tupungato/iStock Editorial via Getty Images

We have not forgotten about Kering (OTCPK:PPRUF, OTCPK:PPRUY), we just deeply analyzed its half-year report. We initiated our coverage 14 days before Ukraine’s invasion by Russia – such bad timing. Then, we deep-dived into the second-largest global luxury group during its Capital Market Day, confirming our investment thesis. Mare Evidence Lab buy case recap was based on the following:

- The lower contribution of Gucci accounts for the long-term horizon while maintaining a positive view from Kering’s cash cow;

- The bright future of the other houses;

- A compelling valuation compared to its peers (and a better dividend yield).

Before jumping to conclusions, let’s first analyze the quarter.

Half-year results

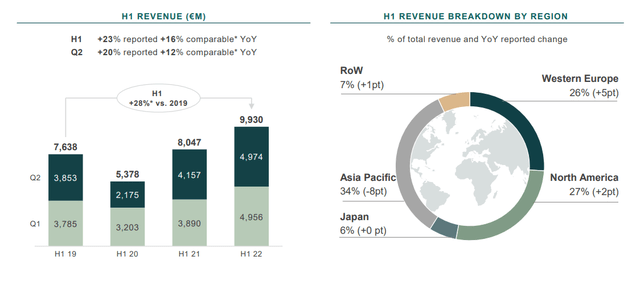

In the period between January and June 2022, the French giant delivered top-line sales of €9.93 billion, up at current rates and at comparable rates by 23% and 16%, respectively. In addition, compared to the first half of 2019, turnover increased by 28%. A positive contribution was also led by e-commerce growth with an incidence of sales of 16%. Looking at the second quarter alone, sales increased at a lower rate. This was mainly due to the prolonged lockdown implemented by the Chinese Government. On a positive note, we should mention the strong performance in Western Europe thanks to local customers and tourism rebound.

Kering half-year results

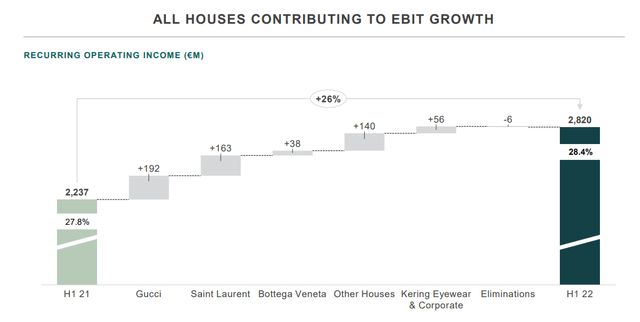

In terms of profitability, EBIT profit grew by 26% to €2.82 billion in the first half of 2022 with a margin of 28.4%, up by 60 basis points compared to the same period last year. Going down to the P&L, it was a record profit for Kering Group with a 34% increase in net income that delivered €1.98 billion. More in detail, the group generated more than €2 billion in free cash flow and net debt increased due to a higher dividend payment and an ongoing buyback.

Looking at the house contributions, we should report the following:

- Once again, Gucci confirmed its appeal and contributed €1.88 billion to Kering’s total EBIT;

- The company recorded an excellent performance of Saint Laurent and Bottega Veneta which grew by 42% and 18%, respectively;

- A record performance was led by the other brands. Kering reported that Balenciaga and Alexander McQueen have maintained very robust growth trajectories. Brioni confirmed a sales rebound. The Qeelin brand suffered from the Chinese healthy crisis in Q2, while Boucheron and Pomellato achieved solid results. Numbers in hand, sales reached almost €2 billion and were up by almost 32%;

- A special note worth mentioning is for the Kering eyewear division. Thanks also to Lindberg integration, sales were up by 50% and the operating profit more than doubled in the period. In addition, Maui Jim’s acquisition will be completed in the second half of 2022.

Kering EBIT contribution

Conclusion and Valuation

As we already mentioned, Gucci is here to stay and is positively contributing to Kering’s success. In the meantime, the French group is moving from Gucci’s sole performance. Historically it was the contributor to more than 80% of the group’s EBIT and has led to a few Wall Street analysts’ criticisms. Currently, Gucci accounts for 66% of Kering’s operating profit (our point 1). Kering Group is now driven by the success of all the houses (our point 2) and is well displayed in the EBIT contribution snap above. Regarding the valuation (our point 3), the company is still trading at a lower P/E multiple than its closest competitors. Thanks to the positive results, we reaffirm our previous valuation.

Be the first to comment