Mark Wilson

Thesis

I recently highlighted a few considerations why I believed JPMorgan Chase & Co. would deliver a strong Q3 quarter. And, in fact, the bank delivered: in the September quarter, JPM’s markets division showed exceptional strength, while the bank’s asset management division and consumer business proved resilient – despite the well-known macroeconomic challenges.

Following JPMorgan’s strong earnings, I remain confident enough to double down on my long-term bullish bet on JPM stock, which I believe should trade at a valuation of around $195 per share.

JPMorgan’s September Quarter

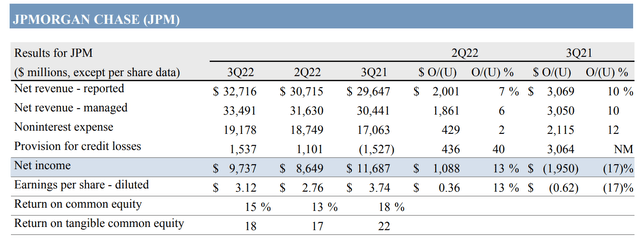

During the period from July to the end of September, JPMorgan generated total revenues of $32.7 billion (up 10% year over year), versus the median analyst expectations being at $31.99 billion. Earnings per share beat analyst expectations: the bank recorded a $3.12/share profit, versus analyst expectations at around $2.88.

Anchored on strong results, Chairman and CEO Jamie Dimon commented that JPMorgan could achieve the target 13% CET1 by Q1 2023 and opened that the possibility of a buyback program:

we hope to be able to resume stock buybacks early next year.

Exceptionally Strong Trading/Markets Results

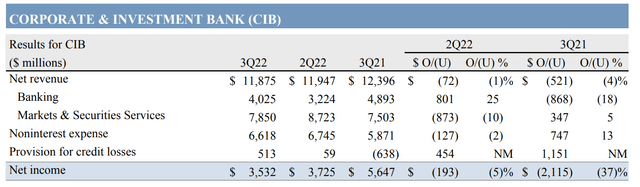

JPMorgan’s earnings beat was as expected, supported by an exceptionally strong performance from the bank’s market division. During the period from July to end of September, Markets & Securities Services revenue totaled $7.9 billion, which reflects a 5% increase year over year (note that Q3 2021 was already very strong, and thus provided a tough comparison).

Fixed Income Markets revenue was $4.5 billion, up 22%, primarily driven by higher revenue in macro businesses, partially offset by lower revenue in Securitized Products.

Equity Markets revenue was $2.3 billion, down 11% compared to a record third quarter in the prior year.

Securities Services revenue was $1.1 billion, relatively flat to the prior year.

Investment banking fees dropped by 43% year-over-year, but analysts had already estimated a 50% drop. Thus, the segment’s $1.7 billion of revenues exceeded estimates at around $1.6 billion.

Solid Commercial Banking & Asset Management

JPMorgan reported that average deposits jumped by 9% year-over-year; average loans increased 2% year-over-year and 1% quarter-over-quarter; Debit and credit card sales volume increased sharply, up 13% year-over-year. JPMorgan CEO Jamie Dimon commented:

In Consumer & Community Banking, we again ranked #1 in U.S. retail deposits, we were the fastest growing bank among the top 20 and we are now #1 in the top 3 largest markets based on the most recent FDIC data.

JPMorgan’s Asset & Wealth Management division delivered solid results: revenues increased by 6% year-over-year – despite falling asset prices and risk-off sentiment.

Loss Provisions Are Acceptable

Going into Q3 – and following the Credit Suisse (CS) bankruptcy discussions – markets feared that JPMorgan would need to take balance sheet write-downs. But these fears proved excessive. The bank “only” took $1.5 billion of credit loss provision and an additional $959 million loss of investment securities losses (cumulatively less than 1% of JPMorgan’s market capitalization)

Still Clearly Undervalued

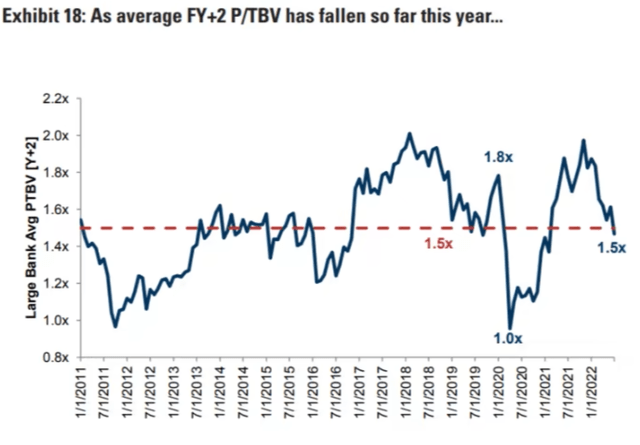

Reflecting on JPM’s strong Q3 results, I am confident to reiterate my believe that JPM stock is undervalued – trading at a one-year forward valuation of x1.2 P/B and x9.8 P/E.

Specifically, I would like to point out the x1.2 P/B ratio, which is about 25% below the industry’s historical average trading multiple. Thus, if multiples revert to the mean – which I believe they will – then JPM stock should have at least 25% upside.

But if JPMorgan would trade at x1.5 price to book, then the bank would only trade in line with the industry average. Shouldn’t JPM – as the industry leader – deserve a premium? I strongly believe so, yes.

I think a residual earnings model is more accurate to estimate JPM stock’s fair implied valuation — and my model indicates that a fair valuation would be somewhere around $195/share.

Risks

Despite the positivity, risks remain. Citing again Jamie Dimon’s recent interview on CNBC, Jamie said that he believes the U.S. will likely fall into a recession within the next 6-9 months. But he did not seem too much concerned about this, saying:

Currently the U.S. economy is still doing well. U.S. consumers still have money… they are spending 35% more than pre-covid. Their balance sheets are in a good shape. Therefore, even if we go into a recession, they are going to be in a much better shape than in 2008.

Moreover, Jamie commented that given technology-supported efficiency and risk management, banks are likely to remain “enormously profitable.” And a recession should not be as scary as implied, given that:

we’ve managed through recessions before. We’ll manage it again. I’m quite comfortable we’ll do it quite well.

Investor Implications

JPMorgan remains an exceptionally well-managed bank – and Q3 has highlighted that the bank may indeed continue to perform even in a challenging economic environment. Thus, for me, the investor implication is clear: Buy, as I remain confident to reiterate my believe that the stock should trade at a valuation of around $195 per share.

Be the first to comment