Drew Angerer

Introduction

It’s the first Friday of December. This means it’s time for the monthly jobless numbers. In this case, it’s once again a key report, as all eyes are on the Fed. After all, the market wants data to come in weak enough to keep the Fed from raising rates any further, but strong enough to keep the case alive for a soft landing.

Unfortunately – for the market – the jobs report was great. Job gains were consistent and higher than expected, even as job openings have come down. Moreover, wage growth was red-hot, which is the last thing I would want to see if I were in Jerome Powell’s shoes.

I’m afraid that my base case continues to be confirmed. As much as the Fed is trying to hint at a pivot, its job isn’t done. More work will be needed and markets will have to price that in.

The good news is that I’m preparing for what comes after that, which we will discuss in this article as well.

So, let’s get to it!

Why Does It Matter?

Besides the obvious reason that jobs are important in any consumer-focused economy, we’re dealing with a report that may tell us what the Fed is going to do when it comes to raising rates and fighting inflation.

Right now, we’re in a time of high and persistent inflation, weak consumer sentiment, weakening economic growth indicators, and a Fed that seems to stick to a very hawkish policy.

That’s keeping markets nervous.

Understandably, markets are looking for reasons that could end Powell’s aggressive hiking cycle. It would put an end to the liquidity downtrend, push up economic expectations, and allow investors to do what they do best: enjoying a Fed-backed stock market rally.

What Happened?

The November jobs report was good. Or bad, depending on how you look at it.

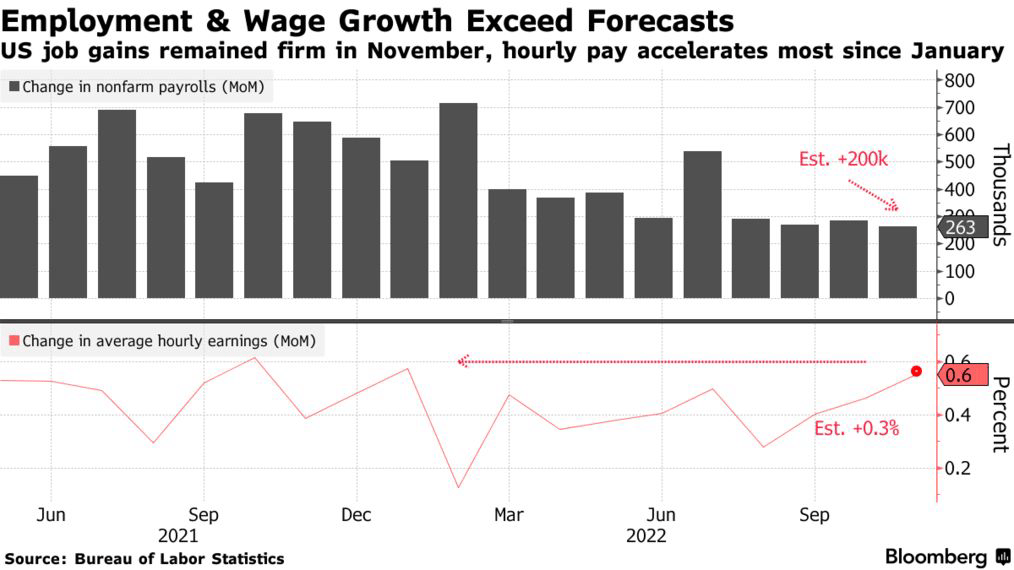

The US economy created 263,000 jobs in November according to the non-farm payrolls report. October job gains were revised higher to 284,000. Estimates were looking for 200,000 new jobs, which means the US economy did much better than expected.

Bloomberg

The unemployment rate came in at 3.7%. That’s exactly what the market expected.

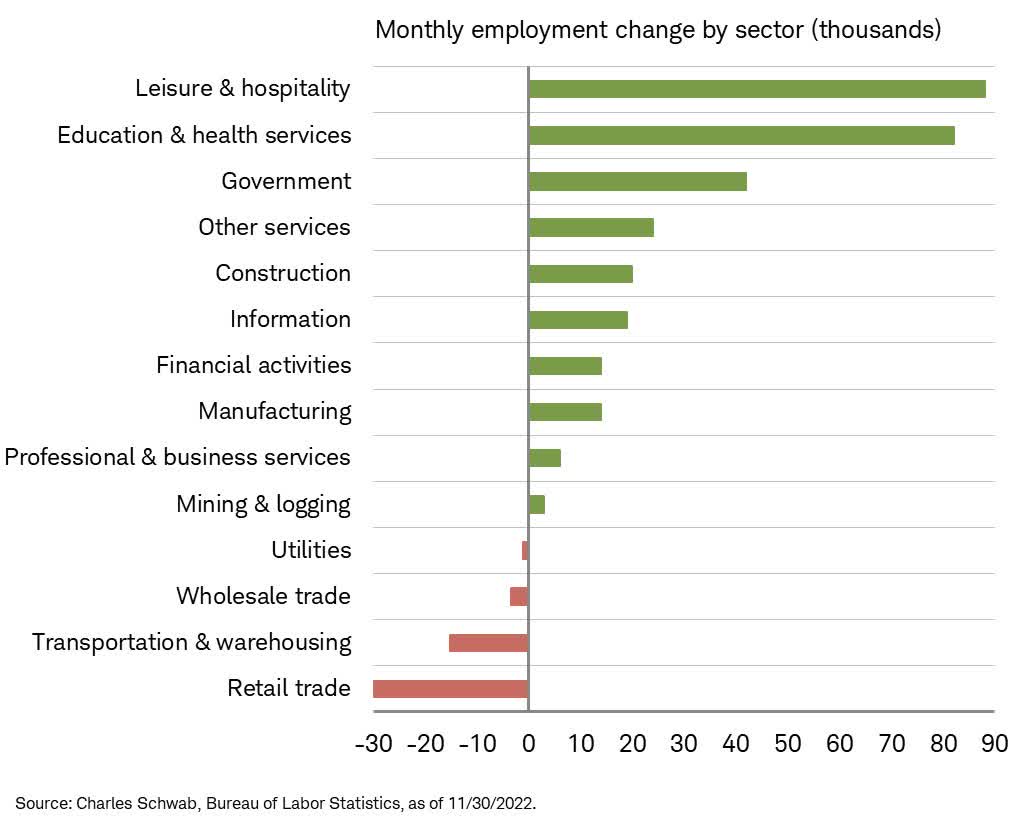

Jobs were created in most industries with weakness in retail trade, transportation and warehousing, as well as wholesale trade. This is a sign of weakness. Retail trade is suffering from consumer weakness while transportation companies are dealing with retail weakness and the post-pandemic supply chain bullwhip effect.

Charles Schwab

Anyway, the biggest problem here is that the US is generating more jobs than expected. That’s not deflationary. It also shows that the hiking cycle – so far – has not done too much damage. That gives Powell some confirmation that he didn’t go too far yet.

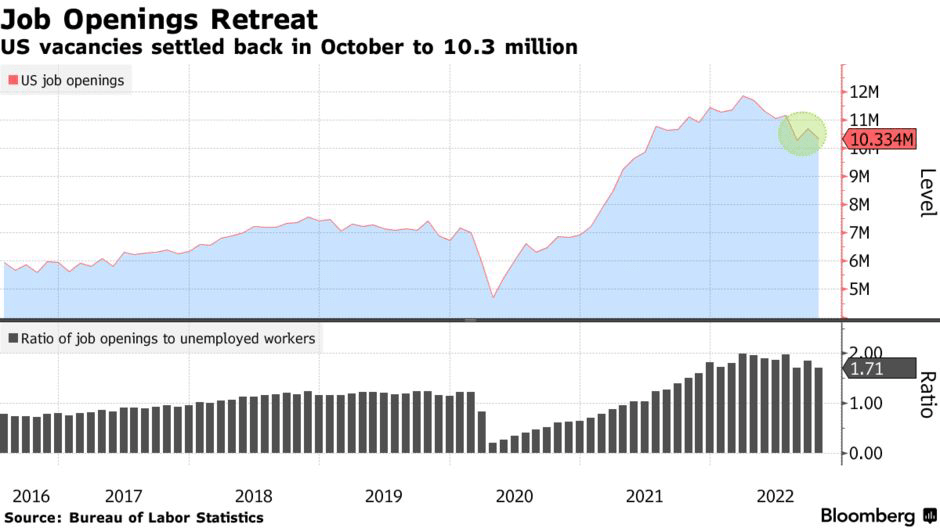

Moreover, despite a lower number of open jobs, there are still 1.71 open jobs for every unemployed worker in the United States. That’s higher than before the pandemic. While it’s down from 2.00 earlier this year, it’s still inflationary.

Bloomberg

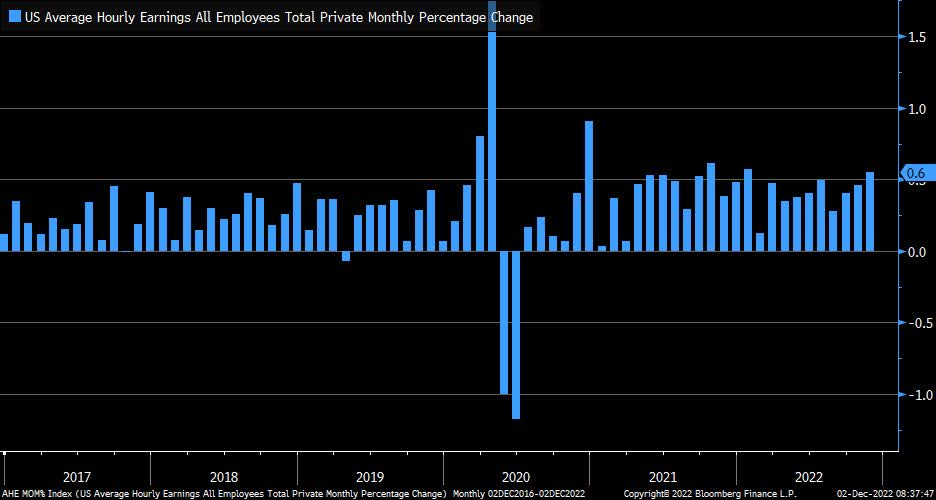

As a result, wage inflation remains high. As the first Bloomberg chart of this article showed, month-on-month average hourly earnings were up 0.6%. That’s a new multi-year high and higher than expectations of just 0.3%.

Bloomberg

That’s terrible news for the Fed as it needs to see some significant weakness in these numbers before it can end the fight against inflation.

Earlier this week, Powell said that a moderation in labor demand is needed to bring the jobs market back into balance.

Today’s numbers clearly show that this is not happening yet.

Now What?

People who, like me, monitor the market daily may have found that the market uses every piece of good info, every dovish comment to start a rally.

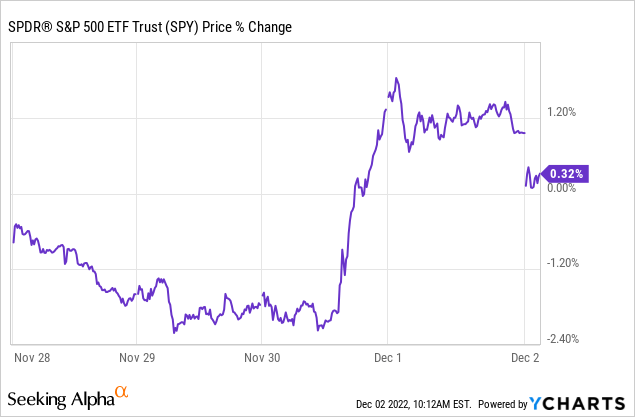

This week was a good example of that:

Powell only needs to think about the world “moderating” and stocks stage a rally.

I have often made the case that the Fed will have to pivot. At some point, the Fed will have to prioritize financial stability over fighting inflation. That’s why I like gold as I discussed in this article (among others).

I believe that the Fed will have to maintain a hawkish stance until there are clear signs that inflation is normalizing. Inflation peaking at 8% is now dovish. It’s obvious that inflation will come down going forward. The question is: how far?

My view is that the market has room to drop to the low 3,300 range. However, I’m not trading that target. I’m not short anything.

I’m looking for new opportunities and buying dividend stocks whenever I like the valuation – built around my cautious market view.

However, on the side, I’m increasing my savings rate and boosting my war chest for large investments down the road. Major housing investors have already made clear that they are waiting for more pain. They’re looking for unemployment to come up, forcing the Fed to cut rates (that’s when something breaks). At that point, large investors benefit from lower rates and uncompetitive private buyers (due to high unemployment).

I believe that this is a realistic scenario for a forced Fed pivot next year.

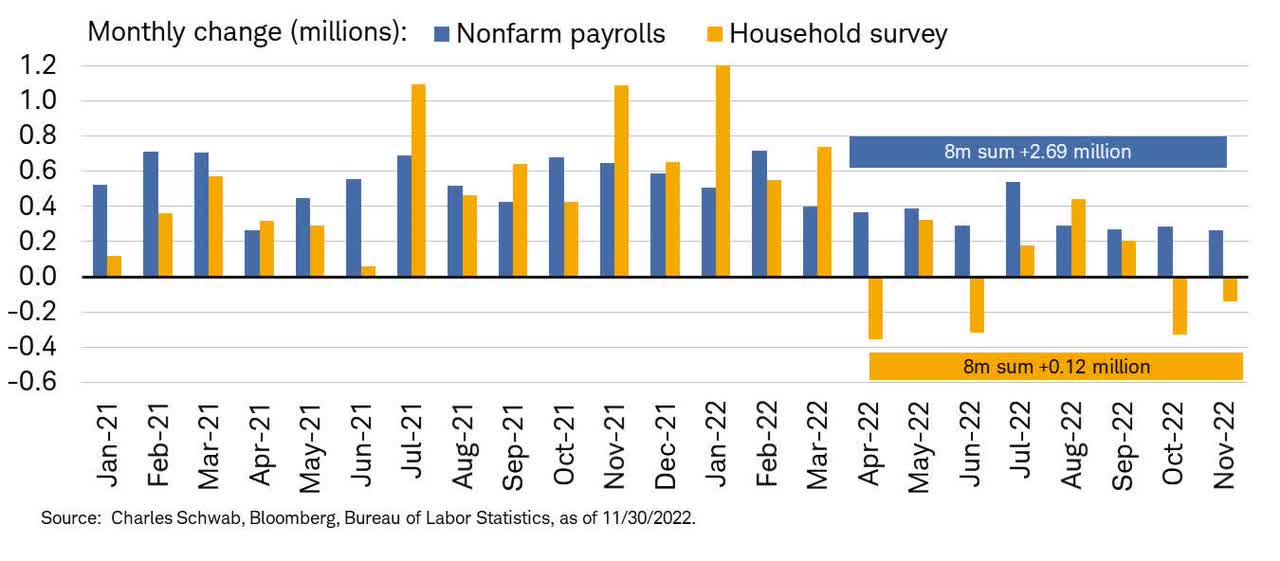

And, as we are discussing jobs, cracks are indeed starting to appear. While the non-farm payroll report has been strong, indicating 2.7 million new jobs over the past eight months. The household survey has been much weaker, indicating no net job growth.

Charles Schwab

The real gain is likely somewhere in between. Yet, the household survey tends to lead during economic downtrends.

I agree with that. The economy is weakening. Going forward, we’ll likely get more economic reports that support a pivot than reports making the case for high rates.

These reports will keep the market volatile, especially because once inflation is down, we could be left with a very fragile economy. An economy that would prevent stocks from rallying endlessly due to low inflation.

“Bears (like us) worry unemployment in 2023 will be as shocking to Main Street consumer sentiment as inflation in 2022,” strategists led by Michael Hartnett wrote in a note showing that global equity funds just had their biggest weekly outflows in three months. “We’re selling risk rallies from here,” he said, reiterating his preference for bonds over equities in the first half of 2023.

With that said, the timing of this report couldn’t be worse. The market is currently once again at major resistance. So far, this trend line has caused two severe drawdowns.

TradingView (S&P 500)

Again, I’m not day trading but making a risk/reward assumption.

I believe that my conservative strategy of only buying stocks on major weakness (in this environment) is justified – and confirmed by new developments.

Takeaway

The November jobs report was NOT what the market needed. Job fundamentals remain too strong. Labor demand is weakening but strong enough to maintain high wage inflation.

The Fed will have to witness some significant weakness in the labor market to communicate a crystal-clear pivot. We’re not at that point – yet.

I expect the market to remain in a very volatile sideways trend in the quarters ahead as the market is assessing growth slowly and persistently high inflation.

My view remains confirmed. I urge investors to refrain from chasing stocks on breakouts. Be aware of the risk/reward after the latest short squeeze. Pick a few stocks you like and monitor them until they reach a favorable risk/reward.

I’ve applied that strategy all year, and I believe it will guide as well until the Fed will, eventually, be forced to pivot in 2023.

(Dis)agree? Let me know in the comments!

Be the first to comment