dima_zel

If you’re a Katapult (NASDAQ:KPLT) investor, then its November 9th earnings call was something you were not going to miss. The news of new merchants, gross originations, repeat customers et cetera, did not disappoint; they even beat on revenue. Although Katapult may not have fared as well as the previous year in terms of revenue, their consistent growth in today’s economy is impressive. If you’re a believer in the magic of Katapult, then please read on.

Katapult CEO Orlando Zayas (Katapult marketing archives)

Katapult is a young company; its IPO was due to a SPAC. Most SPAC IPOs offer $10; Katapult’s was $14, so clearly, investors saw value. Like Kothandaraman at Enphase (ENPH), Rodgers at Enovix (ENVX), I like to look at the leadership of a company to get a feeling if they have what it takes to make my investment money. Katapult CEO Orlando Zayas or “Oz” is humble, well-spoken and has the disposition of a good leader; he was, in fact, rejected for a Gap credit card in 2008, so most importantly, he understands his customer base. Many grew up with the Wizard of Oz on television, and the CEO being nicknamed “Oz” gives a sort of magical marketing to the company. With each earnings call, Oz continues to exhibit confidence, long-range vision for the company and good leadership skills, and with recent strategic hires and board member appointments over this past year, the growth is definitely there.

Katapult stock is cheap right now considering its current valuation

In the last earnings call, Oz opened by saying:

our team continues to work diligently to create value and capture additional share in the large virtual lease-to-own addressable market. We’ve only scratched the surface of the total e-commerce durable goods, market opportunity for under-served customers, which we estimate to be about $40 to $50 billion.“

Considering that $40-50 billion market, then Katapult’s beaten-down stock could reveal a great opportunity; the SPAC acquisition with FinServ at $14 per share brought KPLT to life last year, and then a buyout offer at $8-10 per share this past March also showed the value investors see in this company. At $50M+ revenue this past quarter, they’re currently selling for less than half their annual revenue, and they have ~$153M of cash and credit available.

Katapult’s mission statement is:

We open up paths to ownership for the 30% of shoppers who are overlooked by other payment options. With technology that looks beyond credit scores, Katapult provides lease-purchase plans that meet these shoppers’ needs. It’s good Karma for commerce!

The number of American consumers that now have subprime credit scores is greater than 30% and could be as high as 40%; basically, these are people who have credit scores between 580 and 669, and this is Katapult’s main focus. This customer market has grown ~33% since Katapult’s original mission statement was given.

Furthermore, the above statistic is for people with a credit history. Experian published that 30% of the population has zero credit, so that pushes about a third of the population out of the prime space into Katapult’s.

BNPL (Buy Now Pay Later) is focused on prime versus LTO (Lease To Own) non-prime as the MDR (Merchant Discount Revenue) model. LTO does not work for prime, for the losses are too high and the MDR model cannot absorb them. Katapult is a LTO company, not BNPL. Most retailers have BNPL, but very few have LTO. Katapult is the only eCommerce LTO company that is focused solely on serving non-prime customers, and they view the prime-focused lenders not as competition but as partners like Affirm (AFRM) which has directly integrated Katapult into Affirm Connect.

Katapult’s product serves a different type of customer from the prime lenders given it is a LTO and has different requirements, regulations and benefits than BNPL. Given these differences, prime lenders look to Katapult as a solution and strategic partner for this particular segment of the durable goods eCommerce market.

Katapult continues to exhibit growth every quarter

In just this last quarter, Katapult added 24 merchants. A surprise merchant announcement came at the earnings call – Sears. Although Sears may not be Walmart (WMT) or Amazon (AMZN), they do have almost 150 stores with plans to open 3 more this year, and their online web presence alone netted about half a billion last year. The Sears merchant acquisition is great news, but it is what Oz said on the earnings call that really impressed – that Katapult was “selected as Sears’ exclusive lease purchase solution from a competitive bid process“. In quite a few of their merchant acquisitions, Katapult has had to compete to win the business, and they have won; that is impressive and shows the competitive excellence of the company.

Investors should also know that the Sears merchant acquisition may not have been possible without board member Jane J. Thompson; Thompson was EVP/President at Sears for 11 years in the Credit and Strategic Planning arena before she went to Walmart for 9 years; this shows that Katapult’s selection of board members has been both prudent and fruitful. Board member Joyce A. Phillips has been recognized as one of the “25 most powerful women in banking” by American Banker Magazine; her connections also offer Katapult serious potential. Having strong leadership at the top is very important to a company’s health, and Katapult is showing they have it.

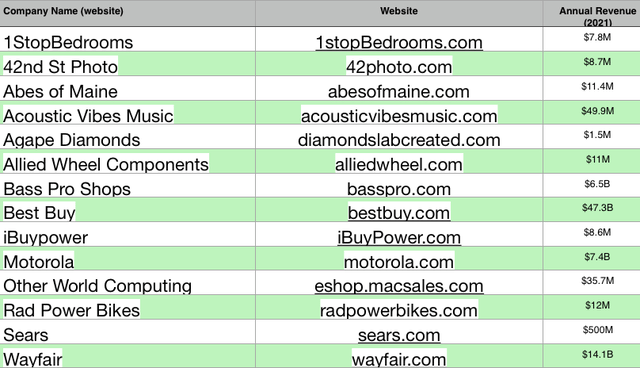

There are now over 200 Katapult merchants, and many are small businesses whose annual revenue is unknown. The list below is for some of Katapult’s merchants with public revenue information, and their total annual revenue exceeds $76 billion. Combined with their other merchants, Katapult clearly has a strong partner base that continues to grow.

* Revenues from Zippia.com (Zippia.com)

If you look at the merchant additions over the past 7 quarters, every quarter the company exhibits growth.

- Q3-2022 24 merchants added

- Q2-2022 42 merchants added

- Q1-2022 42 merchants added

- Q4-2021 20 merchants added

- Q3-2021 25 merchants added

- Q2-2021 31 merchants added

- Q1-2021 26 merchants added

Sears could be bigger than Wayfair for Katapult

Wayfair (W) has been the biggest merchant partner for Katapult. Wayfair’s performance has affected Katapult, but as the list of merchants for Katapult grows, that reliance on one big partner affects the company less and less. Consider that with the recent Sears merchant acquisition, Oz stated on the call that [Sears] “has the potential to become one of [Katapult’s] top merchant partners in 2023.” At the end of Q3-2021, non-Wayfair merchants only made up 34% of originations, so if Sears could be bigger than Wayfair, that’s a huge boost to Katapult’s bottom line, and it ensures that one big merchant’s problems cannot affect Katapult as Wayfair has done in the past.

The financial results summary for Q3-2022 stated that “more than 46% of gross originations came from repeat customers (customers who have originated more than one lease with Katapult over their lifetime)“. That is an impressive stat, and most importantly, it ensures that almost half of Katapult’s business is somewhat guaranteed, for ~50% of their customers have proven records of payment. If you look at past quarters, Katapult presents this statistic consistently, and it is usually around 50%.

- Q3-2022 – 46% repeat customers

- Q2-2022 – 52% repeat customers

- Q1-2022 – 49% repeat customers

- Q4-2021 – 54% repeat customers

Katapult Pay offers a major new revenue stream for the company

Katapult ended Q3-2022 with $77.2 million of unrestricted cash on the balance sheet and $74.8 million available on the asset-backed revolving line of credit. Looking at their financials, they had a losing quarter of ~$8.1 million which would have been $2.7 million had the new ASC 842 rule not cost them $5.4 million.

Katapult just launched a new product in September called Katapult Pay; this product almost doubles the potential revenue channels for the company because it allows customers to check out at select retailers where Katapult does not have an integration yet like Best Buy, Mattress Firm, Trigger Drills, and HP. Katapult has over 20 merchants enabled for Katapult Pay, so this will positively affect revenue in Q4.

Katapult Pay is a one-time-use virtual credit card technology that streamlines lease purchasing, and most importantly, user experience is improved. Since its release, the company has “achieved 30% customer adoption”. With their new product, Katapult has already originated over 2k leases with over $2 million in gross originations; that only comprises ~10% of Katapult’s total merchant base and is not even a full-quarter tally. Until a merchant is integrated into Katapult’s Mobile App, Katapult Pay creates an immediate revenue channel and a simpler option for the customer.

Katapult investors should understand the difference between revenue and gross originations because it requires patience, about 3 quarters worth; it is the issue behind the new accounting rule ASC 842. Gross originations are the total retail value of the merchandise leased using Katapult in a given quarter, and it is recognized immediately, but the revenue associated with the transaction will be recognized over a few quarters. Thus, all the new merchants coming on board is fantastic news, but it is the new ones from a few quarters back that matter most. In Q1 and Q2 of 2022, Katapult had its highest-ever merchant acquisitions, so this is just another factor to consider for Q4.

Katapult’s OpEx reduction should be lower this quarter

At this past earnings call, both Oz and CFO Karissa Cupito discussed long-term strategies and OpEx reductions to achieve profitability. Katapult surprised analysts where Q3-2022 revenue exceeded estimates by ~10% and earnings per share surpassed estimates by ~34%. Katapult revenue is projected to grow ~15% annually over the next 3 years compared to a ~7% growth forecast by the Consumer Finance Industry in the U.S. Can Katapult reach that profitability inflection point in Q4-2022? That would be a great Christmas present to Katapult investors if it happened.

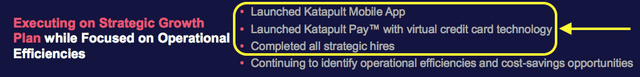

*Q3-2022 Earnings Presentation, 11/9/2022 (Katapult.com)

The CFO stated that “with those major costs out of the way, next quarter we can expect for KPLT’s operating expense to be reduced“; those “major costs” were the “significant initiatives” that have been “completed” like the new Katapult Mobile App, and the entirely new Katapult Pay. With a major reduction in this type of OpEx, all “strategic hires” completed and the Holiday season upon us, maybe Katapult can surprise with a profit. Free money may be no more, inflation and interest rates may be high, and the vacations and spending sprees for many households may be reduced or eliminated, but essential items must be purchased. This is where Katapult is really experiencing a perfect storm considering they service non-prime customers. The CFO even hinted at this in the call saying, “as credit tightens across the credit spectrum, including prime lenders, [Katapult] anticipates new, higher-income customers will seek out our offerings.“

Decentralized power is a winning strategy

In summary and with respect to Katapult’s philosophy of adding many small- and medium-sized merchants, consider decentralized power. As an example, look at Enphase Energy (ENPH) and how they became the leader in residential energy systems after closely averting bankruptcy in 2017; they were successful because they made solar reliable with a decentralized power topology, basically an army of microinverters versus one central string inverter with a single point of failure; the latter represents centralized power and had been the venerable standard for years until Enphase came along. As another example, look at battery maker Enovix; their new battery architecture offers a novel decentralized resistive power approach versus a single resistor and practically makes thermal runaway obsolete and batteries safer than has ever before been possible; their technology will probably become the next step-change in the industry and wind up being in everything from smartwatches, cell phones, portables, and EVs just like Sony (SONY) accomplished in 1991 with their lithium-ion battery. Now look at Katapult; they may not have exclusivities like Amazon or Walmart, but with their growing army of small- and medium-sized businesses, they have a decentralized form of power with multiple revenue streams where the loss of one will not affect them greatly. Oz has stated that Katapult can ally with “thousands of eligible merchants” out there to generate business, he understands decentralized power and how Katapult can flourish using that approach. At Katapult’s current share price, I think they’re a diamond in the rough, but, of course, do your own due diligence and good luck.

Be the first to comment