Oli Scarff/Getty Images News

Introduction

As a dividend growth investor, I constantly seek new opportunities to acquire income-producing assets. Sometimes I add to my current positions, while I start new positions to diversify myself on other occasions. I sell my positions after a company cuts its dividend, which shows bad planning and execution. Therefore, I sold my position at Kraft Heinz (NASDAQ:KHC) following its dividend cut.

In this article, I will return to Kraft Heinz to assess its current situation. When a company cuts its dividend, and I sell the position, I keep following it. I am looking for the reset needed to return to growth. Sometimes, this turnaround is swift, while on other occasions, it takes longer. If Kraft Heinz returns to growth and deals with the challenges that led to the dividend cut, I may consider initiating a position again.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

The Kraft Heinz Company manufactures and markets food and beverage products in the United States, Canada, the United Kingdom, and internationally. Its products include condiments and sauces, cheese and dairy products, meals, meats, refreshment beverages, coffee, and other grocery products. It sells its products through its own sales organizations, as well as through independent brokers, agents, and distributors.

Fundamentals

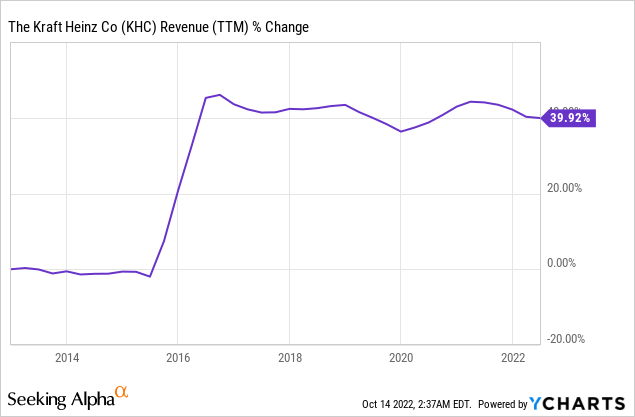

The revenues over the last decade have grown by almost 40%, which equates to roughly 3% annually. However, the growth was inorganic when Kraft and Heinz merged. Since then, the company has suffered from stagnation in its sales as it struggles to grow. Building a new growth engine is a crucial goal for Kraft Heinz. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Kraft Heinz to maintain flat sales in the medium term as the company is working on its turnaround.

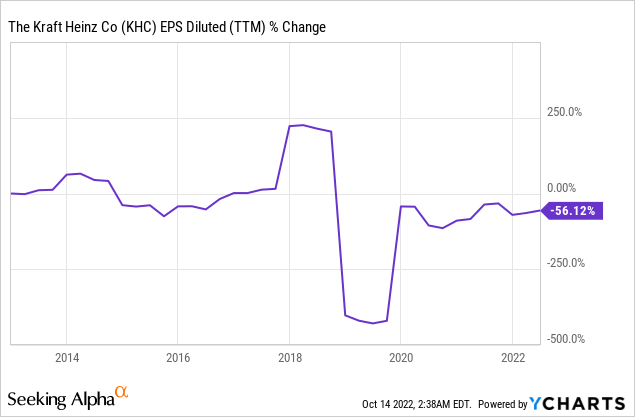

The EPS (earnings per share) has shown an even more disappointing trend as the GAAP EPS declined by more than 50% over the past decade. The situation is challenging even when looking at non-GAAP figures since the merger. The EPS declined by 12% since 2016 and only stabilized recently. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Kraft Heinz to maintain flat EPS in the medium term as the company is working on its turnaround.

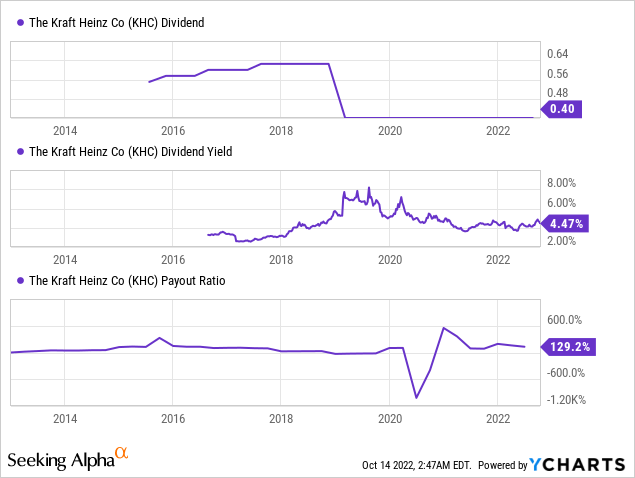

The dividend is a crucial element for dividend growth investors such as myself. Currently, the company is paying a dividend of $1.6 annually. The dividend hasn’t changed since the company cut it, and this is due to the payout ratio. The payout ratio is 130% using GAAP earnings and 55% using non-GAAP earnings. The 4.5% dividend is not at imminent risk, but future growth will rely heavily on sales and EPS growth.

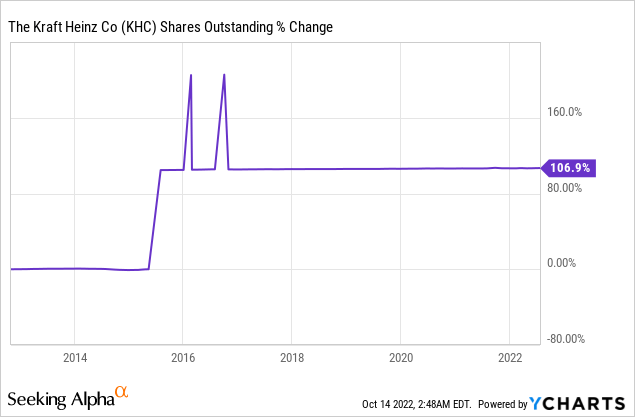

The number of shares outstanding has increased by more than 100%. Buybacks are another form of returning capital to shareholders in addition to dividends. Buybacks are highly efficient when the stock price is low. The increase in the number of shares is attributed to the merger. Since then, while the company didn’t execute major buyback programs, it did maintain its share count flat to avoid further dilution.

Valuation

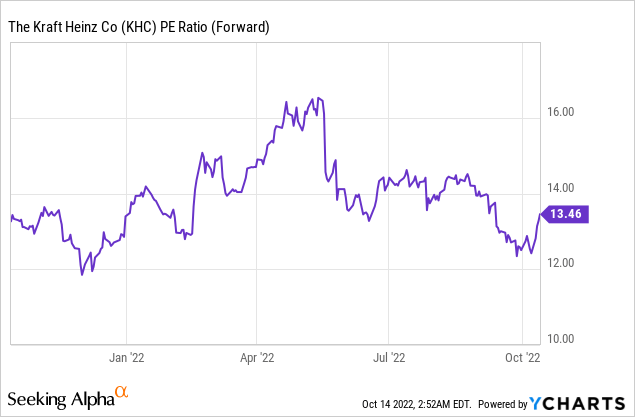

The P/E (price to earnings) ratio shows that Kraft Heinz is trading for 13.5 times the forecasted earnings for 2022. This valuation is slightly lower than our average valuation over the last twelve months. However, as the company is struggling to grow its EPS, this P/E ratio, which may look attractive, may not be enough to justify the investment as the company still seeks growth.

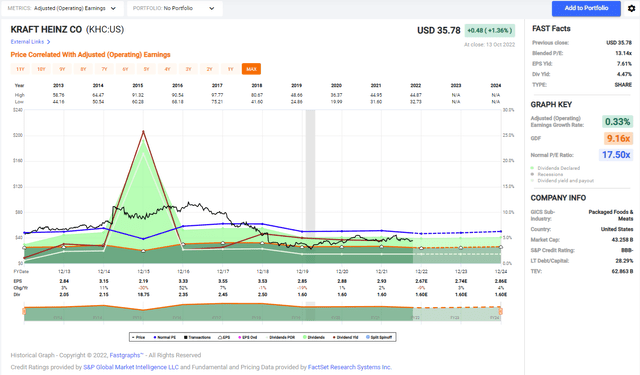

The graph below from Fastgraphs also shows that Kraft Heinz is trading below its average valuation. The average valuation in the last decade was 17.5, and the company failed to show growth during that period, with a 0.33% CAGR in its EPS. The current forecast is for an EPS decline in 2022 and a recovery in the following two years. The valuation seems attractive, but it may be justified due to the growing uncertainty.

To conclude, Kraft Heinz is a company that is still trying to build its future. The company maintains its sales and EPS yet struggles to grow them. Therefore, there is no dividend growth and no buybacks. The current valuation may seem attractive, but without a path for growth, this is merely a 4.5% “bond-like” stock. The company will have to show significant growth opportunities to be an attractive investment.

Opportunities

Kraft Heinz is still a very diversified company with different well-known brands operating across the globe. It also enjoys the confidence of the legendary investor Warren Buffett, who holds roughly one-quarter of the company. The company is going through a turnaround that aims to reignite the growth in sales. So far, sales growth, as we saw in Q2 (10% YoY), is attributed to price increases, yet the company still loses market share.

However, market share loss is declining, and the company seems to get close to stabilizing itself. Kraft Heinz is also amending its products to be more appealing to consumers. It removes sugar and shifts its portfolio to be more attractive compared to the competition. If it can maintain this trend, become more relevant, and gain market share again, the path to growth will be more precise.

Another significant opportunity is the lower leverage. Following the merger, the net debt to EBITDA was above 4, which was one of the main catalysts for the dividend reduction. However, since the dividend cut, the company has deleveraged its balance sheet, and the net debt to EBITDA is now 2.6. It allows the company to build its brand and amend its products and portfolio.

Risks

While there are some signs of growth, there are also significant red flags and risks. The company is still stagnating, and even when we look at the forecast for the medium term, we can’t see material growth in sales and EPS. Therefore, while the company is on the right track, it still has a long way to go with a high level of uncertainty.

The dividend is another risk. Dividend growth investors rely on the growth of the dividend. Kraft Heinz has cut the dividend and never raised it since It keeps paying the same payment for more than two years. The income is eroded by inflation, and we still don’t know when the subsequent increase will happen. Therefore, it may be a risky investment for dividend growth investors who rely on that stream.

Inflation is another risk for Kraft Heinz. The company competes with branded peers and private labels. Inflation forces Kraft Heinz to increase prices to maintain its profitability. However, its market share is already shrinking, and these price increases may stop the trend of slower market share decline, thus prolonging even more the turnaround.

Conclusions

The investment is still risky several years after the dividend cut. The company still suffers from weak yet stable fundamentals. The valuation is not attractive enough to justify the risk. However, we already see operational improvements as the company is not losing market share as fast as it did. There are still risks for the investment thesis.

I believe conservative dividend growth investors should wait for a first dividend increase. It will sign that the EPS is growing or at least going to grow soon. More adventurous dividend growth investors may invest right now to lock on the attractive yield and wait for the company to complete its challenging turnaround. Therefore, I believe that the company is a HOLD at the moment.

Be the first to comment