Guido Mieth

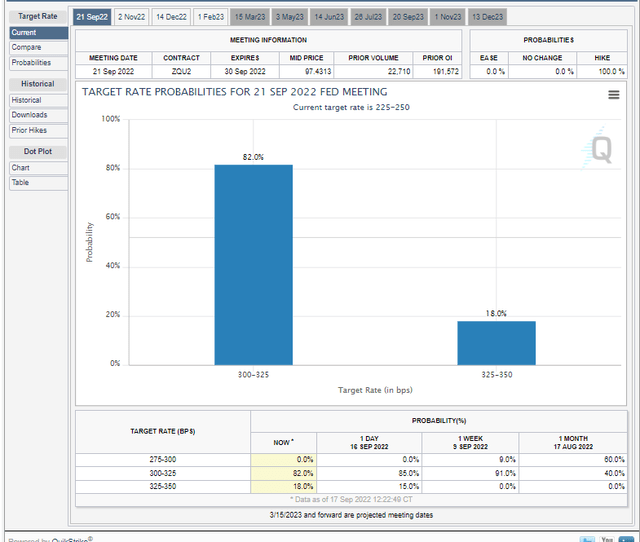

Will it be 75 or 100? All eyes are on the Fed this week ahead of Wednesday’s crucial FOMC interest rate decision. Currently, traders have priced in an 82% chance of a 0.75 percentage point hike, but nobody should be surprised if a full percentage point increase is announced this week.

Fed Funds Probabilities: A 0.75 Percentage Point Hike Likely

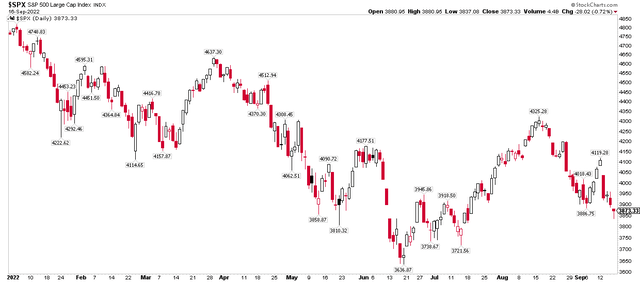

Looking back, investors have seen steep losses over the past month as the market comes to grips with the reality that the Fed is steadfast in its efforts to cool inflation. Powell’s ‘painful’ message at Jackson Hole last month was met with volatility, but stocks snapped back during the early part of September. While it feels like ages ago, it was just Monday last week when the S&P 500 was above 4100, rallying 6% over just a handful of sessions.

S&P 500 YTD: Stocks Sink 10% MoM

Then came Tuesday morning’s CPI report that reveal an unexpected surge in the core inflation rate. While headline consumer prices are tame over the past two months, inflation ex-food and energy, keeps climbing at an uncomfortable pace. At least in the Fed’s hawkish eyes.

An increasing number of pundits are growing worried that the central bank committee might end up erring on the side of a ‘too aggressive’ hiking path, leading to a sharper recession than was thought just a month ago. Consider that Fed Funds futures have discounted a terminal rate near 4.45% by April 2023 – who knows what the economy might look like by then. Moreover, it’s routinely said that it takes at least six months for interest rate increases to feed through to the broader economy.

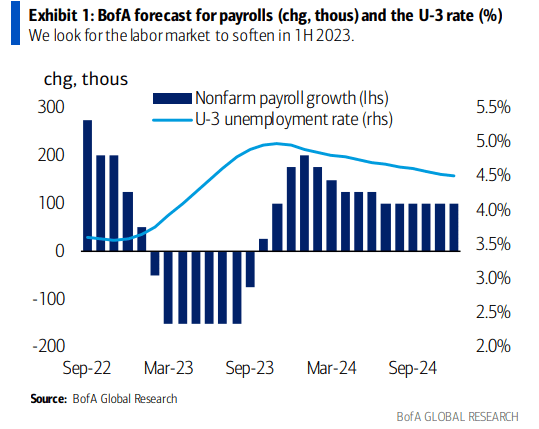

Already, some investment bank forecasters see recession risks on the rise for next year. Bank of America predicts job losses throughout much of the second and third quarters of 2023 with the unemployment rate spiking to 5%. That dire outlook has an upside, though, as it means inflation would almost certainly retreat toward the Fed’s target level.

A Slowdown Morphing Into A Recession?

BofA Global Research

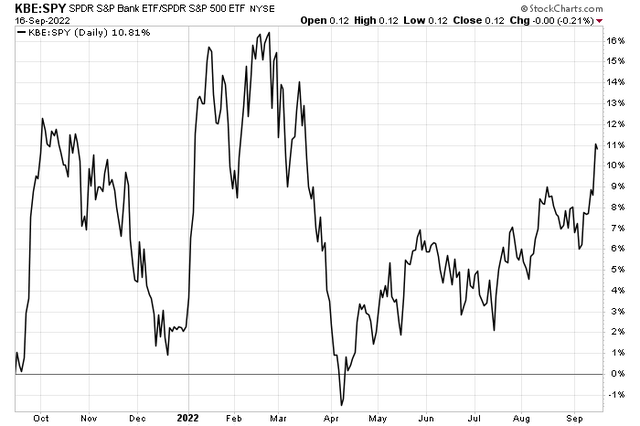

With stocks down 10% over the last month and interest rates climbing dramatically, it seems there’s little place to hide. I see some hope in one of the most beleaguered industries over the last decade – banks.

It seems counter-intuitive given that the Treasury yield curve is the most inverted it has been since 2000, but the SPDR S&P Bank ETF (NYSEARCA:KBE), on a weekly closing basis, settled at a fresh six-month high versus the S&P 500 on Friday. It has been in relative rally mode since early April, in fact.

Banks Vs. S&P 500: Relative Strength For Much of 2022

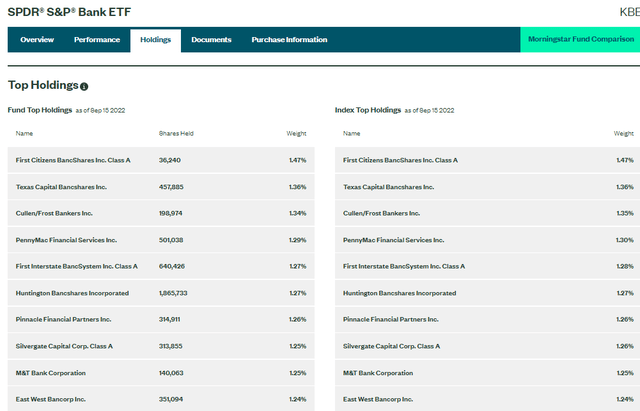

For background, the SPDR S&P Bank ETF offers investors exposure to the following sub-industries: asset management & custody banks, diversified banks, regional banks, other diversified financial services, and thrifts & mortgage finance sub-industries, per SSGA Funds.

The ETF takes an equal-weight approach, so it effectively is a mid-cap fund compared to other cap-weighted bank products. The portfolio has a forward price-to-earnings ratio of 10.0 with expected EPS growth of its holdings above 7%.

KBE Portfolio

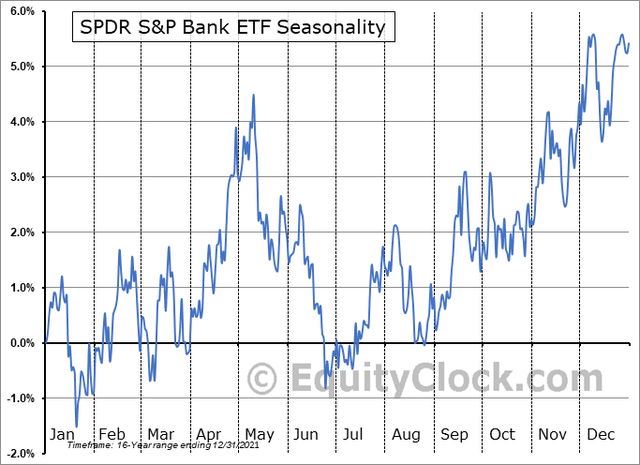

Another arrow in the bank bulls’ quiver is seasonality. Over the past 16 years, through 2021, KBE tends to deliver big gains from late September through year-end.

KBE Seasonality: Bullish Into Year-End

The Technical Take

KBE has near-term relative strength, so it settled last week materially above lows from earlier in the month. Notice in the three-year chart below that the $42 to $43 area is a pivotal spot. While well below the current share price, it’s a level that must hold. If the ETF breaks out above $53, then it could be off to the races back toward its all-time high above $60 – which was a double top from the mid-2000s if you go back further.

I like how the downtrend that began in January was decisively broken in July. Obviously nothing is a sure thing from the long side in this environment, but if we see a Q4 rally given how poor sentiment is, I think KBE could lead the way.

KBE: Downtrend Broken, Watch Two Key Levels

The Bottom Line

With a good valuation and relative strength, I assert that KBE is worth a shot here. Bullish seasonal trends that take root later this month are yet another catalyst for potential upside. Fundamentally, banks might offer a hedge against higher interest rates, as the depository institutions within KBE’s portfolio should stand to benefit in this new rate regime.

Be the first to comment