Falcor

The Q2 Earnings Season for the Gold Miners Index (GDX) has begun, and Newmont (NEM) kicked off the quarter with underwhelming margin performance stemming from cost pressures. The softer report has made some investors uneasy about the Q2 reports from other names, especially those mining in Western Australia. Karora (OTCQX:KRRGF) may be one of those companies, but I’m less worried about its margin profile, with any short-term degradation able to be clawed back by production growth. Besides, with the stock trading at 0.35x P/NAV, I see significant negativity already baked into the stock.

All figures are in United States Dollars unless otherwise noted.

Beta Hunt Mineralization (Company Website)

Q2 Production & Labor Challenges

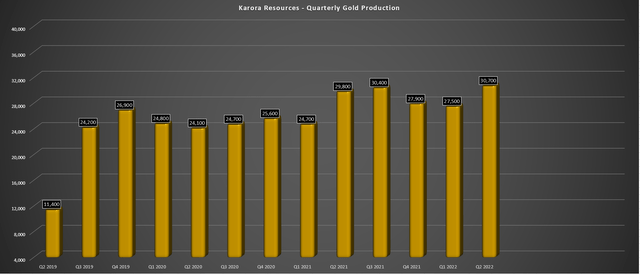

Karora released its preliminary Q2 results earlier this month, reporting quarterly production of ~30,700 ounces, a ~3% improvement from the year-ago period. This was despite the re-opening of the Western Australia border, which led to increased COVID-19 positivity, with Newmont reporting that between one-third to half of its workers at its Boddington and Tanami mines tested positive in the period. When combined with demand from mining competitors and infrastructure initiatives throughout Australia, the labor market is very tight, with some contractors preferring to work in Australia vs. flying out to mine sites, given the current considerable infrastructure spending (~$250 billion).

Karora Resources – Quarterly Gold Production (Company Filings, Author’s Chart)

While Karora’s production results would suggest that the company was immune from the same issues as Newmont, one of the largest operators in Western Australia, this isn’t completely true. This is because looking solely at Newmont’s results, the company actually reported decent production results at Boddington and Tanami, though it did see a benefit from its Autonomous Haulage Fleet. Unfortunately, the issue was that productivity was lower with inflationary pressures (diesel, consumables), higher rates for specialized labor, and missed work hours due to the tight labor market. Hence, the impact didn’t show up in production as much as it did in costs.

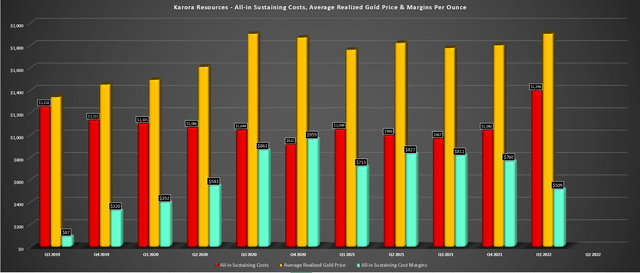

Karora Resources – AISC, Average Realized Gold Price & AISC Margins (Company Filings, Author’s Chart)

As of Q1 2022, Karora reported a significant increase in operating costs, with all-in sustaining costs [AISC] hitting a multi-year high of $1,396/oz, dragging margins down to $509/oz. The company noted that there was over $300/oz in COVID-19-related direct and indirect impact in the quarter, with over 200 work shifts missed due to COVID-19 and labor tightness. Judging by Newmont’s remarks in its Q2 Conference Call, the situation does not appear to be improving greatly, which is one of the reasons the stock found itself down 13% on Monday after it hiked cost guidance by 7% for the year.

Based on these challenges reported by Newmont and other operators, I am less optimistic that Karora will be able to pull its costs back below $1,100/oz in Q2. When we combine this with a relatively flat average realized gold price (~$1,835/oz vs. $1,823/oz in Q2 2021), we are likely to see some margin pressure on a year-over-year basis. That said, one of the reasons that Newmont was hit so hard was that it pushed out the start on two of its projects, increased upfront capex estimates, and it doesn’t have any way to improve its margin profile meaningfully between 2022 to 2024. However, this is not the case for Karora at all.

Karora Operations (Company Website)

Immediate Growth

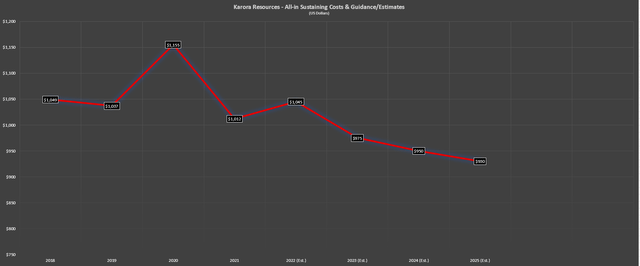

For those familiar with the Karora story, the company’s goal is to increase production from 112,000 ounces in FY2021 to 195,000+ ounces in FY2024 while also increasing nickel production. This sharp increase in production should more than offset higher labor, fuel, consumables, and materials costs, allowing the company to improve margins even against a flat gold price. In fact, even if we use the higher end of estimates to adjust for the tight labor market, Karora could see higher costs year-over-year in FY2022 ($1,045/oz estimates) but see a significant drop off in operating costs as production jumps meaningfully next year and further in FY2024/FY2025.

Karora – All-in Sustaining Costs & Forward Estimates (Company Filings, Author’s Chart)

So, while Newmont will see an up to $140/oz degradation in margins from FY2021 to FY2023 at a $1,760/oz gold price assumption (2023), Karora should see roughly flat margins in the same period. This is based on AISC margins of $780/oz in FY2021 and estimates of $785/oz in FY2023 ($1,760/oz vs. $975/oz AISC). It’s worth noting that the company’s guidance is for $890/oz to $990/oz costs in FY2023, but I am purposely being conservative to add in some effect of inflationary pressures and the tight labor market. The other major difference worth pointing out is that Newmont will have flat production in the period (2023 vs. 2021), while Karora’s production will increase 40% (~160,000 ounces vs. ~112,000 ounces). Hence, it will see growth in cash flow per share in the period. Newmont will not.

Given these differentiators, I am less worried about a tough Q2 report ahead for Karora, which could see costs come in above estimates. This is because Karora has short-term and medium-term tools to claw back any lost margins. On an immediate basis (H2 2022), this includes a larger workforce, increased productivity from new zones, and higher grades mined. The other major wild card and benefit is its nickel production, which, while down sharply from its highs, is still up vs. 2021 levels. To summarize, I wouldn’t be overly worried about what might be a tough Q2 report, at least judging from commentary from other operators in Western Australia.

Exploration & Long-Term Potential

Moving over to the good news, Karora continues to put up phenomenal results from an exploration standpoint. While discovering new zones is a big deal for any gold producer, they are arguably more valuable to Karora. This is because the company has hundreds of thousands of meters of infrastructure, meaning access to newer opportunities comes at a lower cost due to previously completed waste development. One of the more recent opportunities to arise is Larkin, where Karora has identified a nearly 300,000-ounce resource at ~2.40 grams per tonne of gold. Another is the Western Fletcher Zone, parallel to the Western Flanks Zone and the third major shear zone at its flagship Beta Hunt Mine.

Just recently, Karora released new drill results from its high-grade Larkin Zone discovery, reporting the following intercepts:

- 7.8 meters at 29.8 grams per tonne of gold

- 4.0 meters at 8.7 grams per tonne of gold

- 6.9 meters at 4.2 grams per tonne of gold

These intercepts are higher grade than the current resource base at Larkin, but the best intercept (29.8 grams per tonne of gold over 7.8 meters) was drilled 20 meters beyond the existing mineral resource and 120 meters below the ultramafic/basalt contact. This suggests the potential for higher grade areas at depth in this zone, which could make Larkin an even more attractive mining area down the road.

Given the company’s exploration success to date and its aggressive exploration budget relative to peers, I could not be more confident about Karora’s reserve growth outlook and its mine life, with what could ultimately be a 10+ year mine life even at higher rates at Beta Hunt. This might seem like a stretch with just ~6.0 million tonnes in reserve inventory at Beta Hunt and a future processing rate of ~2.0 million tonnes with the addition of a second decline. However, Larkin alone looks to have 5.0 million tonne potential (3.61 million tonnes currently in M&I/Inferred), adding 2+ years of mine life to reserves with this one discovery alone that’s less than two years old.

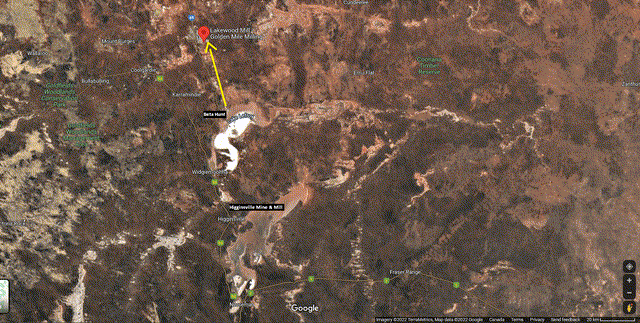

Finally, assuming the closing of the Lakewood Mill acquisition, Karora will not only benefit from lower haulage costs given the proximity of the processing infrastructure, but it will de-risk its growth, making the company less susceptible to capex inflation/supply chain headwinds. Most importantly, though, it will significantly increase the long-term processing potential for the company if new major discoveries are made at Higginsville or Beta Hunt. This is because throughput will immediately increase to 2.6 million tonnes per annum with 2.8 million tonnes per annum potential with a second ball mill in place at Lakewood.

However, this no longer includes the expansion of the Higginsville Mill, which can still be expanded to 2.5 million tonnes per annum if the assets become mill-constrained. In this scenario, Karora could increase its total throughput to ~3.7 million tonnes per annum, which at a 2.15 gram per tonne feed grade and 93% recovery rate would open up the potential for 235,000 ounces per annum, a nearly 16% increase vs. the high end of its initial growth plan of 205,000 ounces per annum. I do not see this as a 2024 opportunity, but this could be achievable by 2026 if reserve growth justifies an expansion of this magnitude. To summarize, while Karora appears to have ~75% output growth in the bag vs. FY2021 levels, there looks to be 105% production growth potential sitting in the wings.

So, Why Is This important?

Aside from the fact that few other growth stories are this executable sector-wide, Karora’s cash flow and earnings per share will be much less sensitive to the gold price than its peers. This is because even if the gold price were to decline from $1,790/oz (FY2021 realized price) to $1,640/oz in 2024, the 10% decline in the gold price would be offset by a 70% increase in gold production at slightly higher margins due to by-product credits. So, Karora has secured itself a position as a growth story irrespective of gold price volatility.

This distinction allowed investors in Kirkland Lake Gold, led by its CEO, Tony Makuch, to enjoy triple-digit returns in the 2016-2019 period. These returns were despite limited upside in the Gold Miners Index, making it a unicorn from a share-price performance standpoint relative to producers of the past decade. To be clear, I do not expect Karora or any producer to reproduce similar returns to the ~130% annualized returns that Makuch delivered for its shareholders through a brilliant acquisition and operational excellence. However, investors in Karora should be comforted by the fact that Karora is in a somewhat similar position, controlling its destiny vs. the gold price being a thorn in the side of producers lacking growth and margin expansion.

Valuation

Based on a conservative ~179 million fully diluted shares (year-end 2023) and a share price of US$2.20, Karora trades at a market cap of $392 million or an enterprise value of approximately $310 million. If we compare this market cap figure to an estimated net asset value of $1.11 billion, Karora is currently trading at 0.35x P/NAV, a dirt-cheap valuation for a company with one of the best organic growth profiles sector-wide. Based on what I believe to be a fair multiple of 1.10X P/NAV to account for its growth, industry-leading margins, and its solely Tier-1 jurisdictional profile, this translates to a fair value of US$6.82 to its 18-month target price.

Given the 210% upside to fair value, if the company can execute successfully, Karora remains one of the most undervalued names sector-wide and remains attractive on a risk-adjusted basis, given that investors don’t have to worry about less favorable jurisdictions. That said, Karora’s Tier-1 jurisdictional profile is also a curse somewhat, given that Western Australia is such a prolific region that it’s one of the tightest labor markets currently for specialized labor and labor in general. Still, with Karora trading at 0.35x P/NAV, I would argue that this risk is already baked into the stock, suggesting there’s limited downside from current levels.

Summary

Normally, I would reserve P/NAV multiples north of 1.0 for only the largest and most diversified producers, but Karora is in a unique position. This is because it has a path towards 70% to 100% production growth over the next 2-4 years, its CEO Paul Huet has a track record of delivering on promises at Karora to date, and it benefits from by-product credits. The latter point should potentially help it sidestep the margin pressure sector-wide. So, with the stock seeing a waterfall decline from its highs, which is not justified at all given its bright future, I see this pullback as a buying opportunity.

Be the first to comment