noel bennett

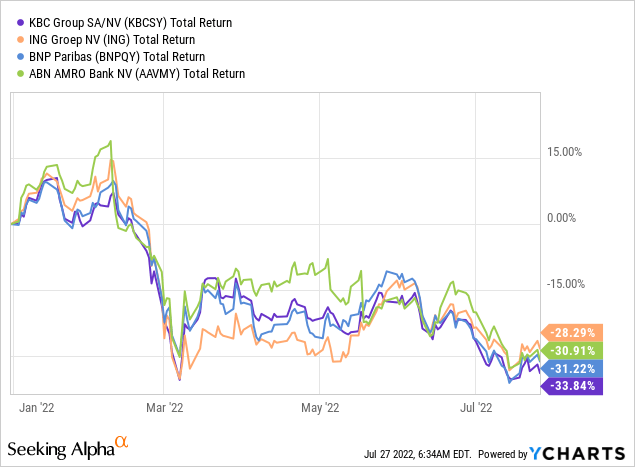

European banks have sold-off sharply this year, as fears grow that the macroeconomic repercussions of Russia’s invasion of Ukraine will tip the area into a significant recession.

Belgian player KBC Group (OTCPK:KBCSY) (OTCPK:KBCSF) hasn’t been immune to that. Shares of the banking giant are off by around 35% year-to-date as I type, broadly mirroring the declines experienced by its regional peers.

While the increasingly challenging economic environment is going to throw up a number of questions in the coming quarters (on credit quality, growth, expense control and so on), KBC is arguably one of the better-placed operators in the industry thanks to its relatively high profitability, previously improving credit quality, robust balance sheet and its lending profile. With shares of the bank now only trading around book value, KBC offers an attractive value and capital returns story. Buy.

One Of The More Profitable Eurozone Banks

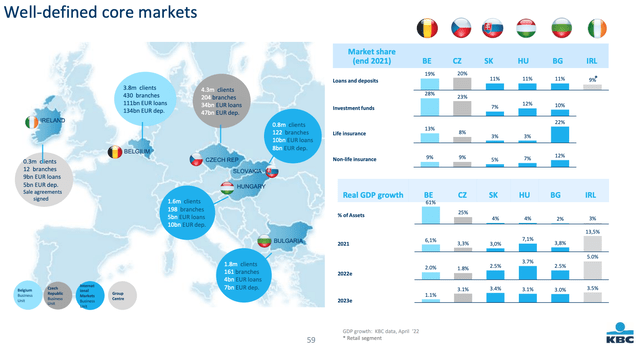

KBC operates in Belgium and Central & Eastern Europe (“CEE”). In Belgium, the bank is one of the market leaders and sports a double-digit share in traditional lending and deposit gathering.

Source: KBC 1Q22 Company Presentation

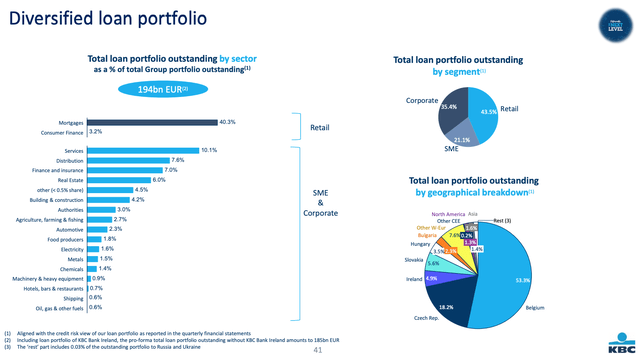

In CEE, KBC has market-leading operations in the Czech Republic as well as in Hungary, Slovakia and Bulgaria. The company is in the process of selling its Irish loan and deposit book, leaving Belgium and CEE as its core operating geographies. Relatively low-risk retail mortgage loans constitute over 40% of the bank’s total loan book.

Source: KBC Group 1Q22 Results Presentation

KBC has amassed an enviable core deposit franchise. Customer deposits currently stand at around €210bn – mainly from retail customers and SMEs – and constitute the majority of its funding mix. Ultra-cheap demand deposits constituted over half of its total deposits as of Q1 2022.

With less reliance on more expensive wholesale funding, KBC likely enjoys a significant cost advantage, helping to contribute to above average profitability. Furthermore, the group’s ‘bancassurance’ business model (i.e. combining insurance and banking) leads to cost synergies and a lower reliance on net interest income, thereby supporting profitability in the low interest rate environment.

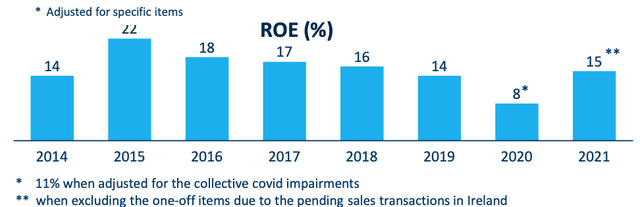

Source: KBC Group 1Q22 Results Presentation

With that, the bank’s return on equity has comfortably averaged in the double-digits over the past few years – notwithstanding a significant dip in 2020 – making it one of the more profitable banks in the Eurozone.

Relatively Well Placed For An Uncertain Period

European banks are likely headed into a more uncertain period as the repercussions of Russia’s invasion of Ukraine spill over into the area’s economies. For KBC, the big risks obviously include a potentially significant weakening in credit quality and higher provision expenses for bad debt. Slower loan growth could also weigh on the income statement, as could the impact of higher levels of inflation (e.g. via higher labor costs).

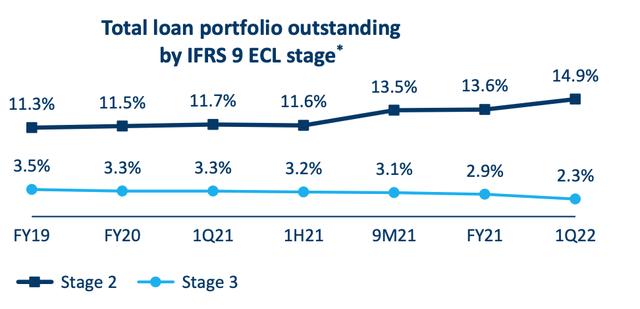

KBC should be relatively well placed for a number of reasons. Firstly, while asset quality could deteriorate as a result of ballooning energy costs and weakening European economies, the bank had been seeing a significant improvement on that front in recent years, aided by the fiscal stimulus measures introduced by governments during the pandemic. The sale of its Irish assets is also a positive for credit quality.

Source: KBC Group 1Q22 Results Presentation

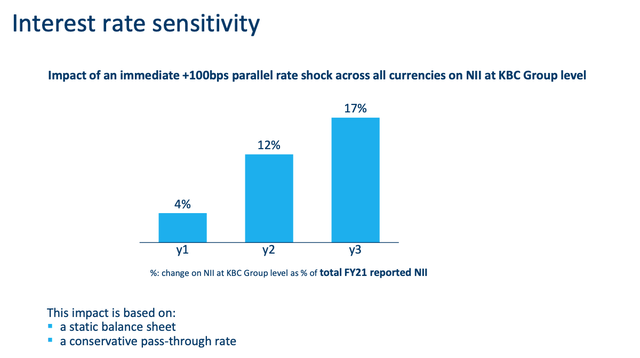

Secondly, the group’s higher levels of profitability should also allow it to absorb higher levels of bad debt. Higher interest rates will also help as they flow through to the income statement via higher lending margins and net interest income.

Source: KBC Group 1Q22 Results Presentation

Finally, KBC is very well capitalized, with its fully loaded CET1 ratio currently in excess of 15%. Strong recurring capital generation further supports this.

Shares Undervalued With Significant Capital Returns Potential

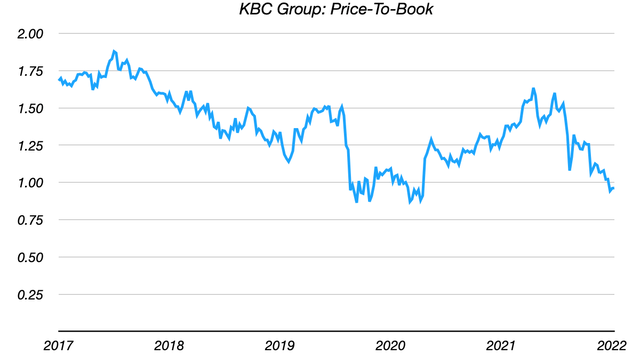

At €50.50 in Brussels trading, KBC shares currently trade for a little under book value. That is a steep discount to its recent historical average – a level that looks more appropriate given KBC’s relatively high underlying profitability. A valuation closer to 1.4x book value – supported by its average historical ROE – would imply a fair value in excess of €70 per share, or 40% above prevailing prices.

Data Source: Yahoo Finance, KBC Group Annual Reports

Of course, these shares have sold-off in anticipation of deteriorating fundamentals that could significantly impair earnings. On that front, management guidance thus fair is still fairly benign – with credit quality still seen coming in below the low-end of its ‘through-the-cycle’ 25-30bps estimate, and with expense growth seen neutralized by the positive impact of higher interest rates – though clearly there is a large degree of uncertainty. Analyst estimates do still imply high levels of profitability, though, with net income seen coming in at €2.50-€2.75bn over the next few years.

On capital returns, management policy is to pay out at least 50% of consolidated profit by way of dividends. Additional returns (via dividends and/or buybacks) of surplus capital (defined as capital in excess of a 15% CET1 ratio) are also at the discretion of management, implying a possible double-digit shareholder yield under mid-cycle conditions. Buy.

Be the first to comment