Introduction

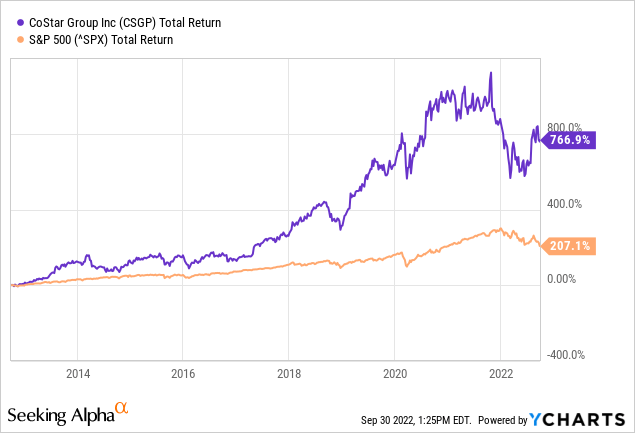

CoStar (NASDAQ:CSGP) has over 30 years of experience in their database of commercial real estate and is by far the best in the industry. It is a fast-growing company, and this is characterized by the strongly increased share price over the past 10 years. On average, the stock grew 24% per year, while the S&P 500 grew 12% over the same period. A significant difference.

The rising share price has been flawed since December 2021, has since been corrected and has risen slightly again from mid-2022. CoStar raised their outlook, but their growth stalled. The high stock valuation figures and the aggressive policy of the FED will not cause CoStar’s share price to rise further.

Results Are Strong, But Revenue Growth Is Stagnating

CoStar delivered strong Q2 results and raised their full-year 2022 outlook. Second quarter revenue grew 12% year over year.

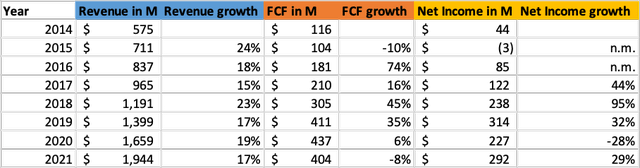

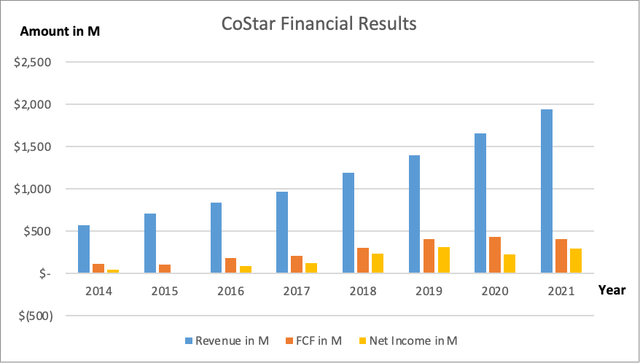

CoStar has grown strongly in recent years in terms of revenue, free cash flow and net income. From 2014 to 2021, sales grew on average by 19% per year, and free cash flow grew by an average of 20% per year over the same period.

CoStar Financial Results Over The Past Years (SEC and Own Calculations)

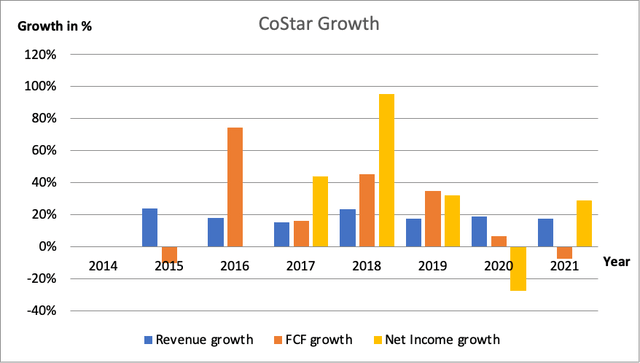

If we look at the big picture, we see revenue growth is stagnating. Where a revenue growth of no less than 24% was achieved in 2015, this was only 17% in 2021. Analysts on the SA CSGP ticker page, who base the FY2022 revenue forecast on CoStar’s outlook, expected revenue growth of 12% for FY2022. For 2023, they expect revenue growth of 16%.

CoStar Financial Results Over The Past Years (SEC and Own Graphical Representation)

However, their expectations remain on the low side. Especially when we look at the growth of free cash flow. Free cash flow was lower in 2021 than in 2020, while it grew strongly until 2020.

CoStar Growth (SEC and Own Calculations/Graphical Representation)

A characteristic of CoStar is that the free cash flow yield is very high, in 2021 their free cash flow yield was no less than 21%. CoStar has strong growth ambitions and uses their cash for increased growth through acquisitions rather than paying dividends or buying back shares. In 2019, for example, it acquired STR, which provides benchmarking and analytics for the hospitality industry. In 2020, it acquired Ten-X, which operates an online commercial real estate auction platform. In 2021, CoStar made an offer to acquire CoreLogic, but declined due to risks in a high interest rate environment. CoStar CEO Andy Florance:

With interest rates moving up, now is not the time for us to aggressively buy into the residential mortgage market.

CoreLogic is a company that provides financial, real estate and consumer information, analytics, and business intelligence. I believe it would be an ideal fit for CoStar. CoStar’s discontinuation of the CoreLogic acquisition is a bold move. Their 2021 annual report states that their top priority for 2022 is to continue developing and investing in residential marketplaces. This, of course, involves investing in their own platforms to improve user experience and help agents promote their home ads, but it’s in stark contrast to the explanation of why they’re opting out of the CoreLogic acquisition.

CoStar’s 2Q22 results also show that the growth rate of their apartments.com business segment faltered in the second quarter of 2022 as a result of fewer properties being listed and customers downgrading ad packages purchased as vacancy rates in multi-family homes have declined from historical averages. This could be worrying for the residential mortgage market.

Valuation Metrics Suggest CoStar Is Overvalued

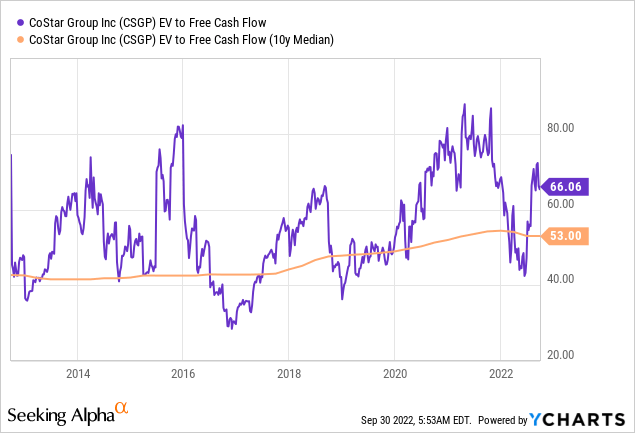

CoStar’s share price has experienced rapid growth since the crash in 2020. CoStar has few assets to write off, so the EV/FCF ratio can be used as an alternative to the EV/EBITDA ratio.

In 2020, we see that both ratios are generally very high (around 45). Because the current free cash flow in relation to the EBITDA is lower than in previous years, the graph from the year 2022 shows a strikingly large difference in both ratios.

The EV/EBITDA ratio is below their 10-year average, but a ratio of 41 is generally very high, especially during the FED’s aggressive policy. I also think the 2023 forward PE ratio of 53 is very high.

I’m surprised that a stock seems overvalued for an extended period. However, CoStar shows no bad outlook and continues to revise their outlook upwards. When expectations are adjusted downwards, I expect their stock price will fall sharply.

What I also find absurd is that CoStar partly finances their acquisitions by issuing shares. For example, $750 million in stock was recently issued to fund future acquisition costs or for working capital purposes. However, they have plenty of working capital, the current ratio is a very high 12. And with nearly $4 billion in cash, I don’t see here a problem either. The issuance of additional shares is disadvantageous for existing shareholders because profits are spread over a larger number of shares. If CoStar paid a dividend, the dividend payment would be lower than it was initially. The issuance of additional shares could also be detrimental to the share price as the EPS is lower after issuance. The fact that CoStar is doing this likely suggests that CoStar believes it is cheaper to raise money by issuing additional shares than by taking out a bank loan or financing with bond issuance.

Key Takeaway

Investing in CoStar has many advantages and disadvantages, below I have summarized it from my article:

Pros:

- Strong proprietary database of commercial real estate information and is by far the best in the industry.

- CoStar has grown strongly in recent years in terms of revenue, earnings, and free cash flow.

- Their free cash flow margin of 21% is very high.

- CoStar raised their expectations for FY2022.

Cons:

- Revenue growth stagnated, free cash flow from 2021 was lower than in 2020 and further growth may stagnate.

- CoStar discontinued the CoreLogic acquisition due to rising interest rates.

- The valuation metrics indicate that CoStar is overvalued.

- The issuance of additional shares dilutes the shares.

I see more downsides than benefits, and I’m particularly concerned about the valuation metrics, as the FED has pushed interest rates sharply to fight inflation. CoStar’s residential business is performing strongly, but they discontinued the CoreLogic acquisition due to rising interest rates. I expect that rising interest rates will have a negative effect on house prices and CoStar’s share price. CoStar is growing strongly, has a high cash flow margin, but I believe the hawkish Fed’s policy will do little good for the share price.

cemagraphics

Be the first to comment