Justin Sullivan/Getty Images News

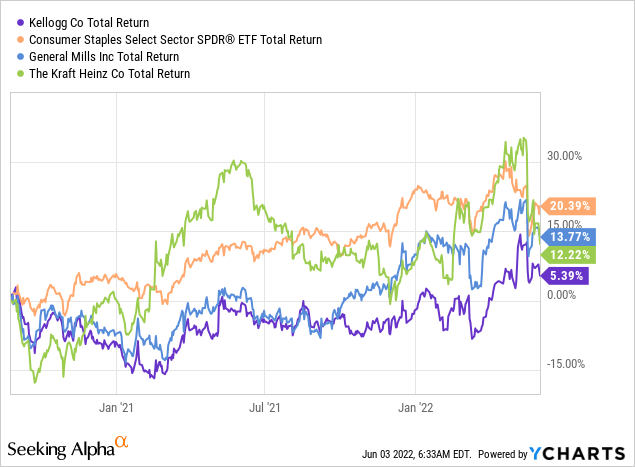

Performance of Kellogg (NYSE:K) over the past two years has been far from satisfactory. Since I first covered the company back in August of 2020, it delivered a total return of barely above 5%. In the meantime some of its major peers, such as General Mills (GIS) and even Kraft Heinz (KHC), achieved total returns in the low teens.

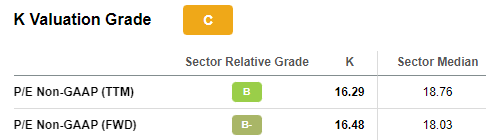

Therefore, Kellogg continues to trade at one of the lowest multiples within its peer set and this seems to attract investors looking for bargain opportunities.

Seeking Alpha

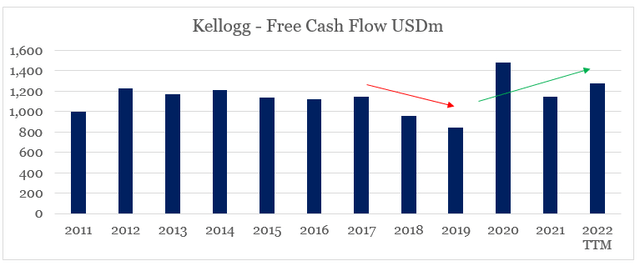

While I covered the risk of relying on these low multiples here, the company’s cash flow is another area of concern. At first, it might seem that Kellogg’s free cash flow is once again in an upward trajectory, following years of disappointing results.

prepared by the author, using data from SEC Filings

However, as we dig deeper into the company’s financial position, the current free cash flow of Kellogg appears unsustainable and is yet another risk area that shareholders need to keep an eye on.

Starting from the top

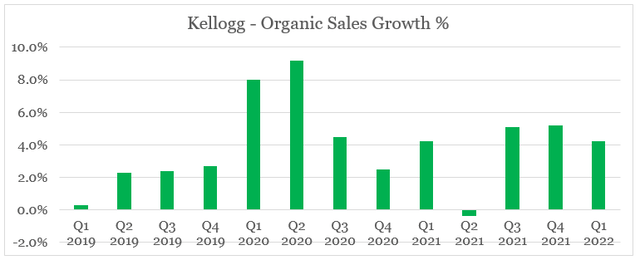

Starting from the company’s topline sales growth numbers, we could see that the figures are quite encouraging following the pandemic induced demand.

prepared by the author, using data from Kellogg Quarterly Presentations

Quarterly sales growth is now hovering around 5%, when compared to barely above 2% before 2020.

These results have become a source of pride for Kellogg’s management, who boasted about the above target growth rate even in the midst of such challenging times.

We had restored top line growth in 2019, experienced the pandemic-related acceleration in 2020, and yet sustained the strong growth in 2021 despite what we were lapping and in quarter one of this year, even with difficult comparisons, we continue to exceed our long-term target of 1% to 3% net sales growth with organic growth of more than 4%.

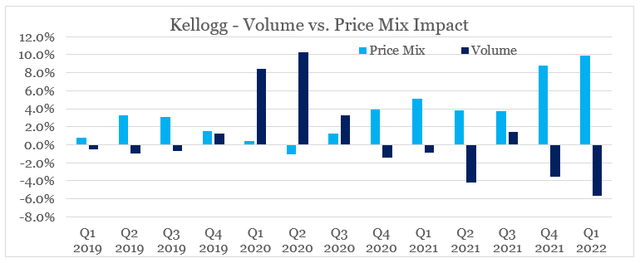

However, if we breakdown these quarterly growth rates, we could see that it was entirely due to Kellogg’s price hikes and overall price mix while at the same time volumes have been falling.

prepared by the author, using data from Kellogg Quarterly Presentations

While the recent strike also had an impact on volumes, a 6% quarterly drop is significant and illustrative of the weaker price premium of some of Kellogg’s brands. To cope with inflationary pressures, however, the company will be forced to continue with its current pricing efforts.

So we don’t comment on prospective pricing. But I think when you look at what we’ve done, it’s a good indication of what we’ll plan for in the future. So we have — in terms of our revenue, our net sales growth, it’s virtually all price/mix (…)

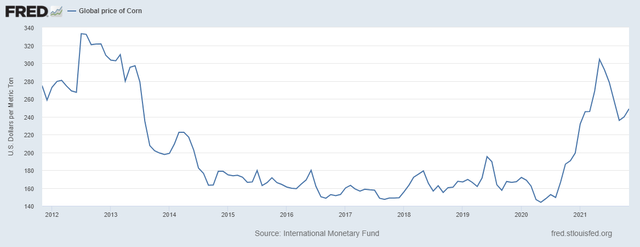

On one hand the price of corn has somehow cooled off which will give Kellogg a breath of fresh air.

However, wheat prices continue to accelerate and wheat is the key commodity used across many of Kellogg’s products.

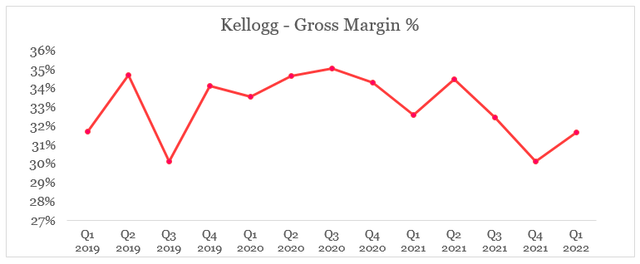

Given the extent of the price mix on overall topline growth rate, it is also concerning that Kellogg’s already low gross margin (when compared to peers) has been trending down in recent quarters.

prepared by the author, using data from SEC Filings

Some improvement of gross margin is to be expected over the coming quarters as production comes back online, however, there is a significant risk that given the price hikes volumes will also continue to trend down.

Net working capital tailwinds subsiding

It appears that the decline in Q4 2021 gross margin was largely due to the fire and strike and as production is restarted, profitability rebounded during the most recent quarter.

The single largest driver of our gross profit decline was a transitory impact of the fire and strike we experienced in the second half of last year. This impact reflects not only lost sales year on year, but significant costs as well. On top of this, are the economy-wide bottlenecks and shortages that are expected to persist at least through the first half. These two factors accounted for almost all of our year-on-year decline in gross profit dollars in quarter one and about half of the margin contraction.

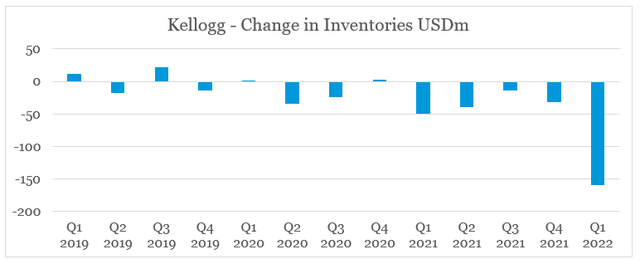

Even if we ignore the supply chain issues and assume stable gross margins as Kellogg rebuilds it inventory levels, working capital tailwinds will most likely subside.

Meanwhile, the team has done an excellent job of quickly restoring and ramping up production in our US cereal plants, following the fire end strike of last year’s second half. Our inventory is gradually building toward normal levels as planned, enabling us to start replenishing retailer inventories earlier than expected in the first quarter.

On one hand, the cash outflow for inventories will be larger as Kellogg rebuilds its inventory levels, but on the other the overall amount will also need to incorporate the higher prices of raw materials. That is why the cash outflow for the rest of 2022 could remain at elevated levels.

prepared by the author, using data from SEC Filings

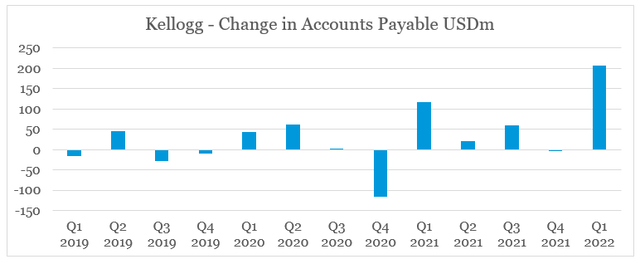

To compensate for these drastic changes and smooth the impact on changes in working capital, Kellogg has stretched its payables to suppliers which benefited the overall cash flow from operations.

prepared by the author, using data from SEC Filings

This increase, however, is less sustainable in my opinion as Kellogg’s bargaining power with suppliers has not changed materially in recent quarters.

Reinvesting into the business

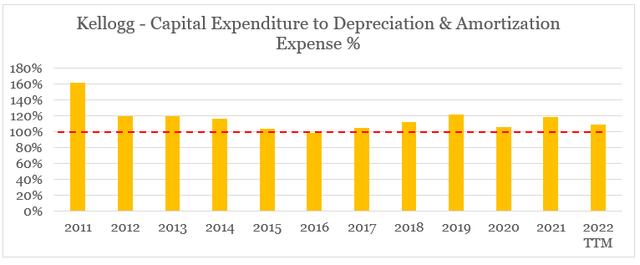

Another major tailwind for Kellogg’s free cash flow has been the company’s low capital expenditure relative to the depreciation & amortization expense. The reason why this ratio is so important is that the D&A expense is indicative of the amount needed to be spent just to sustain current operations. In that regard Kellogg has been keeping this ratio at roughly 100% over the past 10 years.

prepared by the author, using data from SEC Filings

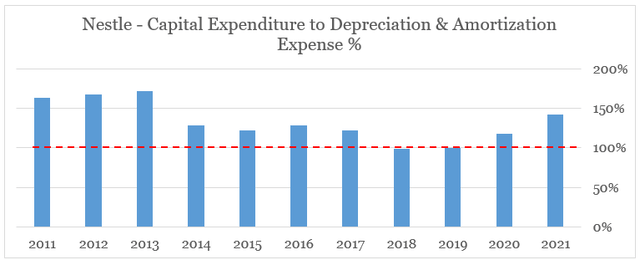

When we compare this to Nestle’s (OTCPK:NSRGY) Capex to D&A Expense ratio, we could see that the latter is already compensating for the 2018-19 period, when it reduced its Capex.

prepared by the author, using data from SEC Filings

Kellogg will either need to significantly increase its Capex into the future or the company is faced with either having to rely more on third-party manufacturers or not being able to grow production in a meaningful way. The former scenario holds significant risks in a world of troubled supply chains, while the latter is at odds with the company’s long-term growth rate strategy.

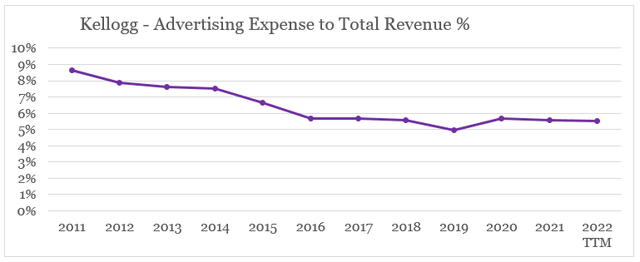

Additionally, advertising expenses relative to sales have also fallen significantly over the past decade (see below).

prepared by the author, using data from SEC Filings

For a company that relies heavily on its brands, advertising & marketing is arguably even more important of an investment than capital expenditures. Even the strongest brands out there could suffer over the long-term, if a company consistently underinvests in brand building campaigns.

Conclusion

Kellogg’s focus on lower gross margin products is a major competitive disadvantage for the company. Being able to derive high price premium is especially important during periods of high cost-push inflation.

While the company’s topline growth rate and high free cash flow might seem attractive when considering the low valuation, underneath the surface there are a number of issues. Growth has largely been possible due to dynamics in price mix, while volumes have been falling. As commodity prices remain elevated, Kellogg might be forced to continue with price hikes even as volumes suffer. In terms of cash flow, the management is faced with the need to invest more heavily into the business at a time when margins are under pressure.

Be the first to comment