jetcityimage

Year-to-date (YTD) as of last night’s (Tuesday, August 9th, 2022) close, JPMorgan’s stock was still down -23.34% YTD while the SP 500 was down YTD -12.75%, for a YTD performance shortfall of over 1,000 basis points, which is certainly better than Coinbase and Carvana (a little humor and also no positions) but the decline still smarts.

Let’s look at the annual EPS and revenue figures for the last several years:

| EPS | y/y gro | Revenue | y/y gro | |

| 2024 – est | $13.66 | +8% | $142.4 | 3% |

| 2023 – est | $12.57 | +13% | $137.4 | 8% |

| 2022 – est | $11.20 | -27% | $127.1 | 5% |

| 2021 | $15.34 | 67% | $121.6 bl | 2% |

| 2020 | $8.87 | -17% | $120.3 bl | 4% |

| 2019 | $10.72 | 19% | $115.6 bl | 9% |

| 2018 | $8.98 | 31% | $105.8 bl | 5% |

| 2017 | $6.88 | 16% | $100.8 bl | 3% |

Source: valuation spreadsheet from earnings reports and consensus estimates from IBES data by Refinitiv

If you look at the expected revenue growth from 2022 to 2024, the consensus revenue estimate numbers, which have been rising, are expected to grow at an average rate of 5% per year, the same average rate of growth from 2017 – 2021.

Financials as a sector, and particularly the big banks that benefitted from the Fed’s massive liquidity additions, as well as the Congressional stimulus, have to pay the price in 2022 to build back credit reserves, that were all released in 2021.

But the nice thing is that after Q2 ’22 results, now in the books, the compares get easier, not just for JPMorgan but for many of the big banks and brokers.

Both JPMorgan and Bank of America saw better net interest income (NII) from rising interest rates, and softer fees, probably from the mortgage businesses.

Since the market lows in mid-June and the peak in interest rates – mainly the 10-year Treasury peaking at 3.5% also in mid-June – that trade will start to reverse.

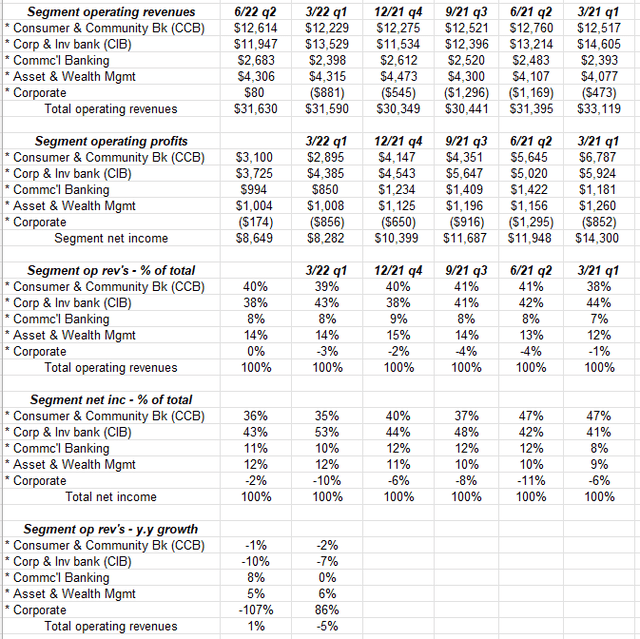

JPMorgan’s operating results by segment:

JPM operating results by segment (earnings reports, 10-Qs )

We are going to leave readers with one last table of JPM’s operating results for the last 5 quarters.

It’s JPMorgan’s “Corporate & Investment Bank” (CIB) (line 2) that tends to generate upside delay in EPS in good markets and thus becomes a drag or pull on EPS in tougher markets, as we saw in the first 6 months of 2022.

Note the steady decline in CIB in terms of operating income from Q1 ’21. That’s been the big drag on the bank, and after Q2 ’22 that starts to get easier.

Summary / conclusion: Now that the toughest of the 2021 compares have passed for JPMorgan, and if the bottom has been put in as of mid-June ’22, the year-over-year compares should look better and 2022 numbers should start to improve.

However, owning the stock today, means investors likely have to wait for 2023 to see some material relative performance for the stock.

Jamie Dimon’s “hurricane” comments seem puzzling in hindsight, particularly after the July ’22 nonfarm payroll report saw a 584,000 net new job increase by the US economy, which should portend well for JPMorgan’s consumer segment, which is the largest segment of the bank by revenue. (It was interesting reading the JPM conference call notes after earnings, which readers can find here on Seeking Alpha, but Mike Mayo went after Jamie Dimon a little bit for the histrionics and hyperbole around the economy that Jamie made in early ’22.)

Running performance numbers on JPM relative to the SP 500, you have to go back to the middle of last decade to see JPM outperform the SP 500 on an “annualized” basis, given the drop in the stock this year.

JPM is still a fairly large holding for clients, so the stock has been added to accounts where there’s room and where it’s weighting doesn’t get too far out of whack with its weight in the SP 500.

Resumption of share repurchases would be a big plus for JPM, but likely won’t hear that before the October ’22 Q3 ’22 earnings release, and by then we will know what the dividend increase is for the next 4 quarters.

For readers who can be patient, the probability is there is more upside to downside in JPM at current prices, particularly if the bottom is in for the equity market as of mid-June ’22 and credit spreads continue to improve as they have for corporate high yield since July ’22.

Be the first to comment