50 billion. The yield on this portfolio is only up 19bp over the past year, given it is mostly fixed-rate. In Q3, it reinvested at a 4.4% yield vs its maturities which were at 2%. Given meaningful maturities in 2023 and 2024, KEY should be able to gradually increase the yield on this portfolio, but it will move more slowly than floating-rate loans. Overall, the portfolio has a duration of 5.8 years.

Because bond prices have fallen as rates rise, KEY is sitting on a large mark-to-market loss on this portfolio. Accumulated other comprehensive income (where these unrealized losses flow to) is now -$6.3 billion from -$4.2 billion in Q2 and -$45 million in Q3 2021. This is what has caused book value to fall to $11.62 from $13.48. Since KEY is holding these securities to maturity, it is best to look at book value ex-AOCI. Adjusted book value is $18.27, and tangible book value is over $15

The bank ended the quarter with a CET1 capital ratio of 9.1% from 9.2% last quarter, and it targets 9-9.5%. While it has a $790 million buyback authorization that runs through Q3 2023, KEY may not use all of this authorization until capital ticks up slightly. It does pay a $0.195 dividend for a 4.7% yield, which is very secure.

Management expects a further 2-4% loan growth in Q4 as well as a recovery in deposits, up 1-3%. Net charge offs should stay near the 0.15% level. Because of its large security portfolio, it does not have the same net interest upside as peers like CFG or Truist (TFC). Still, KEY benefits from strong interest margins, and if it delivers on a deposit increase in Q4, that should alleviate some concerns about this quarter’s decline. At just 1.1x book value and with over $2 in annual earnings power, it is trading at a relatively low valuation, and I can see shares recovering toward $20 or about 10x earnings, though a return to YTD highs past $26 is unlikely given its lower NIM upside.

Be the first to comment