FG Trade/E+ via Getty Images

Introduction

The Apple Hospitality REIT (NYSE:APLE) is a company I frequently covered before and during the pandemic. After all, that was the most interesting time to follow what had become a highly-volatile hotel industry. In this article, I’m going to cover the company again. Apple Hospitality is in a terrific spot again. The pandemic is over. Multiple financial indicators are above pre-pandemic levels. The dividend has rebounded, and the outlook is surprisingly good, especially in light of supply growth. Moreover, the company maintains a fantastic balance sheet, allowing it to withstand ongoing headwinds from high rates and Fed policy uncertainty. Hence, APLE’s stock is up this year, outperforming the market and most of its peers by a wide margin. I continue to believe that APLE will be a good source of long-term REIT income.

Now, let’s dive into the details!

Why Hotel REITs Make Sense

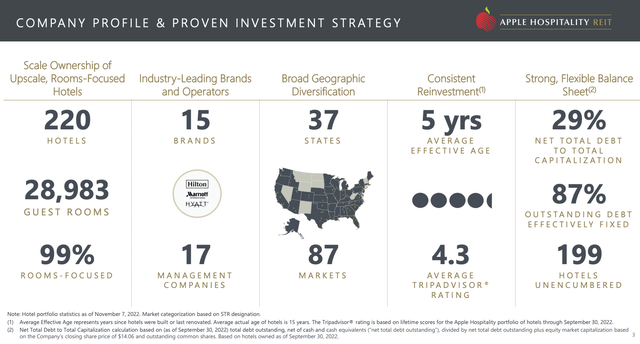

Apple Hospitality is a huge player in the hotel industry. How huge? Well, here are some numbers:

The latest numbers (November investor presentation) show that the company behind the APLE ticker owns 220 hotels. These hotels cover close to 29,000 rooms. The company is 99% room-focused. This means that, unlike some other players, it is less dependent on business events and related.

The company covers 15 brands. Most of them are Hilton, Marriott, and Hyatt. Its hotels are managed under separate management agreements with management companies. The largest is LBAM-Investor Group, managing 34 of APLE’s assets.

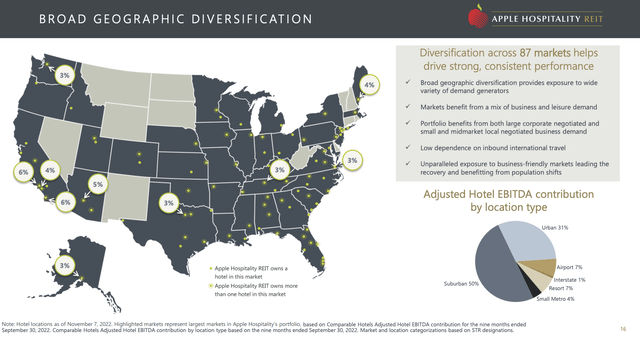

Its hotels cover 37 states and 87 markets. The average TripAdvisor rating is 4.3, which is satisfying – and no surprise as these branded hotels are often well-managed.

Since the pandemic, APLE has been a net buyer of hotels (in $, not units). It bought 14 hotels worth $558 million while selling 25 hotels for $253 million. Acquisitions are performing better than expected as a third of them are producing trailing twelve-month yields of more than 10%.

With that said, why would you want to invest in hotels? There are some benefits to commercial REITs. For starters, APLE gets most of its revenue from luxury hotels. The higher and upper financial classes tend to keep spending during recessions, despite the undeniable fact that travel spending is cyclical luxury spending.

Moreover, the hotel industry is competitive yet hard to master. Unlike self-storage and residential real estate, it’s hard to get access to hotels without being very wealthy – to begin with.

According to The Motley Fool:

In addition, unlike real estate purchases, REIT investors have no active involvement in the property. They only need to choose their hotel REIT carefully, accept the risks that may come with it, and sit back and watch their investment grow. They never have to evict anyone or clean up after a messy tenant; professional management teams behind the REITs do all the heavy lifting.

The APLE Dividend Is Back

The biggest reason why someone would buy into a competitive and rather slow-growing hotel industry is income. Heck, that’s the number one reason why people are buying REITs in the first place.

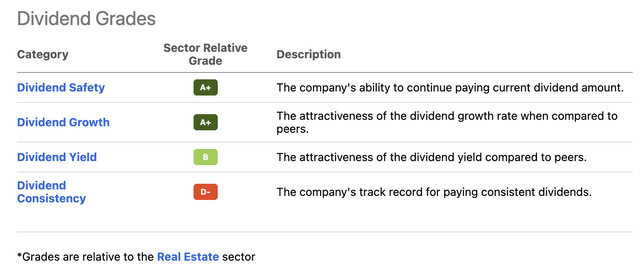

Looking at the Seeking Alpha dividend scorecard, the company scores high on safety and growth, somewhat high on yield, and abysmal on consistency.

That’s no surprise, as the company took measures in March 2020 to combat what was known as SARS-CoV-2 back then.

The company suspended its dividend, postponed all non-essential capital improvement projects, and used all of its liquidity to protect the business.

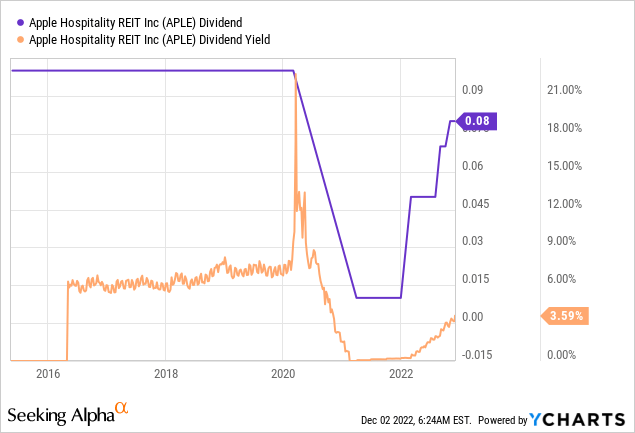

Before the pandemic, the company paid a $0.10 per MONTH dividend. Yes, APLE is a monthly-paying stock. The dividend was reinstated exactly one year later when management announced a penny per share in monthly dividends.

Now, the dividend is back at $0.08 per month, which translates to a 5.6% yield. In other words, the YCharts yield above has not been updated yet.

Before the pandemic, the stock usually yielded close to 8% as the stock price and dividend payout were steady. APLE was an income stock, not a growth REIT.

The company’s dividend recovery is impressive. However, what’s even more important is that it seems sustainable as fundamentals have come roaring back. This is what APLE’s CEO Justin Knight commented:

The increases in dividend are a direct result of continued strength in the operating performance of our hotels and an expectation the current trends would continue into the future. I think to your second question, our payout ratios are lower than they were prior to the pandemic. And we have, in addition to being in a position to increase dividends, been also able to preserve capital to reinvest in our business and to fund share repurchases and partially fund acquisitions and our capital improvement.

Moreover, the company repurchased shares.

Recent market volatility has also provided us with the opportunity to purchase our own shares at a meaningful discount to their intrinsic value. Through October, we had purchased just under 200,000 shares at a weighted average market purchase price of approximately $14.21 per share for an aggregate purchase price of approximately $2.7 million. Shares were purchased under a written trading plan as part of our share repurchase program.

As of October 31, 2022, the company had $342 million remaining under its program.

This Recovery Is Impressive

People researching commercial aerospace know that the United States was the first major country to recover from the pandemic. To this day, domestic travel in the United States is what drives aerospace demand.

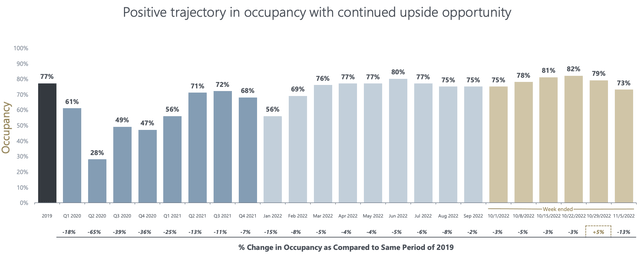

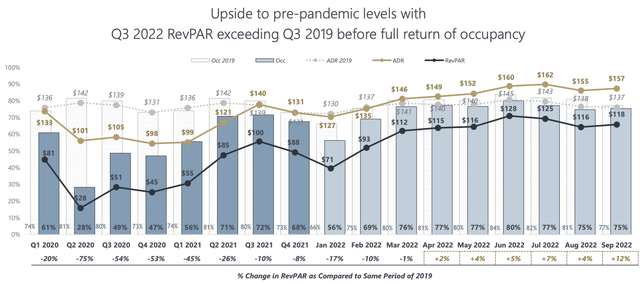

Related, hotels in the US are doing quite well. While occupancy rates for APLE hotels are not yet fully back to normal as the chart below shows, financial numbers have recovered.

Even better than recovered. The company’s average daily rates now exceed pre-pandemic levels. Revenue per available room has improved for six straight months versus pre-pandemic levels, with growth rates reaching double-digit levels.

Note that this recovery is happening despite imploding consumer sentiment, (related) high inflation, and increasing economic uncertainty.

If these headwinds were nonexistent, people would probably be camping outside of hotels to wait for an available spot.

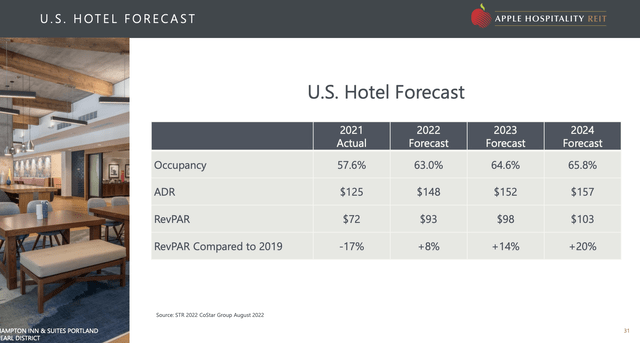

It also helps that industry forecasts expect this recovery to last.

Another tailwind is coming from supply growth. Apple Hospitality expects that nearly 50% of its hotels do not have any exposure to new projects under construction within a five-mile radius. That’s the lowest number in years as high construction costs and supply issues make building new hotels less attractive.

Healthy Balance Sheet

In light of high rates, it is important that APLE has a healthy balance sheet. As of September 30, 2022, the company had $1.3 billion in debt. $990 million of this came from term loans and senior notes. The company has no maturities larger than $240 million until 2025. $800 million worth of debt matures after 2026.

Moreover, 87% of its debt is fixed-rate debt. The weighted-average interest rate on its debt was 3.7% as of September 30.

With just 3.3x net debt to EBITDA, extended and staggered maturities, a relatively young portfolio and over $700 million in total liquidity, we are able to be both patient and flexible as we work to capitalize on dislocations in the market. We have been and will continue to be highly selective and intentional in the build-out of our portfolio pursuing assets that are additive to those that we currently own where we can achieve attractive pricing.

Outperformance & Valuation

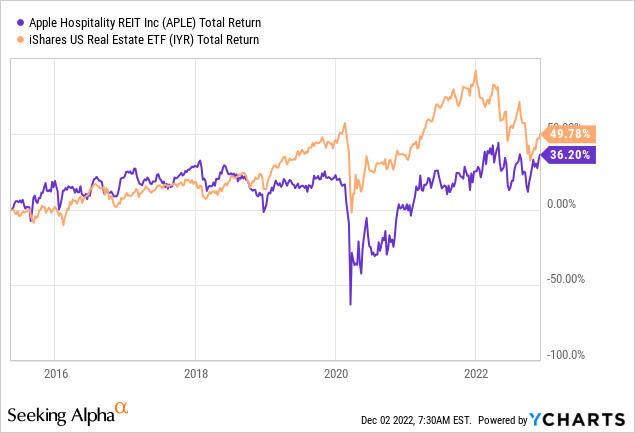

Hence, it is no surprise that APLE shares are back on track. Including dividends (the total return performance), APLE shares have almost closed the gap with the iShares US Real Estate ETF (IYR).

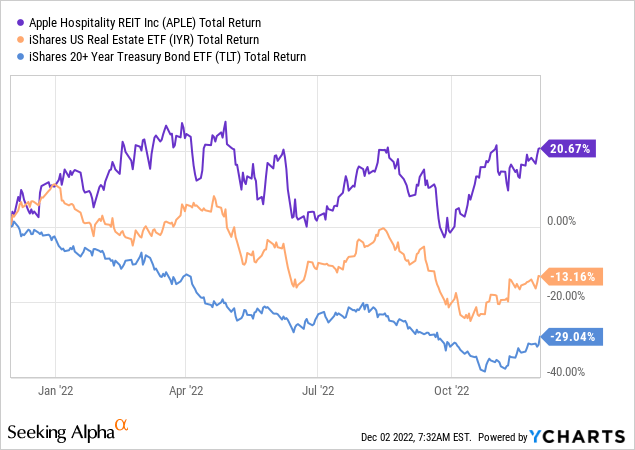

What’s important is that great fundamentals translate to strong outperformance. Over the past 12 months, APLE has returned 21%. Its REIT peers are down 13% as high rates are just not great for yield investments like REITs.

While I do not expect APLE to turn into a capital gains monster, I think the mix of a high (expected) dividend, buybacks, and low (expected) capital gains is a great recipe for high shareholder satisfaction.

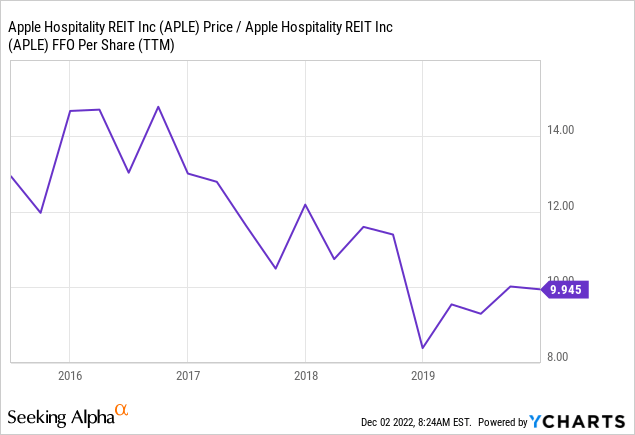

APLE shares are currently trading at 9.5x funds from operations. The historic range, excluding the pandemic (which messes up my y-axis), indicates that APLE shares are still highly attractively priced.

I agree with that. I believe that APLE should not be trading below $21 per share. That’s what I consider the fair value to be, for the time being.

Takeaway

APLE is back on track. The company has turned into a source of high and reliable REIT income again. Unless a new pandemic hits us anytime soon, I expect APLE’s dividend to soar to at least $0.10 per share per month again. This time, there’s more upside as the company is recovering beyond pre-pandemic levels.

Pricing is strong, occupancy rates are improving, and the outlook is supportive of further growth – despite economic challenges.

Moreover, in light of a hawkish Fed, APLE has a stellar balance sheet. The leverage ratio is low, almost all debt has fixed rates, and average yields are low.

While I do not expect APLE shares to take off anytime soon (or ever become a capital gains monster), I think the company is a great place to get high REIT income.

Depending on my personal income situation and diversification plans, I may buy myself some hotel exposure with APLE in 2023!

(Dis)agree? Let me know in the comments!

Be the first to comment