Patrick Kaiser/iStock via Getty Images

Dear readers/followers,

I very much like investing in Aluminum and commodities businesses overall. Fertilizer, Chemicals, Concrete, Metals, alloys – at the right prices, it all becomes attractive to “BUY” – and I’ve been doing so for years. Kaiser Aluminum (NASDAQ:KALU) is an American company in the S&P600 out of Franklin, TS. The company is neither the largest nor the most efficient, but at the right price, it is undoubtedly an attractive business.

Let’s see what makes this business tick and where we can go from here in terms of investing.

Kaiser Aluminum – What the company is and does

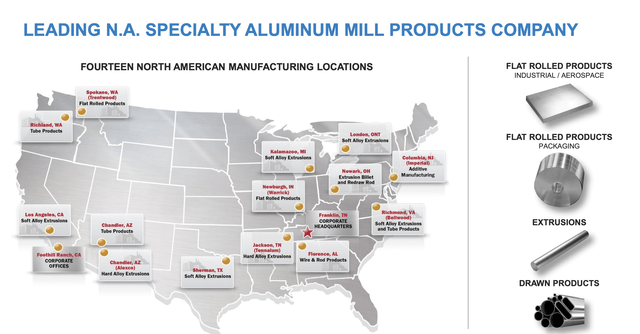

The company has a history going back around 75 years when Henry J. Kaiser bought three government-owned aluminum facilities in Washington. The company quickly grew to become a vertically integrated producer of aluminum, and over the next 50-60 years would M&A and become larger and larger, ultimately becoming one of the leading NA producers of aluminum product.

Like International peers, including Hydro (OTCQX:NHYDY), the company works with flat/rolled products, extrusions, and drawn products. Unlike Hydro, KALU is not yet anywhere near market-leading or forward-thinking in terms of ESG aluminum and low-cost/low-power aluminum. It also doesn’t have its own power generation, which can be considered a positive with aluminum given the immense power requirements for working/creating the metal.

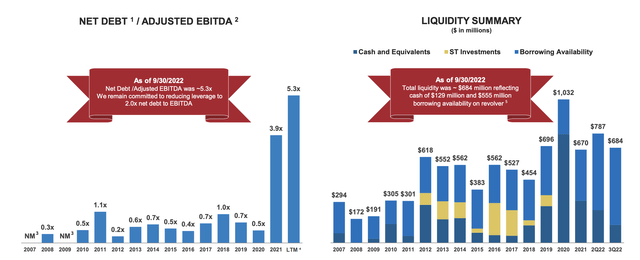

On a high level, Kaiser has a market cap of around a billion, working with revenues of $3.5B, of which it generates an EBITDA of around $200M and paying a dividend of around 5% historically, around 3.8% currently. The company is relatively indebted, coming in at 5.3x net debt/EBITDA. This goes some way to explain the sub-par credit rating of below BBB, coming in at a BB-rating.

KALU is a volatile company in terms of valuation, and it hasn’t always been easy making a profit from investing in the business. Since early 2007, your total annualized RoR would be around 3.9% until today, which is below the mark of the market. However, if you start considering valuation trends, patterns appear that allow for effectively buying, and recognizing when to sell the company at a profit.

Like all Aluminum businesses, the company’s appeal is broad and diverse.

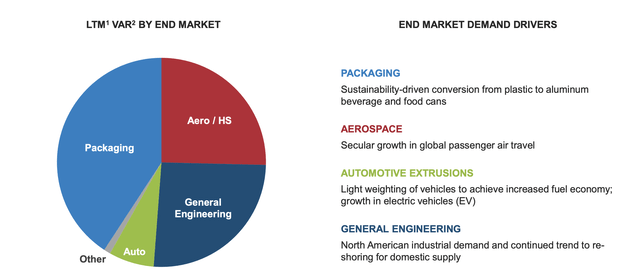

This market is massive on a global basis, and the company’s focus is both extrusion and flat-rolled products. Products go to building/infrastructure, bus/trailer, and industrial applications for extrusion, Auto Body sheeting, Foil, Can Stock, and other sheet/plate for the rolled products. The company’s revenue split in terms of market is heavily tilted towards the packaging market, which is somewhat less volatile than automotive, aero, and infrastructure.

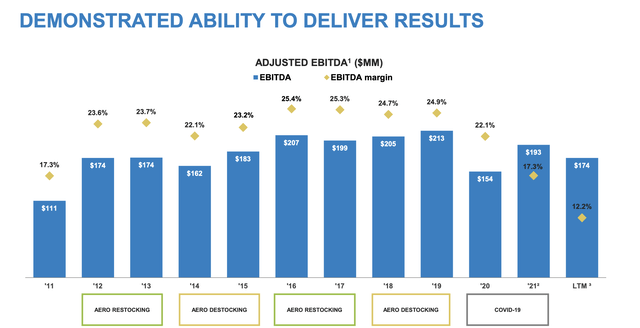

Despite sub-par return numbers, the company’s trends over the past 10 years have been relatively stable overall, and Kaiser is not a bad company. It has a history of being able to deliver results, even in the more difficult of market cycles. Margins have been decent with certain exceptions, and the company has been able to generate through-cyclic stable EBITDA on an adjusted basis.

Furthermore, the current outlook for the company’s 4 end markets remains relatively positive, with 2-7% CAGR for the coming few years. The most positive outlook is in packaging, with the expected shift from plastic to aluminum, the lowest CAGR is found in General Engineering, with around 2% longer-term demand growth expected here.

Drivers in demand are expected to be multi-year contracts with large distributors, efficiency investments where KALU intends to improve its assets, and converting current capacities to higher-margin products, a development that’s already started. The 3Q22 volumes were down almost 40 million lbs, but the actual value-added revenue was up compared to periods with higher shipments.

Furthermore, the company sees continued strength in the massive aerospace backlog that there currently is on a global basis. 2005 this backlog was 3 years – today it’s over 8 years, ensuring demand for aluminum going forward. Also, trends in automotive are aluminum-positive as well, with the aluminum content per automobile growing in light of the shift to EVs. a development that’s expected to continue in light of Electrification, engines, drivetrain, and aerodynamics, which all speak in favor of aluminum.

The challenges instead come in the form of costs, pass-throughs and pricing. There is a lag time that depends on market conditions. When metal prices are rising and demand is strong, the lag time is very short – but during a weak demand, the lag time grows. The opposite is true when the situations for pricing and demands are reversed.

The company’s recent bounce in leverage is something very new. The company’s target is to reduce this back down to below 2x net debt/EBITDA as soon as possible, and the company has ample liquidity currently available.

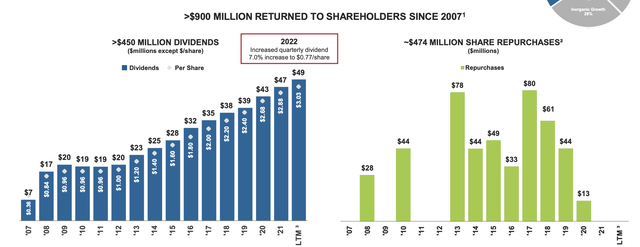

Capital allocation priorities are relatively clear. The company targets around 15-17% of the capital to dividends on an annual basis, with most of the money coming in allocated to either organic growth or M&A’s. Equally much as dividends are being used for share buybacks when possible.

For an aluminum company, the dividend stability is impressive, and share repurchase trends also show appeal here, as the company seems to target these during appealing times.

So, from an investment stability perspective as far as dividends go, this is an appealing business – more so than most metal businesses, in fact.

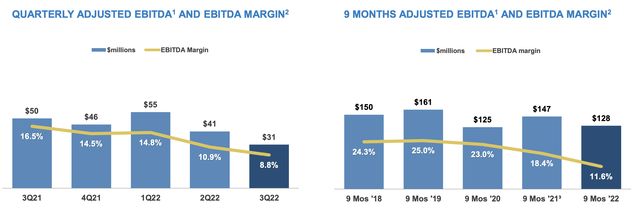

Recent results we have are 3Q22 – and these results came in at relatively appealing levels. Revenue was decently stable, even with shipments slightly down – and the 9M22 numbers show growth in both revenue and shipments to 2021.

Unfortunately, cost and input variables are making things very unfavorable on the margin side of things. 3Q22 margins on an adjusted EBITDA basis dipped below 10%, and are hanging precariously close to double digits for the full year.

What are the problems? Many things, as it happens. The company has ongoing inflationary cost issues such as alloy costs, freight, salary, SG&A, molten metal supply chain issues, and added to by company-specific issues, with operating inefficiencies that are taking their toll.

From an end-market perspective, things are more stable. Not a single of the company’s 4 end market segments showed any particular weakness here – even if automotive was somewhat muted due to continued semi shortages out of China.

The company has given us forecasts for 4Q22 – and these largely confirm what we see on a more global basis. End markets for aluminum remain positive – further, aluminum is needed. The company hopes to solve its inefficiencies and supply chain issues, which should lead to increased shipments, and start bringing home some efficiency improvements.

KALU can’t do anything about inflation – and these headwinds are going to persist – but aside from that, the company’s outlook for 4Q22 is positive.

In the end, KALU is what it appears to be. It operates a strong, NA-based aluminum portfolio in 4 appealing segments with appealing dynamics. It has a strategy for long-term growth, and a solid history in dividends and stability to back this up. In some ways, it’s more stable than Hydro.

However, it also lacks meaningful, IG-rated credit, and it does come with all the negatives and risks of an aluminum business. You should never “BUY” these businesses at too expensive levels.

Let’s, therefore, take a look at valuation.

Kaiser Aluminum – The valuation

The outlook for company valuation is mixed here, and it’s very difficult to put where we would want to evaluate the company. The current blended P/E is close to 73x for the 2022E period, which makes no sense until you look at earnings trends.

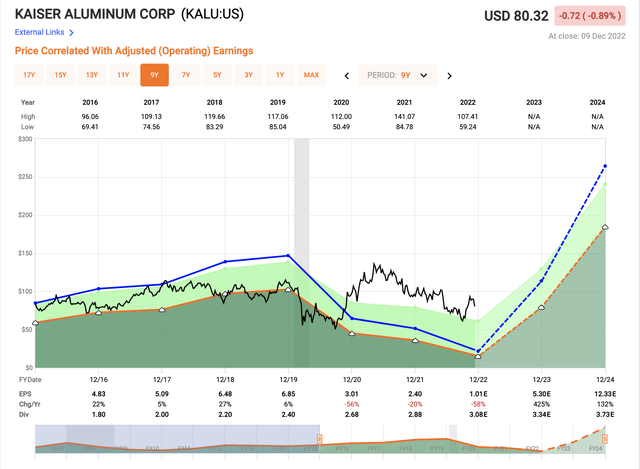

KALU Valuation (F.A.S.T graphs)

If we average out earnings over a longer period of time, KALU comes in at around 18.5x. This is still heavily distorted, but less so than 73x. On a sales multiple, we’re currently paying less than 0.4x, and less than 0.65x to revenues for the business.

The company trades with peers that are larger, and not seldom more effective than KALU. NHYDY is the closest that comes to mind, and the relative valuation for NHYDY is cheaper in terms of P/E, if not revenues. Other peers include Commercial Metals (CMC), ATI (ATI), and some Asian companies in the same business.

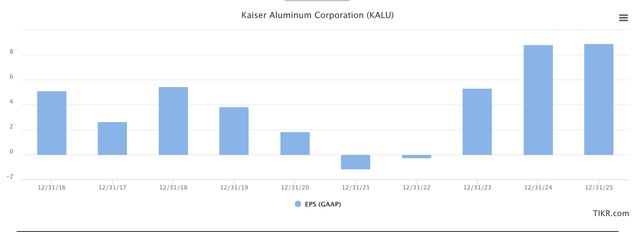

The company is in a GAAP-specific slump due to macro as well as company inefficiencies – but analysts everywhere agree on that things will turn around in 2023 and beyond, when the company’s earnings are forecasted to revert back to 2016-2018 levels, before going significantly higher.

KALU EPS forecast (TIKR.com/S&P Global)

There also isn’t a dividend cut forecasted.

However, analysts here should not be trusted. On a 1-year forward basis with a 10% MoE, the negative miss ratio is nearly 70% here, implying that analysts often, and by more than double digits, miss targets. For the past 2 years, analysts have missed targets by more than 42% in terms of EPS (Source: FactSet)

The average PT for the company according to analysts currently comes to a range of $68 all the way up to $105, with an average of $81. That makes any upside here less than 1.5%, even on a conservative basis. 3 analysts follow the company, and only 1 has it at a “BUY”.

In the case of a P/E-based normalization to around 17-19x P/E, which is where this company typically trades, we could expect annualized RoR of over 70%, based on very positive EPS estimates of $12.33 for 2024E. However, this is not a forecast that I am comfortable making for a 3.8%-yielding commodities company with less than $1.5B in market cap, a BB-rating, and a history of volatility and market underperformance.

I want more clarity, or a cheaper price before I would be willing to go in here. For that reason, I’m giving the company a normalized P/E multiple of 15x, coming to a PT of $70/share.

If the company does go to $70/share, I would be willing to take a stake in this business – because I don’t see it going anywhere – but I also want a better opportunity for an upside. Because at any time at such a multiple, if you had bought the company for the longer or mid-term here, then you would have been pretty fine, all things considered.

If you on the other hand allowed for a premium, you usually would have ended up underperforming the market.

That makes the following my initial thesis for KALU.

Thesis

- Kaiser Aluminum is a not-uninteresting aluminum company active in 4 appealing end markets. It has a solid yield, not a solid credit, and difficult, volatile forecasts. In order to make sure that you have a good upside here, you need to buy the company towards the cheaper end of its usual spectrum.

- I view this as being around $70/share, which is where I start my coverage of Kaiser Aluminum.

- For that reason, I wouldn’t go higher than “HOLD” at this time – but if the company were to drop enough, I will be investing here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company, due to BB, does not fulfill my quality criteria, nor is it cheap. For that reason, I’m only willing to give it a “HOLD” at this time.

Be the first to comment