Robert Way

Nike (NYSE:NKE) is one of the most stable companies in the United States and the world with multiple sales avenues in the athletics, athleisure and general footwear and clothing business segments. They hold physical stores, online mega portal and also sell through third party websites and e-commerce behemoths like Amazon (AMZN) and others.

With the recent surge in inflation during the COVID-19 pandemic, as supply chains were constrained and other headwinds emerged, the company has tried to mitigate a good portion of those headwinds by increasing prices on consumers and cutting operational costs to boost efficiency.

Now that inflation is cooling, down from 8.3% to 7.7% in the most recent report, I believe that the company’s profit margin will increase over the coming few years and outperform their current expectations for earnings per share growth. As a result, I think the company still constitutes a solid long term investment with a renewed focus on profit improvements.

Part 1: Where We’ve Been

From a purely sales point of view, Nike has been doing consistently well over the past few decades as it used all of the tools at its disposal to effectively market and channel where trends are going, as well as setting them.

Marketing and Market Trends

They did this by an aggressive marketing campaign, which includes running hundreds of social media accounts on Instagram, Facebook (META) and Twitter (TWTR), as well as partner with the world’s most famous athletes like LeBron James, Cristiano Ronaldo and many, many more.

They’ve invested heavily into different parts of the sports and activewear markets in order to diversify and immerse themselves in the fastest growing parts of the business. Back in 2017 and 2018, the athleisure market was one of the hottest and fastest growing in the industry, which was a combination of the athletics and leisure markets. The company invested heavily into introducing new lines of clothing and footwear and they took full advantage and raked in billions as a result.

Online Presence & COVID-19 Pandemic

When the COVID-19 pandemic hit, while many other businesses were facing tough times, the company utilized its online presence to such a successful extent that they were generating about 30% of its sales through its online avenues. Back in 2019, there online presence grew so successful that they dropped selling their products wholesale to e-commerce giant Amazon.

While they saw a decline in sales from about $11 billion quarterly to around $6.5 billion in the May 2020 quarter, when the pandemic was at its fiercest public opinion down, they quickly recovered and are now back at growing their quarterly sales compared to prior years.

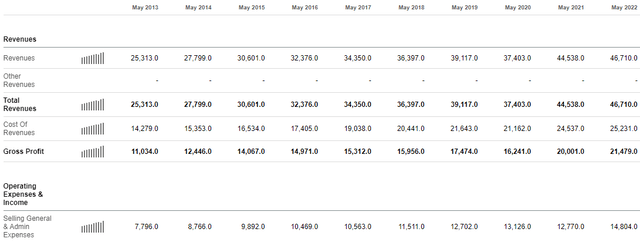

Overall, the company’s sales dropped from $39 billion in 2019 to $37.5 billion in 2020, but quickly recovered and surged to over $44 billion in 2021 and have grown to $46.7 billion in 2022, the last fully reporting year. (Source: Seeking Alpha NKE Financials Income Statement). The real kicker, however, was the company’s margins.

Margins & Costs Volatility

While in some of the quarters in 2020, when the pandemic shut down the global economy, the company did face supply chain issues for its raw material deliveries, finished product deliveries and overall movement of goods, they passed most of those costs on to consumers.

After the main headwinds related to costs subsided, they continued or maintained the higher pricing environment even though the costs were way down. This resulted in their gross profit margin increasing from around 44.7% to just shy of 46% in the most recent reporting full year.

While some analysts predicted that these higher prices would deter some sales growth, that has simply not materialized and the company has already been reporting increased sales at the higher price points in the 2 most recent quarterly financial statements.

With the continued price increases, the company is now investing into new trends and markets, as well as working on improving operational efficiency.

Part 2: Where We’re Going

When it comes to the company’s gross margins, their price increases will I believe, continue to drive gross profit margin expansion for the coming years as inflation eases and the cost of their revenues decreases. As inflationary costs ease, which includes the cost of energy and transportation, I believe that the company will post a higher profit margin in the coming quarters.

Furthermore, the company has been working on reducing their operational costs relative to revenues over the past few years. This doesn’t mean that they’re laying off workers or freezing hiring like many companies are doing in the current economy. They aren’t really. But what they are doing is working to integrate acquisitions and close off some underperforming stores (moving personnel around to other locations) in order to maximize and capitalize off of their superior online presence.

This has resulted in their operating costs (selling, general and administrative) to decline relative to revenues. In 2019, the company reported total operating costs of $12.7 billion on revenues of $39.1 billion, for a total operating costs margin of 32.5%. In their most recent reporting full year results of 2021, the company reported operating costs of $14.8 billion in revenues of $46.7 billion for an operating costs margin of 31.7%.

NKE Operating Expenses / Sales (Seeking Alpha NKE Income Statement)

These multiple margin expansions should help the company, I believe, easily outpace the expectations currently in place by industry analysts. Let’s take a look at those and see how they shape up relative to my investment thesis.

Expectations: Can Easily Outperform

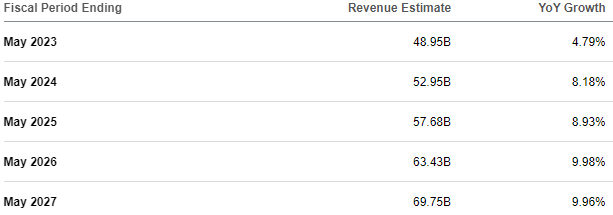

Currently, the company is operating in a market which is expected to grow at a CAGR (compound annual growth rate) of 6.6%, according to leading market experts. However, they are expected to grow their sales by a slightly higher tick, meaning that experts believe they should be gaining market share. This doesn’t come as a surprise, as they are investing heavily into marketing new sportswear equipment, apparel and footwear.

Here are those expectations, based on Seeking Alpha’s aggregator of analysts expectation for Nike’s sales over the next 5 years:

NKE Sales Estimates (Seeking Alpha Projection Aggregator)

Let’s dive into the numbers with my aforementioned expectations. I believe a gross profit margin of 48% averaged across the next few years is appropriate given lower inflation (or even deflation relative to current cost structures).

On top of that, a 30% averaged operating cost structure is appropriate, I believe, given their continued shift to online sales and the lower need for higher cost operating expenses in underperforming physical stores. This 30% is not of gross profits, but of revenues, which is why the numbers are larger.

After that, I expect the company to incur $150 million in net interest expense, due to their cash investments which are generating over $140 million to offset their $300 million in annual interest expense on long term debt. After that, I believe that a historically accurate income tax rate of 15% should be applies as I believe that over the next few years there may be a hike in effective corporate tax rates.

Here are those final numbers:

| 2023 | 2024 | 2025 | 2026 | 2027 | |

| Sales | $48.9B | $52.9B | $57.7B | $63.4B | $69.7B |

| G. Profit | $23.5B | $25.4B | $27.7B | $30.4B | $33.5B |

| O. Expense | $14.8B | $15.9B | $17.3B | $19.0B | $20.9B |

| Tax Rate | $1.3B | $1.4B | $1.5B | $1.7B | $1.9B |

| Net Income | $7.25B | $7.95B | $8.75B | $9.55B | $10.6B |

Given that the company has 1.575B shares outstanding, I expect the company to report around the following earnings per share for the following years:

| 2023 | 2024 | 2025 | 2026 | 2027 | |

| Proj. EPS | $4.60 | $5.05 | $5.56 | $6.06 | $6.73 |

It is worth noting that although there is an argument for lower overall gross profit margins this year, as the company’s most recent quarter saw a slight dip, the company is set to continue with its $18 billion in share repurchases, which means that over the next 5 years period we’re likely to see the share count be lower than the 1.575B, which should balance out any temporary headwinds when it comes to gross profit margins.

These figures present a serious acceleration of net income growth relative to the company’s current EPS expectations, which you can find here. This means, I believe, that with a roughly 18x multiple for forward earnings per share, the company presents a superior investment opportunity as they have the potential to grow at about 15% annually through the next 4 to 5 years. I believe that this growth rate will easily outpace the broader market.

Investment Conclusion

Nike has an extremely consistent revenue stream as a leading global sportwear and activewear brand and those sales are expected to grow at a slightly faster pace than the overall industry as they capture market share.

With my belief that margins will expand as they continue to see more of a shift to online sales and close down underperforming retail stores – I believe that they will easily outperform the broader market and have the potential to grow at around 15% to 20% annually while the market should continue to show a 7% annual growth rate.

It’s these factors which make me re-initiate my bullish stance on the company’s long term prospects.

Be the first to comment