Marlon Trottmann

We previously covered Jones Lang LaSalle (NYSE:JLL) in an article where we argued that shares were very cheap. Since then, the valuation has gotten even more attractive. As a reminder, this is one of the “Big Three” commercial real estate services companies, the other two being Cushman & Wakefield (CWK) and CBRE (CBRE). JLL is, therefore, one of the leaders in its industry, managing ~5.4 billion square feet of space and with an excellent ESG reputation. In fact, it has been awarded Ethisphere’s “Most Ethical Company Award” for 15 consecutive years.

The most recent quarter was weak, with the company having to deal with a slowing commercial real estate sector, largely the result of the sharp increase in interest rates. JLL reported adjusted EBITDA of $276 million, a decrease of 19% from the prior quarter, and the adjusted EBITDA margin declined approximately 390 basis points from the third quarter of 2021. So far this year, the company has generated $909 million of adjusted EBITDA with a ~14.8% margin.

During the earnings call, there were some interesting comments; for example, the company continues to see a flight to quality in the office sector, as occupiers shift to new or Class A space with the amenities and sustainability profile needed to attract employees back to the office.

JLL guided for the full-year 2022 adjusted EBITDA margin to be below the 16% to 19% range it had originally targeted for the year. The company anticipates the intensity of macroeconomic headwinds to increase and believes that the North American real estate market will not begin growing again until the second half of 2023. There are, however, some positives too, including some secular tailwinds. For instance, the work dynamics business continues its impressive growth story and the leasing business is looking forward to the near record number of leases that are due to expire in the next 18 months.

JLL hosted an investor day on November 16th, and we include what we consider to be the highlights below. After going through the presentation, we are further convinced that shares are considerably undervalued at current prices, and that JLL is a good business with solid growth prospects despite the temporary headwinds.

Performance

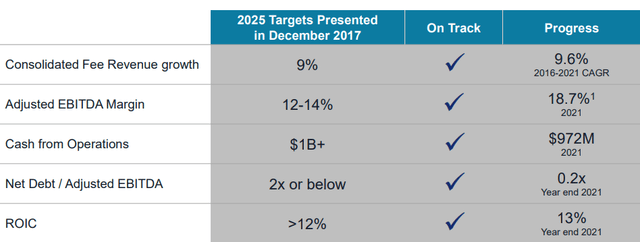

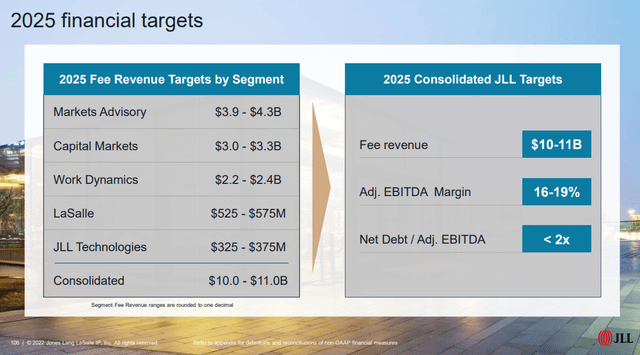

JLL is on track to exceed the consolidated 2025 financial targets that it presented in December 2017. It is now expecting $10B to $11B in fee revenue by 2025 and a 16% to 19% Adjusted EBITDA margin.

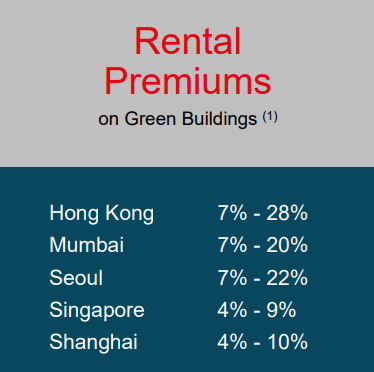

One of the big trends that it believes can help it get there is sustainability as a commercial opportunity, which should help drive fee revenue growth. As can be seen in the graph below, green buildings have a substantial rental premium in several markets, and there is an expectation that there will be a lot of business that can be won in this segment.

JLL Investor Presentation

Importance of Technology

JLL emphasized the increasing importance of technology in its businesses. It also reminded investors that it remains a highly fragmented market where differentiation factors are critical to achieve leadership. For JLL, some of its differentiation factors include its technology, its data, and its vast industry knowledge.

The JLL tech business is growing rapidly, with clients looking at identifying solutions to drive increased productivity of their footprint. This is one of the reasons that the number of Prop-tech startups has grown dramatically.

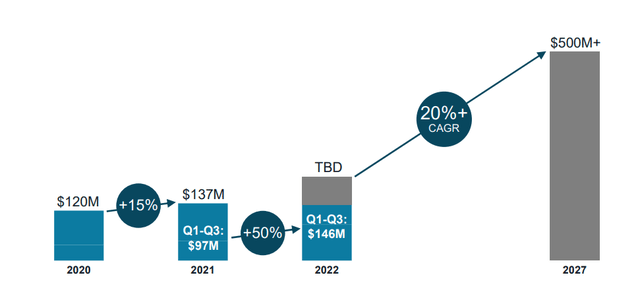

JLL’s fast-growing technology business is set to reach $500M revenue by 2027. The company projects that this will become a $500 million+ business and that it should be profitable within 5 years while growing at a ~20%+ CAGR.

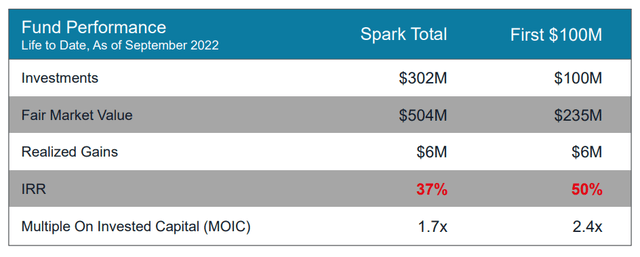

JLL has been investing in market-leading Prop-tech companies through its VC arm, JLL Spark. The fund has an impressive IRR of 37%, outperforming industry benchmarks.

Work Dynamics

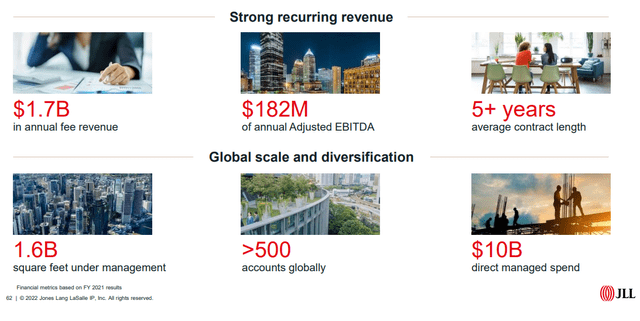

One business that has a particularly strong competitive moat and that has been growing rapidly in work dynamics. It designs, builds, leases, and manages workplaces for its customers. JLL is targeting 2025 fee revenue of between $2.2 billion and $2.4 billion for this business.

Growth & Margin Drivers

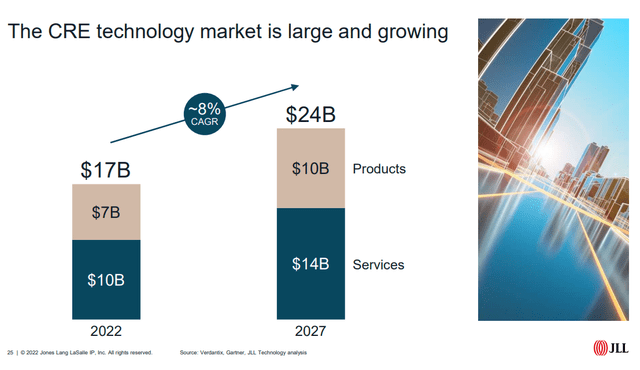

JLL sees the commercial real estate technology market growing at an ~8% CAGR from 2022 to 2027. If this turns out to be right, it should provide a nice growth tailwind.

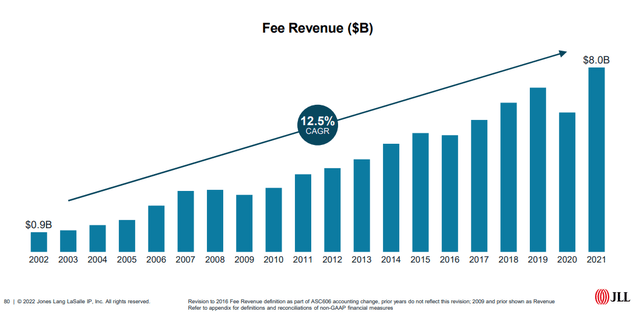

The company reminded investors that it has grown fee revenue at a 12.5% growth rate, and over the last five years at a high single digit rate.

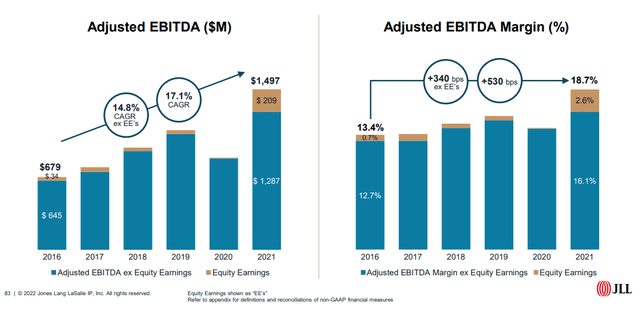

JLL has also delivered margin expansion, which has resulted in mid-teens adjusted EBITDA growth.

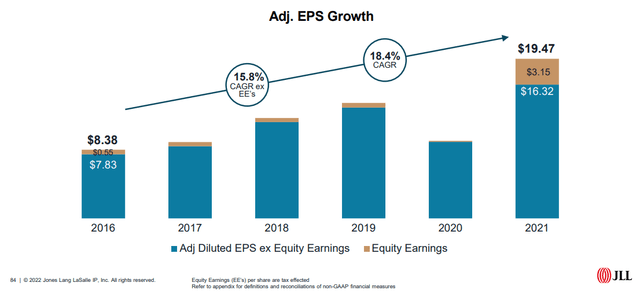

Adjusted EPS has grown faster than both Adjusted EBITDA and Fee Revenue, going from $8.38 in 2016 to $19.47 in 2021.

Financial Outlook

Probably, the biggest takeaway from the presentation is that JLL expects $10 billion to $11 billion in fee revenue by 2025 with an Adjusted EBITDA margin in the 16% to 19% range. JLL has a good growth track record, having delivered about 3x higher growth than global GDP. The company also has a strong history of free cash flow conversion, averaging FCF conversion of 90% of Adjusted Net Income since 2016.

The company has become more resilient to downturns, moving to a more variable cost base, which provides earnings resiliency. It also reaffirmed its commitment to returning capital to shareholders. So far, it has been delivering, given that it has reduced the share count by ~8% over the last three years thanks to generous share buybacks. Its financial targets assume a recessionary environment in the first half of 2023 and a recovery afterward.

Balance Sheet

JLL’s balance sheet remains quite solid, ending the quarter with total net debt of $1.7B and net leverage of 1.1x, just above the midpoint of its target leverage range. Its liquidity totaled $2.1 billion at the end of the third quarter after it expanded its credit facility by $600 million to $3.35 billion.

Given the increasingly uncertain economic environment, the company decided to pause share repurchases. This should help maintain its strong credit ratings, it currently has a Baa1 rating from Moody’s and BBB+ from Standard & Poor’s.

Valuation

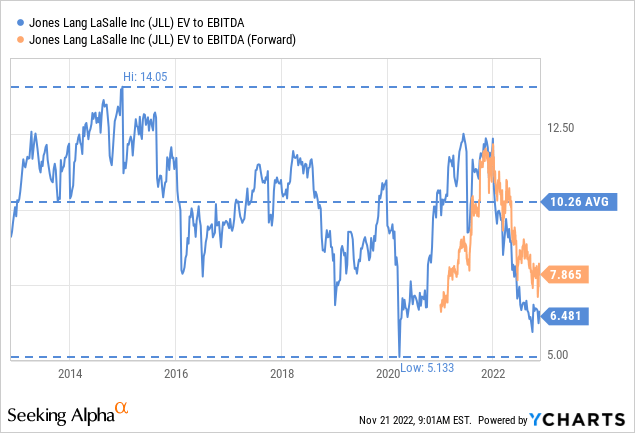

In terms of valuation, shares are really cheap. They are trading at close to the lowest valuation in ten years, with an EV/EBITDA of ~6.4x, significantly below the ten-year average of ~10.2x.

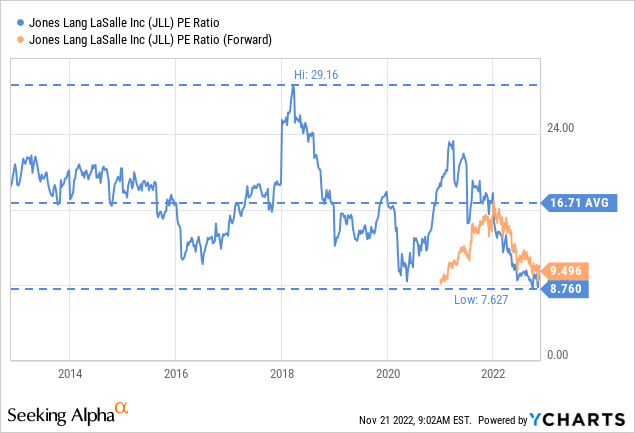

The price/earnings ratio is in the single digits too, currently at ~8.7x, almost half the ten-year average of ~16.7x. The forward P/E ratio is a little bit higher at ~9.4x.

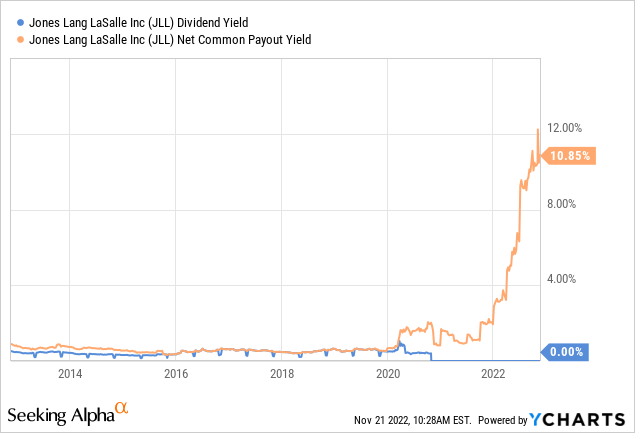

The company no longer pays a dividend but had been until recently very generous in terms of share buybacks, which resulted in a net common payout yield of more than 10%.

Analysts expect earnings to go down in fiscal year 2023, which seems reasonable given the weakness in the commercial real estate sector from the increases in interest rates, and then return to growth in 2024. We believe JLL is a high quality business, with good growth prospects and relatively decent profit margins, that despite the cyclicality deserves a higher valuation than a single-digit price/earnings ratio.

Risks

The main risk we see with JLL is that it operates in a cyclical industry that suffers disproportionately during economic downturns and is very sensitive to the interest rate environment. While the balance sheet is in decent shape, we would like net debt to be even lower, to feel comfortable that the company can navigate any type of economic environment. These risks are somewhat mitigated by efforts by the company to make its cost structure more variable.

Conclusion

JLL’s investor day was quite interesting, and we have shared what we believe to be the highlights of the event. The company is on track to meet its 2025 financial targets and is having excellent results on its technology investments. Overall, we are optimistic about the company’s prospects and believe shares to be significantly undervalued at current prices, even if it increasingly looks like the first half of 2023 will be complicated for the company.

Be the first to comment