CHUNYIP WONG

It is not exactly a secret that the current high inflation rate in the United States is devastating the portfolios and lifestyles of many investors. We have seen most market sectors decline precipitously in response to the rising interest rates and the end of the “free money era,” as well as facing higher prices for the things that we want to buy in our role as consumers. This has undoubtedly left many people scrambling for ways to protect their wealth. One potential option is real estate as it shares many of the same qualities that anything else does that sees price appreciation during inflationary times. The sector has admittedly underperformed year-to-date but there are still indications that it could be a good way to protect yourself long-term. This is particularly true with rental properties as rising rents can help to offset the impact of inflation. One of the easiest ways to invest in real estate may be to invest in a closed-end fund that focuses on this sector. These funds enjoy the benefit of professional management as well as the ability to employ certain strategies that can in many cases result in a higher yield than any of the underlying assets possess. In this article, we will discuss one such fund that investors can use for this purpose, the Nuveen Real Estate Income Fund (NYSE:JRS), which currently yields an impressive 10.52% as of the time of writing. I have discussed this fund before but over a year has passed since then so obviously a great deal has changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances.

About The Fund

According to the fund’s webpage, the Nuveen Real Estate Income Fund has the stated objective of providing a high level of current income and capital appreciation. This is not surprising since real estate has long been used by investors as an income vehicle. This is because it can be easily rented out to other people or businesses, who pay rent and thus provide a source of cash flow. Real estate investment trusts, which many real estate businesses are structured as also enjoy certain tax benefits if they pay out a significant percentage of their earnings as dividends so these companies frequently have higher yields than many other things in the market. Real estate also usually appreciates over the long term so capital gains are a secondary reason to invest in it.

As is the case with many real estate income funds, the Nuveen Real Estate Income Fund does not invest solely in common equity issued by real estate investment trusts. The fund also invests in debt and preferred securities issued by these companies. This is something that could give it a bit of an advantage in the current market because fixed-income securities are not nearly as vulnerable to a recession or other difficulties in the economy. This is because these securities pay out a fixed dividend or distribution that does not change based on the performance of the issuing company. With that said though, they do tend to vary with interest rates and the Federal Reserve’s aggressive interest rate hikes over the past several months have pushed down the market values of these securities. However, they should still hold their value over the long term a bit better than common stocks. On the flip side though, they do not have the same potential for capital gains that common stocks do.

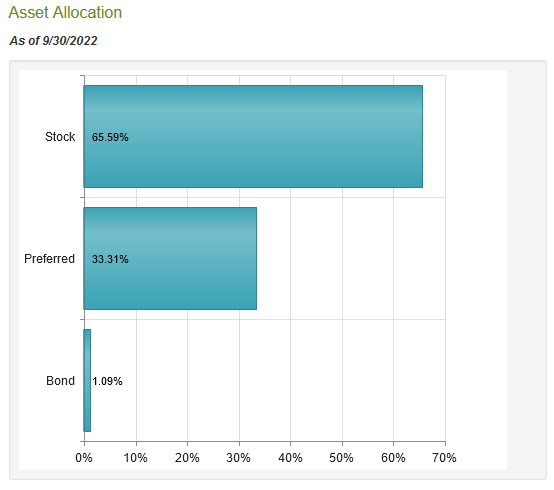

The majority of funds that can invest in both common stocks and fixed-income securities typically have a very high weight assigned to common equities. The fixed income is usually considered to be an afterthought. That is not the case with this fund, however. In fact, about a third of the portfolio is invested in preferred equities:

CEF Connect

The one thing that we note is that the overwhelming majority of the fund’s fixed-income allocation is in preferred stocks. It has very little exposure to bonds issued by real estate companies. This is a fairly big change from the last time that we looked at the fund as it greatly reduced its bond holdings in favor of preferred equity. This is not necessarily a bad thing though, particularly today. This is because preferred stock typically has a higher yield than bonds, although it is slightly riskier. The risk is overall minimal though since the preferred stock is still above common stock in the capital stack so if a company goes bankrupt and its buildings are forcibly sold off, the preferred stockholders must be paid before the common equity holders. This is a reasonable position to be in, especially since most real estate trusts have sufficient cash flow to pay the holders of both the bonds and the preferred stock.

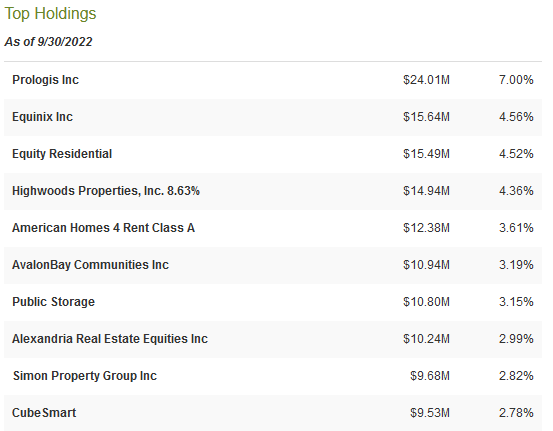

The largest holdings in the fund are likely to be familiar to most people that read articles about real estate investment trusts here at Seeking Alpha. This is because many of these are among the largest and most well-known companies in the industry. Here they are:

CEF Connect

Although the weightings of several of these companies have changed significantly, there were surprisingly few changes to the companies that made the largest holdings list over the past year. In fact, the only changes were Vornado (VNO) and Welltower (WELL) being replaced with Simon Property Group (SPG) and CubeSmart (CUBE). Simon Property Group makes much more sense now than it did a year ago. For the most part, the economy is now reopened and people are not really avoiding shopping malls out of fear of catching COVID-19 anymore. The higher mall traffic should generally prove to be a positive for Simon Property Group since higher traffic generally attracts stores that pay rent to the company. However, the current inflation rate also means that consumers have less discretionary income available to buy goods and services at shopping malls. Simon Property Group’s malls tend to be higher-end compared to many other mall owners so it is somewhat less likely that the typical customer visiting one of its malls will be affected by inflation when compared to a customer at a lower-end mall. The replacement of Welltower (a healthcare property owner) with CubeSmart (a self-storage property owner) is curious, particularly since healthcare is generally considered to be inelastic but self-storage is not. However, it is a fairly small percentage of the total portfolio so it does not really matter a whole lot.

The fact that so few positions in the fund have changed over the past year may lead one to think that the Nuveen Real Estate Income Fund has a fairly low turnover rate. This is not the case, however, as the fund’s current 92.00% annual turnover is higher than most equity and fixed-income funds. The reason why a high turnover can be problematic is that it costs money to trade stocks or other assets, which the fund’s investors end up having to pay. This is one reason why index funds have become so popular as their minimal trading lends itself well to providing investors with incredibly low expenses. The management of a closed-end fund, meanwhile, has to generate sufficient returns to cover all of the fund’s expenses and still outperform the index fund. The higher the fund’s expenses, the more difficult this task is. That does not necessarily mean that a fund with a high turnover will underperform but it does create a higher hurdle for management to clear.

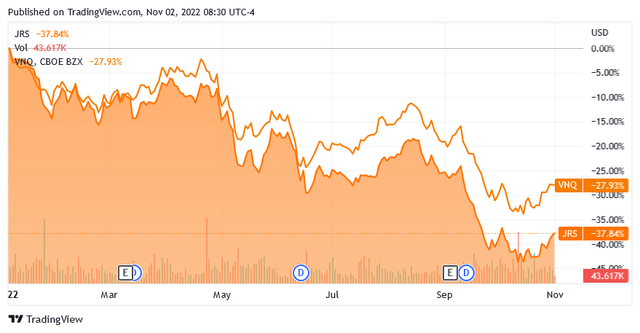

Unfortunately, the Nuveen Real Estate Income Fund has thus far failed to clear that hurdle. We can see this in the fact that it has significantly underperformed the Vanguard Real Estate ETF (VNQ) year-to-date:

This alone does not necessarily mean that the fund is performing as poorly as its share price indicates. This is because closed-end funds do not trade based on the performance of the portfolio itself. As we will see later in this article, it is common for a fund like this to trade for much less than the value of its assets or for much more than its assets. This is not the case with an exchange-traded fund. Thus, we should look at the performance of the underlying portfolio. Unfortunately, this is down by 33.82%, which is better than the fund’s market performance but it still underperforms the index fund. This is disappointing, although the Nuveen fund does have a considerably higher yield. The yield difference does close the gap between the two funds somewhat but the index fund still performed better overall.

Real Estate And Inflation

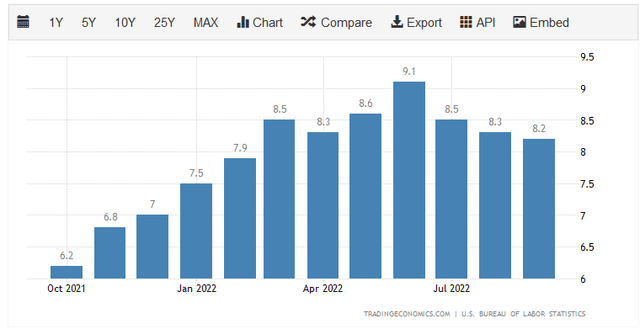

In the introduction to this article, I stated that real estate could work as a potential hedge against inflation. This is something that may be important to many people today because we are all suffering mightily under the ravages of inflation. The most recent consumer price index puts the inflation rate at 8.2% and the inflation rate has been over 7.5% since the start of 2022:

This is the highest rate of inflation that we have seen in more than four decades and it is doubly crippling because it is centered in the necessary areas of food energy. Although many people have seen rising incomes, the general increases in income have not been sufficient to beat the inflation rate. Thus, the finances of the average person are becoming increasingly strained. It is making most people feel as if they are getting poorer and poorer with each passing month.

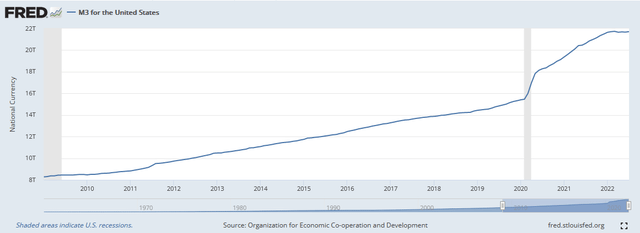

Real estate can help protect the purchasing power of your wealth. In order to understand why it is critical to understand the cause of inflation. Economists generally consider it to be a natural occurrence, but this is not correct. In fact, inflation is caused by the money supply growing faster than the production of goods and services in the economy. This has been the case in the United States for the past thirteen years but it was especially bad in 2020 due to the government spending enormous amounts of money ostensibly to fight the economic effects of the COVID-19 pandemic. This stimulus and pandemic spending was financed by the Federal Reserve printing money for the government to spend, as I discussed in a previous article. We can see the extent of the money-printing by looking at the M3 money supply of the United States, which is the most comprehensive measure of the supply of money in the economy. Here is the nation’s M3 money supply from January 1, 2009 (right at the end of the Great Recession) to today:

Federal Reserve Bank of St. Louis

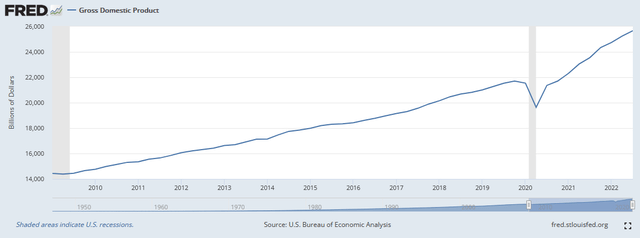

Over the time period in question, the M3 money supply went from $8.2737 trillion on January 1, 2009, to $21.7092 trillion today. This is a 162.39% increase over the period. We can see that the rate of increase increased substantially in both 2020 and 2021, which directly confirms my statement that the government’s pandemic- and stimulus-related spending was financed by the printing of new money. This would not be a problem if the economy grew sufficiently to accommodate the increase in the money supply. However, that has not been the case. Here is the nation’s gross domestic product over the same time period:

Federal Reserve Bank of St. Louis

As we can see, the nation’s gross domestic product went from $14.430901 trillion in the first quarter of 2009 to $25.663289 trillion today. That is a 77.84% increase, which is clearly substantially less than the increase in the money supply. The reason why this situation causes inflation is that a greater amount of money is available and attempts to purchase a given unit of economic output. Therefore, the law of supply of demand results in the price being bid up. At this point, there may be some readers that point out that we did not see inflation over the 2009 to 2020 period but this is not correct. There was significant inflation during that time but it was limited to the asset markets, which is why we saw a raging bull market and rising home prices over that time. The government’s pandemic-related spending efforts were intended to put money directly into the hands of people that would spend it, however, so now we are seeing inflation take hold in the real economy. It is highly unlikely that inflation will drop down to a more acceptable level in the near future either since there is now too much debt in the economy for the Federal Reserve to raise rates above 9%, which is what is actually needed to tame 8%+ inflation. Thus, today’s inflation will likely be with us for quite some time.

Real estate will usually hold its value reasonably well during inflationary times. This is because real estate possesses many of the same qualities that other items that experience rising prices do in the face of inflation. In particular, real estate is in limited supply, and constructing or improving it requires actual human or mechanical effort. Unlike fiat currency, real estate cannot be printed out of thin air. There might be some readers at this point that point out that we have seen some declines in housing prices over the past few months. That is true but that is not due to inflation. That is because many houses were valued at levels that assumed that a potential buyer could get a mortgage with an artificially low-interest rate. Now that interest rates are rising, there are fewer people available that could make the required monthly payment on the mortgage. Thus, sellers are reducing their prices in order to keep the property affordable to potential buyers. This is a factor of interest rates, not inflation. If we assume that high inflation will be with us for years, as it likely will, real estate should still serve as a store of wealth.

In addition to acting as a store of wealth, real estate investment trusts like the ones that the Nuveen Real Estate Income Fund invests in typically rent out their properties to tenants. As rental prices tend to rise with inflation, these companies should see rising cash flows in such an environment. This likewise helps to offset the impact of inflation on the property owner, despite the market’s current distaste for these companies.

Distribution Analysis

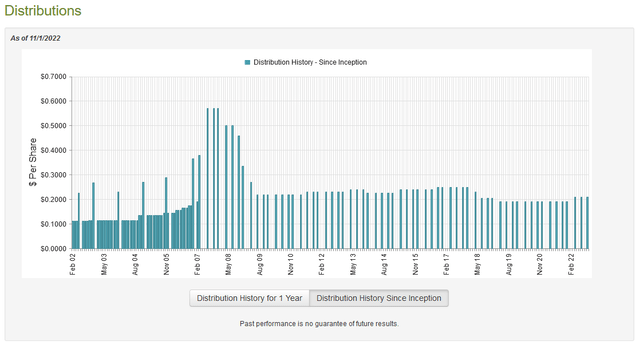

As stated earlier in this article, the Nuveen Real Estate Income Fund has the stated objective of providing its investors with a reasonably high level of current income and capital gains. In addition, real estate investment trusts typically pay out a fairly large percentage of their cash flows in the form of dividends, which gives them a higher yield than many other things in the market. As a result, we would likely assume that the fund has a fairly high yield itself. This is indeed the case as it currently pays out a quarterly distribution of $0.2090 per share ($0.836 per share annually), which gives the fund a 10.52% yield at the current price. This distribution has varied quite a bit over its history, although the fund did increase it earlier this year:

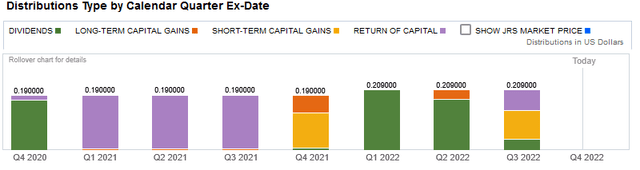

The fact that the fund’s distribution has varied a bit over the years will undoubtedly reduce the appeal of this fund in the eyes of someone that is looking for a steady and secure source of income with which to pay their bills. Interestingly, we can also see that the fund’s distribution does not appear to correlate much with interest rates so there must be other things at work. It is important to note though that anyone buying the stock today will receive the current distribution at the current yield, at least until the fund changes its payout again. Another thing that may concern potential investors is that a not insignificant proportion of the fund’s distributions over the past several quarters were considered to be a return of capital:

The reason why this may be concerning is that a return of capital can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any kind of extended period. There are other things that can cause a distribution to be classified as a return of capital though, such as the distribution of unrealized capital gains. As such, it would be a good idea to have a look at the fund’s finances and see exactly where it is getting the money to pay for its distribution and how sustainable it is likely to be.

Fortunately, we do have a fairly recent report to consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. This is a much newer report than we had available the last time that we looked at the fund and it should give us a good idea of how the fund is financing itself as well as how well it held out during the somewhat volatile market that dominated the first half of this year. During the six-month period, the Nuveen Real Estate Income Fund received a total of $6,571,986 in dividends and $37,101 in interest from the assets in its portfolio. This gives it a total income of $6,609,087 during the period. The fund paid its expenses out of this amount, leaving it with $3,584,283 available for investors. This was, however, not nearly enough to cover the $12,077,053 that the fund actually paid out in distributions during the period. This is likely to appear concerning at first glance, particularly considering that nearly all of the distributions for the first half of the year are classified as dividend income.

The fund does have other ways to get the money that it needs to finance its distributions, though. The most common of these is capital gains. Unfortunately, the fund failed to produce any capital gains during the period. The fund reported net realized losses of $643,416 amplified by net unrealized losses of $98,309,100. Overall, the fund saw its assets decline by $107,445,286 during the six-month period. This is not at all encouraging and clearly indicates that the fund is failing to actually earn the money needed to cover the distribution. It will need to correct this in the very near future, but the current market is not promising many opportunities for it to do that.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Nuveen Real Estate Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them for less than the net asset value. That is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of November 1, 2022 (the most recent date for which data is currently available), the Nuveen Real Estate Income Fund has a net asset value of $8.21 per share but the shares only trade hands for 7.97 per share. This gives the shares a 2.92% discount to the net asset value. This is not an unattractive price, but it is not nearly as good as the 5.85% discount that the shares have traded at on average over the past month. Thus, it may make sense to wait a bit for an even more attractive price to come along before buying into the fund.

Conclusion

In conclusion, real estate could be a way to help protect your wealth against the ravages of inflation. This is especially true if buying rental properties like the ones owned by most real estate investment trusts because the rent will usually increase with inflation. Unfortunately, this fund has failed to outperform a real estate index fund but the much higher yield of the Nuveen fund may be attractive to some investors. The distribution may not be sustainable though due to the losses that the fund is taking right now resulting in it paying out far more than it is bringing in. The price is reasonable, if not attractive yet, but overall it might make sense to wait for a better entry point.

Be the first to comment