Wolterk

Elevator Pitch

My rating for General Mills, Inc.’s (NYSE:GIS) shares is a Hold.

I assessed General Mills’ stock price outlook as the company’s shares reached new highs in my earlier article for GIS written on July 8, 2022. In the past two months or so following the publication of my prior update on the company, General Mills’ share price performance (-0.63%) has largely matched that of the S&P 500 (-0.38%) and this justifies my Hold rating for the stock.

Considering that General Mills will report the company’s financial results for the first quarter of fiscal 2023 (YE May 31) in a couple of days’ time, I decided to publish a new article on GIS previewing its upcoming earnings.

My analysis leads me to the conclusion that General Mill’s upcoming first quarter results will be satisfactory. But I am not prepared to upgrade GIS’ rating to a Hold, as I take private label competition and refinancing risks into consideration in evaluating the company as an investment candidate. As such, I made the decision to retain my Hold rating for GIS.

Q1 FY 2023 Financial Results Release Date For GIS

GIS announced earlier on August 31, 2022 that the company’s Q1 FY 2023 earnings will be revealed on Wednesday, September 21, 2022 in the morning before market trading commences.

Analysts’ Expectations Of General Mills’ Upcoming Earnings Announcement

The market expects General Mills to deliver a fairly good set of results for Q1 FY 2023, and there are three key points that support this assertion.

The first key point is that GIS has a good track record of achieving above-expectations earnings.

General Mills’ actual quarterly EPS has come in better than what Wall Street anticipated in 14 of the past 16 quarters. This implies that GIS has historically provided realistic management guidance that it was able to achieve in most cases.

As a result, it is very likely that the sell-side analysts have confidence in General Mills meeting its full-year FY 2023 guidance of generating positive bottom line growth after adjusting for foreign exchange effects and inorganic transactions.

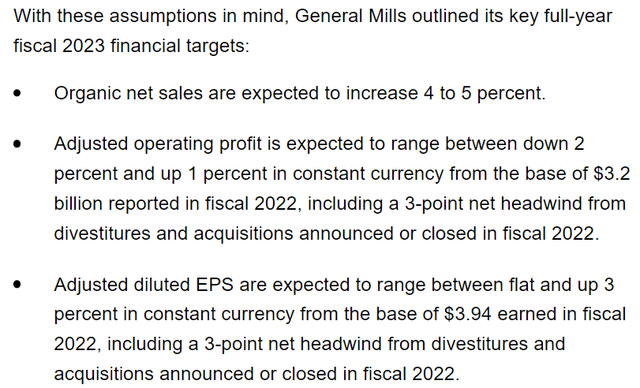

General Mills’ Fiscal 2023 Management Guidance

GIS’ Q4 FY 2022 Earnings Press Release

The second point is that the sell-side analysts are of the view that General Mills will be in a position to generate positive top line and earnings per share or EPS growth for the first quarter of the current fiscal year.

GIS’ revenue is expected to grow by +3.9% YoY to $4.72 billion in Q1 FY 2023 as per Wall Street consensus numbers, and this is comparable with the company’s +4.0% top line expansion on a YoY basis for Q1 FY 2022.

Separately, analysts see General Mills’ bottom line rising by +1.2% YoY to $1.00 per share in the first quarter of fiscal 2023, and this implies an improvement as compared to GIS’ -1.0% YoY EPS contraction in Q1 FY 2022.

More importantly, positive revenue and bottom line expansion for any company will be deemed as a decent set of results in the current challenging operating environment.

The third point is that Wall Street has become incrementally positive on GIS’ prospects in the upcoming quarter.

In the last three months, 7 of the 19 analysts who cover General Mills revised their EPS projections for GIS upwards. In comparison, only two analysts reduced their bottom line estimates for the company. Over this period, the consensus Q1 FY 2023 EPS forecast for General Mills was increased by +1.2%. Also, the consensus sell-side median price target for GIS has been revised upwards by +9% from $68 as of the end of May 2022 to $74 now, according to S&P Capital IQ’s financial data.

The key issue for General Mills now is whether the company’s actual Q1 FY 2023 financial performance can live up to the market’s expectations, and this is something that I address in the next section.

My Prediction Is In-Line Earnings For GIS

The most recent investor event for General Mills is the 2022 Barclays’ (BCS) Global Consumer Staples Conference that was held one and a half weeks ago on September 6, 2022. There are relevant insights that one can draw from GIS’ management comments at this event.

Two main factors are critical in determining if General Mills’ Q1 FY 2023 financial results will be in line with what investors expect, as highlighted below.

One factor is the sustainability of volume growth.

GIS mentioned at the recent Barclays’ Global Consumer Staples Conference that “volumes remain pretty robust” for General Mills and other food companies, based on a review of “scanner data over the past 13 weeks.”

Increased at-home food consumption and market share gains are the likely drivers of GIS’ volume growth in Q1 FY 2023. As the economy slows and consumers tighten their purse strings, more people are choosing to eat at home rather than dine out. This is definitely positive for packaged food companies such as General Mills. On a separate note, General Mills noted at the Barclays investor event that the company continues to gain market share in “eight of our top 10 categories in the US”, because the “availability of our products is better than our competition” for these eight categories.

The other factor is an easing of supply chain constraints.

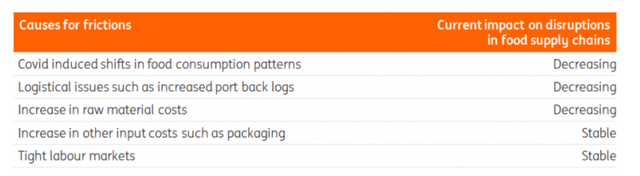

General Mills highlighted at the Barclays Global Consumer Staples Conference on September 6, 2022 that “our supply chain is serving our customers and consumers better than it was six months ago.” GIS’ management comments at the recent investor conference are supported by third-party analysis as well. As indicated in the chart below, there has been an improvement in the supply chain for food companies in areas such as logistics and raw materials as per ING Research’s research outlined in the September 13, 2022 article.

An Analysis Of The Current Status Of Various Factors Influencing The US Food Supply Chain

In conclusion, I expect that there won’t be substantial surprises when General Mills announces its Q1 FY 2023 results on Wednesday.

Concerns About Refinancing And Private Label Competition

I have a positive view of General Mills’ expected performance for Q1 FY 2023 as discussed in the preceding section, but there are still two things about GIS that are of a concern.

According to the company’s Q4 FY 2022 earnings press release, the “current portion of long-term debt” for GIS amounted to a reasonably substantial $1,674 million as of May 29, 2022. While it is a positive that General Mills’ short-term debt due for refinancing is largely EUR-denominated (rates are lower in Europe in general vis-a-vis the US), refinancing debt is always going to be tricky in the current environment of rising rates.

On a separate note, the threat of private labels in an inflationary environment where consumers are looking to stretch their budgets can’t be ignored. An August 3, 2022 Morgan Stanley (MS) research report (not publicly available) titled “Tracking Trade Down Trends” indicated that it is observing “trade down within grocery (64% of consumers traded down in July vs.53% in May 2022)” based on its survey of US consumers. In its report, MS also noted that General Mills is among a handful of food companies which have increased “prices well ahead of private label in their categories.” In other words, private label brands and players might pose a growing threat to GIS, assuming that the economy continues to weaken.

Closing Thoughts

I still assign a Hold rating to General Mills. On the positive side of things, I am not worried about an earnings miss for GIS when it announces upcoming results. On the negative side of things, there are certain risks (refinancing, private labels etc) for GIS that might push its share price downwards if they materialize.

Be the first to comment