Mark Wilson/Getty Images News

Introduction: Why Is JPM Stock Up?

JPMorgan Chase & Co. (NYSE:JPM) reported their Q3 2022 results on Friday (October 14). JPM stock finished the day up 1.7%.

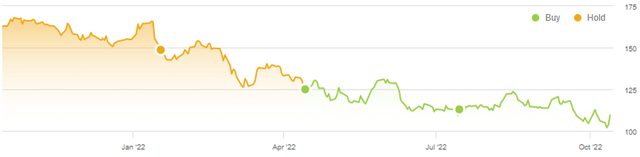

We upgraded our rating on JPM from to Buy in April, having covered the stock on Seeking Alpha since 2019. JPM shares are currently down 11.0% (after dividends) since our upgrade, having fallen by 31% year-to-date:

|

Librarian Capital JPM Rating History vs. Share Price (Last 1 Year)  Source: Seeking Alpha (14-Oct-22). |

JPM’s Return on Tangible Common Equity (“ROTCE”) was an above-target 18% in Q3 2022, though this may prove to be its last good quarter before a downturn. Higher interest rates have significantly benefited Net Interest Income (“NII”), including a temporary boost related to timing, but have not yet had an adverse impact on loan growth or credit losses. In Non-Interest Revenues (“NIR”), Investment Banking fees have fallen materially but were still solid relative to pre-COVID levels, while trading income was boosted by the quarter’s market volatility. Management has improved the NII and Card Net Charge-Off parts of full-year 2022 outlook, but kept the Expense part unchanged.

We expect earnings to decline in the near term, especially with CEO Jamie Dimon having warned on the possibility of a U.S recession in 6-9 months and a further 20% decline in the S&P 500 index. Nonetheless, JPM’s eventual credit losses will likely be limited, and management remain confident that medium-term targets will be met. JPM shares are trading at 1.6x Price / Tangible Book Value, implying a normalized P/E of around 10x. Our forecasts indicate a total return of 86% (22.5% annualized) by 2025 year-end. The current Dividend Yield is 3.6%. Buy.

JPMorgan Buy Case Recap

We believe JPM has the best franchise among large U.S. banks, though Bank of America (BAC) has similar advantages and is also Buy-rated in our coverage. We believe large U.S. banks can grow their earnings at “GDP +”, thanks to their scale, diversified franchise and leading market positions:

- Large banks achieve NII on favourable Net Yields, thanks to their cheap deposit funding; Net Yields had shrunk in recent years due to Quantitative Easing (“QE”), but are reversing with recent rate hikes

- They have large NIR such as investment banking fees, which tend to become elevated during periods of QE as cheap money stimulates corporate and market activity, offsetting NII weakness

- Their cost ratios tend to be stable or improving, as economies of scale and use of technology help them become more efficient

- They are now far less impacted by economic downturns than in the past, thanks to QE policies and much larger capital buffers after the 2008 crisis

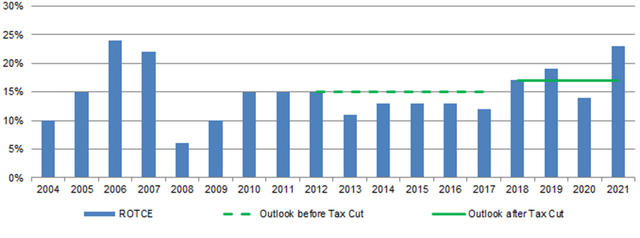

As of our July update, we believe JPM can achieve a long-term, across-the-cycle average ROTCE of 15.5%, supported by its track record (adjusted for differences in capital ratios before 2008 and the tax rate before 2018), though 1.5 ppt lower than management’s own 17% average across-the-cycle target:

|

JPM ROTCE vs. Medium-Term Outlook (Since 2004)  Source: JPM results supplements. |

We also believe JPM shares should trade at a 14.5x P/E, which on a 40% Payout Ratio would mean a Dividend Yield of 2.8%. With a ROTCE of 15.5%, this implies JPM shares should trade at a P/TBV of 2.1x.

JPM’s Q3 2022 results were materially better than our long-term assumptions.

JPM ROTCE at Above-Target 18%

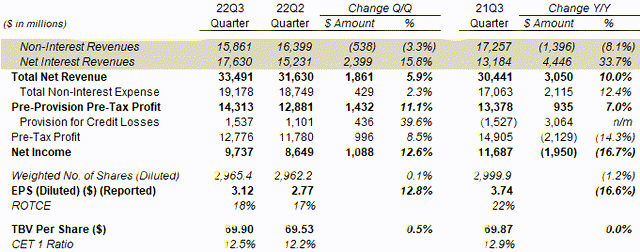

JPM’s ROTCE was 18% in Q3 2022, compared to 17% in Q2 and 22% in the prior-year quarter:

|

JPM Results Headlines (Managed Basis) (Q3 2022 vs. Prior Periods)  Source: JPM results supplement (Q3 2022). |

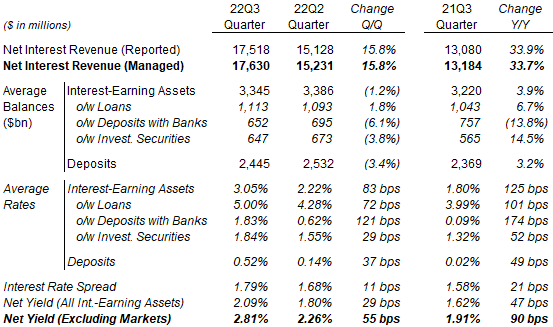

Net Interest Income was 15.8% higher sequentially and 33.7% higher year-on-year, benefiting from both higher interest rates and loan growth. Higher interest rates meant that JPM’s Net Yield (Excluding Markets) rose 55 bps sequentially and 90 bps year-on-year to 2.81% in Q3. Loan growth mean the average Loans balance in Q3 was 1.8% higher sequentially and 6.7% higher year-on-year, though Total Interest-Earning Assets fell slightly from Q2 with small reductions in lower-yield Deposits with Banks and Investment Securities, after a 3.4 decline in Deposits (“primarily” in attrition of non-operational balances):

|

JPM Interest Revenue, Loans & Rates (Q3 2022 vs. Prior Periods)  Source: JPM results supplement (Q3 2022). |

NII in Q3 2022 included a temporary boost related to the timing, as rates paid to customer deposits tend to rise less quickly than rates earned on interest-earning assets. Deposit beta, the percentage of interest rate changes passed on to customers, has so far been low by historical standards, though it is expected to catch up overtime. For this reason, management expect 2023 NII to show a “modest decline” from the guided Q4 2022 run-rate (more below).

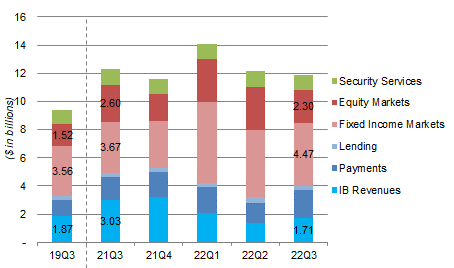

Non-Interest Revenues were down only 3.3% sequentially and 8.1% year-on-year, as Investment Banking fees fell 43% from the prior year but were just 8% lower than in Q3 2019, Equity Markets trading income was $295m lower year-on-year, while Fixed Income trading income was $797m higher, boosted by the quarter’s market volatility:

|

JPM Corporate & Investment Banking Revenues (Q3 2022 vs. Prior Periods)  Source: JPM results presentations. |

We believe NIR may fall further in future quarters. JPM CEO Jamie Dimon predicted “lower IB revenues next quarter than this quarter” on the earnings call, while also stating that trading income was unpredictable.

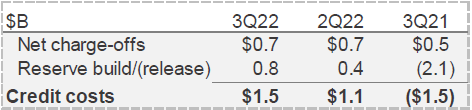

Credit costs have remained low, despite higher interest rates. Total Provision for Credit Losses were $1.54bn in Q3 2022, consisting of Net Charge Offs (“NCOs”) of $727m and credit reserve build of $808m:

|

JPM Provision for Credit Losses (Q3 2022 vs. Prior Periods)  Source: JPM results presentation (Q3 2022). |

The $727m Q3 2022 NCO figure was basically flat from Q2 and low by historic standards, while the $808m reserve build was partly due to loan growth, included a release in Home Lending (of $150m), and was low by historic standards. (For example, JPM had a reserve build of $6.8bn in Q1 2020, after the start of the COVID-19 pandemic.)

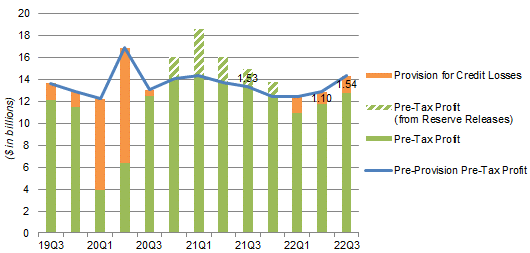

Overall, JPM’s Pre-Provision Pre-Tax Profit has in fact been rising the start of 2022, and was higher than in 2019:

|

JPM Earnings, Provisions & Pre-Tax Profit by Quarter (Since Q3 2019)  Source: JPM results supplements. NB. Figures on managed basis. |

Common Equity Capital Tier-1 (“CET1”) ratio was 12.5% at Q3 2022, in line with Q4 target of 12.5% and on track to meet Q1 2023 target of 13% (the targets each include a 50 bps buffer over regulatory requirements).

Management also raised parts of their full-year 2022 outlook.

JPM’s 2022 Outlook Raised

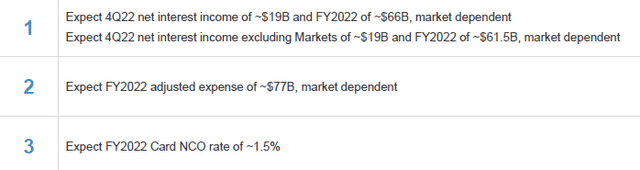

Management has improved the NII and Card Net Charge-Off in their full-year outlook, but kept Expenses unchanged

|

JPM 2022 Outlook(Updated)  Source: JPM results presentation (Q3 2022). |

2022 NII Excluding Markets is now expected to be “around $61.5bn”, up from “$58bn+” guided at Q2 results, while Card NCO is now expected to be “around 1.5%”, improved from “less than 2%”. Expenses were unchanged at “around $77bn”.

JPM Earnings May Start to Decline

We expect earnings to decline in the near term, especially in the event of a U.S recession.

As described above, management has already guided to NII to be lower in 2023 than in Q4 2022, and for Investment Banking fees to be lower in Q4 2022 than in Q3.

In an interview with CNBC on Monday (October 10), CEO Jamie Dimon warned on the possibility of a U.S recession in 6-9 months and a further 20% decline in the S&P 500 index. He said:

These are very, very serious things which I think are likely to push the U.S. and the world – I mean, Europe is already in recession – and they’re likely to put the U.S. in some kind of recession 6 to 9 months from now … (The S&P) may have a way to go … it could be another easy 20%”.

Loan growth and credit quality were strong in Q3, but there were early warning signs among some customers:

With spending growing faster than income, we are seeing a continued decrease in (Consumer & Community Banking) median deposits year-on-year, particularly in the lower income segments. And not surprisingly, small business owners are increasingly focused on the risks and the economic outlook.”

Jeremy Barnum, JPM CFO (Q3 2022 earnings call)

A recession in the U.S. will negatively impact JPM in a variety of areas, including lower loan growth, higher credit losses, lower investment banking activity levels, as well as lower asset levels in Asset & Wealth Management.

Nonetheless, JPM’s eventual credit losses will likely be limited, and management remain confident that medium-term targets will be met.

JPM Resilience and Medium-Term Targets

We have always believed that JPM will be able to limit credit losses, thanks to its best-in-class culture and risk management. CEO Jamie Dimon predicted that JPM would need only $5-6bn of additional credit reserves in a recession:

This number is going to be plus or minus several billions but, if unemployment goes to 6%, and that becomes the central kind of case, and then you have possibly it gets better, possibly it gets worse, we will probably have bad debts of about $5 or $6bn. That probably will happen over two or three quarters”

A credit reserve build of $5.5bn would be easily manageable, being equivalent to just 10% of JPM’s 2021 Pre-Provision Pre-Tax Profit ($54.0bn) or just 2.7% of its latest Tangible Common Equity ($205.0bn).

Similarly, management remains confident that JPM can meet its medium-term target of a 17% ROTCE. CEO Jamie Dimon confirmed this on the call and shared his view that JPM’s Q3 2022 ROTCE of 18% represented only “a little bit” of over-earning on NII and some over-earning on credit quality, and that recent acquisitions in non-capital, service-related businesses should help JPM achieve its ROTCE target, even with its expected higher capital requirement.

Our JPM Stock Forecasts

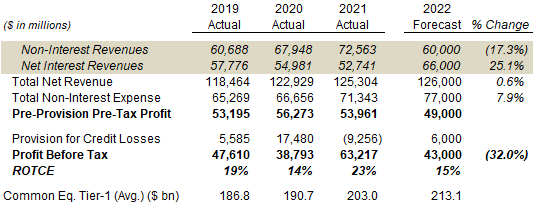

We agree with management’s assessment. For 2022, we now assume:

- NII and Expenses to be in line with guidance

- NIR to be $60.0bn (was $63.7bn), compared to Q1-3 figure of $47.6bn

- Provision for Credit Losses to be $6.0bn (was $5.59bn), compared to Q1-3 figure of $4.10bn

- Average CET1 capital to be 5% higher year-on-year (unchanged)

Together these give a 2022 ROTCE of 15% (compared to Q1-3 figure of 17%):

|

Illustrative JPM 2022 Forecasts  Source: Librarian Capital estimates. |

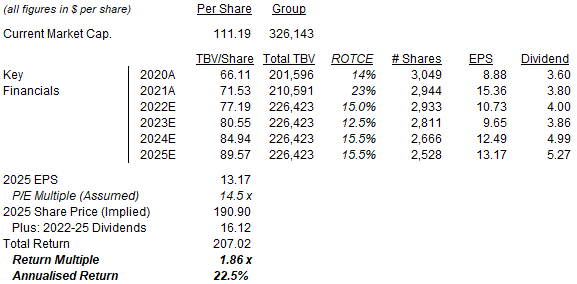

For 2023-25, we revised our assumptions as follows:

- Tangible Book Value to rise to $226.4bn at 2022 year-end then stay flat (was $225.2bn)

- Share count to be 2,933m at 2022 year-end (unchanged)

- ROTCE to be 15% in 2022 (was 14%) and 12.5% in 2023 (was 15.5%)

- Dividend to be $4.00 in 2022 (was $4.29)

- ROTCE to be 15.5% from 2024 (unchanged)

- Dividend to be on a 40% Payout Ratio from 2022 (unchanged)

- Net Income after dividends to be spent on buybacks from 2023 (unchanged)

- Buybacks to be done at 1.8x P/TBV (unchanged)

- P/E multiple to be 14.5x at 2025 year-end (unchanged)

Our new 2025 EPS forecast of $13.17 is 0.5% lower than before ($13.23):

|

Illustrative JPM Return Forecasts  Source: Librarian Capital estimates. |

With shares at $111.19, we expect an exit price of $191 (implying a P/TBV of 2.1x) and a total return of 86% (22.5% annualized) by 2025 year-end.

Our forecasted TBV/Share figures imply a 2021-25 CAGR of 6% (mostly driven by buybacks), the re-rating from 1.6x TBV to 2.1x is worth approximately 10% annually, while dividends will be worth approximately 5% annually (on average).

JPM Stock Key Metrics

With shares at $111.19, JPM shares are trading at 1.6x P/TBV (TBV/Share is $69.90). The P/E multiple is 9.4x if we apply management’s targeted ROTCE of 17%, or 10.5x if we apply our expected long-term ROTCE of 15.5%.

(Relative to history, JPM shares are on 9.4x, 11.9x and 7.0x P/E relative to 2019, 2020 and 2021 earnings respectively, though 2020-21 earnings are distorted by credit reserve builds/releases and not representative.)

JPM stock pays a dividend of $1.00 per quarter ($4.00 annualized), representing a Dividend Yield of 3.6%.

Conclusion: Is JPM Stock a Buy?

We reiterate our Buy rating on JPMorgan Chase & Co. stock.

Be the first to comment