Ljupco/iStock via Getty Images

Investment Thesis

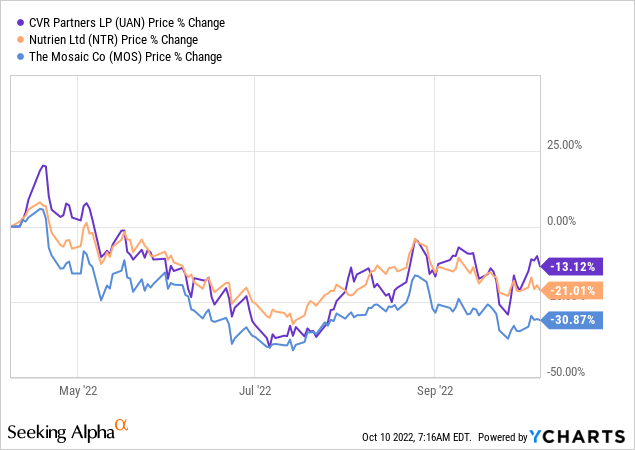

CVR Partners (NYSE:UAN) has been a tough stock to hold. On the surface, the stock is priced at approximately 4x this year’s EPS. That’s obviously cheap. But when the stock is up and down more than 20% in a month, investors can be justified in having ”short-termism” mindsets.

I don’t believe that the problem with UAN is in recognizing that the stock is cheap. The problem is in having the stomach to hold on to this holding.

Ah, the Turbulence

UAN’s stock has been volatile. Perhaps this is an understatement. To give you a sense of just how volatile, in the past 30 days the stock fell more than 22%, only to hit a bottom and bounce back 27%. Nonetheless, in the past month, this stock actually ended up slightly lower. With that happening how can investors remain sane?

Indeed, keep in mind that we are often told that commodity stocks are not for the buy-and-hold crew. The buy-and-hold crew prefers to align itself with secular growth companies.

And so, we reach the quandary of our puzzle. Few investors want to buy fertilizer stocks and stick with them. This can be clearly seen in the fact that this stock was dramatically down and up in a 30-day period, with a chunk of investors churning out of the stock and new investors entering.

So why should investors take a longer-term view?

What’s Happening Right Now?

As I look across the board most fertilizer stocks appear to have fallen out of favor with investors.

The rumor I’ve seen circulating is that Brazil and the US have been softer than expected, which has led to a surprising oversupply with regional markets seeing fertilizer prices dropping and coming in lower.

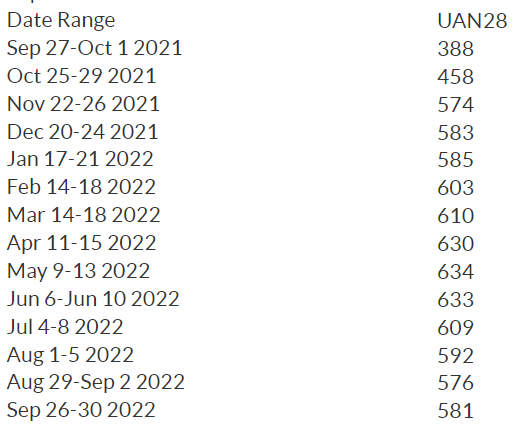

And while I don’t have any way of seriously checking the veracity of these comments, what I can check is that prices for semi-concentrated ammonia, UAN28, have been volatile since the summer. And on the face of it, the lower fertilizer prices appear to support the narrative of oversupply in the nitrogen market.

dtnpf.com

That being said, ammonia UAN28 appears to have found a base in the last few weeks.

As you can see above, prices for UAN28 were coming down since early in the summer, but now coming out of September prices appear to have stabilized. How will nitrogen prices go from here is anyone’s guess. There are two conflicting considerations.

The advice given to farmers is to limit fertilizer application. And that will obviously work up to a certain extent, but ultimately this just delays the inevitable use of fertilizer application next year.

On the other hand, we know that food prices have been soaring. In fact, the Wall Street Journal recently reported that 345 million people around the globe are facing immediate danger of food shortages.

Yet, the thesis here is quite convoluted, with on the one hand fertilizer prices coming down, while on the other hand, food prices soaring. Indeed, for farmers, when food prices are so high, it makes a lot of sense to pay up for fertilizer irrespective of fertilizer prices — or so one would be led to believe.

But this line of thinking isn’t supported in the data. Thus, rather than changing my narrative to fit the date, I prefer to take a step back and take a more fundamental view.

UAN Stock – Cheap, But so What?

I roughly estimate UAN’s 2022 EPS figure to be around $35 per share. This would put the stock very roughly at around 4x this year’s EPS. And I can confirm for readers that this multiple isn’t all that different from Nutrien (NTR) or Mosaic (MOS).

Or better said, perhaps it’s a nudge cheaper than Nutrien. However, there are good reasons to support Nutrien trading at a slight premium to UAN. After all, Nutrien is not only a lot bigger than UAN and a price marker in this market but also geographically much more diversified.

So my point is this, truly I haven’t got a clue how the very near term is going to unfold for UAN. But I’m very much in the camp that investors need to form some opinion over how 2023 is going to end up.

And I struggle to believe that in 2023, UAN’s EPS figures end up dramatically lower.

So, that means that investors are paying around 4x this year’s EPS and will likely get a strong 2022 and a likely strong 2023. Meaning that this valuation is cheap enough that investors can be patient. But again, that’s difficult when the stock is just so volatile.

The Bottom Line

So what’s the downside now? The market has had to rapidly adjust to much higher interest rates. That’s of course a significant headwind for stocks. But could one make the argument that the bulk of interest rate adjustment has already been made?

So then, we circle back, is paying 4x this year’s EPS for UAN cheap enough? I believe that it is. Yes, one could obviously try to be super cute and wait ”for the bell” to ring at the bottom, but outside of a totally theoretical exercise, I’m inclined to believe that the time to be a seller of UAN has come and gone.

That’s not to say that everything will be rosy going forward, it’s simply to remark that looking at UAN objectively, there’s a positive risk reward on offer here.

There aren’t so many areas of the market apart from energy priced at single digits to GAAP earnings. And sure, energy stocks are likely to continue to be attractive, but for investors looking elsewhere for market exposure outside of just energy, I believe that fertilizer is well worth considering.

Be the first to comment